Overview Of Union Budget 2023-24

On 1st February 2023 the Hon’ble Finance Minister of India Smt. Nirmala Sitharaman ji announced the BJP-led NDA government’s Union Budget for the financial year 2023-24. While presenting the budget she said ‘the Indian economy is on the right path and heading towards a brighter future’. She introduced the new tax regime and other important amendments that we will discuss in this blog.

Amendments In Income Tax Regime For FY 2023-24

Before talking about amendments in the income tax slabs, let’s look at the new tax regime before the budget:

The new tax regime before the budget was:

| No. | Total income band | Tax rate |

| 1 | Upto Rs. 2.5 lakhs | Nil |

| 2 | From Rs. 2.5 lakhs to 5 lakhs | 5% |

| 3 | From Rs. 5 lakhs to 7.5 lakhs | 10% |

| 4 | From Rs. 7.5 lakhs to 10 lakhs | 15% |

| 5 | From Rs. 10 lakhs to 12.5 lakhs | 20% |

| 6 | From Rs. 12.5 lakhs to 15 lakhs | 25% |

| 7 | Above 15 lakhs | 30% |

Now, let’s have a look at the new tax regime.

The new regime after the budget is as follows:

| No. | Total income band | Tax rate |

| 1 | Upto Rs. 3 lakhs | Nil |

| 2 | From Rs. 3 lakhs to 6 lakhs | 5% |

| 3 | From Rs. 6 lakhs to 9 lakhs | 10% |

| 4 | From Rs. 9 lakhs to 12 lakhs | 15% |

| 5 | From Rs. 12 lakhs to 15 lakhs | 20% |

| 6 | Above 15 lakhs | 30% |

Here is the list of the important announcement that CAs and accountants should make a note of:

- Earlier there were six income slabs, now it is reduced to five and the minimum taxable income would be Rs. 3 lakhs instead of Rs. 2.5 lakhs.

- The new tax regime will be the default; however, people will be able to opt for the old tax regime.

- The rebate limit increased from Rs. 5 lakhs to 7 lakhs.

- In 2002 the limit of tax exemption on leave encashment of non-government employees to the extent of Rs. 3 lakhs which is now increased to Rs. 25 lakhs.

- The standard deduction of Rs. 50,000 was proposed for salaried individuals in the new tax regime and on the earnings of Rs. 15.50 lakhs the Standard Deduction amount will be 52500

- No more tax exemption on the maturity of the insurance policy issued after 1st April 2023 has a premium of over Rs. 5 lakhs per annum.

- The threshold limit of Rs.10,000 is revoked on winning prize money from online games. Now proposes TDS and tax applicability on the net winnings of any amount at withdrawal or at the end of the fiscal year.

- Primarily cooperative societies could process a cash transaction up to 2 lakhs only.

- Co-operative society can withdraw cash of Rs. 3 Cr in a year without being subjected to TDS on such withdrawal

- In the case of unavailability of a PAN card the TDS rate is reduced from 30% to 20% on the taxable portion of EPF withdrawal

