GST Software: Everything You Need To Know About E-Way Bill

Before GST, state taxes were levied on interstate sales of goods and services. And a part of it was shared with the central government. This old tax regime was complex and ambiguous; thus, GST was implemented. Under this new tax system, businesses can avail goods and services outside of their states without paying additional taxes, all they need is an e-way bills to transport goods interstate or within the state.

In this blog, we will answer your questions, like, What are the Eway bills? Who can generate it? and how to generate an eway bill in detail. Also, you will know how GST software can help you generate GST eway bills easily. So, let’s get started.

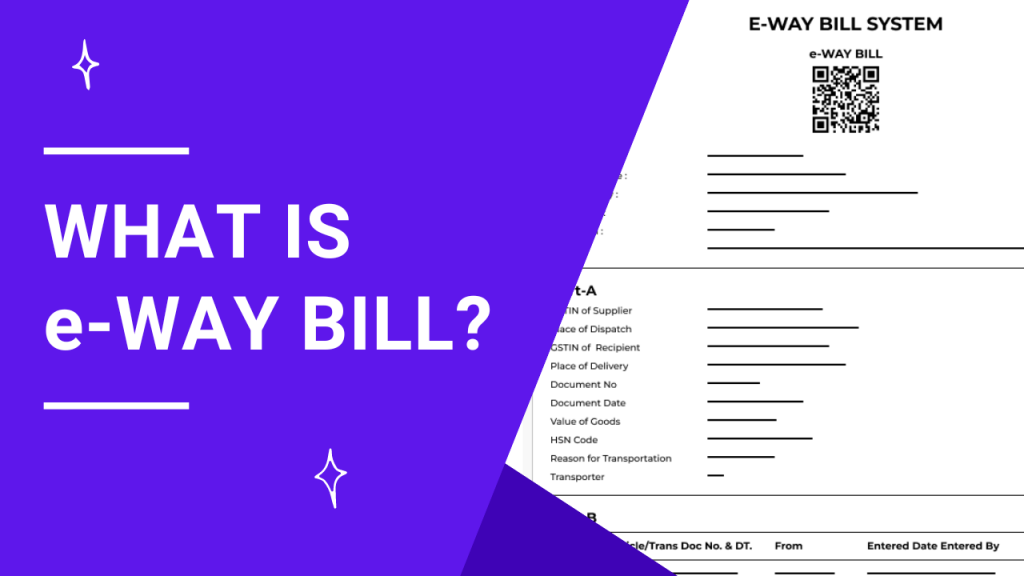

What is E-Way Bill?

Under the GST tax regime, the process of obtaining authority for the movement of goods is managed through e-way Bills, also known as Electronic Bills. These unique bill numbers are crucial for transporting goods interstate or within a state. Now, let’s delve into the latest updates on e-way, the prerequisites to generate them online, and the cases where bills are exempt. We’ll also explore the validity of e-way Bills and how you can extend them when required.

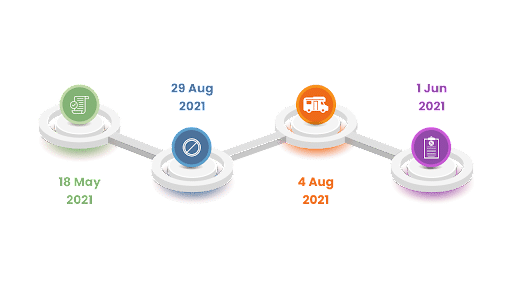

The implementation of the e-way bill was initially deferred to give more time to businesses, institutions, and the government to make the necessary preparations for its implementation.

Unleash The Latest Updates On E-Way Bills

Following are the latest updates on e-way bills online:

29th August 2021

From May 1st, 2021, to August 18th, 2021, e-way bills will not get blocked due to failure to file GSTR-1 or GSTR-3B for March 2021 to May 2021.

4th August 2021

E-way bills will get blocked due to the non-filing of GSTR-3B from August 15, 2021.

1st June 2021

- The e-way bill portal released a notification clarifying that suspended GSTIN cannot generate an eway bill. However, they can get an eway bill generated as a transporter or recipient.

- A new mode of transport was updated, namely ship/Road cum ship, to facilitate the initial movement of goods via roadways to reach the seaport for the due course of shipment. With this update, an option to add a vehicle number is activated.

18th May 2021

The Central Tax Department notified that blocking of GSTIN e-way bill generation will now onwards be limited to the supplier’s GSTIN if defaulted. It will not affect the transporter’s or recipient’s GSTIN.

Prerequisites To Generate eWay Bills Online

- An entity should be registered on the e-way bill portal.

- The generator should have invoice/delivery challan handy.

- Transporter ID or vehicle no., if the goods are being transported via roadway.

- Transport ID, transport document number with date, if the goods are being transported via rail, air, or ship.

When Do You Need eWay Bills?

