A Complete Guide on What is GSTR-1 Return Filing in 2024

GSTR-1, is the monthly/quarterly return summarizing a taxpayer’s sales, plays a crucial role in the GST regime. Staying on track with the latest news & updates is vital for seamless compliance.

In this blog, we’ll delve into the essentials of gstr 1, covering its basics, recent changes, and key considerations for smooth filing in 2024. Let’s embark on this journey to simplify gstr 1 filing.

Let’s Start From the Basics

Understanding the basics of GSTR-1 is the first step towards seamless compliance with GST regulations. This section will provide a comprehensive overview of what gstr1 means, its fundamental purpose, and the critical components involved.

What is GSTR-1?

GSTR-1, also called Goods and Service Tax Return 1, is an important paper that Indian businesses whether they are e-commerce operator or in the niche of B2B supplies must regularly submit. It is a monthly or quarterly return summarising all the details of sales or outward supplies taxpayers make. This return is essential in achieving transparency and accuracy in the GST payment system.

Let us now move on to the critical components of GSTR-1:

Monthly/Quarterly Return Filing: As a periodic return, GSTR-1 should be submitted either monthly or quarterly, depending on the business’ turnover.

Sales Summary: The primary purpose of GSTR-1 is to give a detailed summary of all outward supply details, which include business or e-commerce sales of goods and services. These cover both intra-state supplies and inter-state supplies.

13 Sections: Thirteen sections in GSTR-1, each dealing with particular information of the Filing returns. These sections range from supplying basic details such as GSTIN and aggregate turnover to more comprehensive tables capturing various supplies, amendments, and documents issued during the tax periods.

Recent Updates: Inaccurate filing can only be avoided by keeping up with current period updates. Recent changes include tables concerning e-commerce operators and modifications to filing deadlines since 2024; hence, businesses must stay updated about these changes for filing accurate returns.

Fundamentals of GSTR-1 Returns

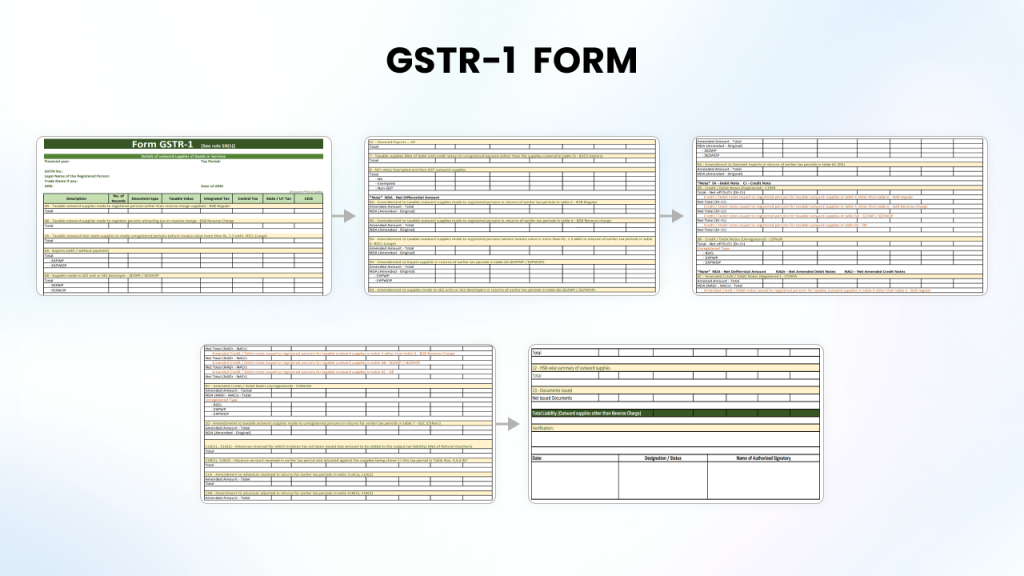

Understanding GSTR-1 means breaking it down into 13 sections; the different periods in Table and determining the importance of each one.

GSTIN, Legal and Trade Names, Aggregate Turnover (Tables 1-3): The first tables capture who the taxpayer is meant to be recognized based on aggregate annual return.

