How Do Accounting & GST Software Empower Freelancers to Manage Finances Efficiently

Freelancers often manage many projects, multiple clients, deadlines, and finances. Effective financial management lies at the core of their business. Additionally, filing and maximizing GST returns requires a streamline process. Managing all these accounting and compliance processes alone is tedious. They need a cost-effective solution that assists them in managing their business seamlessly. This is where online accounting and GST software come into the picture.

Why Do Freelancers Need Accounting and GST Software?

- Work from anywhere

Freelancers offer multiple services and tend to serve their clients from anywhere worldwide. Collaborating with clients and managing projects from dispersed locations can be tedious. This is where accounting and GST software plays a crucial role. This software assists freelancers in working from anywhere in the world.

- Cost-effective Solution

Munim offers the best accounting and GST software with zero subscription charges. The software reduces task repetition and eliminates errors due to manual intervention, saving costs associated with data loss due to errors.

- Client Management

Freelancers deal with multiple clients and projects simultaneously, making it difficult for them to handle all the client requirements simultaneously. Accounting and GST software make it easier for freelancers to manage these needs efficiently.

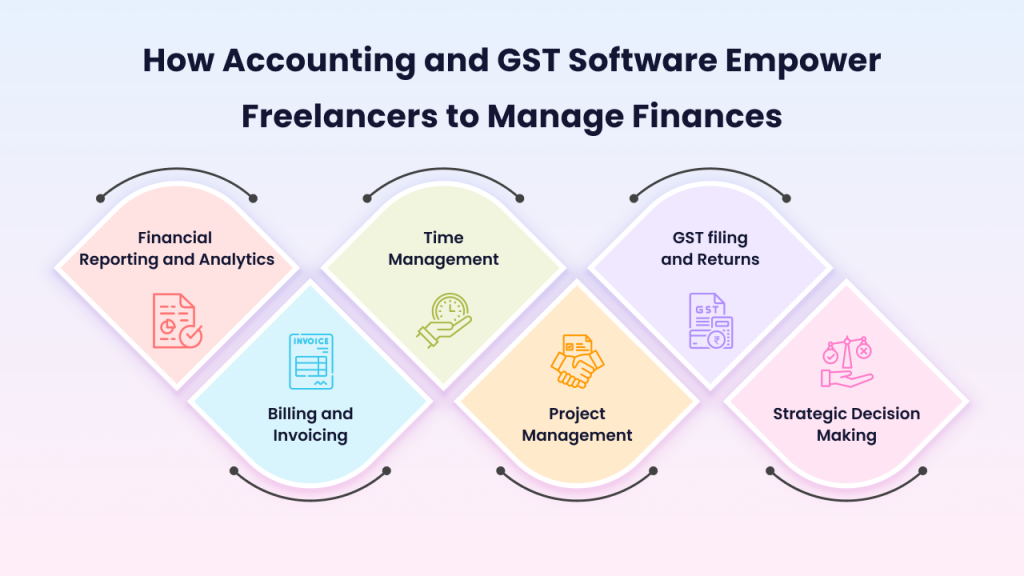

How Accounting and GST Software Empower Freelancers to Manage Finances

- Financial Reporting and Analytics

- Online accounting and GST software assist freelancers in analyzing revenue and expenses associated with clients, helping them determine their profits.

- The GST filing application simplifies preparing for annual tax returns by providing a précised summary of income, expenses, and tax owed.

- These reports provide insights into freelancers’ financial health and stability, giving a clear overview of assets, equity, and liabilities.

- The online accounting and GST software help freelancers track cash inflow and outflow for proper financial planning.

- Billing and Invoicing

- Accounting software for freelancers helps them create professional-looking invoices that represent their brand identity.

- The software also maintains a client database that includes billing information, payment terms, and history.

- It automates invoicing and payment reminders for timely billing.

- The accounting software for freelancers ensures accurate invoicing by tracking billable hours on projects.

- Time Management

- Billing software links time logs directly to particular clients and projects to convert hours tracked into invoices.

- It fosters trust and transparency between the clients through a detailed breakdown of time spent on different tasks.

- Online Accounting and GST software generate reports to segment time utilization and identify which task needs more efficiency.

- The timely reports assist freelancers in enhancing project and personnel performance over time.

- Project Management

- Accounting and GST software prioritize tasks and set deadlines to ensure timely completion.

- These solutions regularly monitor the budgets to ensure the project’s expenses don’t exceed the allocated costs.

- Accounting software for freelancers ensures optimal resource utilization by allocating resources efficiently across all projects.

