3021 views

3021 views This module is used to create sales returns (Credit notes).

Create sales return (Credit Note):

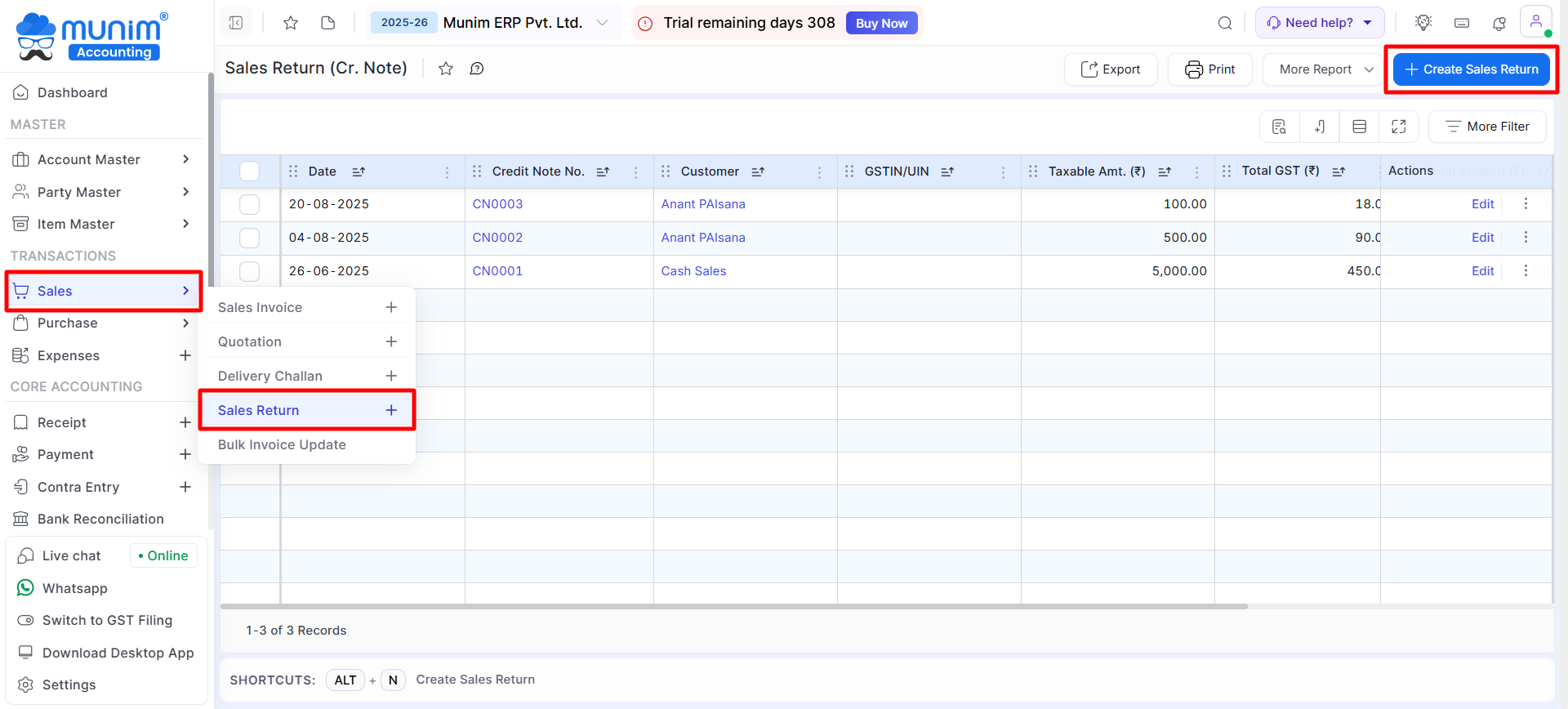

- Go to the Sales module of the Transactions section in the left sidebar.

- Click on the Sales Return option from the dropdown menu.

- Click on the + Create Sales return button or press the Alt+N key.

