On 1st July 2017, Goods and Services Tax (GST) came into effect across India replacing the multiple indirect taxes in India. Since its inception businesses across India have embraced this new indirect tax system with open hands, as of January 2023 there are over 14 million registered GST taxpayers, according to Statista.

If you are starting a new business and want to get a GST number for your business then you must read this blog. Here we have explained the GST registration process in a step-by-step manner and some information that you should know before starting the GST number registration process.

Documents Required for GST Registration

Following is the list of documents required to get a GST number for your SME:

- GST Registration Document Lists

- Identity and Address proof of Promoters/Director with Photographs

- PAN card of the applicant

- Aadhaar card

- Digital Signature

- Address proof of the place of business

- Bank Account statement/Canceled cheque

- Letter of Authorization/Board Resolution for Authorized Signatory

- Proof of business registration or Incorporation certificate

Also know the Documents Required for GST Registration for Partnership Firm

Compulsory GST Registration

There are some specific categories of individuals notified in the CGST Act, Section 24 that they must register for GST compulsorily, irrespective of their aggregate turnover. Details are as follows:

- Electronic Commerce Operators

- Input Service Distributors

- Individuals making the interstate supply of goods

- Individuals required to pay tax under RCM

- Providers of online information and database access or retrieval services from outside India to a person in India other than a registered person

- Persons required to deduct tax under section 51

- Persons making taxable supplies on behalf of other taxable persons, whether as an agent or otherwise.

- Non-resident taxable persons making a taxable supply.

- Casual taxable persons making a taxable supply.

Latest Update on GST Registration Process

Update #1 - Notification no: 3/2025 Dated 17th April 2025

The CBIC issued instructions to the GST officers outlining process of GST registration application, including the guidelines to verify place of business and overall physical verification process.

Update #2 - Notification no: 3/2025 Dated 12th February 2025

The GSTN has published an advisory with regards to the new Aadhaar and biometric authentication requirements for GST registration.

Update #3 - Notification no: 13/2024 Dated 10th July 2024

Biometric-based Aadhaar authentication was implemented across the country, which was earlier implemented on a pilot basis in Gujarat and Puducherry.

Update #4 - Notification No: 10/2024 Dated 10th July 2024

If applicants do not opt for Aadhaar Authentication, then have to submit their photograph and get the original documents verified at designed facilitation centers.

GST Registration Process — Step-by-Step

Follow the below explained GST registration process to get a GST number for your business:

The GST number registration process is quite easy, anyone can successfully register their business by following these steps.

