Accounts Payable Vs Accounts Receivable: A Complete Guide!

Accounts payable and accounts receivable are the crux of every business model. When revenues are in healthy equilibrium with expenditures, the company unlocks growth opportunities, expands customer relationships, and establishes long-term partnerships.

Let’s quickly explore the two terms.

What are Accounts Payable?

Accounts payable also abbreviated as AP is a critical component of an organization’s financial management process. It refers to the outstanding debts and obligations a company owes to its suppliers, vendors, or creditors for goods and services received but not yet paid for. In simpler terms, accounts payable represent the money a company owes to others for various business-related transactions.

Normally, it doesn’t comprise the payrolls and long-term debts. These obligations are to be recorded as monthly payments for debts. Additionally, wages are processed separately in this system.

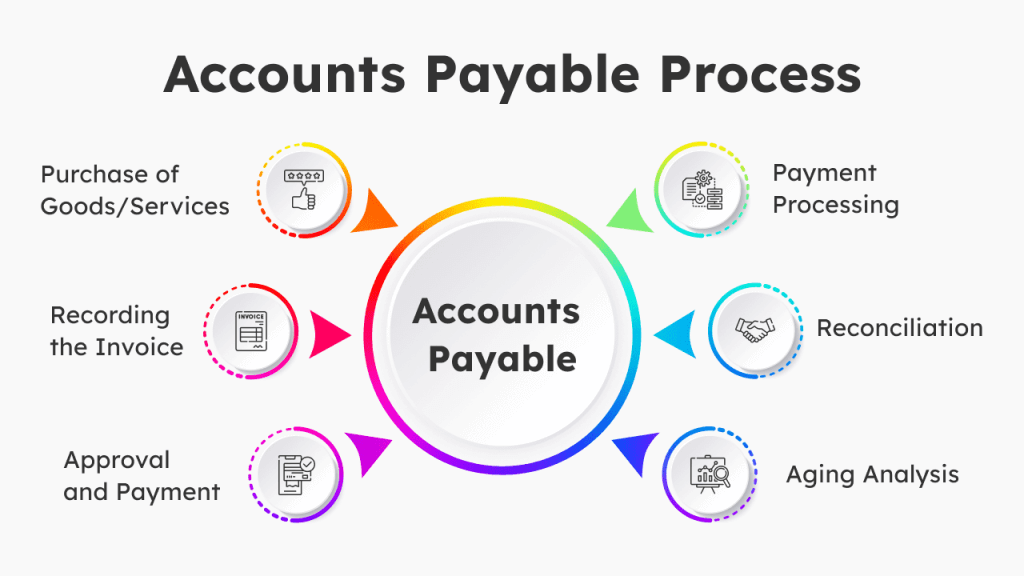

Accounts Payable Process

Accounts payable is a crucial part of a company’s working capital management. Timely payment of suppliers helps maintain good relationships and can sometimes lead to early payment discounts, while late payments can strain relationships and even result in penalties or disruptions to the supply chain.

Efficient management of current liability accounts is essential for financial stability and liquidity within an organization. It ensures that the company’s obligations are met promptly while optimizing cash flow and maintaining good business relationships with suppliers.

Here’s how the accounts payable process typically works within an organization:

- Purchase of Goods/Services: When an organization purchases goods or services from a supplier or vendor, an invoice is generated. The invoice contains details of the products or services provided, their quantities, prices, and the total amount owed.

- Recording the Invoice: The accounts payable department receives the invoice and enters it into the accounting system. This step involves verifying the accuracy of the invoice, ensuring that the goods or services were received and that the prices and quantities are correct.

- Approval and Payment: The invoice is then sent for approval to the appropriate personnel within the organization. Once approved, the accounts payable team schedules the payment based on the agreed-upon payment terms with the supplier.

- Payment Processing: Depending on the payment terms, the current liability account processes the payment, which could be done via check, electronic funds transfer (EFT), wire transfer, or other methods. The payment is then sent to the supplier or vendor.

- Reconciliation: The accounts payable department regularly reconciles its records with supplier statements to ensure that all payments are accurately accounted for and that there are no discrepancies.

