Save Time, and Stay Compliant!

Munim GSTR-3B Return Filing Software is packed with powerful features that align with your filing needs. With accuracy, simplicity, and efficiency, our solution becomes a one-stop shop for compliance.

Ensure a faster filing experience than ever with us! Start saving time and effort from today! Scroll down to see what features we offer for GSTR-1 and GSTR-3B.

Auto-populate Data from GSTN

Fetch your data directly from the GSTN portal and auto-populate all the details effortlessly. Eliminate manual data entry to ensure faster, smoother, and stress-free GSTR-3B filing

Smart Validation for Identifying Errors

Identify discrepancies and errors with our smart compliance checks to ensure 100% accuracy for GSTR-3B Return Filing. It highlights and suggests corrections for the mismatched data.

Data Review and Edits

Review and edit your auto-populated information for accuracy before you proceed. At Munim GST Return filing software, you will get hints for modified data, ensuring accuracy.

ITC Balance Utilization

Automatically calculate optimal ITC utilization, maximize credit usage, and simplify GSTR-3B filing through our offset logic.

Cash Shortfall

Our GSTR-3B filing software facilitates verifying cash utilization to identify shortfalls in the cash ledger. This makes it simpler to generate new tax challans for the return filing process.

GSTR-3B Summary

Get a comprehensive summary of the information fetched from the GSTN portal that offers a complete overview of your GST account.

GSTR-3B Return Filing on Cloud

We offer both cloud and desktop solutions for all GSTR types, including GSTR-1 and GSTR-3B. Munim’s cloud-based solution allows return filing from anywhere and at any time with an active internet connection. It auto-fetches portal data, validates information, and facilitates filing directly through the software.

Sync Your Data in Real-time

Automated Computations

Faster Return Filing

Highly Scalable Solution

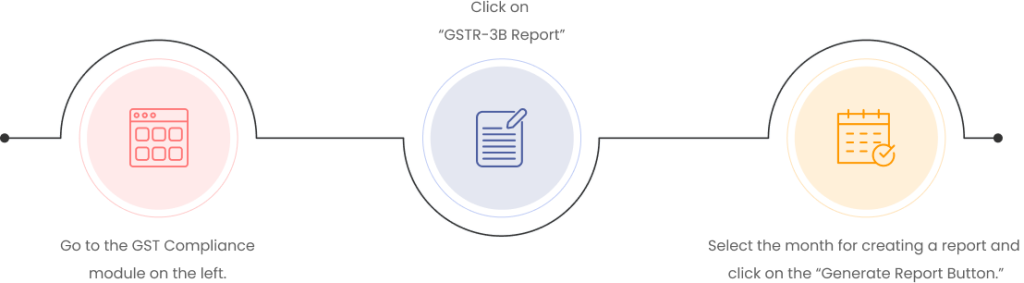

Quick Guide to File GSTR-3B Online in 6 Steps!

How to file GSTR-3B Online with Munim? Here’s Your Quick Setup Guide for Munim GST Return Filing Software!

Get GSTR-3B Return Filing Reports In Minutes!

Access the GSTR-3B Reports in the Blink of an Eye!

GSTR-3B Summary at a Glance!

A comprehensive overview of summarized grand totals for outward and inward supplies.

Verify the interest and late fees applied to the previous tax periods.

View the tax payment mode summary to see if it is a credit, cash, or liability balance.

Get a single-screen view for inter-state supply details.

Stay notified about the supplies under section 9(5) of CGST Act, 2017.

You can also view eligible ITC directly on the screen.

Prepare your GSTR-3B Data 3X Faster than ever!

Auto-fetch and populate your data directly from the GSTN portal within minutes. Munim’s smart validation rules and warnings for early error identification ensure 100% accuracy.

Save time and effort by identifying discrepancies in every entry and displaying warnings for unmatched details.

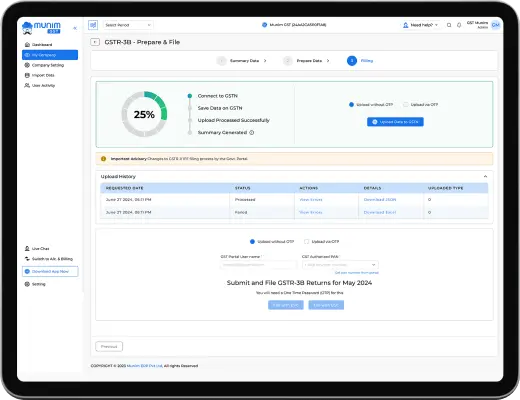

Real-time Insights From Dashboards

Simplify filing returns for taxpayers through a single screen view for GSTR-3B return filing. Generate insights from our intelligent dashboard for strategic decision-making.

Get Filing status updates for chosen financial year.

Overview of your net tax liability.

Stay updated with the filing deadlines, recent GST circulars, and announcements.

USPs of Munim GST Return Filing Software

Easy-to-use Interface that navigates the complexities of GST filing to a simplified process.

Heightened Data Security integrated with encryption protocols, login authentication and more.

Cloud and Desktop Solution that deliver online and offline access to the data.

Join Us Today and Ensure Effortless GSTR-3B filing!

Munim GST Return Filing Software- your go-to solution for GSTR-1 and GSTR-3B filing. Hurry up! Start filing returns on time and get rid of GSTR-3B penalties now.

Why are CAs preferring Munim GST Return Filing Software?

It has a simple UI integrated with navigation labels, making it easier for CAs to use GSTR-3B Filing.

Get your queries resolved at any time with our experts.

Save time and effort when filing GST returns.

Serve multiple clients at the same time.

Why is Munim the Best Choice?

No installation is required

There is no need to store data on your computer

100% theft-proof data security

The lowest TCO (Total Cost of Ownership) is assured

Suitable for budding entrepreneurs, CAs & accountants

Enables seamless collaboration with various stakeholders

Allows remote working from anywhere in the world

Client Story

Here’s What Our Clients Say About Us!

We used Tally to maintain our accounts for the past 15 years, and we were looking to adopt new technologies to manage our accounts. Finally, in 2022, we switched to Munim. Since Munim is cloud-based, the financial dashboards are updated on a real-time basis, which helps us in making faster decisions.

Nainesh Acharya

Consultant – 20 years exp.

This software has already saved many many hours reconciling our accounts, having previously done this manually for our business. 5 STARS!

Bhavesh Gohil

Munim User

I’m very much impress with this software, very light and easy to use, even fresher can use this, best part is that if get minor to minor issue u will get prompt response, Naryan alwz theier to help you. I will recommend this app.

Nuraveda Care

Business Owner

I have used this application, and its really good compare to other products Also, Mr.Manish and NArayana help always to understand the application .really appriciated both of them. they have available always whenever i required help. they came online and share the screen and try to resolve the issue immediately.

Pragati Solar

Business Owner

Wonderful software. Have been using their services for the last few days and it is extremely professional and hassle-free! Thank you. Keep up your good work.

CA Rahul Mistry

Practicing Chartered accountant

Frequently Asked Questions

Get Your Queries Answered Here!