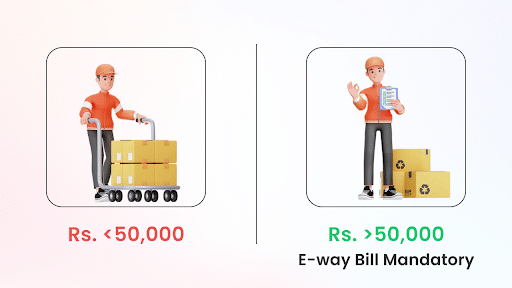

When the invoice value of goods in transport is greater than Rs. 50,000 (either each invoice or the sum of all invoices in transport) in the following cases you need a valid eway bill.

- Goods are in supply

- Goods are in other than supply (e.g return)

- Inward from an unregistered entity

For the above purpose, below are the cases of supply:

- Goods transported against payment within the business course

- Goods transported against the payment outside of business course

- Goods transported without payment

Thus, you need to generate eway bills online for these cases. For the notified goods you require an eway bill even if the invoice value is less than Rs. 50,000, which is:

- Inter-state transport of goods by Principal to registered/unregistered job worker

- Inter-state transport of handicraft goods by an entity exempted from GST

Cases Where eWay Bill Is Exempt

Following are the cases where e-way bills are not required:

- Empty cargo containers are being transported

- Goods exempted from the eway bill in a particular state or union territory

- Mode of transport is a non-motor vehicle

- Goods transported under the supervision of the Customs department or Customs seal

- Goods transported under the supervision of Customs Bond to ICD from one custom checkpoint to another

- Goods bought or sold by the Ministry of Defense

- Goods sent for weightage to a weighbridge within 20 km of the location of business, accompanied by a delivery challan

- Goods transported via railway in cases where the consignor is the Central government, State government, or local authorities

- Cargo in transit to or from Nepal or Bhutan

- Goods are transported from an airport customs port, air cargo complex, or land customs station to an inland container depot or container freight station to get clearance from Customs.

Validity Of E-Way Bill

The validity of an eWay bill depends on the distance to be traveled by goods. Following are the conditions for the validity of eWay bills.

| Type of conveyance | Distance to be traveled | Validity |

| Other than Over oversized cargo | Less than 200 kms | 1 day |

| For every additional 200 kms there of | Additional 1 day | |

| Oversized cargo | Less than 200 km | 1 day |

| For every additional 20 km thereof | additional 1 Day |

One can extend the validity of eway bills if need be. The generator of the e-way bill is provided with 8 hours of room before and after the expiration of the e-way bill within which it can be extended.

Meet Munim’s GST Accounting Software

Our software is designed to make your compliance journey smooth and hassle-free. Here are some key features:

- GST Billing & Invoicing: Generate GST-compliant invoices in a blink of an eye, and even handle bulk e-invoice generation effortlessly.

- Automatic Tax Calculation: Simply input the data, and Munim will automatically calculate your tax liability. Just cross-verify the entries for accuracy.

- Easy GSTR Filing: Forget manual logins to the GST portal. Munim integrates with your GST account to file returns on your behalf, with the ability to track the status.

- Generate E-Way Bills: While creating invoices, you can simultaneously generate E-Way Bills. Just enter the transporter details, and Munim will handle the authorization from the GST portal.

- Designate HSN/SAC Codes: Streamline GST tax returns by assigning HSN/SAC codes to your products and services without additional hassles.

- TDS/TCS Calculation: Munim’s product-specific feature allows you to calculate TDS/TCS for particular products with ease.

Let’s Conclude!

E-Way Bills are vital for GST compliance, facilitating smooth goods movement. Stay updated, use Munim’s user-friendly GST Accounting Software for invoicing, return filing, and E-Way Bill generation to streamline operations, ensure compliance, and drive growth. Sign up with Munim now and unlock its potential for success!

FAQs

Q. How to generate e-way bills?

Ans.

Step 1 – Login to the e-invoice portal

Step 2 – Go to ‘e-way bill’. Click on ‘Generate e-way bill’

Step 3 – Select any option from IRN, date, and Acknowledgement no., and add the data for the selected option.

Step 4 – Then enter the Transporter ID, Transporter name, and approximate distance to be covered.

Step 5 – In the next step, enter Vehicle no. and Transporter doc no., and click ‘Save’

Step 6 – Once the e-way bill gets generated with a unique 12-digit number, save it in a PDF or JSON file.

Q. What is the minimum invoice amount requiring bills with e-way bill generation software?

Ans.

For safe and compliant transportation, bills are needed when the invoice value exceeds Rs. 50,000, facilitated by e-way bill generation software.

Q. Are there penalties for the non-production of e-way bills using GST e-way Bill Software?

Ans.

Yes, failing to present e-way bills carries a minimum penalty of Rs. 10,000. Utilize GST E Way Bill Software to avoid such penalties.

Q. How long are the e-way bills generated via e-way bill generation software valid?

Ans.

E-way bills remain valid for 24 hours up to 200 km. For oversized cargo, this extends to 20 km. GST E Way Bill Software ensures compliance within validity.

Q. Can the validity of e-way bills be extended using GST E-Way Bill Software?

Absolutely, transporters can extend e-way bill validity using our GST E-Way Bill Software. Ensure smooth transportation and compliance effortlessly.

Ans.

Consignees, consignors, and transporters all have the capability to generate bills conveniently using e-way bill generation software.