1612 views

1612 views

Our software is able to create E-invoices and E-way bills along with creating sales invoices. Here you can generate an E-Invoice and E-way bill along with the sales invoice or you can create both of these invoices individually with the sales invoice.

You can easily manage E-Invoice and E-Way Bill records, and also you can cancel E-Invoice and E-Way bills from here.

Click here, To learn how to enable and set up an E-Invoice and E-way bill

How to create an E-Invoice and E-way bill:

- First, create a sales invoice after that generate an E-way bill and E-Invoice.

Create sales invoices:

- Go to the Sales Invoice module in the left sidebar.

- Click on the Create Invoice button or press the Alt+N key.

+−⟲

| Field | Description | Note |

|---|---|---|

| Customer | Here select customer for creating sales invoices. here also you are able to add new customers. | Mandatory field |

| GST IN | As you select the customer, the GST number will automatically come here from the account. | Disabled field |

| Mobile no. | If you have written the mobile number in the customer account, then the mobile number will automatically come here as you select the customer. here you are able to change the mobile number. | |

| If you have written the email in the customer account, then the email will automatically come here as you select the customer. here you are able to change the email. | ||

| Billing address | If you have written the address in the customer account then as you select customer, the Billing address will automatically come here. | Mandatory field |

| Shipping address | If you have written the address in the customer account, then the shipping address will automatically come here as you select the customer. here you are able to edit the shipping address. | Mandatory field |

| Prefix | If you have written the prefix in the invoice setting then the prefix will automatically come here. here you are able to change the invoice prefix. | |

| Invoice sr. | Here invoice sr auto-generate, also you are able to write invoice sr. | |

| Invoice no. | Invoice no auto-generate. invoice no is a combination of invoice sr & Prefix. | |

| Invoice date | The invoice date is auto-generated, also you are able to change the invoice date. | |

| Terms (Days) | If you have written the terms(Days) in the customer account, then the terms(Days) will automatically come here as you select the customer. here you are able to change the terms(Days). | |

| Due date | As you write Terms days, The due date will automatically be set. | |

| Book | Here select the sales book for sales record. | |

| Quotation No. | If you are creating a sales invoice using a quotation then the quotation number is shown here but if you are creating a direct sales invoice then this field showing disabled. | |