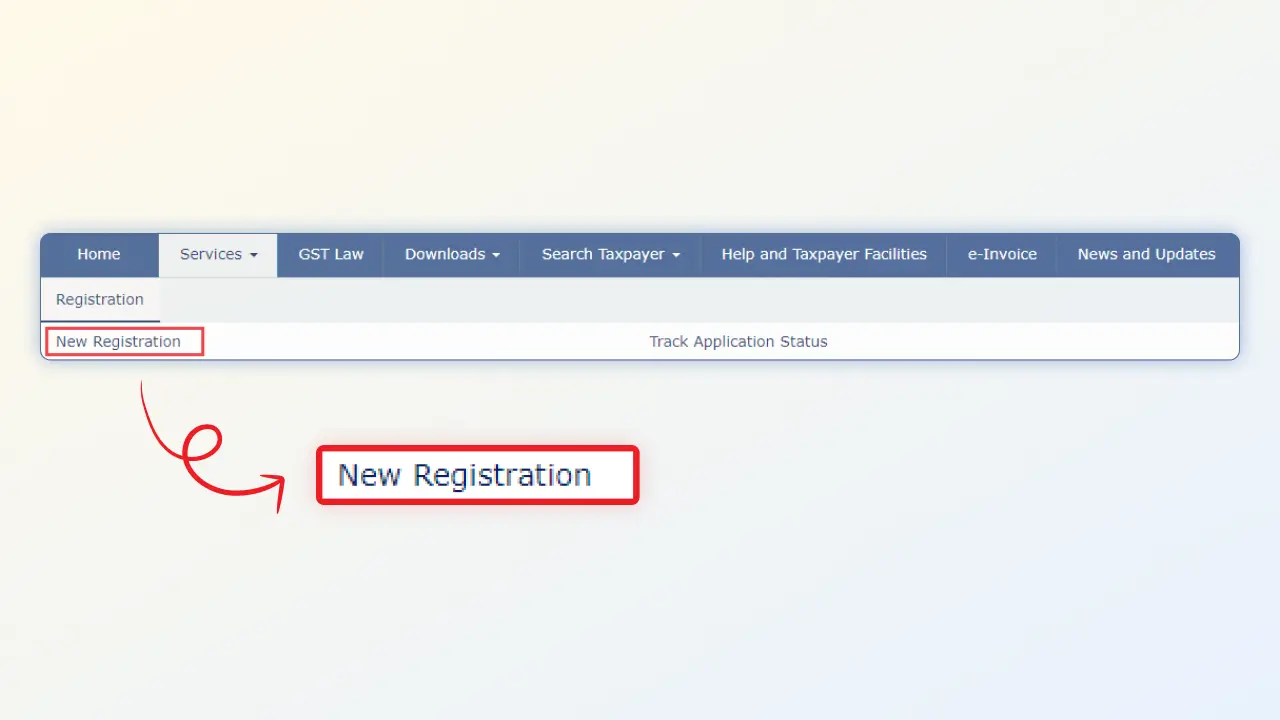

Step 1 - Go to the Official GST portal. Under the 'Service' tab click on the 'Registration' option.

The GST registration form is divided into two sections i.e. Part A & Part B.

