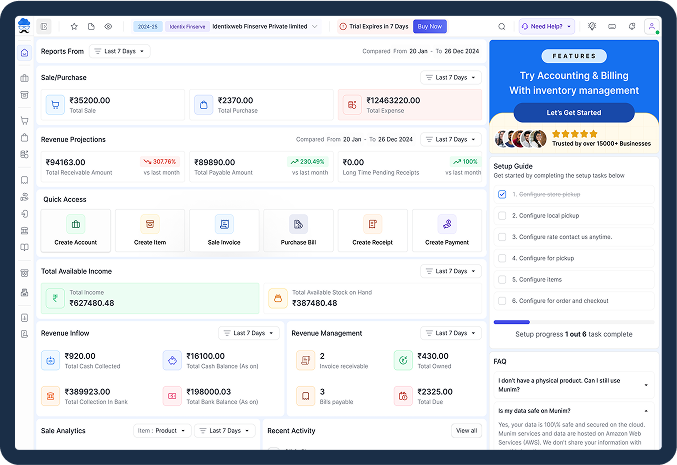

Effortless & Fast GST E-Invoicing Software

Now you don’t need to sign up in the IRP portal to generate e-invoices. With Munim Accounting & Billing software, you can generate them from our software itself.

Super Smooth E-Invoicing Software To Make Business GST Compliant

In business ‘time is money’ we are well aware of it. All businesses want to streamline their process such that it increases their efficiency and compliance is no exception. If you are looking for a complete accounting solution that helps you stay compliant with the latest GST rules and regulations, Munim Accounting & Billing is the answer for you. Know what features make Munim one-of-a-kind GST e-invoicing software.

Features Of Our E-Invoicing Software

Following are the features of our software which you will rarely get in any other accounting software together:

Seamless Integration

Our e-invoicing software is smoothly integrated with Invoice Registration Portal allowing you to generate e-invoices without any glitches.

Easy Cancellation

Manually e-invoice cancellation is a waste of time and sometimes you may experience server downtime on the other hand with Munim Accounting & Billing software it gets canceled with just one click.

One-click E-Way Bill Generation

While generating invoices if you provide transporter details such as transporter name and vehicle no., you can generate e-way bills along with an e-invoice.

Affordability

You can generate as many e-invoices as you want in Munim Accounting & Billing software, all you have to pay is 1 credit per e-invoice, and 1 credit is equal to 1 rupee.

Cess Consideration

When you generate invoices with Munim Accounting & Billing software you can specify whether your products/services fall under Cess or not. If it does so you can mention the same and it will be reflected in the e-invoice.

Mention Taxable Amount

If the price of the product/service is different from the taxable amount, Munim Accounting & Billing software allows you to mention the same in a separate column for further calculation.

Experience Hassle-Free GST e-invoicing and Stay Ahead of Your Tax Obligations

You will get full access to all the features for a limited period.

Benefits Of Using Our GST E-Invoicing Software

In the following ways it is advantageous for your business to start using Munim for generating e-invoicing software:

Transparency

When you send an e-invoice to your customers they get to know exactly how much you are charging for a product/service and how much tax they are paying.

Stay GST-compliant

In B2B transactions it is mandatory for suppliers to issue an e-invoice as per the common format notified by the GST council. Munim Accounting & Billing can help you do so.

Enhanced Security

Since Munim is cloud-based software, all your invoices will be stored securely and it is connected with IRP via trusted API thus, you don’t have to worry.

Enables Interoperability

Since all the e-invoices are generated in a standard format hence invoices generated in one software can be read by different software as well.

Minimizing Data Entry Errors

Under e-invoicing software, the chances of data entry errors reduce greatly since all the invoices are auto-populated on the GST portal and e-way bill portal.

Easier Loan Approval

Normally MSMEs have to present over a dozen documents with e-invoices. Securing a loan gets easier since the sales are authenticated by the GST invoice portal.

Why Choose Munim Accounting & Billing Software?

Munim Accounting & Billing software is one of the best e-invoicing software among its rivals. It makes your compliance process easy with its feature-rich GST module. Apart from that it also makes your accounting and inventory management easier than ever. If you are looking for a complete accounting solution you should definitely try Munim and the best part is, it offers 7 days of free trial.

Frequently Asked Questions

How much does it cost to create an e-invoice effectively?

Do I need to log in to the Invoice Registration Portal (IRP) even after using Munim Accounting & Billing software?

Is there an option to create an e-invoice in bulk?

Can I cancel my e-invoice from Munim Accounting & Billing ?

Other Features

The following are the benefits of cloud accounting software for small and medium-scale businesses in India:

Stay on top of your GST obligations with regular updates and notifications with the best accounting software.

Say goodbye to spreadsheets! Automatically track your finances with ease. Save time and focus on what matters most – growing your business.

Ensure smooth and compliant deliveries with instant e-way bill generation. Avoid delays and focus on growth.