- Aging Analysis: The current liability account team monitors the aging of outstanding invoices to keep track of how long each payment has been pending. This helps identify any overdue payments and manage cash flow effectively.

What are Accounts Receivable?

Accounts Receivable (AR) is another crucial aspect of financial management in a business. It refers to the money owed to a company by its customers or clients for goods or services provided on credit. A few examples of cash inflow are payments or bills that are yet to be cleared by the clients or consumers for the services rendered.

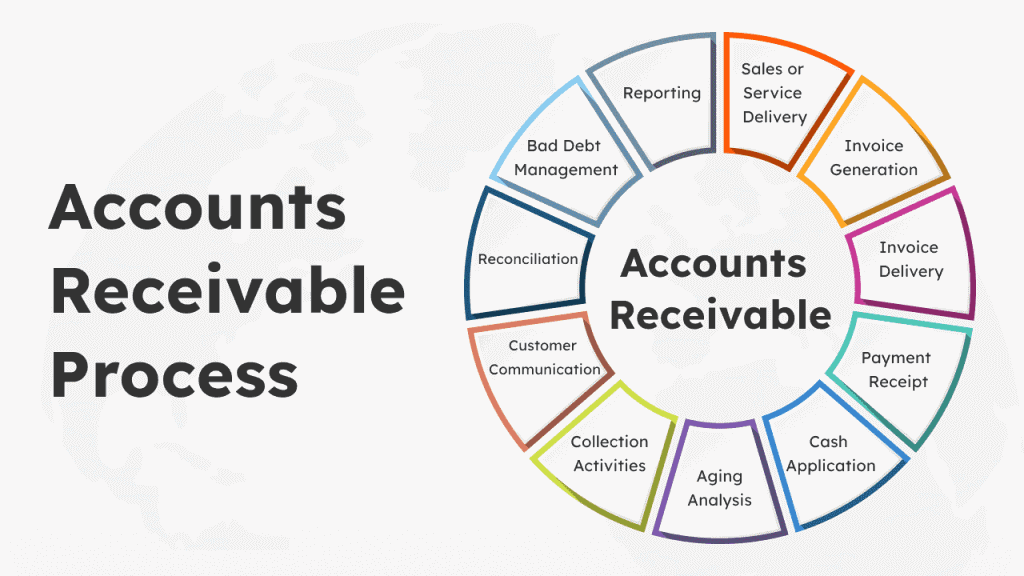

Accounts Receivable Process

Efficient management of pending payments is crucial for maintaining healthy cash flow and financial stability. Companies often use online accounting software and customer relationship management (CRM) systems to streamline the accounts receivable process and ensure timely collections.

The accounts receivable process involves several steps, from generating invoices to collecting payments. Here’s an overview of the typical accounts receivable process:

- Sales or Service Delivery: The accounts receivable process begins with the sale of goods or the provision of services to customers. The terms of the sale, including the credit period and payment due date, are agreed upon at this stage.

- Invoice Generation: After the goods are delivered or the services are provided, the company generates an invoice detailing the transaction’s specifics, such as the items sold, quantities, prices, and payment terms. The invoice is then sent to the customer for accounts receivable.

- Invoice Delivery: The billing receipt is delivered to the customer, either through e-invoice or through traditional mail. In some cases, a piece of remittance advice may accompany the invoice, providing instructions to the customer on how to make the payment and which invoices to include.

- Payment Receipt: The customer reviews the invoice and processes the payment according to the agreed-upon payment terms. Payments can be made through various methods, such as cash, checks, credit cards, electronic funds transfer (EFT), or other online payment platforms.

- Cash Application: Once the payment is received, the company records the transaction in its accounting system, matching the payment to the corresponding invoice. This process is called cash application and helps maintain an accurate accounts receivable ledger.

- Aging Analysis: The company regularly generates an aging report that categorizes outstanding invoices by their age (e.g., current, 30 days past due, 60 days past due, etc.). This report helps monitor the status of cash inflows and identifies overdue invoices that require follow-up.

- Collection Activities: If an invoice becomes overdue, the company initiates collection activities to remind the customer of the outstanding payment. These activities may include sending reminder emails, making phone calls, or issuing formal collection letters.

- Customer Communication: Throughout the accounts Receivable process, maintaining good communication with customers is essential. Addressing any concerns or disputes promptly can help expedite payment and improve customer relationships.