Part A

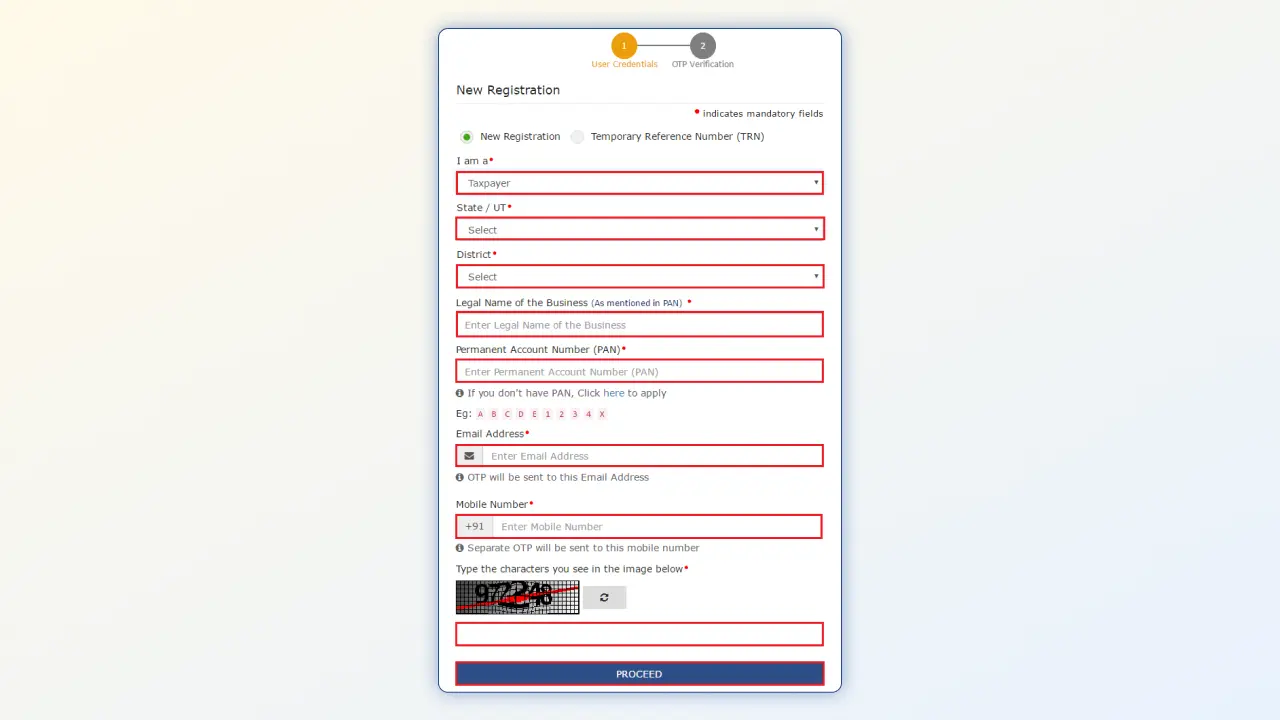

Step 2 - In the ‘I am’ dropdown menu, select the ‘Taxpayer’ category.

Step 3 - Select your State/UT and District where your business is located.

Step 4 - Write your business name as mentioned on the PAN card.

Step 5 - Enter the other details mentioned on the PAN of the business to be registered as well as the proprietor's.

Step 6 - Enter the email address, and ensure you are entering the email of the primary authorized signatory.

Step 7 - Enter the mobile number of the primary authorized signatory.

Step 8 - Enter the captcha correctly and click on the ‘Proceed’ button.

Now you will receive a Temporary Reference Number (TRN) on the registered email address and mobile number.

Part B

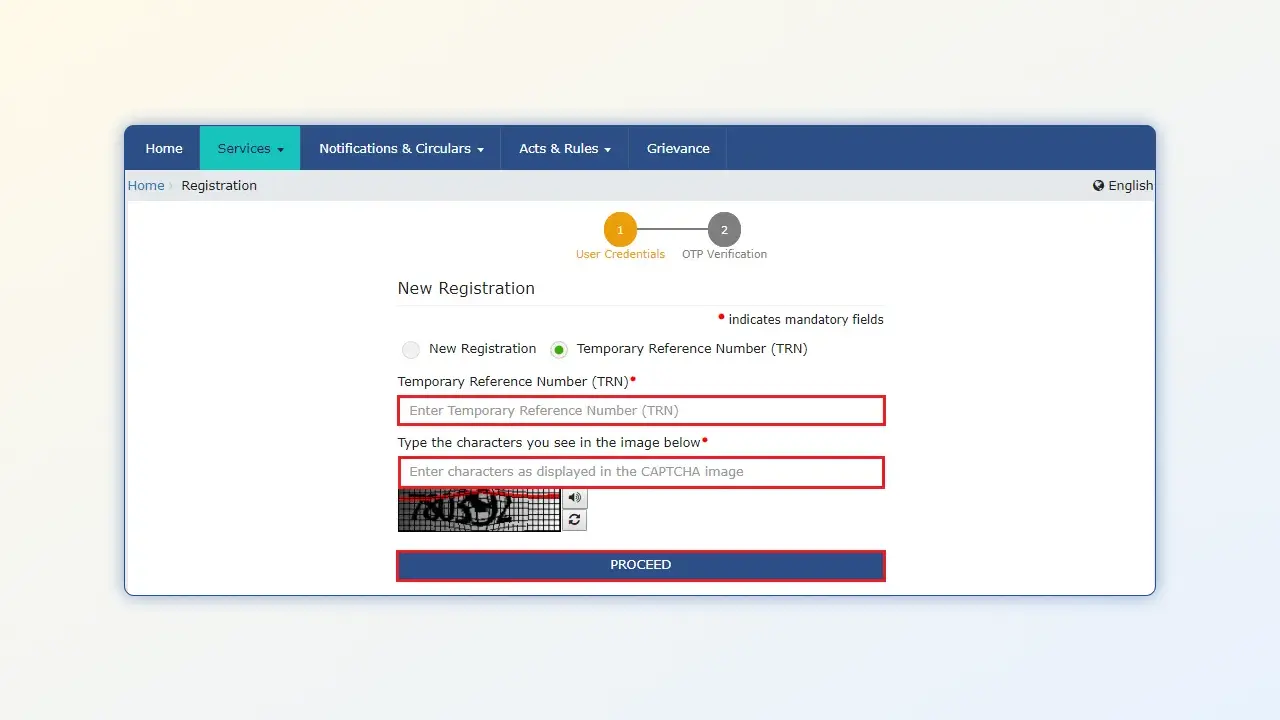

Step 9 - On the GST portal, go to Service > ‘New Registration’ then select the option ‘Temporary Reference Number (TRN)’.

