Why CAs Should Use Munim GST Software?

In the era of GST and tax compliance, efficiency and accuracy are vital. Chartered accounts take care of the GST reconciliation and look after their clients’ financial management. This process is daunting and time-consuming. They spend plenty of time understanding the GST laws and their impact on the client’s financial status. However, the dawn of GST Software in India has helped the CAs streamline workflows, reduce errors, and improve efficiency. It also helps to scrutinize the business data and ensure accurate GST calculations.

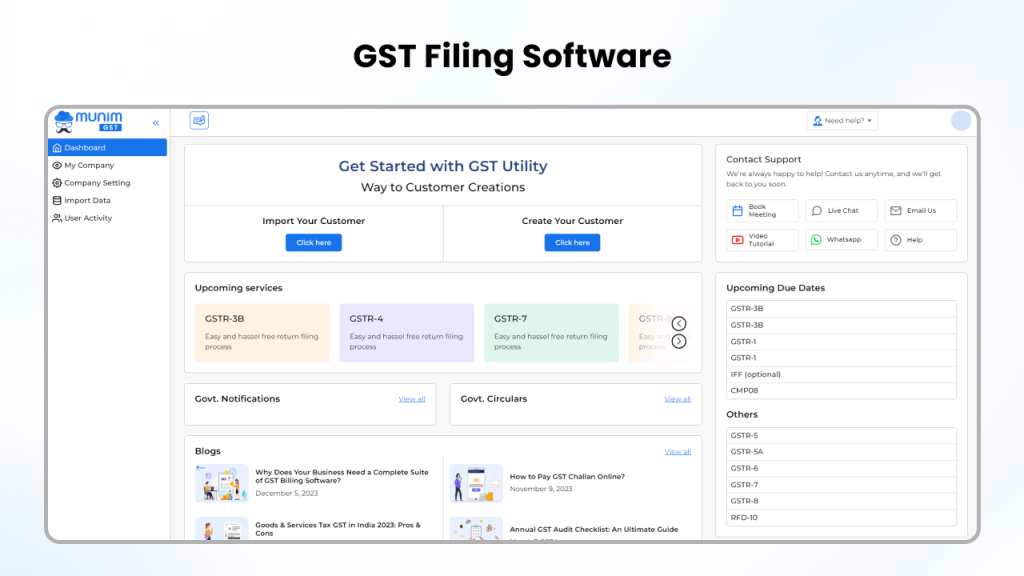

What is GST Filing Software?

GST filing software helps businesses or taxpayers compute, record, and file taxes accurately. It also presents detailed and accurate reports on the financial status, taxes applied, tax to be paid, and due amount. GST software is automatically updated with fluctuating tax laws, eliminating the need for CAs to keep a check on changing regulations. GST software is designed to save human effort and time.

Munim GST Utility Software

Munim offers a next-gen tax management solution that enables GST filing at your fingertips. This time-tested software automates all financial processes, ensuring time-efficient tax control and management. For CAs, it is a go-to solution that handles all client accounts seamlessly.

Let’s dig deep to understand why CAs should use our automated

Why CAs should use Munim GST Software?

- Identify and Minimize Errors

CAs invest a huge amount of time and effort in understanding the financial data shared by their clients. This process is critical to filing GSTR accurately. We have specially designed GST software for CAs, which ensures precision in every data entry and computation.

Our compliance application identifies errors and incomplete transactions to ensure correctness when filing returns. It notifies chartered accountants of these errors or missing details, guiding them to take desired actions. Munim GST filing software’s ability to proactively detect inaccuracies minimizes the probability of GSTR rejection.

The software also allows CAs to verify whether the clients have submitted accurate GSTIN information by cross-checking the GSTIN numbers. CAs can easily file GSTR by submitting the prefilled Excels downloaded from the portal.

- Client Management

CAs cater to multiple clients simultaneously. It becomes difficult for them to handle massive client data. Also, every client has a different financial status and a unique GST requirement. Our GST billing software allows chartered accountants to manage multiple clients simultaneously through a centralized system. It segments clients based on business type, turnover, or tax filing status.

Munim GST utility software is a centralized system that meets all the client requirements. It eliminates the need to switch between the systems or applications, streamlining the overall process. Additionally, our GST software allows CAs to import files in bulk and upload large volumes of data. This saves time that would be invested in one-at-a-time data entry. CAs can activate our notification and alert system to keep track of multiple compliance deadlines.

- GST Filing

Our tax management software allows CAs to file unlimited GST returns for unlimited clients. It has no limitations on the purchase of extra licenses for additional clients. Also, our compliance software is constantly updated with the latest changes in the tax laws.

Munim also offers online and offline GST filing through its cloud solution. It allows chartered accountants to file all GSTR types for their clients. Our GST software simplifies the reconciliation of purchase and sales data with the GST portal for CAs. This rectifies and avoids discrepancies.

This automated tax solution allows bulk GST filing to save time and effort. It automates data upload and GSTR filing for multiple clients. Our desktop solution can also be downloaded for any operating system and device.

- Smart Insights

Our GST billing software offers a smart dashboard that analyzes your company’s financial data and shares insights about it. The dashboard displays the number of companies that have filed GSTR and companies that are pending and indicates monthly and quarterly filings for all GSTR types.

Our GST Software for CAs helps them monitor clients’ compliance status in real time. It also allows taxpayers, or CAs, to check the tax liability for the next fiscal year. The software offers comparison reports for purchases and sales. The added advantage is that you can download the reports in customized formats.

Benefits of Munim GST Filing Software

- Munim offers an intuitive interface to simplify complex processes.

- It generates real-time notifications and alerts for GST updates.

- Munim GST software is beneficial for CAs as it can handle massive client data.

- It gives 100% accurate tax computations.

- Also, it formulates collaborative work between the CAs and their juniors.

- Advanced reports from the software help you maximize returns for your clients.

- The GST software can be accessed from anywhere and at any time.

- Our tax management software has a desktop solution to speed up bulk filing.

Let’s Wrap Up

Have you understood the importance of Munim GST filing software for CAs? If you want to manage your clients seamlessly and help them file GSTR, Try Munim now!

FAQs

- Which is the best GST Software for CAs?

- Munim GST filing software is recommended for CAs.

- How can I download GST filing software for my desktop?

- Login or Register to your account.

- Scroll down to the sidebar.

- Click on Download the app now.

- Choose the Windows type if it is Windows 7 and 8 or above Windows 10. For Windows 7 and 8, you have to choose the size of the software. For Windows 10 and above, download the software directly.

- Once the .exe. file is downloaded; execute and install the software to get started.

- What is the subscription fee for Munim GST software?

For now, the software is available for free. Grab the software now.