Taxable Outward Supplies to Registered Persons (Table 4): The information in this section emanates from sales made to registered taxpayer, excluding zero-rated supplies and deemed exports.

Taxable Outward Inter-State Supplies to Unregistered Persons (Table 5): Taxable supplies to unregistered business with invoice values greater than Rs.2.5 lakh are recorded in this table.

Zero-Rated Supplies and Deemed Exports (Table 6): Accurate reporting requires that we catch the details relating to supplies having zero-rated tax and deemed exports.

Amendments to Outward Supplies (Table 9): They shall include all taxable outward supplies reported in earlier periods, such as debit notes, credit notes, refund vouchers, etc.).

Outward Supplies Summary – Based on HSN (Table 12): It overviews HSN-based classifications for outward supply. It overviews HSN-based classifications for outward supply.

Documents Issued (Table 13): This table presents all documents issued during the reporting period.

The Journey to GSTR-1 Filing Begins Here: Be a Step Ahead

About complying with GST regulations, embarking on the journey of GSTR-1 filing is critical for businesses. This section gives elaborate guidelines, starting from eligibility criteria, essential requirements, step-by-step filing process, due dates, and intricacies associated with filling out the GSTR-1 form.

Eligibility Criteria

It is essential first to establish who qualifies for GSTR-1 filing before rushing into the filing process. The following are the main eligibility criteria:

Registered Persons: Despite the absence of any transactions during the reporting period, every registered person under GST must file GSTR-1.

Exemptions: Certain entities like Input Service Distributors, Composition Dealers, Suppliers of online data & database access or retrieval services (OIDAR), non-resident taxable person, as well as those liable to collect TCS or deduct TDS, are not required to file GSTR-1.

Nil Filers: From 1st week of July 2020 this year, there is also an option for SMS-based nil filing.

Requirements When Making GSTR-1 Returns

Ensuring that you have all the details and documents necessary for smooth GSTR-1 filing is very important. These are:

Sales Details: Correct and detailed information on all outward supplies made during the month.

Original Invoice Records/Invoice Details: Maintain a complete record of Details of debit notes & credit notes and refund vouchers issued in the period covered. Including sales invoices, B2B invoices, export invoices.

Advance Payments: Details of advances received or adjusted during the current tax period or amendments to information reported in the previous tax period.

HSN Codes: Categorization of outward supplies as per the Harmonized System of Nomenclature (HSN) codes.

How to File GSTR-1?

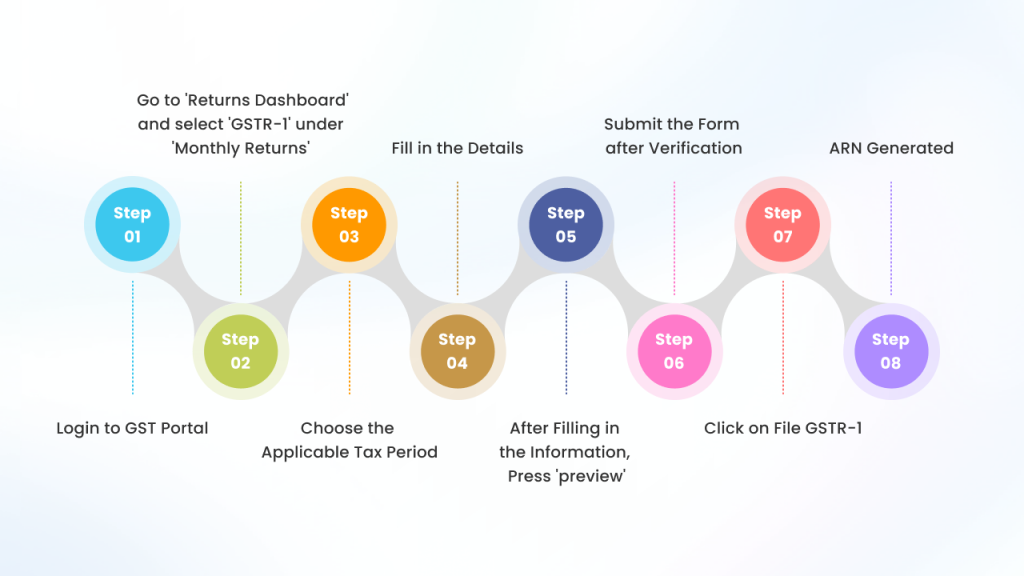

Filing GSTR-1 requires a systematic approach to ensure precision and conformity. A step-by-step guide follows:

Step 1: Login to GST Portal: Gain entry to GST portal with your login credentials.