Step 10 - Enter the TRN and the captcha text. Click on ‘Proceed’.

Step 11 - Enter the OTP sent to your email or mobile number and then click on the ‘Proceed’ button.

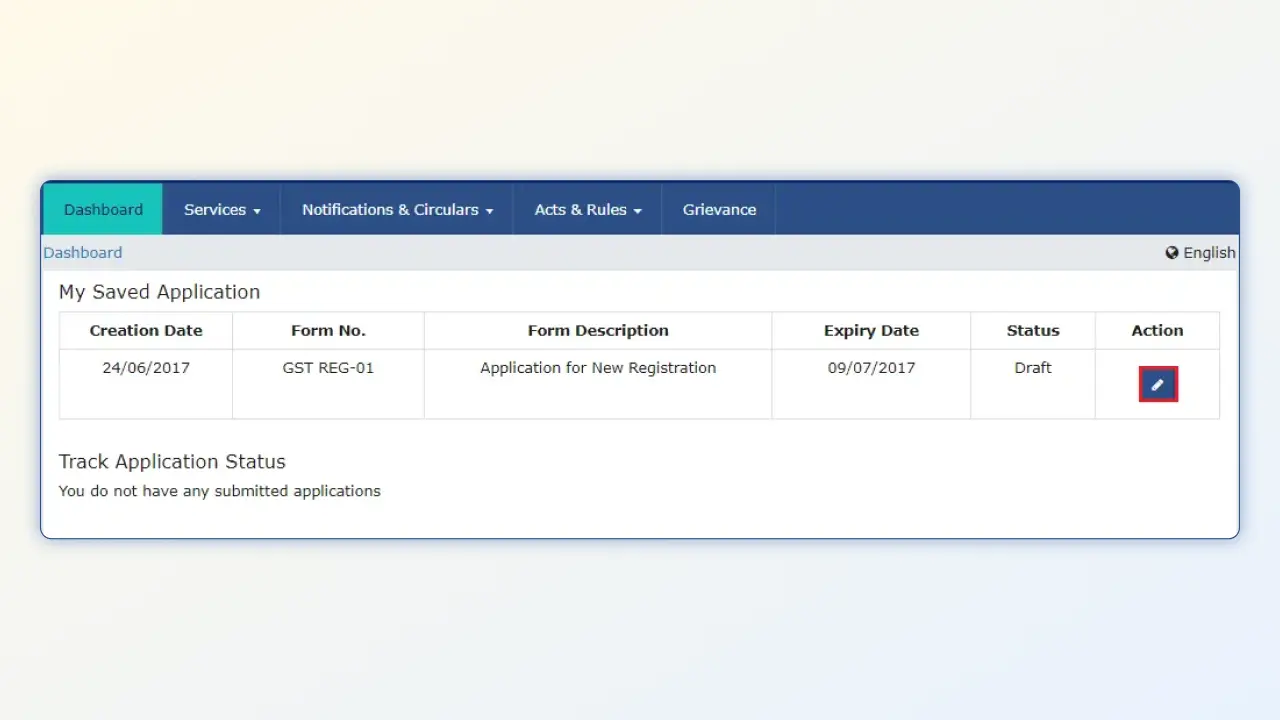

Step 12 - Go to the dashboard and check out the ‘My saved Application’. Under the ‘Action’ column, click on the edit button.

