This module is used for creating sales invoices. Here you are able to add new customers and new items.

On this page, you are able to import the sales invoices. we are providing the sample Excel file which you can download, add the details and import the data.

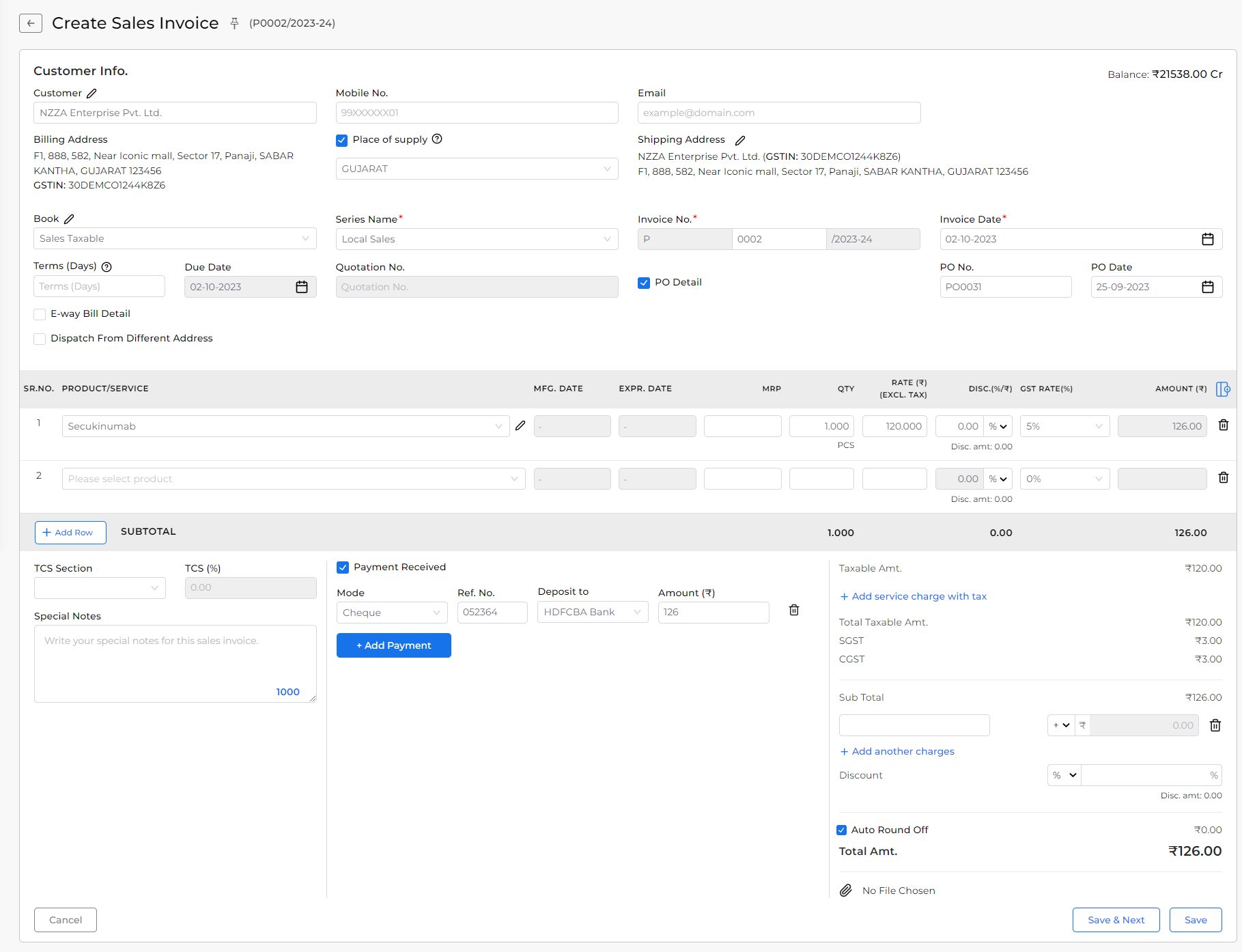

Create sales invoices:

- Go to the Sales Invoice option in the Sales module in the left sidebar.