Step 2: Select GSTR-1: Go to ‘Returns Dashboard’ and select ‘GSTR-1’ under ‘Monthly Returns’.

Step 3: Choose the Applicable Tax Period: Select either the monthly or quarterly tax period for which you are filing GSTR-1.

Step 4: Fill in the Details: Fill each section of the form with correct information such as GSTIN details, outward supplies, amendments, document details like: shipping bill details, invoice level details etc.

Step 5: After filling in the information, press ‘preview’ to ensure accuracy.

Step 6: Submit the form after verification, and the system will generate a summary for you to review.

Step 7: File GSTR-1: Check the summary for correctness and click on File GSTR-1.

Step 8: Acknowledgment: An Acknowledge Reference Number (ARN) gets generated upon the successful submission of this filing.

GSTR1 Last Date & Late Fee Payments

One needs to know when are the gstr 1 last date so as not to fall into gstr 1 late fee penalties. Here is a brief of return filing frequency.

Below is the time limit to file monthly/quarterly GSTR-1s filing Based on businesses with turnovers:

More than Rs.5 Crore Turnover – Monthly Filing, should be done by the 11th day of the following month.

Turnover up to Rs.5 Crore — Quarterly Filing (QRMP Scheme), should be done by the 13th day of next month after relevant quarter.

There is gstr 1 late fee penalty when filing gst late, which varies with a maximum late fee depending upon turnover.

How to Fill GSTR-1 Form?

It is very critical that the gstr1 return form is filled accurately. Here are some pointers to guide you:

GSTIN details (Tables 1-3): The correct GSTIN, legal and trade name and aggregate turnover shall be given in the Form GSTR-1.

Taxable Outward Supplies to Registered Persons (Table 4): The filing of Form GSTR-1 includes filling in Details of taxable supplies made to a registered person other than zero-rated and deemed exports.

Taxable Outward Inter-State Supplies to Unregistered Persons (Table 5): Under Form GSTR-1 the information of taxable inter-state sales supplies to unregistered persons with e-way bill or invoice values greater than Rs.2.5 lakh are recorded in this table.

Zero-Rated Supplies and Deemed Exports (Table 6): Capture information on zero-rated supplies and deemed exports to fill out the Form GSTR-1.

Amendments to Outward Supplies (Table 9): Record amendments to taxable outward supplies reported in previous periods to submit the Form GSTR-1 with accuracy.

Outward Supplies Summary Based on HSN (Table 12): While filling the Form GSTR-1 you need to summarize outward supplies using HSN codes.

Documents Issued (Table 13): Provide details of all documents issued during the reporting period when filling the Form GSTR-1.

Latest Updates on GSTR1 Filing

Keeping abreast of the latest updates in GSTR-1 filing is crucial for businesses to ensure compliance with the ever-evolving GST regulations.

Let’s delve into the recent amendments and enhancements introduced in the GSTR-1 filing process, providing businesses a more streamlined and efficient experience.

1. Amendment in Filing Deadline (February 1, 2023)

Update: As of February 1, 2023, a necessary amendment has been made to the filing deadline. Taxpayers are now restricted from filing GSTR-1 beyond three years from the relevant due date for a tax period. This amendment aligns with the provisions in Section 37 of the CGST Act.

Implication: Businesses must adhere to the revised timeline for filing GSTR-1, ensuring timely compliance to avoid penalties and legal repercussions.

2. Introduction of New Tables (December 26, 2022)

Update: Several new tables have been inserted in the GSTR-1 format, enhancing the reporting structure for both suppliers and e-commerce operators.

