Reduce Your Loan Interest and Save More Money

Did you know? Personal loan interest rates in India can range from 10% to 24% per year! This means a sizeable chunk of your monthly payment goes towards interest. Leading to non-reduction in your principal debt. But don’t worry! An impressive reducing interest rate calculator can help you. Save money and pay off your loans.

What is the Reducing Interest Rate Calculator?

Imagine a simple calculator, but way smarter!

This one considers your monthly expenditures. And it only charges interest on the remaining amount. This means you pay less interest over time, leading to significant savings!

Benefits for you:

- Know your actual monthly payment (EMI): Practical financial plan.

- Compare loan options like a pro: Prefer the best deal for your needs.

- Make smart financial decisions: Comprehend the total cost of your loan.

- Negotiate with confidence: Get lower interest rates with lenders.

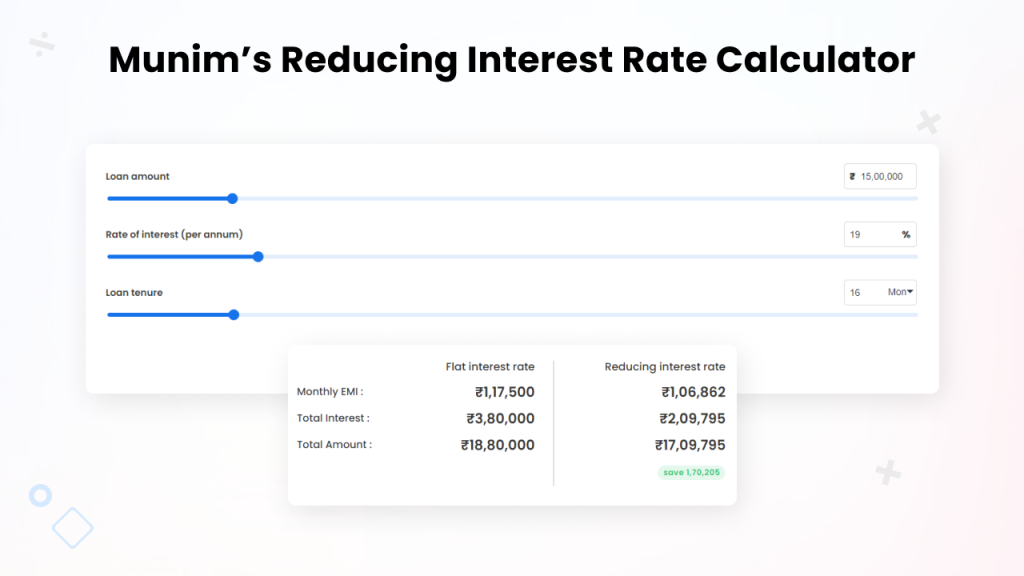

Using The Munim’s Calculator

Say goodbye to loan estimation complexities! The Munim’s calculators simplify your monetary planning journey.

Here’s how:

1. Enter Your Loan Details: Mention the loan amount, interest rate, and loan term.

2. Get Your EMI: The calculator automatically computes your monthly payment using the balance method.

3. Examine Your Repayment Schedule: Dive into a detailed breakdown of your loan repayment plan. Including each installment’s principal and interest components. This helps you track your progress and stay on track.

4. Compare Scenarios: Explore various interest rates and loan terms easily. Understand their impact and choose the option that best serves your financial needs.

With The Munim’s Reducing Interest Rate Calculator, You Can-

- Plan your finances effectively.

- Make informed decisions about your loans.

- Negotiate confidently with lenders.

- Reach your financial goals faster.

Start simplifying your loan management today! Visit The Munim and unlock a world of financial clarity.

Explore Other Munim Calculators

The Munim offers more tools to help you manage your loans like a boss:

- Best EMI Calculator: Estimate your home loan, car loan, or personal loan EMIs effortlessly.

- Best FD Calculator: Determine the interest you’ll accrue by using Munim’s FD calculator for fixed deposits.

- Business Loan Calculator: Discover your borrowing potential with our business loan calculator.

- Mutual Fund Return Calculator: Get an estimate of your investment return with our mutual fund return calculator.

Smart Loan Management Tips

- Make extra payments: Even small amounts make a big difference.

- Shorter loan term: Pay less interest overall and be debt-free faster.

- Refinance your loan: Look for lower interest rates to save money.

- Focus on high-interest debt: Pay off loans with higher rates first.

- Automate your payments: Avoid late fees and stay on track.

- Build your credit score: Lower rates are yours with a good score.

- Live within your means: Avoid excessive expenses and stick to your budget.

- Seek help: Get financial advice if you need it.

Understanding Flat V/S Reducing Interest Rates

There are two primary ways loan interest is calculated:

Flat Rate: The interest is calculated on the entire loan amount throughout the loan term. It is regardless of the amount you’ve paid back.

Reducing Rate: The interest is calculated only on the overdue balance. Which decreases with each payment you make.

Conclusion: Take Control of Your Finances Today!

Now you have the knowledge and tools to manage your loans effectively and achieve financial freedom. Don’t wait any longer, start exploring Munim today and get debt-free faster!

Unlock a world of financial clarity and reach your goals with Munim’s powerful tools and expert guidance. Visit The Munim now and:

- Get a clear picture of your finances with The Munim’s reducing interest rate calculator.

- Compare loan options like a pro and choose the best deal for your needs.

- Develop a practical financial plan and make informed decisions about your loans.

- Negotiate confidently with lenders and secure lower interest rates.

- Access additional tools like the Loan EMI Calculator, Repayment Schedule Generator, and Budget Planner for comprehensive loan management.

Start your journey towards financial freedom today!

FAQs

1. How does a reducing interest rate calculator work?

The calculator uses your loan details to calculate your EMI and breaks down your repayment plan. It helps show how much goes to the principal and interest each month.

2. What are the benefits of using a reducing interest rate calculator?

The benefits include accurate EMI calculation, intelligent loan comparison, informed financial planning, and confident negotiation.

3. How is reducing interest calculated?

Reducing interest is calculated using a simple formula:

Interest = Outstanding Principal Balance x Interest Rate x Time

4. How do you convert a flat rate to a reducing rate?

For a loan period of 3 years, a flat interest rate of 12.00% is roughly equivalent to a reduced balance interest rate of 21.20%. Whether with a flat rate of 12.00% or a reducing balance interest rate of 21.20%, the total interest payment over the 3-year term for a loan amount of ₹1,00,000 is ₹36,000.

5. Which loan is better, flat or reducing?

In most cases, a reducing interest rate loan is advantageous. It is leading to lower overall interest payments and faster debt payoff.

6. What is the formula for reducing a loan?

The formula for reducing a loan is:

Outstanding Principal Balance = Loan Amount – Total Payments Made

7. How can I save money on my loans using a reducing interest rate calculator?

By comparing loan offers, negotiating with lenders, and making extra payments towards the principal, interest is calculated using a simple formula:

Interest = Outstanding Principal Balance x Interest Rate x Time