1813 views

1813 views

This module is used to create purchase returns (Debit notes).

Create purchase return (Debit note):

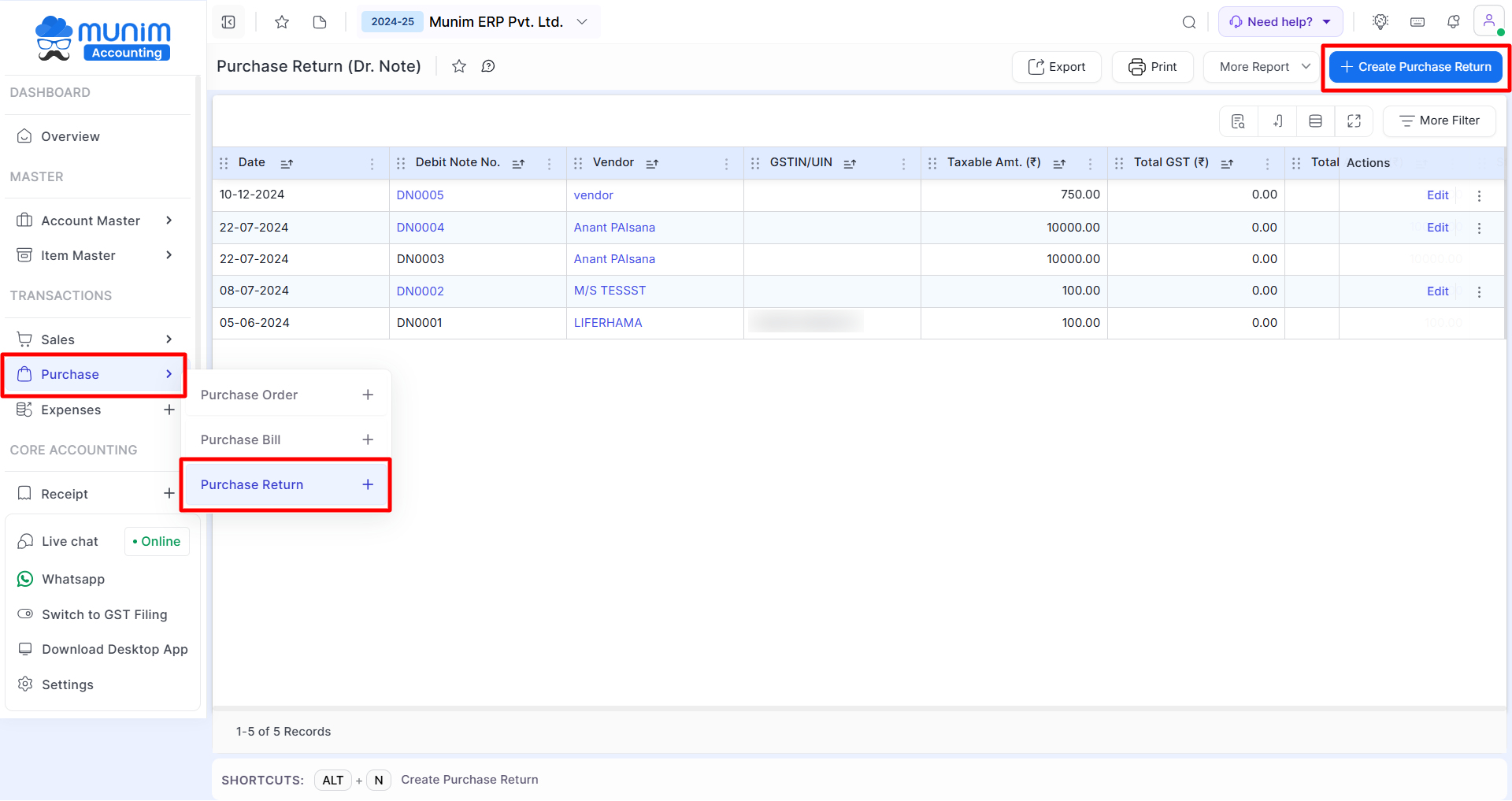

- Go to the Purchase module in the left sidebar.