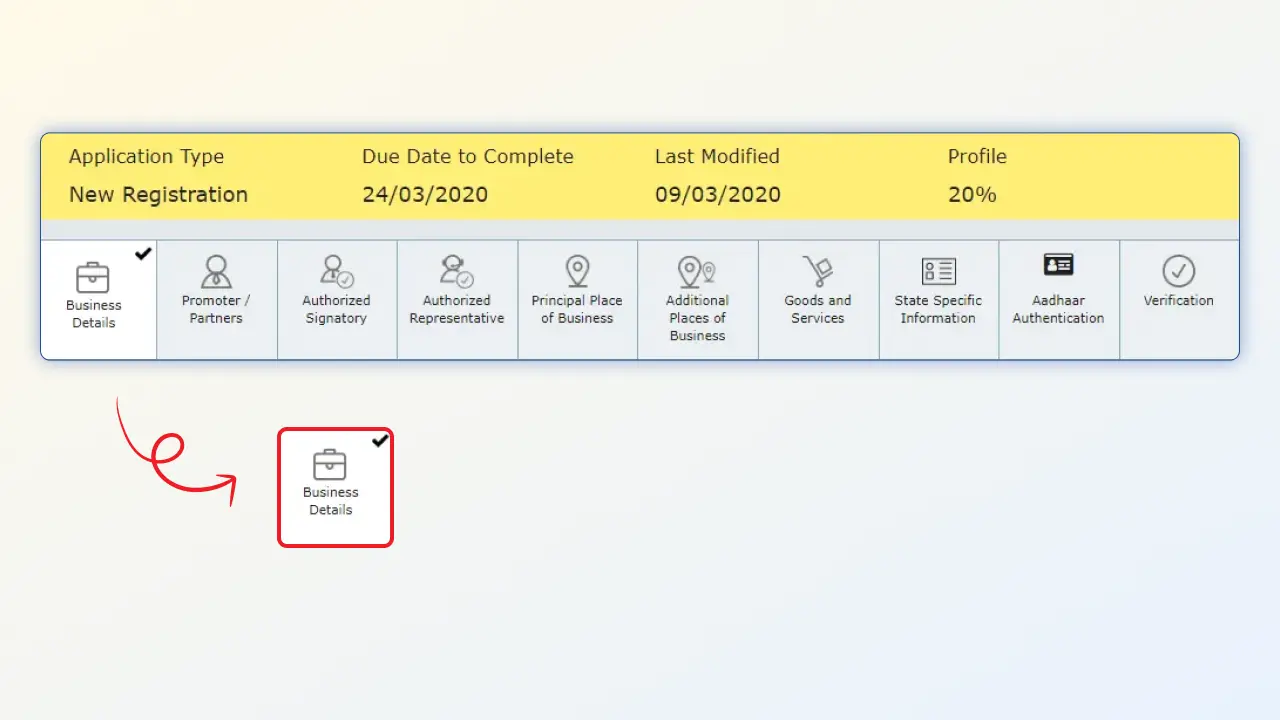

Step 13 - On top of the page, you will see 10 tabs. In each of the tabs you have to fill in your business details like promoter/partner information, goods & services details, and authorized signatory details and Aadhaar verification will be done.

Step 14 - Once all the details are provided, click on ‘Save and continue’.

Step 15 - Sign the application through EVC (DSC is optional) if you are registering as Proprietorship. For LLPs and Companies, it is mandatory to authenticate the application using DSC.

