What is Cloud Accounting, How It Works And Advantages

Running an enterprise with flexibility & limited manual work is what every business needs it! However, it is no longer just a dream! Enter cloud accounting software, offering a freeing and efficient approach to managing your finances, supported by some pretty impressive numbers.

Check this out:

Did you catch wind of this?

Looking into the crystal ball, Mordor Intelligence’s forecast for 2023 predicts that cloud accounting usage will skyrocket, with an expected annual increase of 20% until 2026.

And here’s the cherry on top: According to Xero’s findings in 2023, businesses that switch to cloud accounting save an average of 7 hours from their weekly bookkeeping workload.

Excited to be a part of this cloud revolution and reap the rewards firsthand? Then buckle up and dive into this blog to uncover the wonders of cloud accounting for your business!

What is Cloud Accounting?

Imagine cloud accounting as your trusty virtual accountant, residing on remote servers and accessible via the Internet. Unlike the old-school accounting methods that tied you to specific computers, cloud accounting sets you free. It securely stores, processes, and access your financial data from anywhere with an internet connection.

With cloud accounting, your team can collaborate effortlessly, like a well-oiled machine. Multiple users can work together seamlessly, making financial tasks smoother and your business more agile.

A Brief History of Cloud Accounting

Do you recall the days of dial-up internet days? Yes, those were not the best for handling your business finances. Cloud accounting as a solution became possible with the rise of cloud computing in the early 2000s. These days, companies of all sizes may use these advanced, safe solutions.

How does Cloud Accounting Software Work?

Users of cloud accounting software can access the platform using specialised programmes or web browsers, and it functions on a subscription basis. Secure encryption and remote server storage of financial data provide strong defences against hacking and data breaches. Using tools like customisable reports, log monitoring tools, automatic processes, and connectivity with external apps, users may enter, monitor, and analyse financial data in real-time.

Traditional vs. Cloud Accounting: A Clear Difference

Know the difference between the traditional and cloud-based accounting:

| Aspect | Traditional Accounting | Cloud Accounting |

| Accessibility | Limited to office premises | Anytime, anywhere access |

| Collaboration | Restricted by geographical location | Enables real-time collaboration across locations |

| Data Security | Vulnerable to physical theft and hardware failure | Encryption and multi-factor authentication ensure data security |

| Scalability | Dependent on hardware capacity and software upgrades | Easily scalable with growing business needs |

| Maintenance | Manual backups and updates | Automated backups and software updates |

Benefits of Cloud-Based Accounting Software

Get Your Accounting Handy

Your financial data is always accessible with just a click thanks to cloud accounting software, provided you have an internet connection, regardless of your location. You have the flexibility to view your money whenever you choose. Goodbye to being shackled to your desk — cloud accounting allows you to make choices on the spur of the moment, no matter where inspiration strikes.

It’s Your Turn to Make Informed Decision-Making

Cloud accounting may be compared to having a knowledgeable adviser at your side who helps you make astute judgements, rather than merely a tool for crunching numbers. You may take on any business obstacle with confidence when you can easily access your financial data. No matter how erratic the market may be, you’re equipped to seize chances and steer clear of trouble when you have immediate access to real-time knowledge.

Save Time with Automation

It’s a reality that some people are not fond of working with spreadsheets or becoming mired in paperwork. Cloud accounting saves the day in this situation. You can Automate your businesses’s manual & time-consuming processes like generating invoices and more. Goodbye to errors made by hand and hello to maximum efficiency.

Foster Your Collaboration

Working together towards a common goal is what drives success, isn’t it? Cloud accounting simplifies collaboration, allowing your team to unite regardless of their locations. With effortless sharing of live data, you can collaborate closely with your colleagues.

Improve the Accuracy of Your Accounting

Accuracy is key when it comes to finances, and cloud accounting has your back. By centralizing your financial data and following standardized practices, it minimizes the risk of errors. With precise transaction categorization and reliable report generation, you can trust that your numbers add up perfectly every time.

No Installation Required

Gone are the days of complicated software installations and endless updates. Cloud accounting lets you skip the hassle and access your accounts straight from your web browser or mobile app. It’s simplicity at its finest, freeing you from IT headaches and ensuring smooth sailing ahead.

Access to Tech Support

Stuck on a tricky issue? No problem – help is just a call or chat away. Cloud accounting platforms offer dedicated tech support to guide you through any challenges you may encounter. Whether you need assistance troubleshooting or maximizing software functionality, expert support is always at your service.

Reduce Paperwork and Organise Your Office

The days of disorganised desktops and overstuffed file cabinets are past because cloud accounting will simplify your workspace. Documents may be digitally scanned and safely stored in the cloud, allowing you to say goodbye to mountains of paperwork and welcome to a neat, orderly workstation. Both productivity and peace of mind benefit from it.

Top 5 Cloud Accounting Software: Finding Your Perfect Fit

Top 5 Cloud Accounting Software: Finding Your Perfect Match

Here are 5 excellent options, each with special qualities to take into account:

- FreshBooks is easy to use and perfect for small companies and independent contractors.

- Zoho Books provides expanding organisations with an extensive range of accounting solutions.

- One well-liked option with many of features and integrations is QuickBooks.

- Xero is an automation-focused platform for small and medium-sized enterprises.

- Munim is designed with Indian enterprises in mind, Munim provides a special blend of functionality, scalability, and affordability.