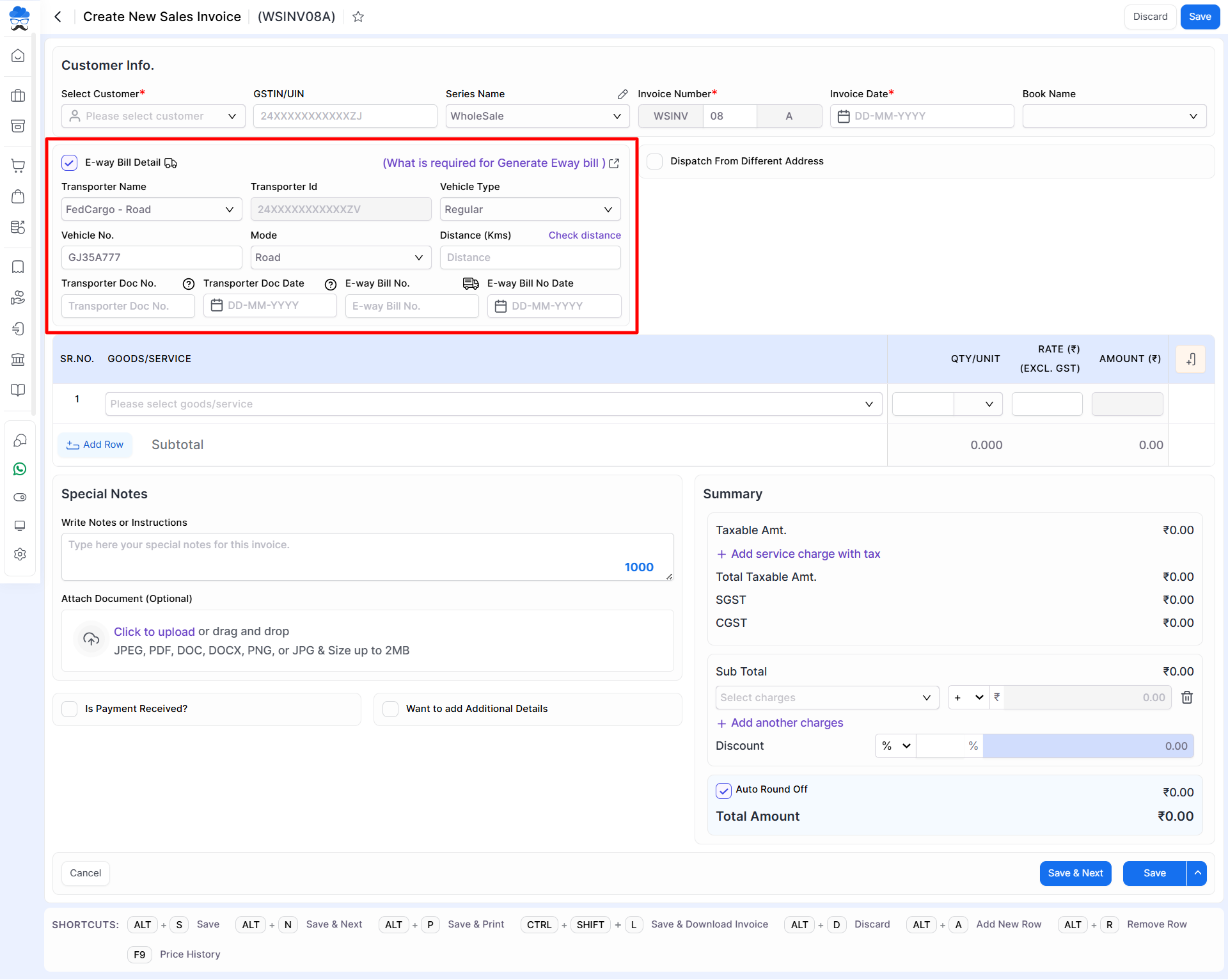

| E-way bill detail | If you require an e-way bill for this invoice then click this checkbox and fill in all the details. | |

| Transporter name | Here select the transporter name and also create a new transporter. | |

| Transporter id | Here show transporter id. this field is disabled. | |

| Vehicle No. | As you select the transporter name the vehicle number automatically comes here, also you are able to write the vehicle number. | |

| Mode | As you select the transporter name the transport mode automatically comes here, also you are able to change transport mode. | |

| Distance (Kms) | Here write kilometre. | |

| Vehicle type | Here select vehicle type. | |

| Transporter doc No. | Here write the transporter document number. | |

| Transporter doc date | Here write the transporter document date. | |

| E-way bill No. | Here write the e-way bill number. | |

| E-way bill no date | Here write the e-way bill number date | |

| Dispatch from different address | Click this checkbox if the goods are to be delivered from a different address. | |

| Product/Service | Here select an item, here also you are able to add an item and edit item. | Mandatory field |

| HSN/SAC | If you have written the HSN/SAC code in the item master then as you select an item, the HSN/SAC code will automatically come here. | |

| Batch NO. | Here select the batch number. | |

| MRP | Here write the item MRP. | |

| Quantity | Here write the item quantity. | Mandatory field |

| Rate (₹) | As you select the item, Rate automatically comes here from item master. Here you are to change item rate. | Mandatory field |

| Discount (%/₹) | Here write discount. here you are able to apply discounts in two types, first percentage-wise and second amount-wise. this discount apply only for this item. | |

| Discount amount | As you write discount, The discount amount will automatically come here. | |

| Taxable amount | As you select the item, write the item quantity, write the item rate, add the discount then the the taxable amount will show here. | |

| CESS (%) | As you select the item, CESS automatically comes here from the item master.Here you are able to change CESS(%). | |

| GST Rate (%) | As you select the item, GST Rate automatically comes here from the item master. Here you are able to change GST rate. | |

| Amount (₹) | As you select the item, write item quantity, write the item rate, and discount then the amount will show here. | |

| Special notes | Here write a special note for this invoice. | |

| TCS section | Here select the TCS Section rule. | |

| TCS (%) | As you select the TCS Section rule, TCS (%) will come here. | |

| +Add another charge | Here you are able to add and remove another charge for this invoice. here you are able to add multiple other charges. | |

| Discount Amount | Here you are able to apply a discount for this invoice. | |

| Auto round off | This checkbox is useful for rounding off the total amount, and also you are able to set a custom amount. | |

| No file chosen | Here you are able to attach the document for this invoice. | |

| Save & next | This button is used to save the sales invoice and page redirect on the same page. | |

| Save | This button is used to save the sales invoice and page redirect on the Sales invoice listing page. |

