Guide on EMI Calculator: Understand Your Monthly Payment Cycle

Ever dreamt of owning a sleek gadget, a new bike, or that perfect designer outfit? But before you hit that “buy now” button, the question of affordability pops up. Enter EMIs, your magic key to making those dreams a reality, with the EMI Calculator!

In India, 70% of millennials rely on EMIs, making them a financial tool you can’t ignore. So, what is an EMI, and how can you calculate it like a financial wiz?

What is an EMI Calculator?

An EMI calculator is your secret financial weapon. It effortlessly juggles numbers like loan amount, interest rate, and loan tenure to unveil your monthly EMI payment. Think of it as a pocket-sized financial advisor quietly guiding you towards informed borrowing decisions.

And the best part? You don’t need a math degree to use it! Most calculators do the heavy lifting for you, making EMIs accessible to everyone.

Many online tools simplify it further, requiring just a few clicks for instant EMI results.

Types of EMI Calculators – Choosing the Right Tool

Just like there are different loans for unique needs, EMI calculators come in various uses, too! Here are some options to suit your needs:

Home Loan EMI Calculator:

Imagine buying your dream house! The home loan EMI calculator helps you understand how much your monthly payments will be based on the loan amount and your income. Think of it like planning your monthly budget for your new castle!

Car Loan EMI Calculator:

Zoom into your dream car! The car loan EMI calculator lets you see how much you’ll pay each month based on the car’s price and loan terms. It’s like test-driving your finances before hitting the road!

Personal Loan EMI Calculator:

Need a helping hand for a big purchase or unexpected expenses? The personal loan EMI calculator shows you how much your monthly payments will be based on the loan amount and repayment period. Think of it like a financial advisor in your pocket!

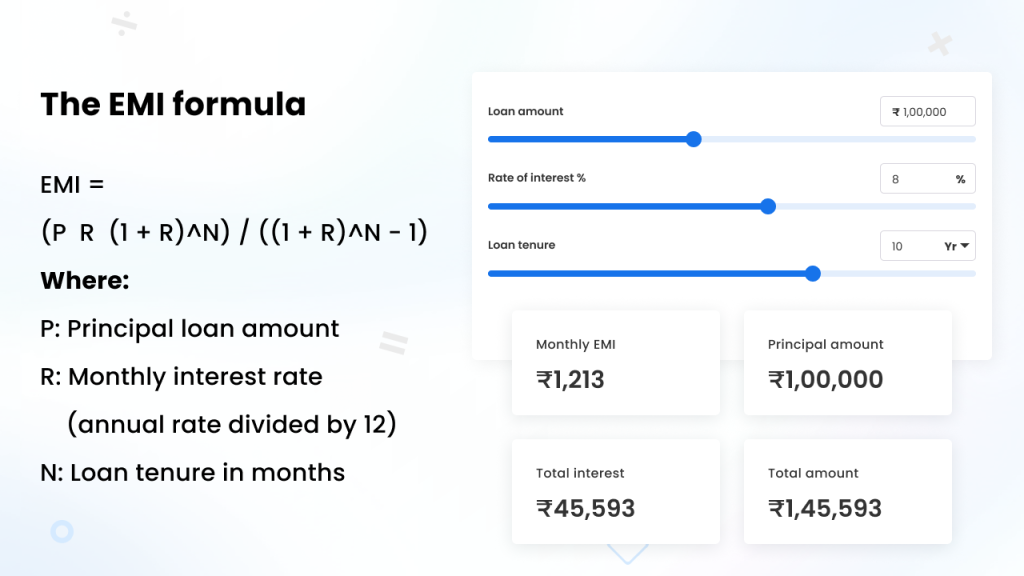

Decoding the EMI Formula – Math Made Easy

The emi formula might look like a cryptic code at first, but it’s pretty simple. Imagine it as a simple code with P as the loan amount, R as the monthly interest rate (don’t worry, most calculators convert annual rates to monthly for you!), and N as the loan tenure in months:

EMI = (P*R*(1+R)^N) / ((1+R)^N – 1)

Remember, you don’t need to be an expert to use this calculator! Most calculators do the calculations with apt emi formula for you, but understanding the emi formula gives you a deeper understanding of how your EMI is calculated.

