3 Golden Rules Of Accounting – Rules with Best Examples

Every business or organization is required to provide its financial data to all of its stakeholders. The financial information presented must be accurate and present a true image of the company. It must account for all of its transactions for this display. Accounting must be consistent since economic entities are compared to understand their financial state. There are 3 Golden Rules of Accounting that must be followed in order to achieve uniformity and appropriately account for transactions. These criteria are the foundation of passing journal entries, which are the foundation of accounting and bookkeeping.

What is Accounting?

In simple words, accounting refers to recording, classifying, summarizing, and presenting financial transactions sequentially so that they can be analysed and interpreted. Summary in accounting refers to the preparation of trial balance and the basis of analysis and interpretation are the final accounts, under which business account, profit and loss account, and balance sheet/statement of position or balance sheet are prepared.

Accounting offers various important information related to business, such as:

- Profit and loss

- Assets and liabilities

- Total funds to receive

- How much to pay?

- What is the economic condition of the business?

Main objectives of Accounting

- To record all business transactions in a complete and systematic manner. Due to systematic accounting, there is no possibility of mistakes and the result is pure.

- To find profit and loss for a certain period.

- One of the objectives of accounting is to obtain information regarding the financial position of the institution.

- To provide financial information so that managers can make the right decisions. Accounting also provides alternative measures for this.

- There are many stakeholders in a business, such as a workforce, managers, creditors, investors, etc. One of the objectives of accounting is to provide information related to the various parties interested in the business.

Benefits of Accounting

Hundreds of transactions take place every day in business, buying and selling of goods take place. These can be both cash and credit. Payments are made in the form of wages, salaries, commissions, etc. It’s hard to remember all of these.

- No matter how capable a person is, he/she cannot remember everything. Accounting removes this deficiency.

- Businesses can obtain many precious insights using Accounting.

- Accounting records can be produced as evidence in court in case of disputes with other traders. The court recognizes the accounting presented.

- Financial accounting helps in determining the problems related to salary, bonus, allowances, etc. of employees.

3 Golden Rules of Accounting

Accounting rules are statements that define how transactions should be recorded. All accounting transactions must be reflected in the entity’s books using the double-entry accounting method, according to accounting standards.

The double-entry accounting approach requires debiting and crediting two (or more) accounts for each transaction. 3 Golden Rules of Accounting are explained along with examples are as Follows:

1)Debit The Receiver, Credit The Giver

2)Debit What Comes In, Credit What Goes Out

3)Debit All Expenses And Losses, Credit All Incomes And Gains

RULE 1: Debit The Receiver, Credit The Giver

Personal Account

Accounts relating to individuals and organizations are called personal accounts. Like Mohan’s account, Shankar Vastalaya’s account became a personal account.

Golden Rules of Personal Account: Debit The Receiver, Credit The Giver

Those who receive something are called receivers, and they are kept in “debit”. The person who gives something is called a giver and is kept in “credit”.

For example, Mohan was given 1000 rupees, Mohan is taking 1000 rupees, he became a receiver, so he will be kept in debit.

1000 received from Sohan. Sohan 1000 rupees have been due, he became a giver. Therefore, he will be credited.

