Say Goodbye to GSTR-9 Filing Hassel With Us!

Munim GST Return Filing Software makes annual return filing much easier than never before! A complete package of compliance with convenience is all that your business needs today!

Fetch Data Automatically from GSTR-3B

Import data from GSTR-3B, GSTR-1, and more to minimize manual effort and save time. It reduces errors, boosts accuracy, and enables businesses to file GSTR-9 confidently.

Get Accurate Details on Taxes to be Paid

Get an accurate overview of tax liabilities to understand taxes paid and payable at a glance. This reduces errors, ensures accurate compliance, and helps the taxpayers understand the tax liabilities of GSTR-9 Return Filing.

Auto-fill Tables 17 and 18

Fill in HSN/ SAC details for inward and outward supplies and validate all the values in seconds. Once all the details entered are accurate, tables 17 and 18 of GSTR-9 are auto-filled, saving you time.

Clear Bifurcation of Demands and Refunds

Extract records of total refunds claimed, sanctioned, rejected, pending, and total tax demands automatically. You just need to import data from GSTN, and our software will sort all demand and refund details for you.

Ensure Optimized Credit Utilization

Get detailed ITC analysis that covers claimed, eligible, and ineligible ITC. This simplifies reconciling purchase and sales data, identifying unclaimed credits, and using them within the applicable limits.

Identify Discrepancies with Validation Flags

Identify missing information, mismatched data, tax discrepancies, and more through the validation flags displayed on your screen for filing annual return GSTR-9. This ensures data accuracy and streamlined compliance.

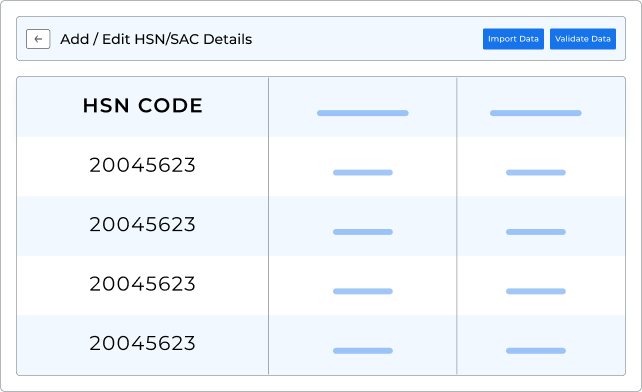

Validate HSN Details with Ease!

Our GSTR-9 return filing solution facilitates you to validate HSN details with ease. Ensure 100% accuracy by simply entering required values like HSN Code, UQC, Total Quantity, Total Taxable Value, Tax (%), IGST, CGST, SGST, and CESS. Once the details are added, the difference will be auto-calculated. If it appears “0” it means your data is accurate and you are good to go. But, if it is not then you need to recheck the values!

Get rid of these HSN validation hassles and save time with our advanced GSTR-9 filing software!

How to File GSTR-9 with Munim?

Check out the Easiest Way to File GSTR-9!

1. Register or Login

Register or Log in with your credentials to Munim GST Return Filing Software and Get started.

2. Click on GSTR-9

Navigate to My Company, select a company you want to file returns for or create a company, click on returns and choose GSTR-9 from drop-down.

3. Prepare Data and Validate

Import data and all the tables will get auto-populated. Check for validation flags and correct the in correct entries. Save and proceed to next.

4. File GSTR-9

Once all the details are updated, click on upload data to GSTN portal and proceed to file. For uploading data you need to enter your credentials and Captcha.

5. GSTR-9 Filed Successfully

Once the process is complete, the GSTR-9 Filing successful message will be displayed on your screen.

Get Auto-populated Data

Entries from GSTR-1 and

GSTR-3B!

Save time and effort through auto-populated details from the GSTN portal. Once you click on import data from GSTN, the information below is auto-fetched.

Perks of Munim GSTR-9 Filing Software

Your Trusted Compliance Partner that You Can Count on for Annual Return Filing!

Why Is Our GSTR-9 Filing Software the Best Choice for CAs?

1. Collaborative Working

CAs can file GST returns from anywhere in the world and at any time with our return filing software. They can also collaborate remotely with their teammates, ensuring work transparency.

2. Multi-client Management

Our GSTR-9 filing software makes managing multiple clients on the go much easier. Massive data management, handling multiple projects simultaneously, and filing returns efficiently are the key takeaways for CAs.

3. Notifications and Alerts

Get notified of the filing due dates, government circulars, GSTR updates, and more at your fingertips. With Munim, you don’t need to keep a check on all the important updates, and you can manage your clients stress-free.

Say Goodbye to GSTR-9 Filing Stress – Start Filing today!

Experience fast, accurate, and hassle-free compliance with us today! Sign up to our 1st stop solution for filing annual returns right away! Start your free trial today and experience the benefits of our advanced features.

Client Story

Here’s What Our Clients Say About Us!

We used Tally to maintain our accounts for the past 15 years, and we were looking to adopt new technologies to manage our accounts. Finally, in 2022, we switched to Munim. Since Munim is cloud-based, the financial dashboards are updated on a real-time basis, which helps us in making faster decisions.

Nainesh Acharya

Consultant – 20 years exp.

This software has already saved many many hours reconciling our accounts, having previously done this manually for our business. 5 STARS!

Bhavesh Gohil

Munim User

I’m very much impress with this software, very light and easy to use, even fresher can use this, best part is that if get minor to minor issue u will get prompt response, Naryan alwz theier to help you. I will recommend this app.

Nuraveda Care

Business Owner

I have used this application, and its really good compare to other products Also, Mr.Manish and NArayana help always to understand the application .really appriciated both of them. they have available always whenever i required help. they came online and share the screen and try to resolve the issue immediately.

Pragati Solar

Business Owner

Wonderful software. Have been using their services for the last few days and it is extremely professional and hassle-free! Thank you. Keep up your good work.

CA Rahul Mistry

Practicing Chartered accountant

Frequently Asked Questions

Get Your Queries Answered Here!

Intuitive interface

Intuitive interface Heightened Data Security

Heightened Data Security Cloud and Desktop Solution

Cloud and Desktop Solution 7-days Free Trial

7-days Free Trial