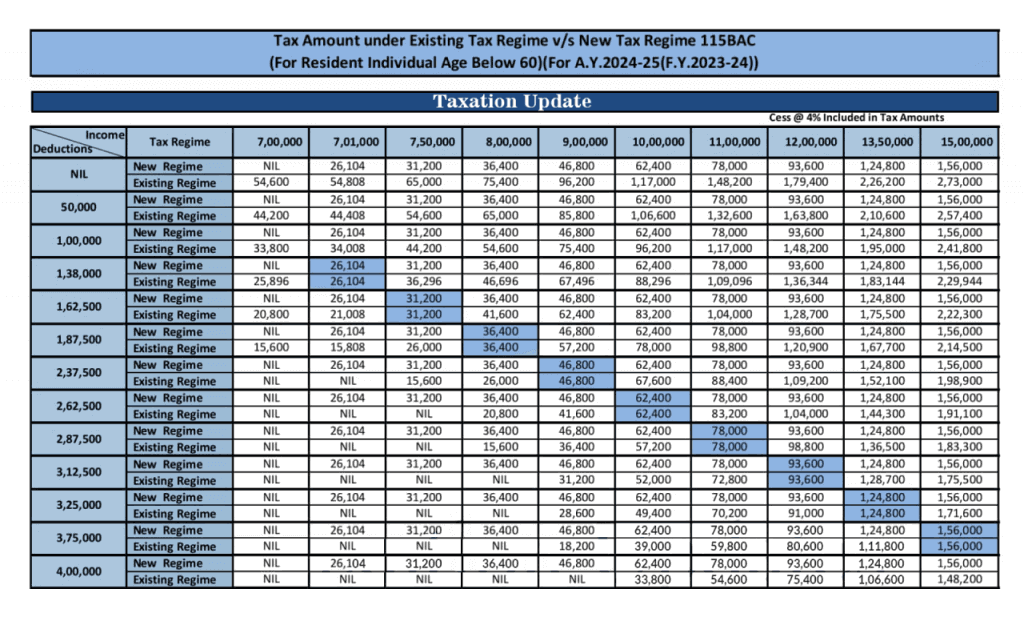

Here is a detailed comparison of the old and new tax regimes for salaried employees:

Startup Eligibility Date Extension

As the Hon’ble Finance Minister of India highlighted in the economic survey 2022-23 in her budget speech “We have taken a number of measures for startups and they have borne results,” said Nirmala Sitharaman. “India is now the third largest ecosystem for startups globally, and ranks second in innovation quality among middle-income countries.”

She proposed to extend the eligibility date of Startups from 31st March 2023 to 31st March 2024 to avail of income tax benefits.

Here’s the catch,

The FM used the term ‘Eligible’ which means that only DPIIT-registered entities will be called ‘Startups’.

Secondly, the annual turnover of such companies cannot exceed 100 crores in any fiscal year since its inception.

The third condition is the entity must be working in the development, innovation, or improvement of services, processes, or products. Or the business model is scalable with the potential of generating employment for the masses.

Furthermore, she proposed to extend the period of relaxation for losses incurred from 7 years to 10 years.

Experts believe that this amendment will boost the startup ecosystem of India, strengthening the vision of Atmanirbhar Bharat.

Amendment In Custom Duty

Following are the changes the FM spoke about in her budget speech:

- Reduce the Customs Duty Exemption to Crude Glycerine, Marine Products, Electric Kitchen Chimney, and seeds used for the manufacture of diamonds.

- Increase custom duty on cigarettes by 16%

- Reduction in customs duty by 2.5% for the parts of open cells used in the manufacturing of Television

- The basic import duty on compounded rubber would be 25% now as opposed to 10% before.

- 7.5% increase in custom duty of imported kitchen chimneys

- The relaxation in tariffs for certain goods used in the manufacturing of mobile phones.

The intent behind raising the customs duty on several goods is to demotivate imports and further set up manufacturing facilities to produce the same in India.

Revised Limit For Presumptive Taxation Scheme (PTS)

Before knowing what amendments are introduced in PTS let’s understand what this scheme actually is.

Under the Presumptive taxation scheme (PTS) a taxpayer need not to maintain books of accounts. Thus, one saves the additional cost of maintaining the same.

This scheme is defined under different sections of the Income Tax Act which are — 44AD, 44ADA, and 44AE.

With an intent to make compliance easy and enhance cashless transactions throughout the country, the government proposed to increase the upper limit on eligible businesses from an annual turnover of Rs. 2 crores to Rs. 3 crores. While for specialized professions the turnover threshold limit increased from Rs. 50 lakhs to Rs. 75 lakhs. It is subjected to the condition that the total cash receipt does not exceed 5% of the total turnover/gross receipt.

Final Words

So this was the overview of the Union budget of India, 2023-24. We hope after reading this blog you are informed about all the latest amendments introduced by the finance minister of India and will help your clients make the right financial decisions. In case you want to switch your accounting software then you should consider Munim – India’s best online accounting software. Not only it helps you maintain books of accounts but also aids in managing inventory, E-invoice, E-way bills, realtime access to financial reports, and GST filing. For more information, you can schedule a free demo with us.