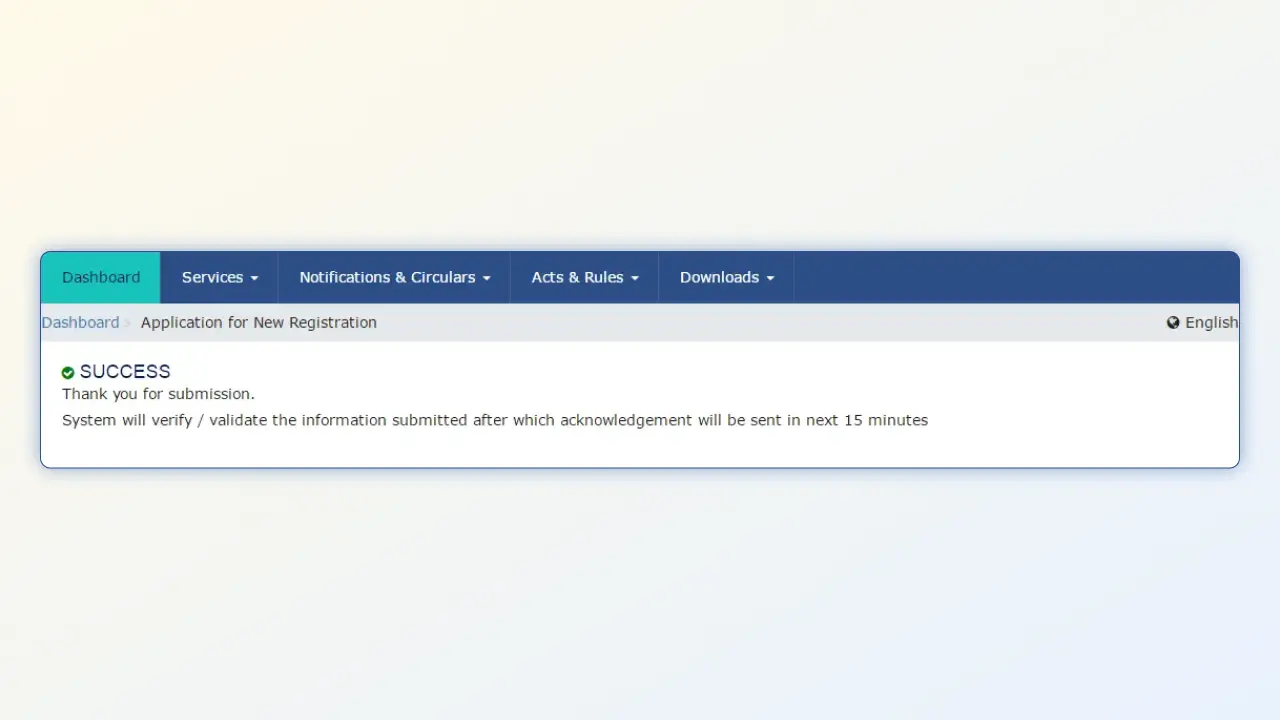

Step 16 - When the form is submitted successfully, you will receive an ‘Application Reference Number (ARN)’ via email or SMS on your registered mobile number.

Over to You

We hope after reading the GST registration process in this blog you have registered your business easily by yourself. Now that you have registered your business on the GST portal, you need GST return filing software to file GST returns regularly. Check out Munim GST Return Filing software, enabling you to file GSTR effortlessly.

GST Registration Process FAQs

1. How to check GST registration status?

Follow the below-explained steps to check GST registration status:

- Go to www.gst.gov.in

- Click on Services > Registration > New Registration

- Select the ‘Temporary Registration Number (TRN)’ option

- Enter your TRN, fill in the captcha code correctly and then click on 'Proceed'

- Enter the OTP received on your registered mobile number and then click on 'Proceed'.

- Now you will be redirected to the ‘My Saved Application’ page. Here you can check your GST registration status.

2. How to download a GST registration certificate?

Following are the steps to download the GST registration certificate:

Step #1 Go to the GST portal.

Step #2 Log in using your credentials

Step #3 Go to ‘Services’ > ‘User Services’ > ‘View/Download Certificates’

3. Is GST registration mandatory?

GST registration is mandatory only in the case your business surpasses the following annual turnover threshold:

For goods’ suppliers: More than 40 lakhs in annual turnover

For service providers: More than 20 lakhs in annual turnover

4. How to activate a suspended GST number?

If your GST registration number got suspended, by following the below steps you can activate it:

Wait for verification and approval

Find the reason behind the suspension of the GST number.

Take necessary steps to fix the non-compliance issue

Keep necessary documents handy like financial statements, GST returns etc.

Apply for revocation on the online portal