The “Place of Supply” is a significant upgrade to our GST software. the “place of supply” is a crucial concept under the Goods and Services Tax (GST) regime. It determines which state’s GST is applicable to a particular transaction. The place of supply rules are designed to ensure that the tax revenue goes to the state where the consumption or utilization of goods or services occurs.

GST is a destination-based tax, meaning that the goods/services are taxed at the point of consumption rather than the point of origin. Therefore, the authority to collect GST will lie with the state in which they are consumed.

As a result, the place of supply is essential under GST because it is the focal point of all of its requirements. According to the GST, the location of the supplier of the products determines whether the transaction qualifies as intrastate or interstate and, as a result, the amount of SGST, CGST, and IGST that will be levied.

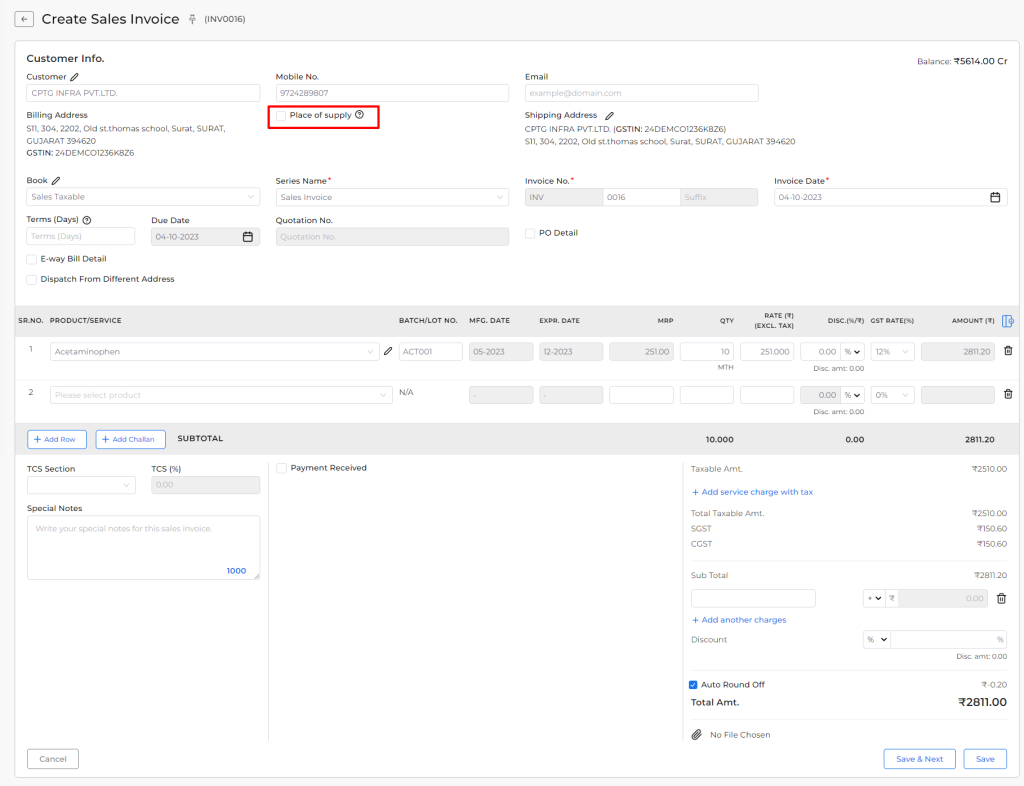

How to add Place of Supply in Sales Invoice:

- First, go to the Sales Invoice module in the left sidebar.

- Click on the Create Invoice button or press the Alt+N key.

- Select the Customer for creating the invoice.

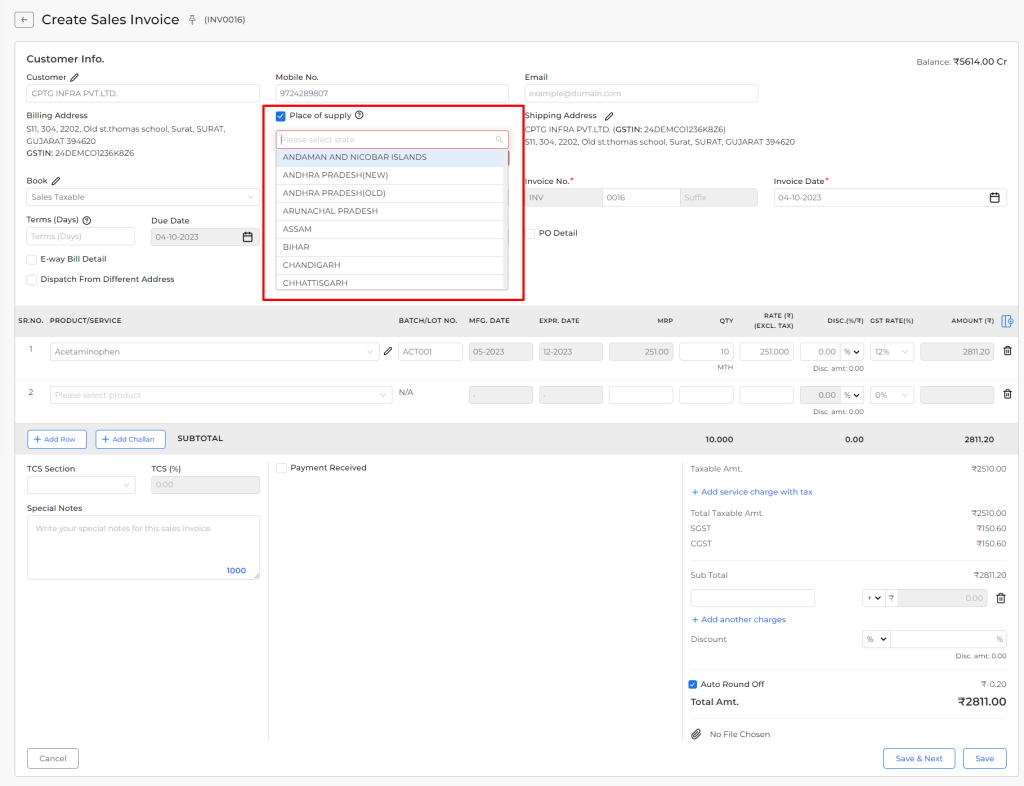

- Click on the “Place of Supply” checkbox button.

- Select the State in the drop-down list.

Example 1- Intra-state sales Mr.Anant of Surat, Gujarat sells 10 Laptop sets to Mr. Purvesh of Vadodara, Gujarat

The place of supply is Vadodara in Gujarat. Since it is the same state CGST & SGST will be charged.

Example 2- Inter-state sales Mr.Anant of Surat, Gujarat selles 25 Laptop sets to Mr. Dharmesh of Mumbai, Maharashtra

The place of supply is Mumbai in Maharashtra. Since it is a different state IGST will be charged.

Example 3- Deliver to a 3rd party as per instruction Tejash in Lucknow buys goods from Mr. Anant in Surat (Gujarat). The buyer requests the seller to send the goods to Vadodara (Gujarat)

In this case, it will be assumed that the buyer in Lucknow has received the goods & IGST will be charged. Place of supply: Lucknow (UP) GST: IGST