- Click on the Create Invoice button or press Alt+N key.

| Field | Description | Note |

|---|---|---|

| Customer | Here select customer for creating sales invoices. here also you are able to add new customers. | Mandatory field |

| Mobile no. | If you have written the mobile number in the customer account, then the mobile number will automatically come here as you select the customer. here you are able to change the mobile number. | |

| If you have written the email in the customer account, then the email will automatically come here as you select the customer. here you are able to change the email. | ||

| Billing address | If you have written the address in the customer account then as you select customer, the Billing address will automatically come here. | Mandatory field |

| Place of supply | IGST will be applicable on the invoice. Suppose selected billing accounts province is different in comparison to the Place of supply province. | |

| Shipping address | If you have written the address in the customer account, then the shipping address will automatically come here as you select the customer. here you are able to edit the shipping address. | Mandatory field |

| Book | Here select the sales book for sales record. | |

| Series Name | Here select the invoice series. | |

| Invoice No. | The Invoice number is auto-generated regarding your invoice series. | |

| Invoice date | The invoice date is auto-generated, also you are able to change the invoice date. | |

| Terms (Days) | If you have written the terms(Days) in the customer account, then the terms(Days) will automatically come here as you select the customer. here you are able to change the terms(Days). | |

| Due date | As you write Terms days, The due date will automatically be set. | |

| Quotation No. | If you are creating a sales invoice using a quotation then the quotation number is shown here but if you are creating a direct sales invoice then this field showing disabled. | |

| PO Detail | If the user clicks on this checkbox then it shows PO.NO and PO Date field. if the user maintains sales with a purchase order then this option is most important, and PO No. and the PO Date is also shown on the sales invoice print. | |

| PO No. | Here write the purchase order number. | |

| PO Date | Here write the purchase order date. | |

| E-way bill detail | If you require an e-way bill for this invoice then click this checkbox and fill in all the details. | |

| Dispatch from different address | Click this checkbox if the goods are to be delivered from a different address. | |

| Challan No. | If you are creating a sales invoice using a challan then the challan number is shown here but if you are creating a direct sales invoice then this field showing disabled. | |

| Product/Service | Here select an item, here also you are able to add an item and edit item. | Mandatory field |

| Description | Here write product description. | |

| Batch NO. | Here select the batch number. | |

| Mfg.Date | If you select a batch number then the manufacture date auto-fill. | |

| Expire Date | If you select batch number then expire date auto fill. | |

| MRP | Here write the item MRP. if you add MRP on item master then MRP auto fill. | |

| Quantity | Here write the item quantity. | Mandatory field |

| Free quantity | Here customers get items without cost along with paid items. This free quantity is affected in the stock report but not in the invoice amount. | |

| Rate (₹) | As you select the item, Rate automatically comes here from item master. Here you are to change item rate. | Mandatory field |

| Exclusive rate/Inclusive rate | As you write Rate then Exclusive/Inclusive rate auto-generate. | |

| Discount(%/₹) | Here write discount. here you are able to apply discounts in two types, first percentage-wise and second amount-wise. this discount apply only for this item. | |

| Discount amount | As you write discount, The discount amount will automatically come here. | |

| Taxable amount | As you select the item, write the item quantity, write the item rate, add the discount then the the taxable amount will show here. | |

| CESS(%) | As you select the item, CESS automatically comes here from the item master.Here you are able to change CESS(%). | |

| GST Rate(%) | As you select the item, GST Rate automatically comes here from the item master. Here you are able to change GST rate. | |

| Amount (₹) | As you select the item, write item quantity, write the item rate, and discount then the amount will show here. | |