Now, how does this translate to calculating an equated monthly installment?

Simply plug in your loan details into the calculator, and voila! Your personalized EMI pops up like magic.

Benefits of Using an EMI Calculator

- Budget Boss: Knowing what an equated monthly installment is helps you plan your monthly expenses like a pro. No more surprise credit card bills!

- Loan Comparison Guru: Don’t settle for the first loan offer that comes your way. Use the calculator to compare an equated monthly installment is for different loan amounts, interest rates, and tenures, and choose the one that fits your budget.

- Informed Decision Maker: Borrowing isn’t something to take lightly. The calculator helps you understand the impact of different loan terms on your finances, empowering you to make informed decisions that won’t leave you with buyer’s remorse.

- Stress Buster: Financial worries can be a drag. The calculator takes the guesswork out of loan repayments, giving you peace of mind and letting you focus on the things that matter.

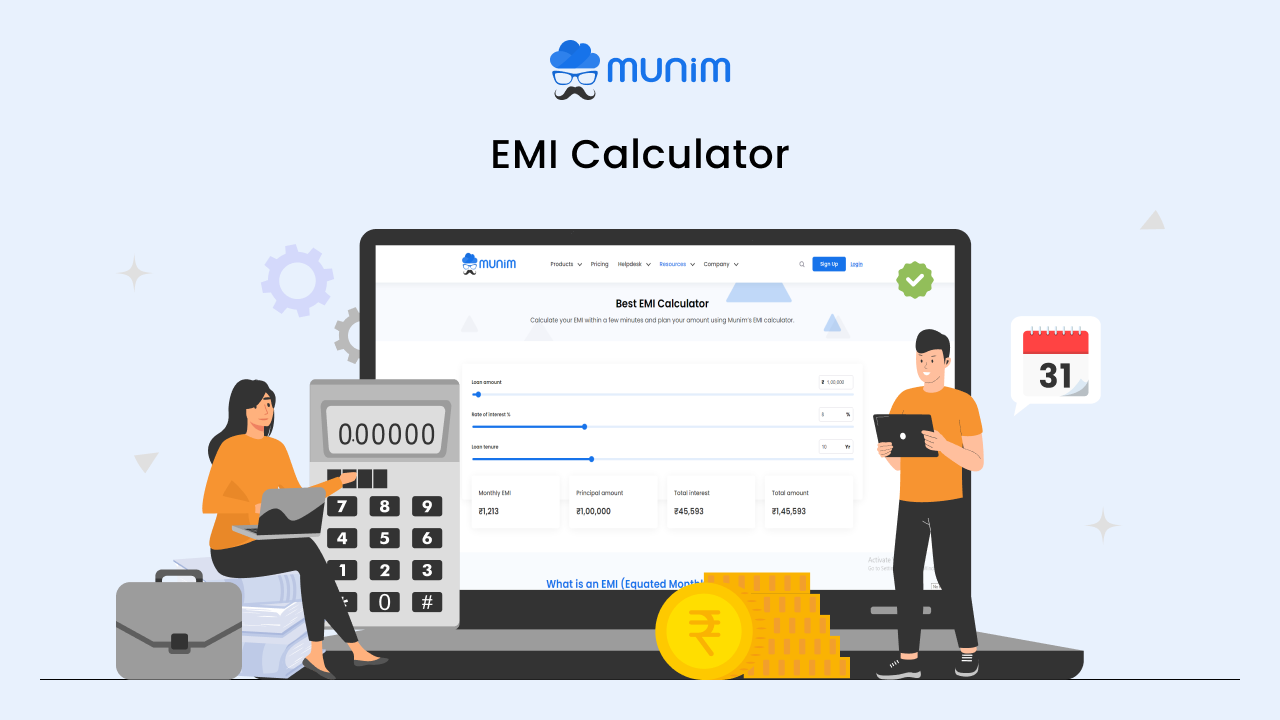

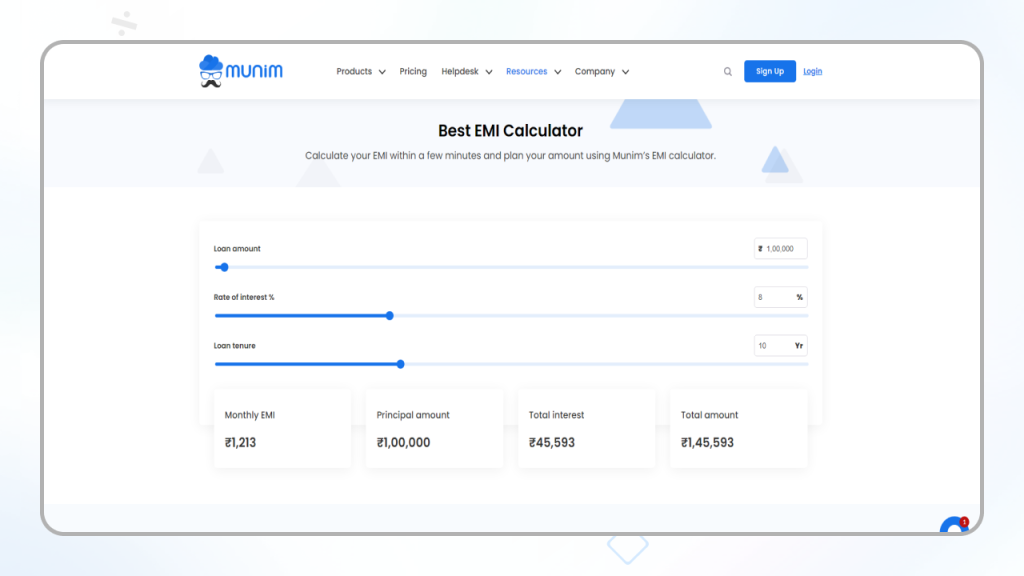

Introducing the Munim EMI Calculator – Your One-Stop Loan Advisor

Now, meet Munim’s super-powered EMI calculator! It’s not just a calculator; it’s your loan advisor in your pocket. Here’s why it’s your BFF:

- Simple User Interface: No financial jargon, just clear instructions and a user-friendly interface that non-tech users can navigate.

- Accurate as a Swiss Watch: Get precise about an equated monthly installment figure based on your specific loan details. No more rounding errors or guesswork, just reliable numbers you can trust, like a finely tuned Swiss watch!

- Free Forever: Unlike some fancy financial services that charge hefty fees, Munim’s EMI calculator is completely free to use.

How to Calculate EMI on Calculator with Munim

Step 1: Head to Munim’s EMI calculator: Think of it as your financial control center – ready to blast off into informed borrowing!

Step 2: Fill in these key details:

- Loan Amount: How much are you borrowing? Like, ₹10,000 for that sweet gadget.

- Interest Rate: This affects your “engine power,” impacting payments. Enter the annual rate (e.g., 10%), and the calculator handles the rest.

- Loan Tenure: How long will you repay the loan? Enter months, like 12 for a year-long journey.

Step 3: Hit “Calculate,” and boom! Your personalized EMI Assistant.