Details:

- Table 14: For suppliers – Reporting ECO operators’ GSTIN-wise sales through e-commerce operators on which e-commerce operators are liable to collect TCS u/s 52 or pay tax u/s 9(5) of the CGST Act.

- Table 14A: For suppliers – Amendments to Table 14.

- Table 15: For e-commerce operators – Reporting both B2B and B2C suppliers’ GSTIN-wise sales through e-commerce operators on which e-commerce operators must deposit TCS u/s 9(5) of the CGST Act.

- Table 15A: For e-commerce operators – Amendments to Table 15 for sales to GST-registered persons (B2B) and sales to unregistered persons (B2C).

Significance: These additions reflect the evolving dynamics of e-commerce transactions, ensuring a more comprehensive and accurate representation of such supplies.

3. Amendments in Filing Corrections (February 1, 2022)

Update: Budget 2022 brought about significant changes in the correction and amendment process for GSTR-1 filings.

Key Points:

- The last date for amendments, corrections, and uploading missed invoices or debit/notes is no longer the deadline to file the September return of the following year.

- Amendments now require tax period-wise sequential filing of details of outward supplies.

Impact: Taxpayers need to adjust to the revised timeline for corrections, emphasizing the need for meticulous and timely filing of amendments.

4. Changes in Non-Filing Consequences (December 21 2021)

Update: Effective January 1, 2022, changes in consequences have been introduced for non-filing of GSTR-1.

Revised Consequences:

- Taxpayers can only file GSTR-1 if the previous period’s GSTR-3B was filed.

- GST officers can initiate recovery proceedings without show-cause notice against taxpayers who under-report sales in GSTR-3B compared to GSTR-1.

Significance: These changes underscore the importance of filing GSTR-1 in alignment with GSTR-3B, emphasizing a holistic approach to GST compliance.

5. Due Date Restriction for Filing (December 21, 2021)

Update: Another noteworthy update from December 21, 2021, pertains to the due date restriction for GSTR-1 filing.

Revised Condition: From January 1, 2022, taxpayers can only file GSTR-1 if the previous period’s GSTR-3B was filed.

Implication: This restriction underscores the interdependence of GSTR-1 and GSTR-3B filing, emphasizing the need for timely completion of both processes.

Staying informed about these updates is crucial for businesses, ensuring they align their filing practices with the latest regulations.

Here is How to File GSTR-1 with Munim’s GST Software

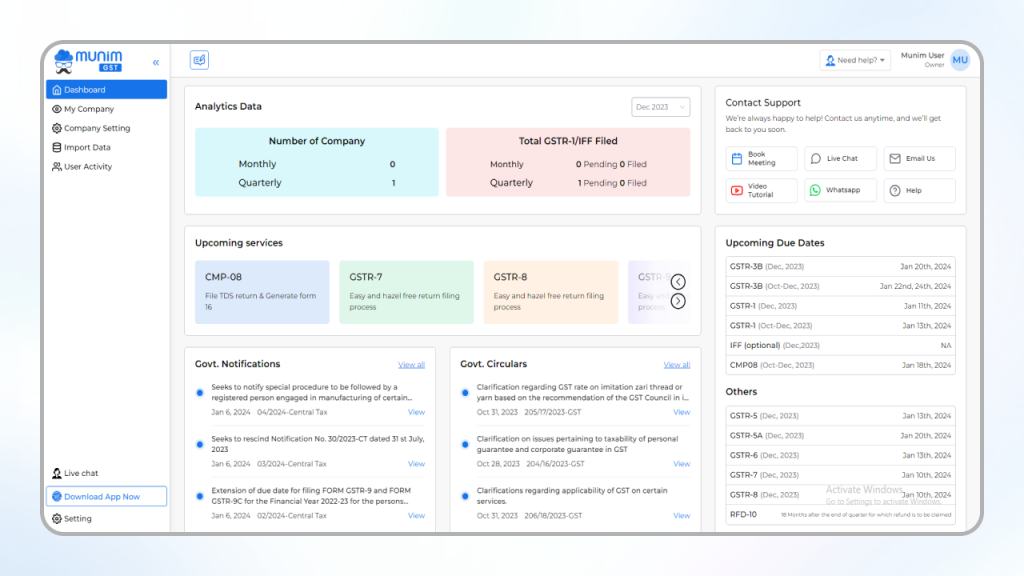

In this section, we will explore the streamlined process of filing GSTR-1 with Munim, a comprehensive GST billing and return filing software designed to simplify the complex landscape of GST compliance.