| Special notes | Here write a special note for this invoice. | |

| TCS section | Here select the TCS Section rule. | |

| TCS (%) | As you select the TCS Section rule, TCS (%) will come here. | |

| Payment Received | If the user clicks on this checkbox then show the payment received entry option. If the user performs both operations (Sales & Receipt) at the same time then this checkbox is most important. here the user adds payment received data like mode, deposit to, and amount then the receipt voucher is auto-generated. | |

| Mode | Select receipt methods like cheque, net banking, cash, and UPI. | |

| Ref.No | Here write the receipt reference number or reference details. | |

| Deposit to | Select receipt to deposit account. | |

| Amount | Here write the received amount. | |

| +Add Payment | This button is used to generate multiple payment entries. | |

| + Add service charge with tax | Here you are able to add an additional service charge for this invoice. here you are able to add multiple additional services. | |

| +Add another charge | Here you are able to add and remove another charge for this invoice. here you are able to add multiple other charges. | |

| Discount Amount | Here you are able to apply a discount for this invoice. you can apply discounts for both types like percentage and amount. | |

| Auto round off | This checkbox is useful for rounding off the total amount, and also you are able to set a custom amount. | |

| No file chosen | Here you can able to upload files. | |

| Save & next | This button is used to save the sales invoice and page redirect on the same page. | |

| Save | This button is used to save the sales invoice and page redirect on the Sales invoice listing page. |

| Shortcut | Description |

|---|---|

| Alt+S | Save- This shortcut is used to save the sales invoice. |

| Alt+N | Save & next- This shortcut is used to save the sales invoice and redict on same page. |

| Alt+P | Save & Print- This shortcut is used to print sales invoices. |

| Alt+D | Discard- This shortcut is used to discard the sales invoice. |

| Alt+A | New- This shortcut is used to add new row. |

| Alt+R | Remove- This shortcut is used to remove a row. |

| Alt+C | Cancel- This shortcut is used to cancel the sales entry. ( work as Back button) |