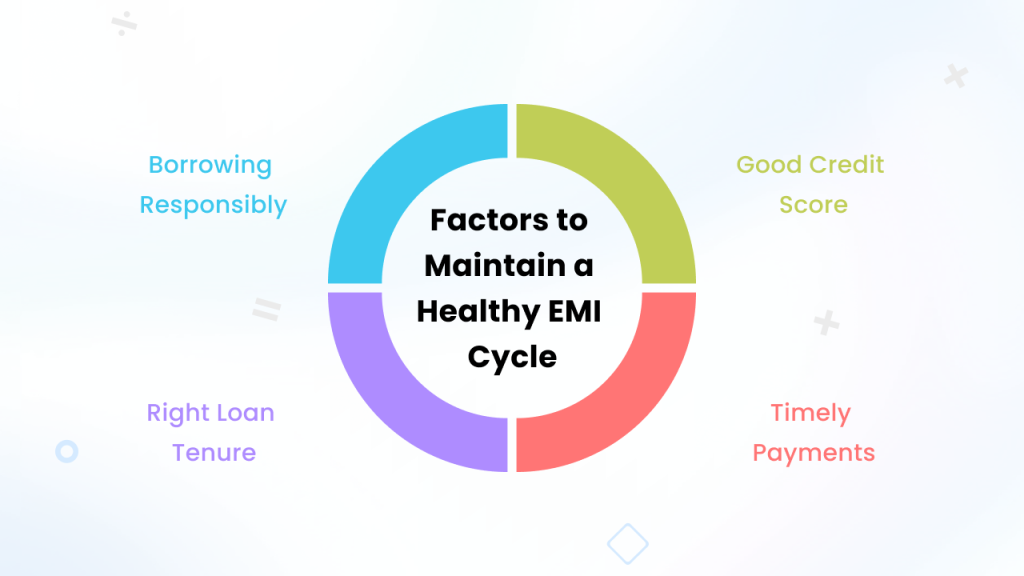

Bonus Tip – Maintaining Healthy EMIs

\Now that you’re a whiz at calculating EMI for personal loans and any other loan type using the Munim calculators or the formula for calculating EMI, here are some bonus tips to keep your EMIs healthy and your finances thriving:

- Borrow Responsibly: Don’t let the ease of EMIs tempt you to over-borrow. Remember, every EMI is a commitment, so only borrow what you can comfortably repay.

- Choose the Right Loan Tenure: A longer tenure might mean lower EMIs, but it also means paying more interest in the long run. Choose a tenure that balances affordability with minimizing interest costs.

- Maintain a Good Credit Score: A good credit score unlocks lower interest rates, which translate to lower EMIs. So, pay your bills on time, avoid unnecessary debt, and keep your credit score sparkling!

- Make Timely Payments: Delays or defaults can attract penalties and damage your credit score. Remember, consistency is key! Just like following a step-by-step guide ensures a desired outcome, making timely EMI payments keeps your finances on track.

Conclusion

EMI can be your friend or foe – it all depends on how you use it. By understanding what is an equated monthly installment and using the right tools like the Munim EMI calculator, you can make informed borrowing decisions and unlock your financial goals with confidence. Remember, knowledge is power, especially when it comes to your finances! So, calculate your EMIs wisely and make those dreams a reality, one wise financial decision at a time.

FAQs

1. How to calculate EMI on loan?

The easiest way to calculate EMI on loan is by using the Munim EMI calculator! Simply enter your loan amount, interest rate, and tenure, and it will calculate for you. You can also use the formula mentioned in Section 4, but the calculator is much faster and more convenient.

2. Is there an emi reducing calculator?

Yes, there are! With each EMI payment, some EMI calculators can show you how your loan balance will decrease over time. An emi reducing calculator can help you understand how your loan progresses and plan your finances accordingly.

3. What is the formula for calculating emi?

The formula for calculating EMI is: EMI = (P * R * (1 + R)^N) / ((1 + R)^N – 1)

Where:

- P: Principal loan amount

- R: Monthly interest rate (annual rate divided by 12)

- N: Loan tenure in months

4. How to calculate monthly EMI?

There are two main ways to calculate your monthly EMI:

- Use the Munim EMI calculator: This free and user-friendly tool lets you easily enter your loan amount, interest rate, and tenure and instantly see your estimated EMI. It’s the simplest and fastest way to get accurate results.

- Use the EMI formula: While the formula can help understand how EMIs work, it requires manual calculations. Multiply the principal amount by the monthly interest rate and then multiply that result by (1 + monthly interest rate) raised to the power of the loan tenure in months. Finally, divide this by ((1 + monthly interest rate) raised to the power of the loan tenure in months) minus 1.

5. What is an emi?

EMI stands for Equated Monthly Installment; it’s your fixed monthly “rent” for the money you borrowed, making loan repayments predictable and budget-friendly!