Filing GSTR-1 with Munim: A Simplified Process

Access Munim Platform: Navigate to the GST Compliance module from the left sidebar.

Initiate GSTR-1 Report: Click the GSTR-1 report button to begin filing.

Select Reporting Month: Choose the relevant month for filing the GSTR-1 report.

Generate Report: Initiate the reporting process by clicking the “Generate Report” button.

Choose File Format: Select the preferred file format, “Generate Json” or “Generate Excel,” based on your convenience.

Upload Data: Follow the prompts to seamlessly upload data from Munim accounting software, Excel, or JSON formats.

Verify and Review: Ensure accuracy by reviewing and verifying the uploaded invoices and data.

File GSTR Successfully: Complete the GSTR-1 filing directly within Munim GST utility software with a few clicks.

Benefits of Using Munim for GSTR-1 Filing

Error-Free Filing: Munim ensures error-free GSTR filing, minimizing the risk of discrepancies in reporting.

Convenient Data Import: Seamlessly import data from Munim accounting software, Excel, and JSON, providing a hassle-free experience.

Smart Insight Reports: Munim offers intelligent insight reports, allowing businesses to compare sales and purchase data, access financial reports, and more.

Security Protocols: Robust security measures, including user access control, multiple login authentication, and encryption standards, safeguard your financial data.

Versatile Solutions: Munim caters to businesses of all sizes and financial advisors, providing a complete suite of GST filing solutions.

Desktop and Cloud Solutions: Choose between cloud and desktop solutions based on your preferences, ensuring flexibility and accessibility.

Free for Starters: Munim offers a free version, making it a cost-effective solution for businesses looking to get started with GST compliance.

Businesses can streamline compliance processes by choosing Munim for GSTR-1 filing, minimizing errors, and leveraging insightful reports for informed decision-making. Whether opting for the cloud or desktop solution, Munim ensures a user-friendly experience, empowering businesses to stay tax-compliant efficiently.

Conclusion

In conclusion, Munim provides a user-friendly interface, error-free filing, and versatile solutions, making the GSTR-1 filing process more accessible. By simplifying the GST compliance journey, Munim empowers businesses to stay tax-compliant, ensuring a seamless and efficient experience in Goods and Services Tax.

Key Takeaways

- GSTR-1 or GST returns filing serves as a vital monthly or quarterly basis return for GST taxpayers.

- Munim streamlines GSTR-1 filing, offering a user-friendly experience.

- Understanding eligibility, requirements, details in Table, debit or credit notes and due dates is crucial for seamless filing.

- Regular updates on GST returns and GSTR-1 regulations ensure compliance.

- Munim’s secure, feature-rich platform enhances GST filing efficiency, ensuring businesses stay on the right side of tax regulations.

FAQs

1. What is GSTR-1 return?

GSTR-1 is a monthly/quarterly return summarizing a taxpayer’s outward supplies under GST.

2. How do you file GSTR-1 with Munim?

Follow the steps provided: Login/Register, Choose Online/Desktop, Upload Data, Review/Verify, and File Successfully.

3. What are the GSTR-1 due dates?

Due dates vary based on turnover, ranging from the 11th to the 26th of the month following the relevant period.

4. Can I revise a filed GSTR-1?

No, revisions are not allowed. Mistakes can be rectified in the subsequent month’s GSTR-1.

5. What are the late fees for GSTR-1 filing?

Late fees range from Rs. 50 to Rs. 10,000, depending on the annual turnover.

6. Why is GSTR-1 filing mandatory even for no sales?

Every registered person, including nil filers, must file GSTR-1 to comply with GST regulations.