- Click on the Purchase Return option.

- Click on the Create purchase return button or press the Alt+N key.

+−⟲

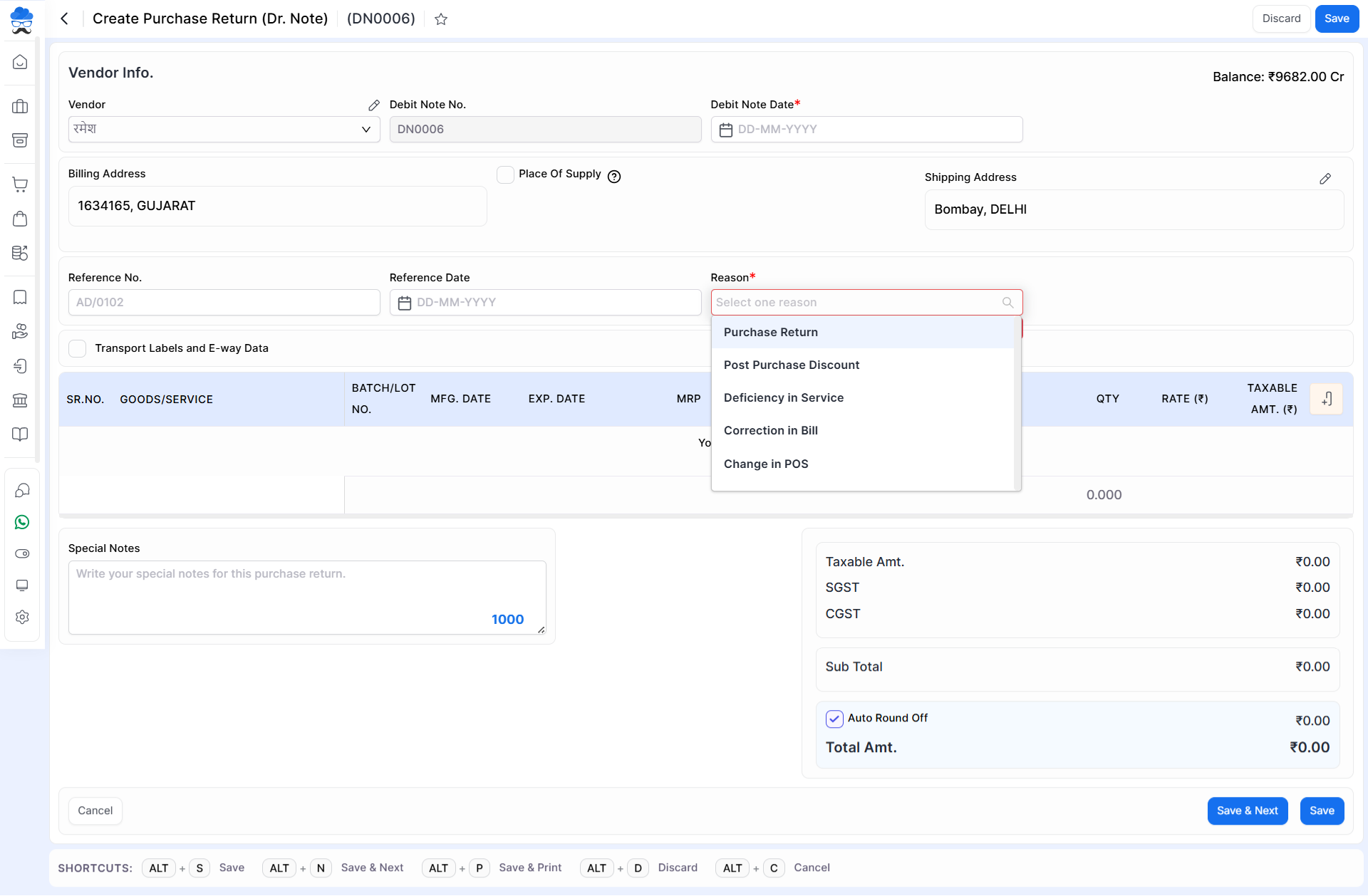

- Once you select a Vendor to create a Purchase return, the Reason field will be open to select any one reason.