- Reconciliation: Regularly reconciling accounts receivable balances with customer statements helps ensure the accuracy of records and identify any discrepancies.

- Bad Debt Management: In some cases, customers may be unable or unwilling to pay their outstanding invoices, leading to bad debts. Companies may need to write off these uncollectible amounts and make adjustments to their financial statements.

- Reporting: Ensuring regular reviews reports related to customer pending payments, including aging reports, collection progress, and other key performance indicators (KPIs). This helps identify areas for improvement and supports strategic decision-making.

Accounts Payable Vs Accounts Receivable

| Accounts Payable | Accounts Receivable |

| Accounts payable is defined as the money to be disbursed by a company to the suppliers and vendors. | Accounts receivable is defined as the money to be received from customers or consumers for the services availed. |

| It is recorded as the current liability on the balance sheet. | It is recorded as a current asset on the balance sheet. |

| It is recognized as a liability until paid. | It is identified as an income unless written off. |

| Accounts payable belong to the client’s record. | Accounts receivable belong to the vendor’s record. |

Let’s Wrap

Hopefully, the blog has enlightened your knowledge of accounts payable and receivable. If you are looking for accounting software, check out Munim now!

FAQs for Accounts Payable and Receivable!

- What are accounts payable on a balance sheet?

Accounts Payable on a balance sheet represent the outstanding obligations a company owes to its suppliers and vendors for goods and services received on credit. It is a liability and falls under the current liabilities category since these obligations are typically due within one year. It reflects the amount the company needs to settle with its creditors and provides insights into the company’s creditworthiness and payment practices.

- What are accounts receivable on a balance sheet?

Accounts Receivable on a balance sheet represent the amounts owed to a company by its customers or clients for goods and services provided on credit. It is categorized as a current asset since it is expected to be collected within one year. Accounts Receivable showcases the company’s sales and serves as a measure of its credit sales and collection efficiency.

- What is the accounts payable turnover ratio?

The accounts payable turnover ratio is a financial metric used to assess a company’s efficiency in paying its suppliers and managing its accounts payable. It is calculated by dividing the total purchases made on credit during a specific period by the average accounts payable during that period. A higher accounts payable turnover ratio indicates that the company is paying its suppliers quickly, which can be advantageous in negotiating favorable credit terms. Conversely, a lower ratio may signal inefficiency or potential cash flow issues. Regularly monitoring the accounts payable turnover ratio helps businesses optimize payment processes and maintain good relationships with suppliers.

- What is the accounts receivable turnover ratio?

The accounts receivable turnover ratio is a financial metric used to evaluate how efficiently a company collects payments from its customers. It is calculated by dividing the net credit sales during a specific period by the average accounts receivable balance for the same period. A higher accounts receivable turnover ratio indicates that the company is collecting payments quickly, which is a positive sign of strong cash flow and effective credit management. A lower ratio may suggest issues with collecting payments, potential bad debts, or inadequate credit policies. Regularly monitoring the accounts receivable turnover ratio helps companies identify areas for improvement and optimize their collection processes.

- What is the accounts payable cycle?

The accounts payable cycle refers to the entire process a company follows from the time it orders goods or services from suppliers to the time it makes payment for those purchases. It typically includes the steps of purchase requisition, purchase order generation, goods receipt, invoice verification, and payment processing. The accounts payable cycle represents the time it takes for a company to pay its suppliers, from the initiation of the purchase to the actual disbursement of funds. A well-managed accounts payable cycle is essential for maintaining positive relationships with suppliers, taking advantage of payment discounts, and optimizing cash flow and working capital.

- What is the accounts receivable cycle?

The accounts receivable cycle refers to the complete process a company follows from the sale of goods or services to customers on credit to the collection of payments from those customers. It involves steps such as generating invoices, delivering them to customers, recording payments, and managing collection activities for overdue accounts. The accounts receivable cycle represents the time it takes for the company to convert its credit sales into cash. An efficient accounts receivable cycle is important for maintaining healthy cash flow, minimizing bad debts, and optimizing working capital. Effective credit management and timely collections are essential elements of a well-managed accounts receivable cycle.