7. Is there a penalty for late filing of GSTR-1?

Yes, late filing incurs penalties based on the number of days delayed, ranging from Rs. 25 to Rs. 5,000.

8. What happens if I miss the GSTR-1 due date?

Filing after the due date incurs late fees, and the taxpayer may face penalties for non-compliance.

9. Can I file GSTR-1 after filing GSTR-3B?

GSTR-1 and GSTR-3B, GSTR-1 must be filed before GSTR-3B from January 1, 2022, onwards.

10. Are amendments allowed in GSTR-1?

Yes, amendments are allowed, but specific details have restrictions.

11. How does Munim assist in GSTR-1 filing?

Munim facilitates seamless GSTR-1 filing with features like data import, error-free filing, and real-time insights.

12. Can I upload invoices only during GSTR-1 filing?

Invoices can be uploaded anytime, but regular uploads are recommended to avoid bulk uploads during the filing period, saving time and effort.

13. What is GST liability?

GST liability refers to the amount of Goods and Services Tax (GST) that a registered taxpayer is liable to pay to the government. Under the GST regime, businesses are required to collect GST from their customers on taxable supplies of goods and services and remit it to the government.

14. How to do GST Registration?

The process for GST registration is primarily online through the official GST portal (https://www.gst.gov.in/). Here’s a simplified breakdown:

- Eligibility: Any business with an annual turnover exceeding Rs. 20 lakh (Rs. 40 lakh or Rs. 10 lakh depending on state and type of supply) needs to register for GST.

- Steps:

- Visit the GST portal and select “Services” > “Registration” > “New Registration.”

- Choose your taxpayer type and enter basic details like PAN, email, and mobile number.

- Complete Part A & B of the application form, providing business information, bank details, and director/partner details.

- Upload required documents like PAN card, Aadhaar card, and proof of business address.

- Verify your application using OTP received on email/mobile linked to PAN.

- Upon successful verification, you’ll receive a Temporary Reference Number (TRN).

- Log in with your TRN and complete any pending tasks.

- On final approval, you’ll receive your GST Identification Number (GSTIN) certificate.

15. What are the Non-GST Supplies?

Non-GST supplies are goods or services exempt from GST. Some examples include:

- Agricultural products not packaged or labeled (except some specific items)

- Educational services provided by schools and colleges

- Healthcare services by doctors and hospitals

- Religious and charitable activities

- Exports outside India

16. What does input tax credit means?

Input tax credit (ITC) is the tax paid on purchases of goods and services used in your business, which can be offset against the GST you owe on your sales. This encourages businesses to purchase from within the GST system and promotes transparency.

17. What are Nil Rated Supplies?

Nil rated supplies are goods or services where GST applies at a rate of 0%. These include essential items like basic foodstuffs, unbranded food grains, books, newspapers, and menstrual hygiene products.

18. What is a tax rate?

The tax rate is the percentage of GST levied on a good or service. There are four main GST rates:

- 0% (Nil rated)

- 5% (Lower rate on essential items)

- 12% (Standard rate on most goods and services)

- 18% (Higher rate on luxury items)

19. How are tax invoices and vendor payments related to GST?

- Tax invoices: Every registered business must issue a tax invoice for all taxable supplies made. This invoice specifies the value of the goods or services, the applicable GST rate, and the GST amount payable. You can claim ITC on the GST paid through these invoices.

- Vendor payments: When you make payments to your vendors for the goods or services they provide, be sure to consider the GST component included in the tax invoice. If you’re eligible for ITC, you can claim it while remitting your GST returns.

20. How to file gstr 1 nil return?

Filing a GSTR-1 Nil return can be a simple process if you know the right steps. This guide will walk you through the online procedure on the GST portal, making it quick and easy even for first-timers.

- Login to GST portal > Services > Returns > Returns Dashboard.

- Choose tax period, click Prepare Online under GSTR-1.

- Tick File Nil GSTR-1, verify, and file with DSC/EVC.

Pro tip: Use “Single Click NIL filing” on the Dashboard.

Remember: File before due date to avoid penalties.