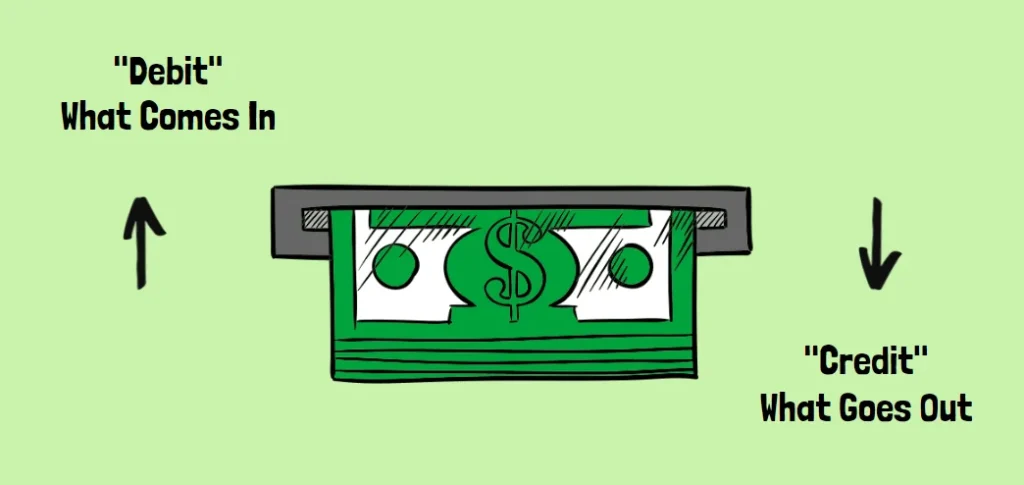

RULE 2: Debit What Comes In, Credit What Goes Out

Real Account

Accounts relating to goods and property are called actual accounts. Like the account of cash, the account of the cycle became the actual account.

Golden Rules of Real Account: Debit what comes in, Credit What Goes Out

The things that come in business are kept in debit and the things that go out of business are kept in credit.

For example, 1000 were received from Mohan. A 1000 rupee is coming, so it is kept in debit. The watch was sold to Sohan. The clock is going, so it will be kept in credit.

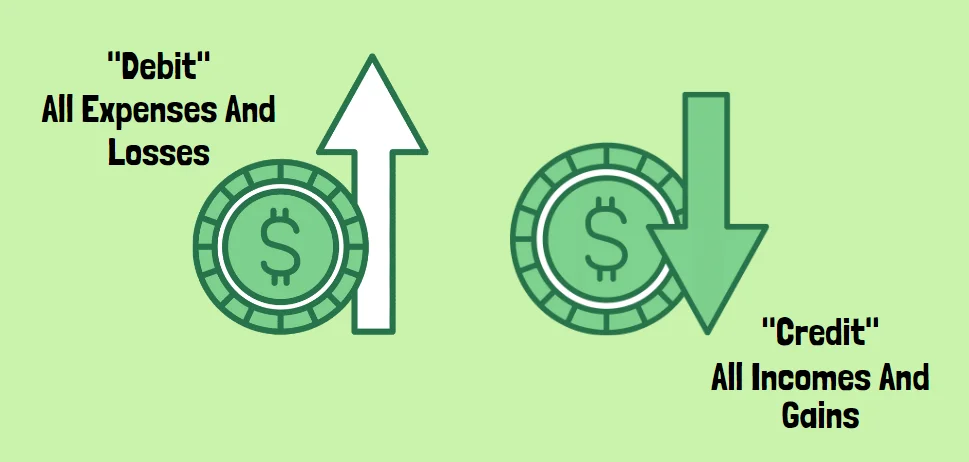

RULE 3: Debit All Expenses And Losses, Credit All Incomes And Gains

Nominal Account

Accounts relating to expenses and income are called non-realistic accounts. The rent accounts or the interest accounts are the best examples of non-realistic accounts.

Golden Rules of Nominal Account: Debit all expenses and losses, Credit all incomes and gains

All the expense names incurred in the business are debited. Similarly, the name of the income earned is credited.

For example, Mr. Dave sold goods to Mr. Bedi on credit for Rs. 6,000. In this situation, Mr. Dave will create two accounts: Mr. Bedi (Debtor Account, which is an asset account) and sales (which is a liability account) (which is a revenue account).

Because revenue has increased, and the asset account has also increased, the asset account will be debited, and the sales account will be credited in this situation.

Conclusion

An entity must account for all of its transactions. The entity must pass journal entries to account for these transactions, which are subsequently summed up in ledgers. The accounting Golden Rules are followed when recording journal entries. To use these rules, determine the type of account first, then apply the rules.