+−⟲

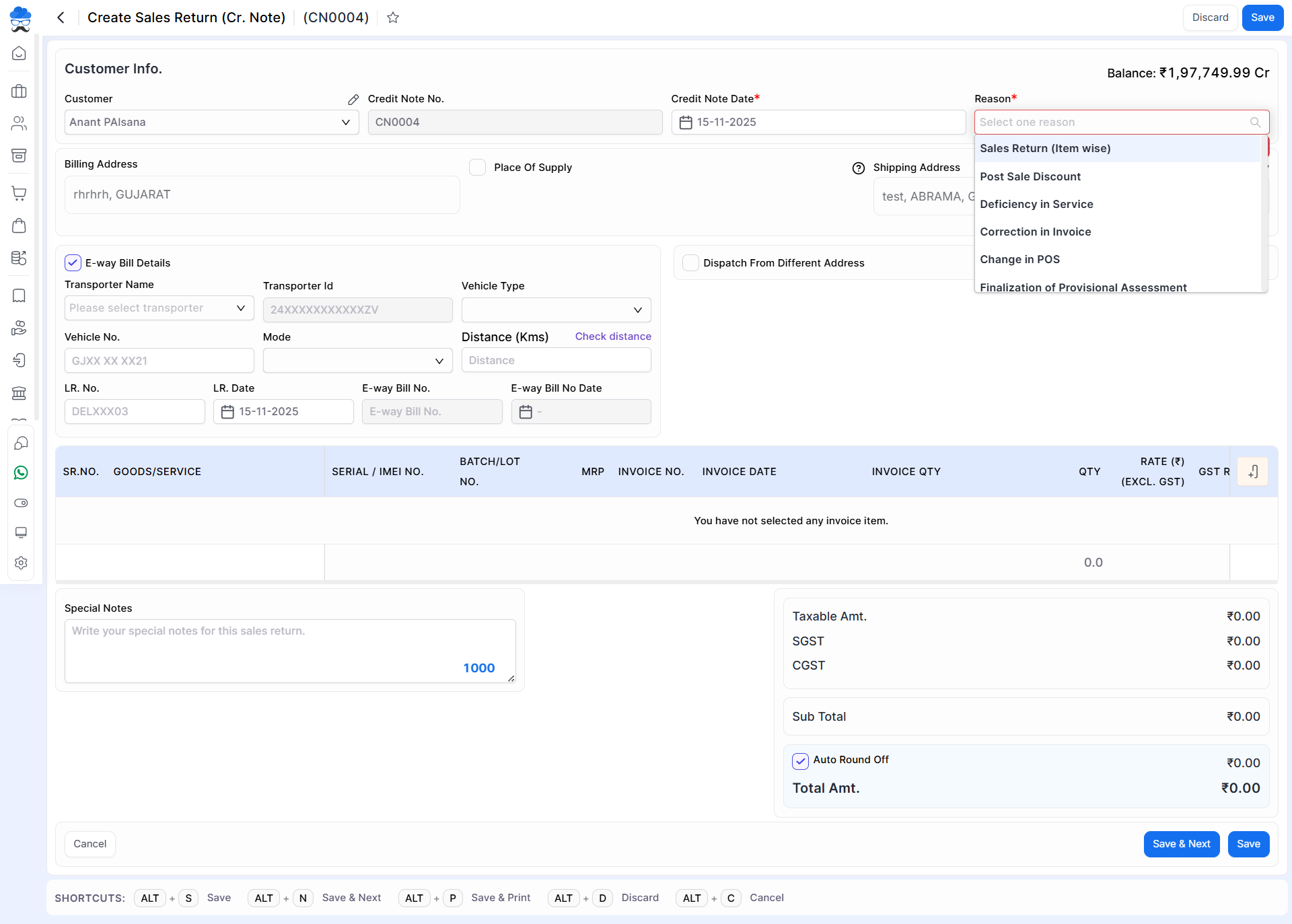

- On this page, users can select a customer and then choose a reason from the dropdown menu.

