Delivery Challan Under GST: A Guide for Small and Mid-sized Businesses!

All small and mid-sized businesses are trying to shape their financial ecosystem. Most businesses are migrating to cloud accounting and billing software for generating invoices, e-way bills, record maintenance, and much more. A Delivery Challan is considered an important document under GST regulations for the ongoing communication between the vendors and the buyers. Section 31 of the CGST Act 2017 says the registered users for transporting taxable goods or products need to submit an invoice with the amount and desired information. Similarly, the delivery receipt is crucial for transporting and shipping the products.

Let’s quickly scroll down to understand the delivery challan’s meaning.

What is Delivery Challan?

A delivery challan is a document used in commercial transactions to record the transfer of goods from one party to another. It serves as proof of delivery and includes details such as the description of the goods, quantity, and date of delivery. This document is commonly used for internal record-keeping, to facilitate invoicing, and for tax purposes. It helps ensure transparency and accuracy in the movement of goods between parties involved in the transaction. According to the rules, creating a tax invoice is considered the primary requirement for the supply of most goods and products.

Explain the Delivery Challan Under GST

Under the Goods and Services Tax (GST) system in India, a delivery challan is a crucial document used for the movement of goods from one place to another without an invoice. A delivery challan under GST is used in cases where the actual supply of goods is not happening, but there is a need to transport the goods for reasons such as job work, exhibition, or providing services.

Issuing Delivery Challan Under GST Law

A delivery receipt is issued in specific situations when the movement of goods is required without the issuance of a tax invoice. Here are the common instances when a delivery challan is used:

- Transportation for Job Work: When goods are sent to a job worker for further processing, repair, or any other treatment, a delivery slip is issued instead of a tax invoice. The goods return to the sender after the job is completed.

- Supply of Exhibition or Trade Samples: If goods are sent for display in exhibitions, trade fairs, or as free samples, a delivery challan is issued to facilitate their movement without a tax invoice.

- Transfer of Goods Between Branches: When goods are transferred from one branch to another within the same company, a transport receipt is issued to record the movement without raising a tax invoice.

- Supply of Goods on Approval: In situations where goods are sent on an approval or sale-or-return basis, a delivery slip is used to move the goods without a tax invoice until they are accepted by the recipient.

- Supply for Export or Import: For the export or import of goods, delivery is used to move the goods from one location to another without a tax invoice.

How to Make Delivery Challan and Convert it into Invoice in Munim

Delivery Challan Format

The delivery challan format can vary depending on the specific requirements of a business or the regulations of the country or region. Check out the basic format below:

- Under GST regulations the delivery challan format comprises a pre-identified serial number.

- It also has the delivery slip’s date of issuance.

- Its header consists of the consignor logo, name, address, GSTIN, and Challan Identification Number.

- The delivery challan format also includes the consignee’s name, address, and even GSTIN or UIN if registered.

- The delivery receipt also details the product description and harmonized system of nomenclature codes.

- The quantity is also listed in the delivery challan format.

- It also includes the total taxable value, price per product unit, overall sum, and discounts provided.

- The GST amount is also stated in the delivery slip.

- In the case of interstate movement, the supply location is also mentioned.

- Lastly, a signature of an authorized person is present.