- It assists in planning workload and capacity to avoid underutilization of time.

- GST filing and Returns

- The GST software automatically calculates GST for each transaction based on applicable rates.

- It auto-generates pre-filled GST return forms based on the transactions recorded earlier to reduce manual errors.

- The accounting and GST software reduces the need to log in to the GST portal, ensuring direct return filing.

- They assist freelancers in making timely GST transactions through regular reminders.

- Strategic Decision Making

- The accounting software for freelancers analyzes critical financial metrics to get insights into business performance.

- The solutions assist freelancers in making proactive decisions by identifying income and expense patterns.

- It helps freelancers identify the most profitable clients and projects, assisting them in focusing on high-value opportunities.

- It analyzes past revenue and current contracts to project future revenue-based projects.

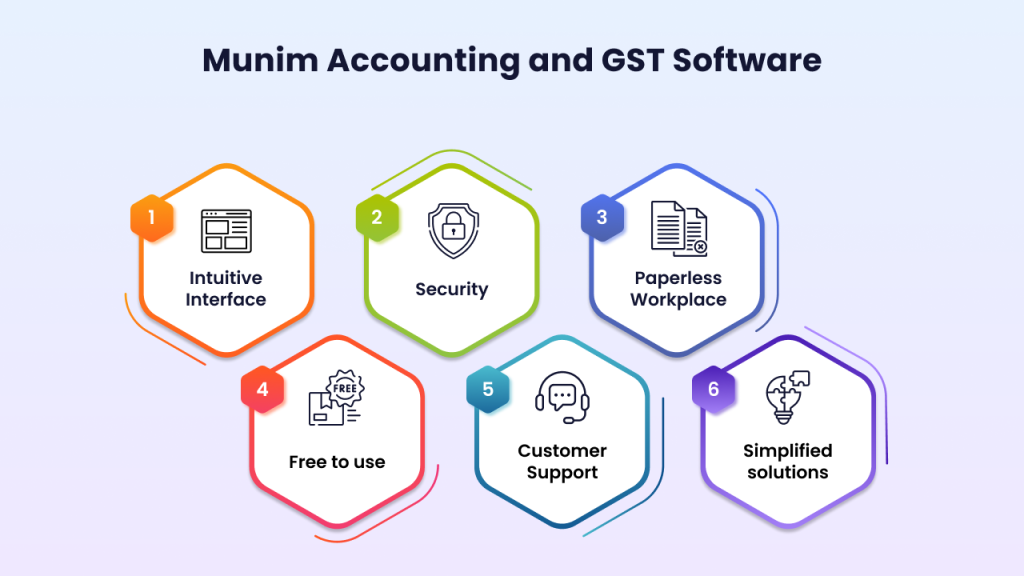

Munim Accounting and GST Software

Munim is a one-stop solution for all your accounting and compliance needs. It serves freelancers with accounting, client management, project management, and GST filing.

Check out the perks of the best accounting and GST software – Munim!

- Intuitive Interface

Munim GST and accounting software for freelancers offers a well-designed UI/UX, ensuring an exuberant customer experience.

- Security

Your data is safe with Munim’s financial solutions that offer multi-layer security to your confidential information.

- Paperless Workplace

Munim reduces its carbon footprint by taking freelancers on a digital journey, ensuring more accessible access to the data.

- Free to use

Munim accounting and Billing software are free to use and do not require any subscription charges.

- Customer Support

Munim offers expert advice to its customers, resolving all their queries simultaneously.

- Simplified Solutions

Munim maps the complexities of accounting and GST filing processes to its accounting and GST software, delivering easier access.

Wrap Up

You have understood how online accounting and GST software empower freelancers. These solutions assist freelancers to manage their projects or clients seamlessly and grow their business. Accounting solutions open the gateway to enhance customer relations and save time on manual work. Hurry up! Switch to the best accounting and GST software now! Get rid of manual tasks and errors with the right solutions in place.

If you are looking for accounting and GST software, Munim is the right choice! Sign up to Munim for free immediately and access unlimited features.

FAQs

- How do accounting and GST software help freelancers in expense management?

The software tracks and categorizes expenses, records receipts, and creates detailed expense reports. This assists freelancers in monitoring spending capacity and identifying cost-saving opportunities for tax purposes.

- What is the best accounting practice for freelancers?

- Track your finances regularly

- Automate invoicing and payment module

- Maintain a separate record of personal and business finances.

- Can Freelancers manage multiple projects with Munim?

Yes, Munim helps freelancers to manage multiple clients and projects simultaneously.