+−⟲

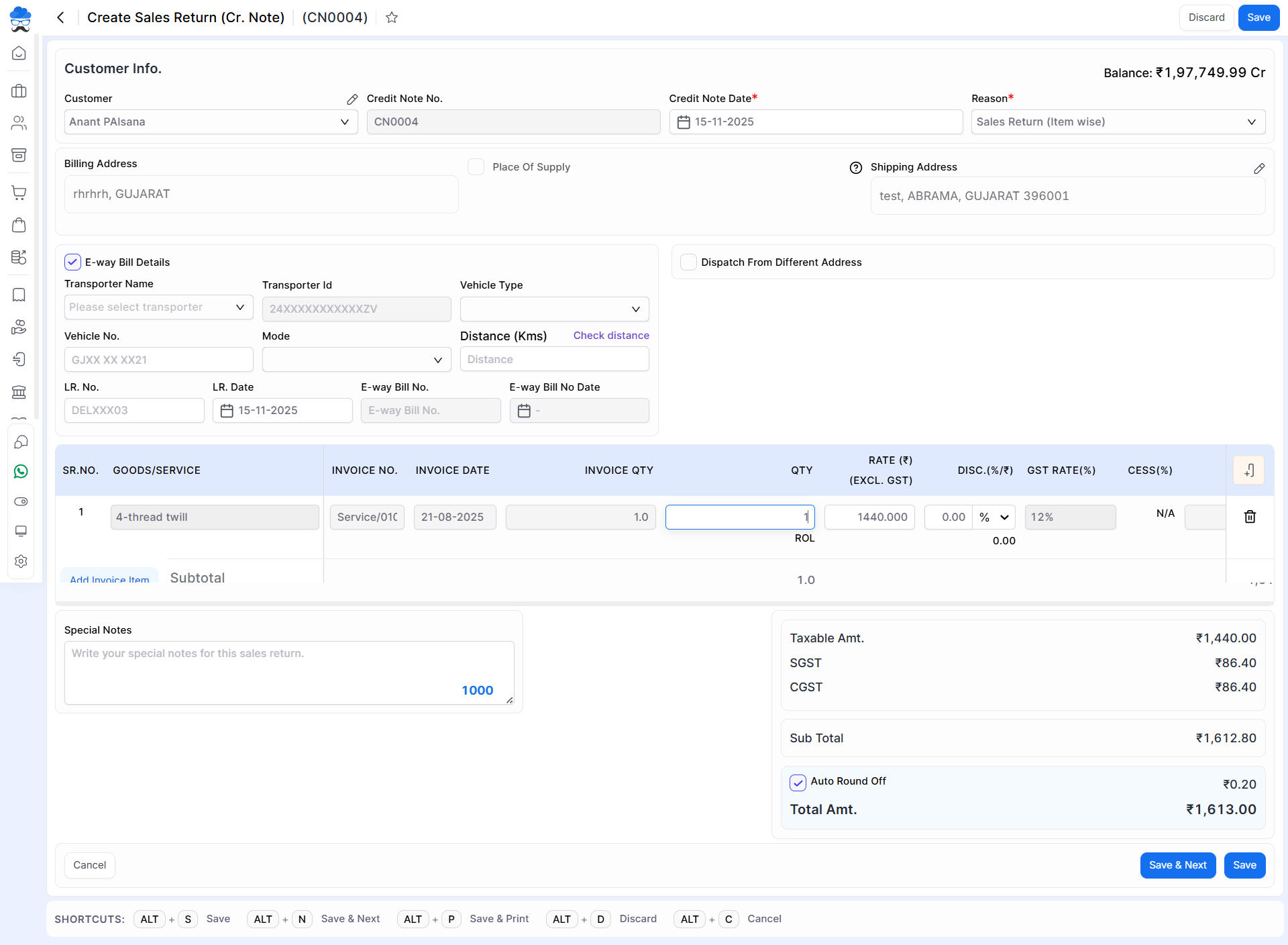

- After selecting the appropriate reason, you can select the invoice for which to create the return entry, and you can also select the item to be returned.