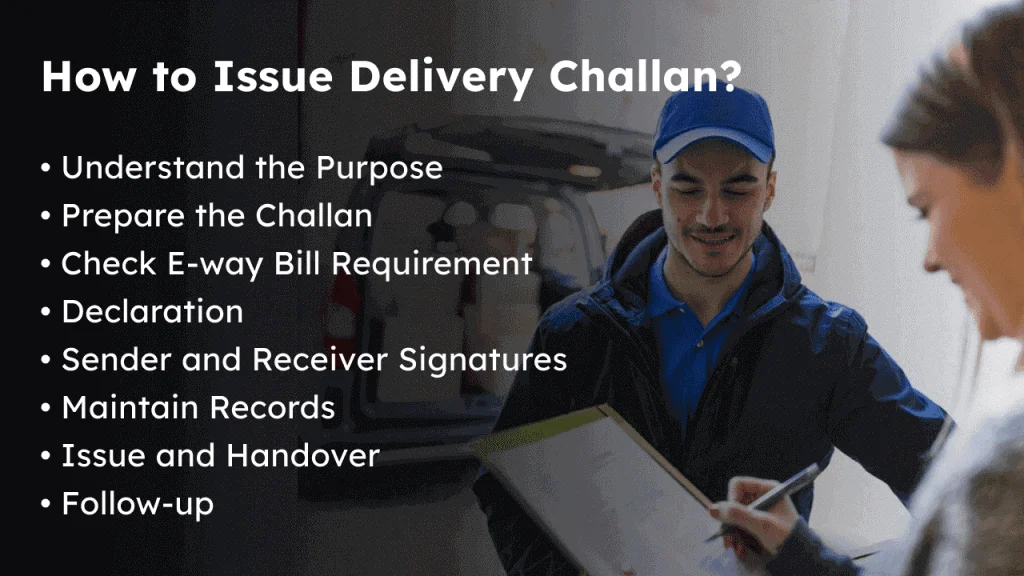

How to Issue Delivery Challan?

The procedure for issuing proof of delivery involves several steps to ensure proper documentation and compliance. Here’s a step-by-step guide on how to issue a delivery challan:

- Understand the Purpose: Determine the purpose of issuing the proof of purchase, whether it is for job work, exhibition, transfer between branches, or any other eligible reason.

- Prepare the Challan: Prepare the delivery document with all the necessary information. Include details such as the sender’s name, address, GSTIN, receiver’s name, address, GSTIN, challan number, date of issuance, and a clear description of the goods being transported, including their quantity and HSN/SAC codes.

- Check E-way Bill Requirement: If the value of the goods being transported exceeds the threshold limit specified by the GST authorities, check if an e-way bill is required. If needed, generate the e-way bill with the relevant information and attach it to the proof of purchase.

- Declaration: Include a declaration on the delivery challan stating the purpose of the movement of goods and ensuring that all the information provided is accurate and true.

- Sender and Receiver Signatures: Ensure that both the sender and the receiver sign the delivery slip as an acknowledgment of the movement of goods.

- Maintain Records: Keep a copy of the issued delivery receipt and related documents for your records. It is essential to maintain these records for at least three years from the date of issuance.

- Issue and Handover: Issue the delivery challan to the person responsible for transporting the goods and ensure that it accompanies the goods during transit.

- Follow-up: After the movement of goods, follow up with the receiver to ensure the goods are received as intended. For job work, ensure that the goods return to the sender after completion of the job.

Issue Delivery Challan at a Single Click!

Finding the procedure a bit tedious? Try Munim now, the simplest solution to issue a delivery challan. Check out this step-by-step guide to issuing a delivery challan through Munim.

Wrap Up

Hopefully, the blog has enlightened your knowledge of Delivery Challan. If you have any queries, shoot them in the comment section below. We will surely try to answer them.

If you are looking for a one-stop solution to issue delivery challans, e-way bills, and, invoices; Munim is the best platform for you. If you haven’t tried yet, get our 14-day free trial now!

FAQS on Delivery Challan

- How to generate an e-way bill for a delivery challan?

Registered transporters or any taxpayer can create an e-way bill through the GST portal. Go to the GST portal or invoice registration portal and fill in the details required to generate an e-way bill. A tax invoice, delivery challan, and bill of sale are the primary requirements to create an e-way bill.

- What is the difference between a delivery challan and an invoice?

Delivery challans and invoices are both documents used in commercial transactions but serve different purposes.

An invoice is a legally binding document that provides a detailed record of the goods or services sold, their quantities, prices, taxes, and payment terms. It serves as a demand for payment and is essential for initiating and completing the supply transaction.

On the other hand, a delivery challan is a document used to record the movement of goods from one place to another without invoicing. It is used for specific purposes like job work, exhibitions, or inter-branch transfers. It does not create a tax liability as it does not involve the actual supply of goods.

- Difference between the e-way bill and delivery challan?

E-way bills and delivery challan are both documents used in the movement of goods, but they serve different purposes. An e-way bill is a mandatory electronic document generated for the movement of goods worth a certain value under GST. It includes details about the goods, parties involved, and transportation. On the other hand, a delivery challan is a document used to record the movement of goods without invoicing, typically for job work, exhibitions, or inter-branch transfers. While an e-way bill is required for taxable supplies, a delivery challan is issued when the goods do not result in an immediate supply, and no tax liability arises.

- What is a returnable challan?

A returnable challan is a document used for the temporary movement of goods, where the receiver is expected to return the same goods to the sender after use. It is commonly used for scenarios like job work, repairs, or exhibitions. The challan specifies that the goods are returnable and helps in keeping track of the temporary movement without creating a permanent supply transaction until the goods are returned.