+−⟲

+−⟲

| Field | Description | Note |

|---|---|---|

| Vendor | Select the vendor to create a Purchase Return (debit note). | |

| Debit Note No. | Debit note No. is auto-generated. | |

| Debit Note Date | Here you can write the debit note date. | Mandatory field |

| Billing address | If you have written the address in the vendor ledger and as soon as you select the vendor, the billing address will be displayed here automatically. | Mandatory field |

| Place of supply | IGST will be applicable on the invoice. Suppose selected billing accounts province is different in comparison to the Place of supply province. | |

| Shipping address | Here you can write the shipping address. If the shipping address is the same as the billing address then click on the “same as billing address” checkbox. | |

| Reference No. | Here write the reference number. | |

| Reference Date | Here write the reference date. | |

| Reason | Here, debit note’s reason list is available. select any one reason for a debit note. After selection, Bill selection popup will appear | Mandatory field |

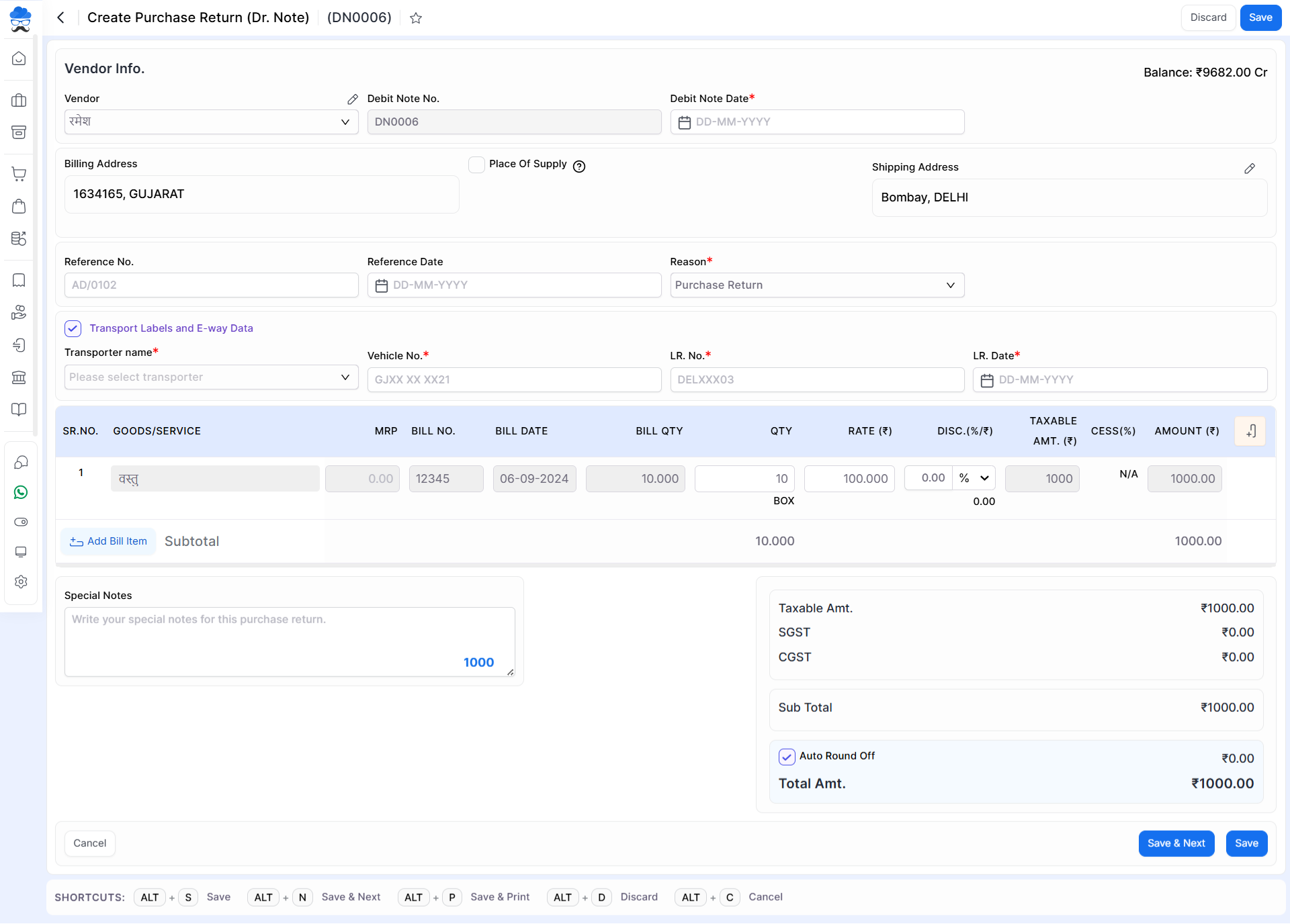

| Transport labels and E-way data | Click this checkbox to enable and add transportation data and E-way data. | |

| Transporter name | Here select the transporter name. here also you are able to create a new transporter account. | |

| Vehicle no. | Here you can write vehicle no. | |

| LR. no. | Here you can write LR. no. | |

| LR. date | Here write LR date. | |

| Product/Service | Here data will be auto-shown from the original purchase bill. | |

| Batch Bo. | Here show batch number from the original purchase bill | |