- You may utilize the search function to locate the invoice you wish to return and filter invoices status wise. Additionally, you can select multiple invoices and their associated items for return.

+−⟲

- Following the selection of the invoice and the items to be returned, users may input the quantity to be returned, as well as the rate and discount amounts on the page.

+−⟲

| Field | Description | Note |

|---|---|---|

| Customer | Select the customer for creating a credit note. | |

| Credit Note No. | Credit note No. is auto-generated. | Mandatory field |

| Credit Note Date | Here write the credit note date. | Mandatory field |

| Reason | Here credit note reason list is available. select any one reason for a credit note. | Mandatory field |

| Billing address | If you have written the address in the customer account then as you select customer, the Billing address will automatically come here. | Mandatory field |

| Place of supply | IGST will be applicable on the invoice. Suppose selected billing accounts province is different in comparison to the Place of supply province. | |

| Shipping address | If you have written the address in the customer account, then the shipping address will automatically come here as you select the customer. you can also able to change the shipping address. | |

| E-way Bill Details | If you need to add transportation data and E-way data then click on this checkbox. | |

| Dispatch from different Address | If dispatch address is different then enable this option to change address. | |

| Transporter name | Here select the transporter name. here also you are able to create new transporter account. | |

| Transporter Id | Here you can ad transporter ID or GST number. | |

| Vehicle Type | Here select the vehicle type | |

| Vehicle no. | Here write vehicle no. | |

| LR. no. | Here write LR. no. | |

| LR. date | Here write the LR. date. | Mandatory field |

| E-way Bill No. | Here you can see Eway Bill number | |

| E-way Bill no Date | E-way Bill No Date | |

| Product/Service | Here data is auto-showing from the original sales invoice. | |

| Batch No. | Here data is auto-showing from the original sales invoice. | |

| Invoice No | Here data is auto-showing from the original sales invoice. | |

| Invoice Date | Here data is auto-showing from the original sales invoice. | |

| Invoice Qty | Here data is auto-showing from the original sales invoice. | |

| Quantity | Here write the sales return quantity. | Mandatory field |

| Rate (₹) | Here write rate. | Mandatory field |

| Discount | Here write the discount amount. here the user can apply discount two types amount wise discount and percentage-wise discount. | |

| Taxable Amount | Here auto set taxable amount. | |

| GST Rate(%) | As you select the item, GST Rate automatically comes here from the item master. | |

| CESS(%) | Here write the CESS percentage. | |

| Amount (₹) | As you write the item quantity, and item rate then the amount will show here. | |

| Special notes | Here write a special note for this credit note. | |

| Auto round off | This checkbox is used for the total amount set in the round. | |

| Save & next | This button is used to save the sales return and page redirect on the same page. | |

| Save | This button is used to save the sales return and page redirect on the Sales return listing page. |

| Shortcut | Description |

|---|---|

| Alt+S | Save – This shortcut is used to save the credit note. |

| Alt+N | Save & Next – This shortcut is used to save the credit note and redirect to the same page. |

| Alt+P | Save & Print- This shortcut is used to print credit notes. |

| Alt+D | Discard- This shortcut is used to discard the credit note. |

| Alt+C | Cancel- This shortcut is used to cancel the credit note. (work as for Back button) |