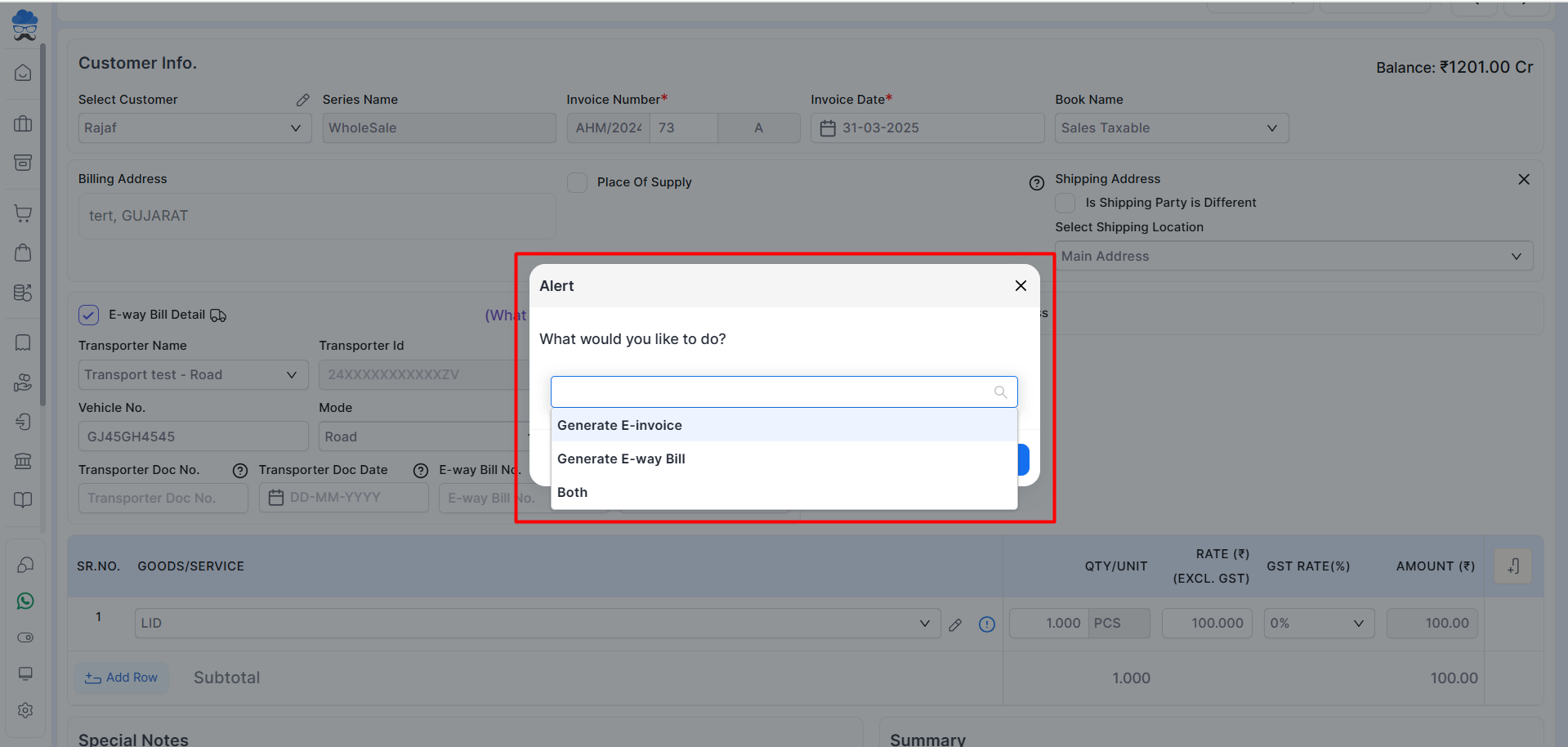

- As soon as you save the invoice, the E-invoice alert pop-up opens and you can generate an e-invoice and e-way bill individually, or both.

- Select your required option and click on the Proceed button.

+−⟲