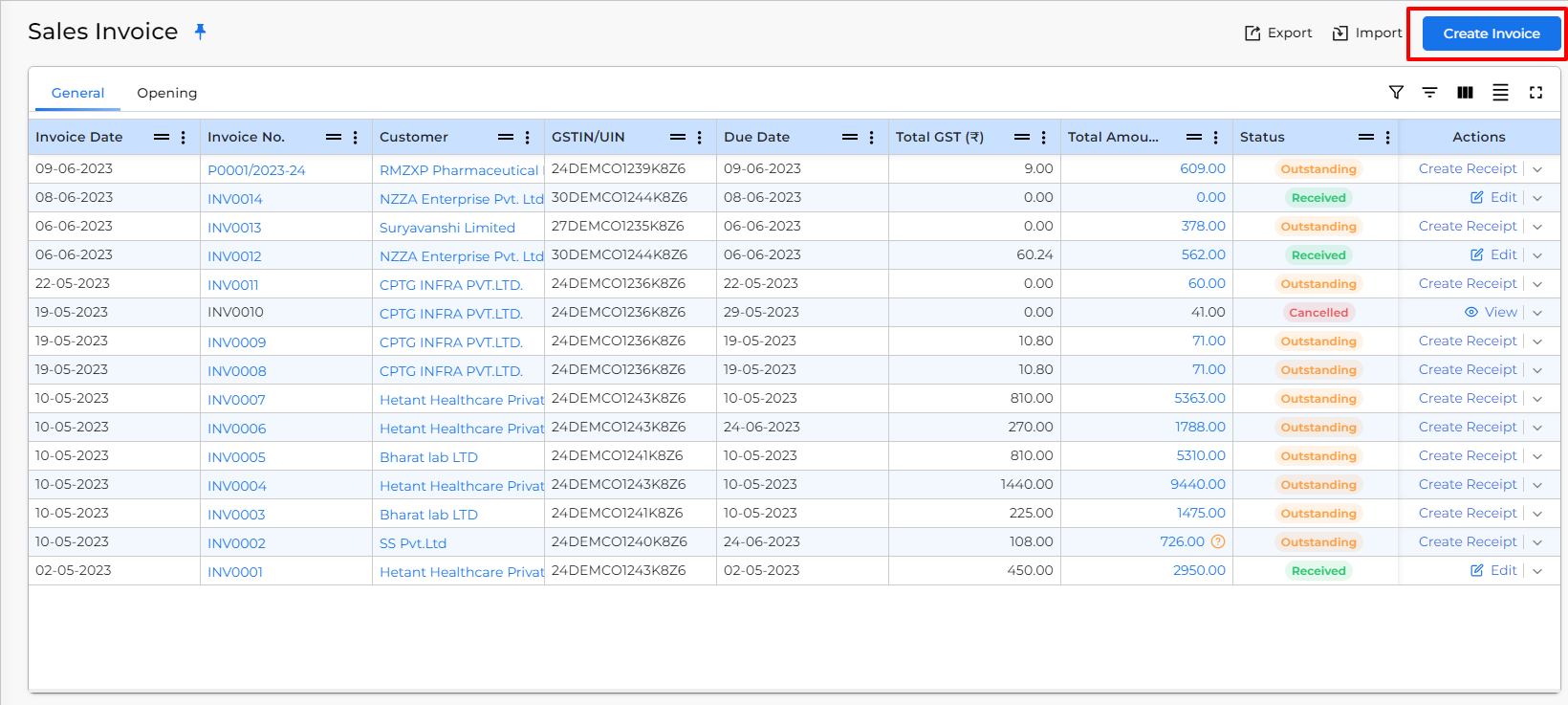

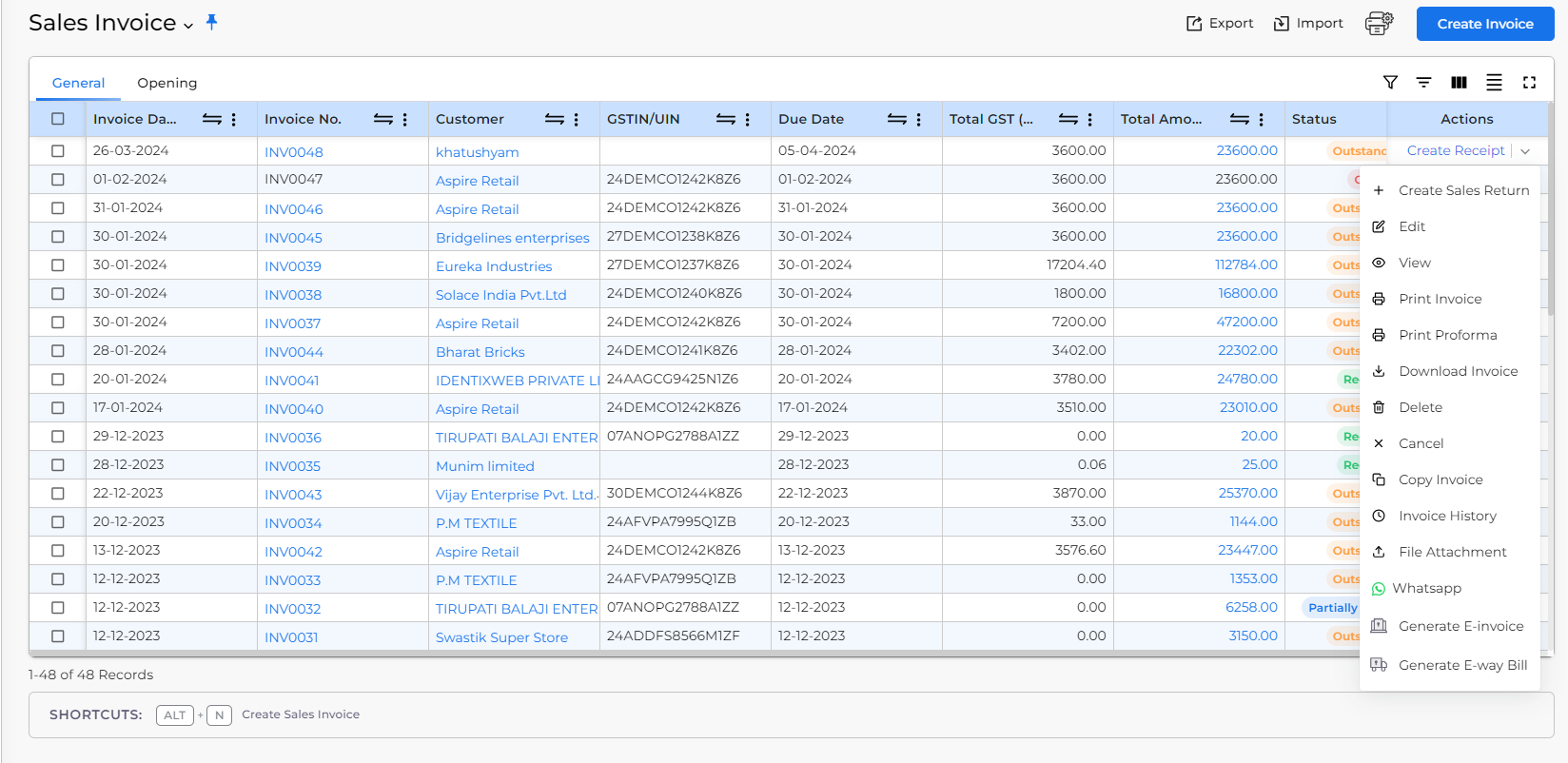

| Field | Description |

|---|---|

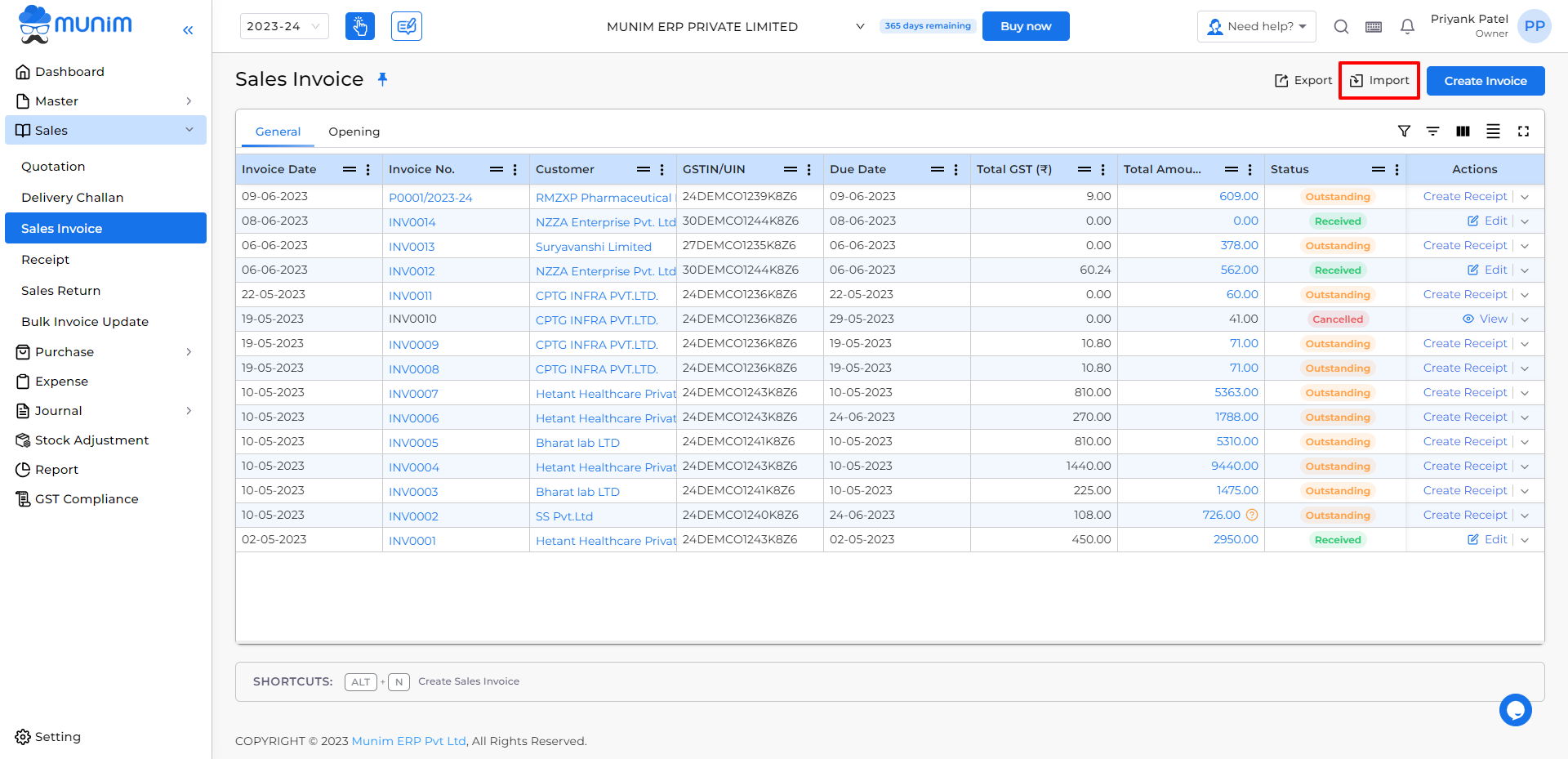

| Export | This button is used to export data. |

| Import | This button is used to import data. |

| Actions | Here multiple types of actions are available, Create Receipt, Create Sales Return, Edit, View, Print Invoice, Print Proforma, Delete, Cancel, Copy Invoice, Invoice History, File Attachment, Whatsapp, Generate E-Invoice, Generate E-Way bill. |

| Create Receipt | This action is used to create a receipt for the sales invoices. |

| Create Sales Return | This action is used to create sales returns (Credit Note). |

| Edit | This action is used to edit sales invoices. |

| View | This action is used to view sales invoices. |

| Print Invoice | This action is used to print sales invoices. |

| Print Proforma | This action is used to print proforma invoices. |

| Download Invoice | This action is used to download sales invoice. |

| Delete | This action is used to delete sales invoices. |

| Cancel | This action is used to cancel sales invoices. |

| Copy Invoice | This action is used to copy invoices. this action is used to create a new invoice with the same data. |

| Invoice History | This action is used to view invoice history. |

| File Attachment | This action is used to attach a document for this invoice. |

| This action is used to send invoice copy through WhatsApp. | |

| Generate E-Invoice | This action is used to generate e-invoice. |

| Generate E-Way bill | This action is used to generate e-way bill. |

| Status | Details |

|---|---|

| Outstanding | This status will identify the entry as Outstanding, As this Invoice payment has not been received yet or not adjusted with receipt entry. |

| Received | This status will identify the entry as Received, As this Invoice payment has been received and adjusted with the Receipt entry. |

| Partially received | This status will identify the entry as partially received, As a Half or Partial payment is received of the invoice. |

| Cancelled | This status will identify the entry as cancelled as if a user has cancelled it manually. |

| Closed | This status will identify the entry as closed if a user has created a Sales return against the invoice. |