+−⟲

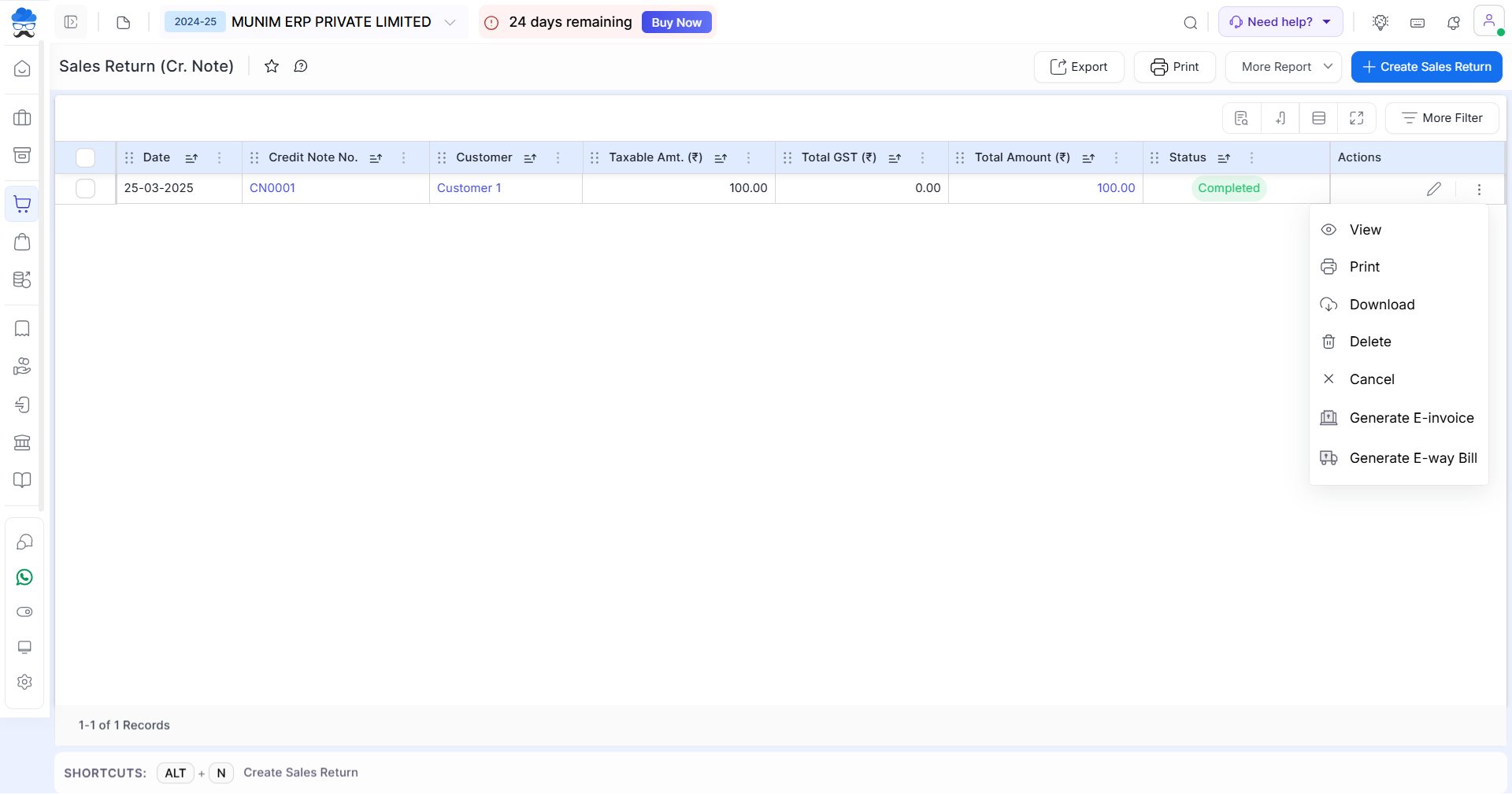

| Field | Description |

|---|---|

| Actions | Here multiple types of actions are available, Edit, View, Print, Delete, Cancel, Generate E-invoice and Generate E-way Bill. |

| Edit | This action is used to edit sales returns. |

| View | This action is used to view sales returns. |

| This action is used to print sales returns. | |

| Delete | This action is used to delete sales returns entry. |

| Cancel | This action is used to cancel sales returns entry |

| Generate E-invoice | This action is used to generate e-invoice. |

| Generate E-way Bill | This action is used to generate an e-invoice. |