Since 1986, India has been using HSN, or Harmonic System of Nomenclature, to classify commodities for Customs and Central Excise. After the implementation of GST, the Ministry of Finance has mandated the furnishing of an HSN code in invoices if your business’s annual turnover exceeds 1.5 Cr; since the use of HSN code is widespread now, let’s understand what HSN code in GST is and how it works.

What is the HSN Code Exactly?

The HSN code system was developed by the World Customs Organization (WCO) and is internationally accepted for categorizing goods in a standardized manner. India adopted it because of this.

From India’s GST perspective, the HSN code works as a basis for determining the GST liability of goods. A specific GST tax rate is assigned to each HSN code, making it easier for GST authorities to identify the goods being supplied and to verify the tax being paid.

Role of HSN Codes in GST

The main role of HSN codes in GST is to provide a standardized format for classifying goods worldwide. This standardized format simplifies international trade. Manufacturers, wholesalers, traders, and exporters used HSN codes even before GST.

After the introduction of GST, these codes are mainly used for taxation purposes. They help identify the applicable GST rate on a particular product.

Difference Between HSN Code and SAC Code

Goods are classified with HSN codes; similarly, services are classified with the SAC code system. The acronym SAC stands for Services Accounting Code (SAC). After the introduction of this system, service classification became standardized, particularly for taxation purposes.

Similar to how HSN codes are mentioned in the invoices, SAC codes are also mentioned in the invoices to indicate the type of service rendered.

Decoding HSN Code Format

Decoding HSN code under GST in India involves breaking down the alphanumeric code to understand the underlying meaning of its components. The code is divided into four main parts, details of which are as follows:

- First Two Digits: The first two digits denote the HSN chapter.

- Next Two Digits: The next two digits denote the HSN heading.

- Subsequent Two Digits: The subsequent two digits represent the HSN sub-heading.

- Last Two Digits: The last two digits denote the tariff items.

Being a business owner, knowing the intricacies of the HSN code helps you dodge GST's complexities with ease.

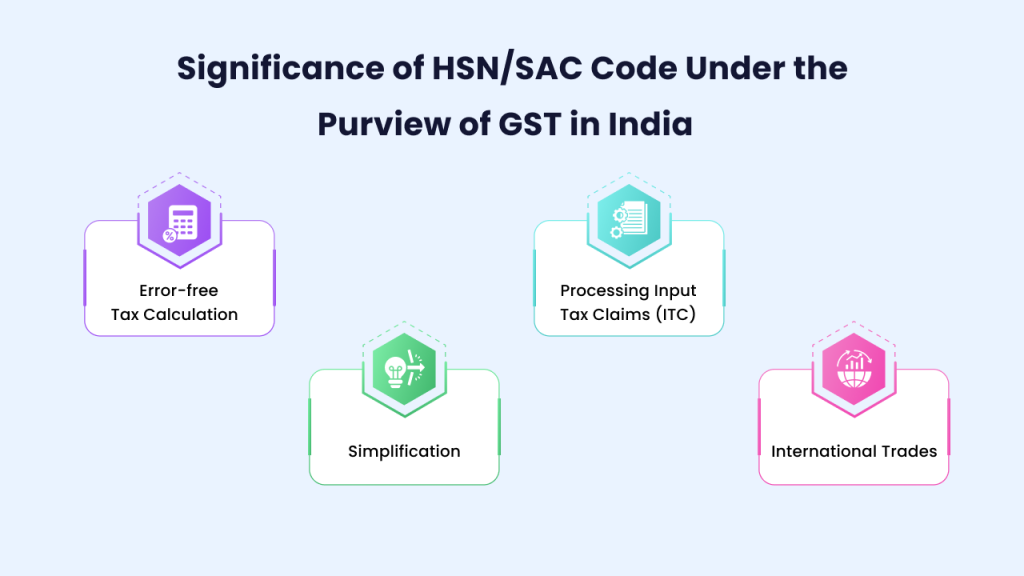

Significance of HSN/SAC Code Under the Purview of GST in India

After introducing GST in India, businesses must disclose the HSN for goods and the SAC codes for services on the invoice. These codes are implemented in India for the following reasons:

Error-free Tax Calculation

One of the main reasons for implementing the HSN/SAC code in India is to enable accurate tax calculation. Thousands of products are traded in India, and each attracts different tax rates under GST. Thus, a standardized product identification code (HSN code) ensures that businesses pay the correct tax, reducing the risk of tax evasion.

Simplification

HSN codes are a common language between tax authorities, businesses and consumers. This system of codes prevents communication gaps between all the stakeholders.

Processing Input Tax Claims (ITC)

The indirect tax system in India relies on HSN/SAC codes to process Input Tax Credits (ITC). Accurately disclosing these codes in invoices ensures the smooth and quick processing of ITC claims.

International Trades

In a globalized economy, having a standardized product classification code is crucial to facilitate international trade. HSN codes, being universally recognized, ensure seamless international trade while adhering to the tax regulations of various countries, providing a sense of reassurance to businesses involved in global trade.

Over to You

So this was all about HSN codes in GST that you should know. We hope that after reading this blog, you understand HSN code's significance, usage, and structure. If your business’s annual turnover exceeds 1.5 Cr, disclose the applicable code in your invoices.

If you are facing troubles while generating GST-compliant invoices, sign up with Munim, a comprehensive invoicing platform. If you find this blog insightful, check out Munim's blog for more tips and information on GST compliance and business finance.

Frequently Asked Questions on HSN Codes in GST

What is the HSN code in GST?

The HSN code is used to classify various products under GST. This coding system, developed by the World Customs Organization (WCO), is accepted worldwide.

How to add HSN code in the GST portal?

Following are the steps to add an HSN code in the GST portal:

Step 1: Log in to the GST portal

Step 2: Go to Dashboard > ‘Services’ > ‘User Services’ > ‘HSN/SAC Masters’ and then click on ‘Add HSN/SAC’

Step 3: Enter the HSN code

Step 4: Enter a brief description of the product and the applicable GST rate

Step 5: Hit ‘Save’

Step 6: Verify the HSN code

How do I find the HSN code in the GST portal?

Following are the steps to find HSN code in the GST portal:

Step 1: Visit the GST portal

Step 2: Log in to the portal with valid credentials

Step 3: On the Menu bar, click on ‘Services’ > User Services > Search HSN Code

How many digits of HSN code are required in GST?

If a company’s annual turnover is up to Rs. 5 crore, then 4-digit HSN code is to be disclosed. In case the annual turnover is more than Rs. 5 Crores, then the 6-digit HSN code is to be disclosed.

How can the HSN code in GST be amended?

In order to update the HSN code in the GST portal, go to the HSN/SAC master section and select the HSN code you want to edit. Edit the HSN code as required and hit ‘Save’.

Explore Our Guide

GST Registration for Partnership Firm

MSME Business Registration