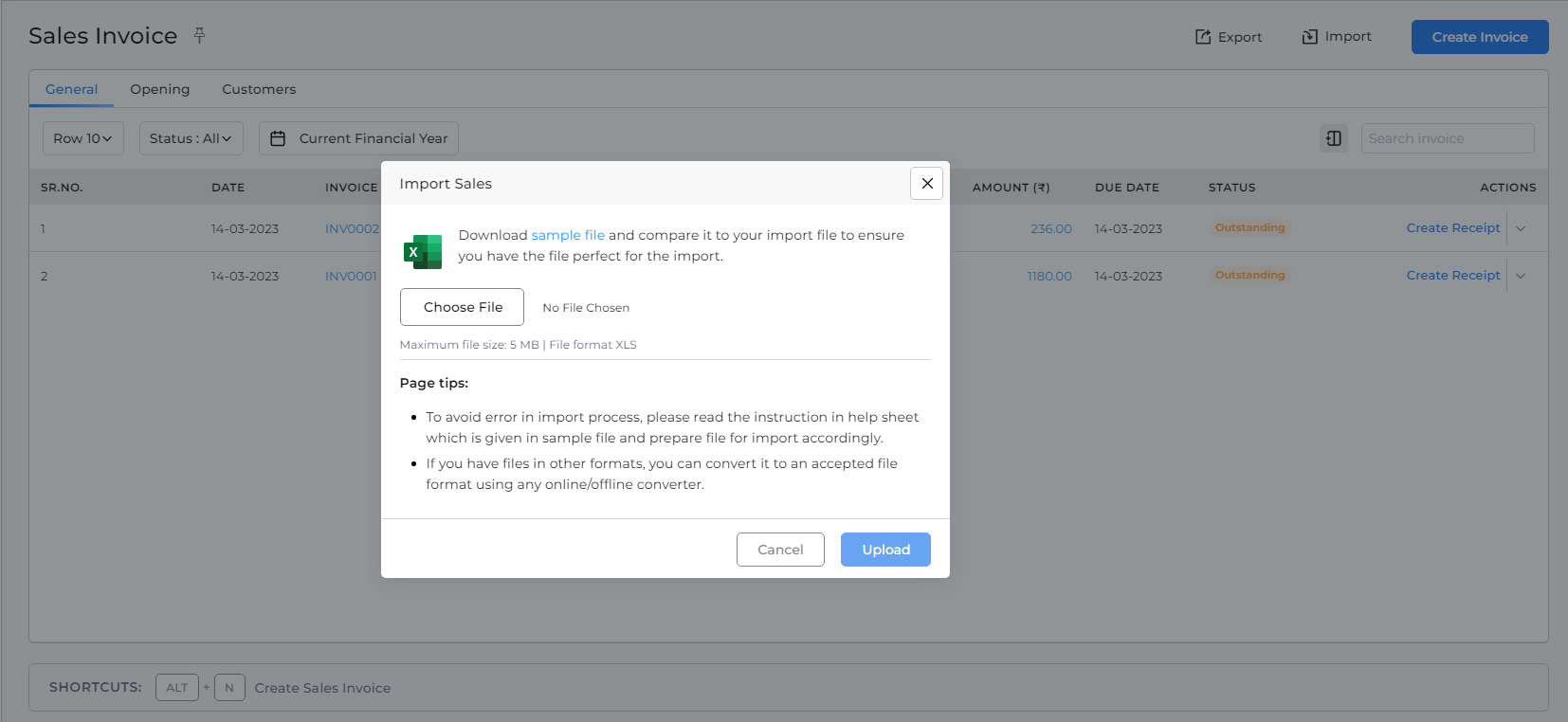

Import sales invoices:

- Go to the Sales module from the left sidebar and then select the Sales Invoice.

- Now on this page, click on the Import sales button from the top right corner.

- Now the import sales popup will be shown from which you need to click on the Download sample file.

- Now open the downloaded excel file, add the details, save it and upload the file in that popup itself.

+−⟲

+−⟲