| Bill No. | Here data will be auto-shown from the original purchase bill. | |

| Bill date. | Here data will be auto-shown from the original purchase bill. | |

| Bill QTY | Here data will be auto-shown from the original purchase bill. | |

| Quantity | Here you can write the purchase return quantity. | Mandatory field |

| Rate (₹) | Here you can write the rate or auto-fetched from Purchase Bill. | Mandatory field |

| Disc. | Here you can ad Discount in Amount or in Percentage. | |

| GST Rate(%) | As you select the item, GST Rate will automatically be shown here from the item master. | |

| CESS(%) | Here you can write the CESS percentage. | |

| AMOUNT (₹) | As you write the item name, item quantity, item rate, and discount then the amount will be shown here. | |

| Special notes | Here you can write a special note for this debit note. | |

| Auto round off | This checkbox is used for the total amount set in the round. | |

| Save & next | This button is used to save the purchase return and page redirect on the same page. | |

| Save | This button is used to save the purchase return and page redirect on the purchase return listing page. |

| Shortcut | Description |

|---|---|

| Alt+S | Save – This shortcut is used to save the debit note. |

| Alt+N | Save & Next – This shortcut is used to save the debit note and redirect to the same page. |

| Alt+P | Save & Print- This shortcut is used to print debit notes. |

| Alt+D | Discard- This shortcut is used to discard the debit note. |

| Alt+C | Cancel- This shortcut is used to cancel the debit note. ( work as for Back button) |

