2713 views

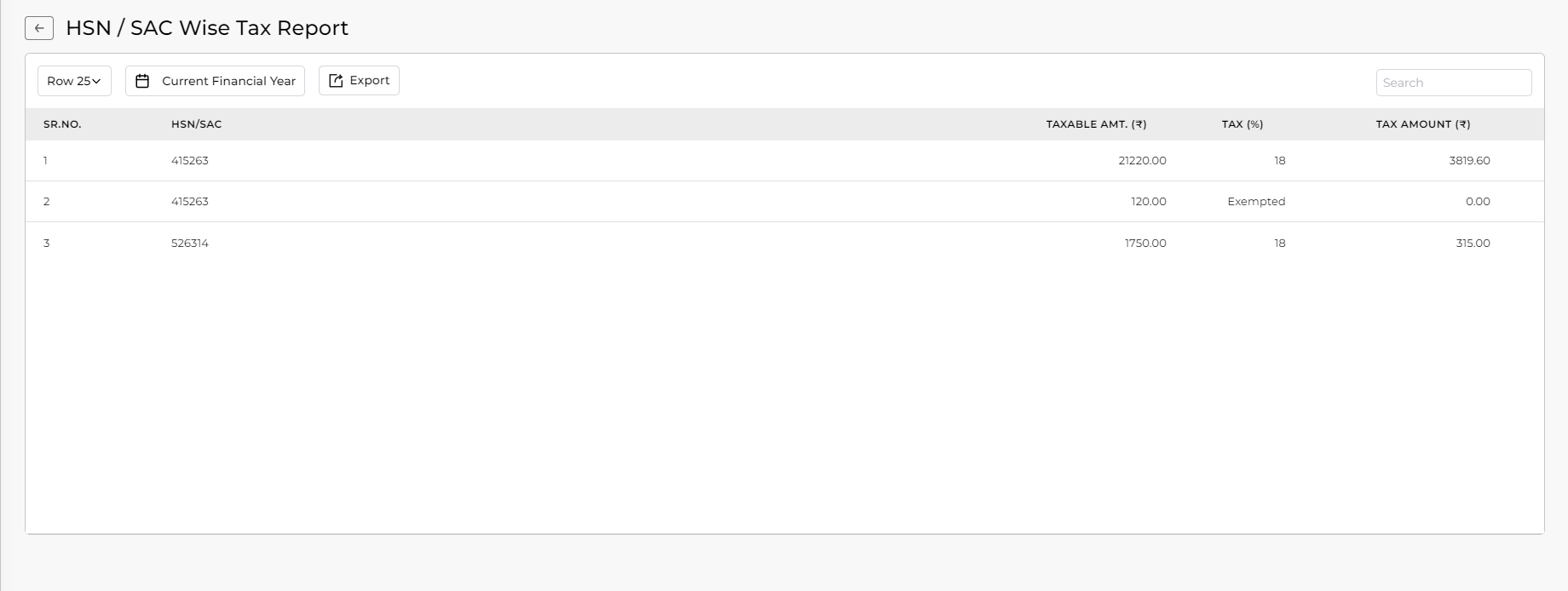

2713 views HSN/SAC wise tax report contains the details of HSN/SAC-wise taxable amount, tax percentage, and tax amount.

Why you should generate HSN / SAC wise tax report?

Generating tax reports that are categorized by Harmonized System of Nomenclature (HSN) or Services Accounting Code (SAC) can provide several benefits for businesses. Here are a few reasons why generating HSN/SAC wise tax reports is important:

- Compliance: HSN/SAC codes are used to classify goods and services for tax purposes. Generating tax reports that are categorized by these codes can help businesses ensure they are in compliance with tax laws and regulations.

- Accuracy: HSN/SAC codes provide a standardized way to classify goods and services. By generating tax reports that are categorized by these codes, businesses can ensure the accuracy of their tax filings.

- Better Insights: HSN/SAC wise tax reports can provide businesses with a better understanding of their sales and expenses by category. This information can be used to identify trends, optimize pricing, and make more informed business decisions.

- Audit Trail: In case of any tax audits, having HSN/SAC wise tax reports can provide a clear audit trail that can help businesses provide evidence of their tax compliance.

Overall, generating HSN/SAC wise tax reports can help businesses ensure compliance, accuracy, gain better insights, and maintain a clear audit trail, making it an important aspect of tax management.

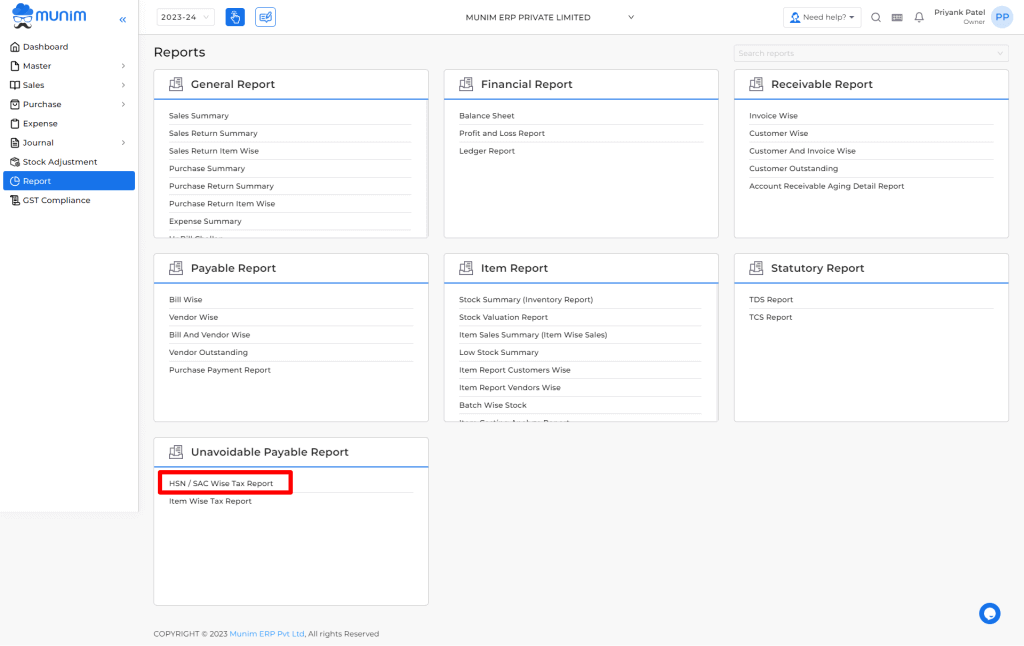

How to open HSN/SAC wise tax report Report:

- Go to the Report module in the left sidebar.

- Click on the HSN/SAC wise tax report button.

| Field | Description |

| Row per page | This drop-down list is used to view the report that you want to see on each page |

| Current Financial Year | This date picker(Filter) is used to show date-wise data. |

| Export | This export button downloads and share data through email in PDF & Excel formats. |

| Search | The search functionality is used to search HSN/SAC codes of specific items. |