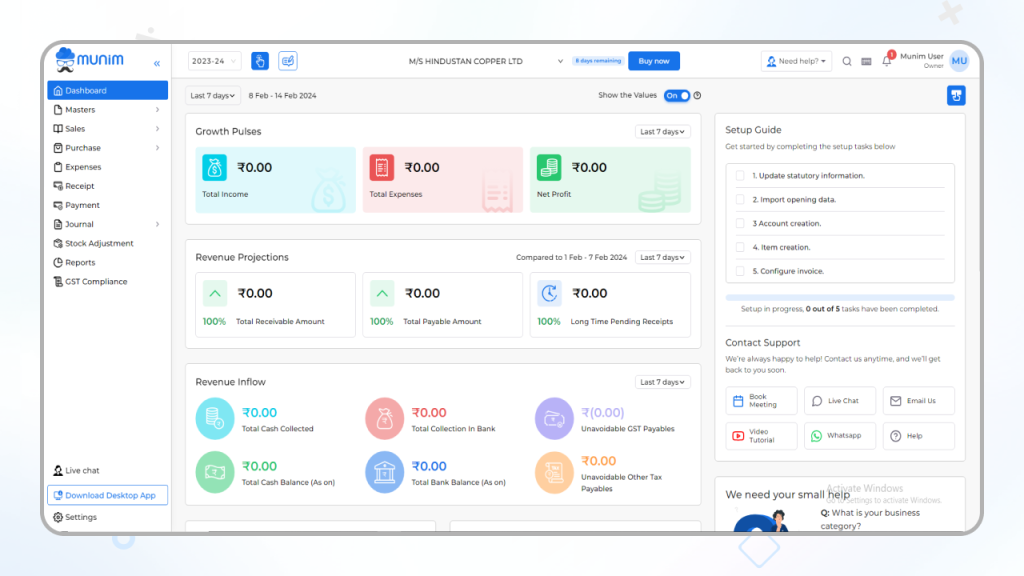

Why Opt for Munim?

Munim is your cloud-based financial partner, not merely a cloud accounting programme. What distinguishes us is this:

- All-inclusive functions: Munim provides a wealth of functions, such as financial reporting, payroll administration, spending monitoring, and invoicing, that are designed to satisfy the various demands of companies.

- User-Friendly Interface: Munim’s interface is simple to use and intuitive, allowing users to explore and complete accounting duties with ease.

- Professional support staff: Whenever you need assistance, reach out to our committed staff.

- Pay attention to Indian compliance: We make sure your money adhere to Indian laws.

Of course! Here are the main conclusions, condensed into bullet points:

Key Takeaways

- Experience effortless collaboration and data access from any location with cloud accounting software, simplifying teamwork.

- Say goodbye to installation headaches; cloud accounting offers enhanced accessibility, scalability, and collaboration right at your fingertips.

- Save time and resources with automated operations, increased accuracy, and simplified workflows offered by cloud accounting software.

- Get real-time data access, automation, and collaboration tools to fuel efficiency and growth for your modern business.

Conclusion

In closing, think of cloud accounting software as the superhero of financial management, empowering businesses across India to thrive in our increasingly digital landscape. Businesses that use these cloud-based solutions benefit from cost-effectiveness in addition to efficiency and scalability. With its continued development, cloud accounting promises to become an essential instrument that will significantly impact India’s financial management landscape and enable more efficient and prosperous corporate operations than in the past.

FAQs

1. What is cloud-based accounting?

Cloud-based accounting, formally known as cloud accounting software, refers to the utilization of remote servers for hosting financial management software. This eliminates the need for local installations and permits access from any device with an internet connection, fostering increased flexibility and global accessibility.

2. Is SAP a cloud-based accounting software?

While SAP itself is not software, rather a set of established accounting principles (Statutory Accounting Principles), its application extends to cloud-based accounting software. Additionally, certain SAP software solutions, such as SAP S/4HANA Cloud, offer ERP (Enterprise Resource Planning) systems hosted in the cloud, which encompass accounting functionalities alongside other business management features. Therefore, while not directly cloud-based accounting software, SAP is compatible with it.

3. Why is cloud accounting considered a preferable option?

Cloud accounting offers several distinct advantages over traditional methods, making it a highly sought-after option. These advantages include:

- Enhanced Accessibility: Users can access and manage their financial data from any location with an internet connection, regardless of device, promoting flexibility and remote work capabilities.

- Real-Time Data Availability: Up-to-date financial information is readily available, enabling informed decision-making based on the most recent data.

- Simplified Collaboration: Seamless collaboration is facilitated by real-time data sharing and joint access, improving teamwork and efficiency.

- Scalability: Adapting to business growth is achieved effortlessly as cloud-based software scales seamlessly, eliminating the need for expensive upgrades.

- Robust Security: Cloud providers employ stringent security measures, significantly enhancing data protection compared to local storage solutions.

- Automated Tasks: Repetitive tasks such as data entry and invoice creation can be automated, leading to significant time savings and reduced error rates.

- Cost-Effectiveness: Cloud-based solutions eliminate the need for expensive software licenses and dedicated IT infrastructure, offering a more cost-efficient option.

4. Can you elaborate on cloud-based ERP?

Cloud-based ERP software expands upon the functionalities of cloud accounting by providing a comprehensive cloud-hosted business management system. It integrates various functions such as inventory management, sales, customer relationship management, and human resources, fostering centralized data, streamlined processes, and enhanced departmental visibility.

Key Takeaway: Both cloud accounting and cloud-based ERP offer unique benefits and functionalities depending on your specific business needs. Carefully consider your requirements to select the optimal solution for your organization.