+−⟲

| Field | Description |

|---|---|

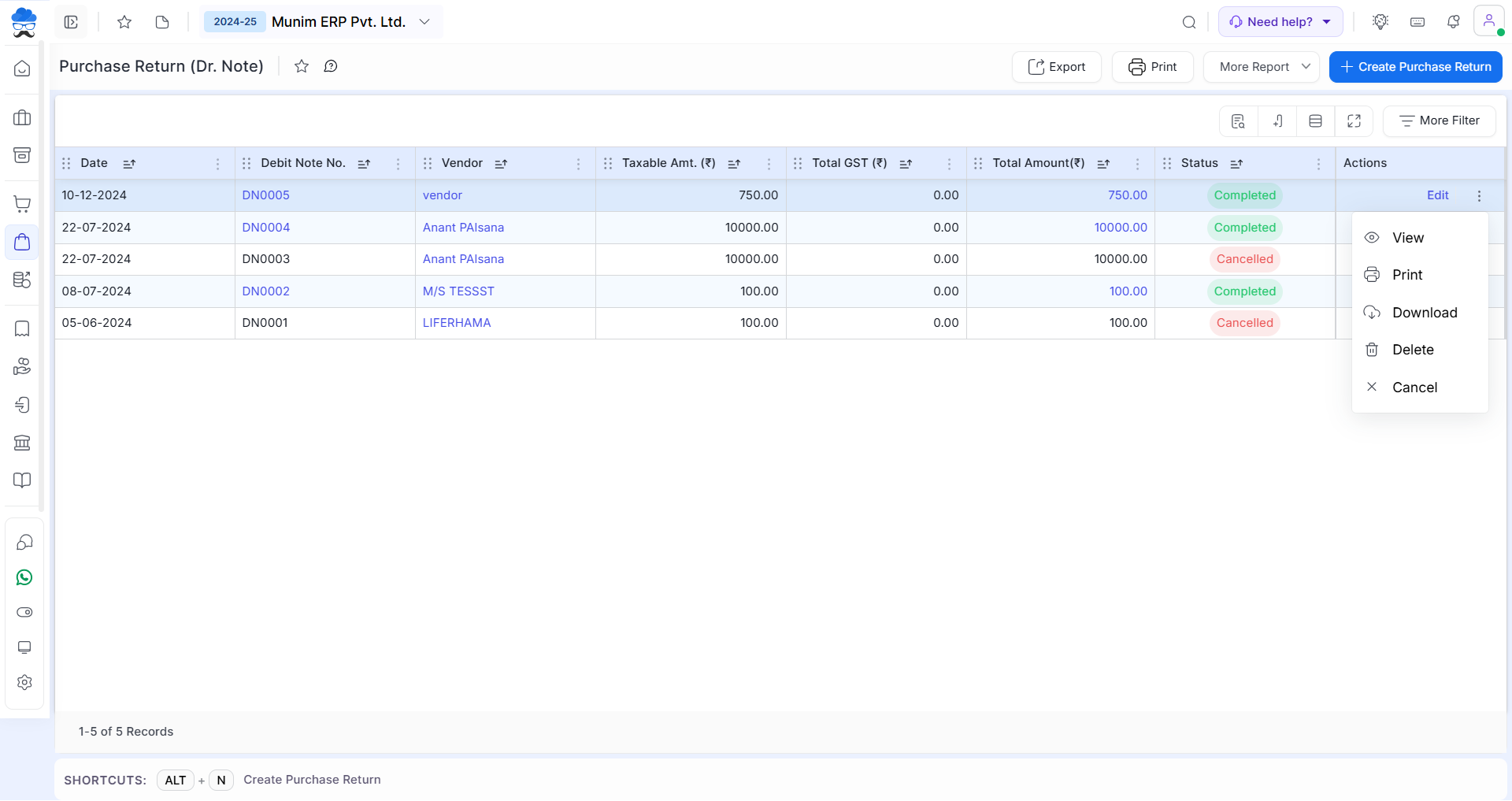

| Export | This action is used to Export data of Purchase Return in Excel format |

| This action is used to print Purchase Return | |

| More Report | This option provide multiple preset filters to see transactions list better. |

| Actions | Here multiple types of actions are available, Edit, View, Delete, Print |

| Edit | This action is used to edit purchase returns transaction. |

| View | This action is used to view purchase returns transaction. |

| This action is used to print purchase returns transaction. | |

| Download | This action is used to download purchase return transaction |

| Delete | This action is used to delete the transaction. |

| Cancel | This action is used to cancel purchase returns. |

| Status | Description |

|---|---|

| Completed | This status shows that this transition is completed. |

| Cancelled | This status shows that this transaction is cancelled |

Need Assistance?

For any questions or further support with Munim Software, please contact our support team.