Problems Addressed By Our Books Shop

Management Software

Select challenges you face and meet your solutions

Having trouble managing your bulk book sales?

- > Creating Invoices in a time-consuming manner.

- > No more entry errors

- > Institutional billing issues

Invoicing & Billing

- > Instantly create GST compliant invoices

- > For quick processing, use WhatsApp share

- > Rapid & efficient bulk billing

Payment tracking institutions?

- > Missed collection deadlines

- > Unstructured payment records

- > Cash flow tracking difficulties

Accounts Payable & Receivable

- > Instant visibility into receivables

- > Manage your cash flow accurately

- > Avoid late payment issues

Confused by different tax rates?

- > Stationery vs. books tax differences

- > Manual calculation errors

- > Compliance concerns

GST Accounting

- > Categorize products correctly

- > Absolute on-point tax calculations

- > Real-time GST validation

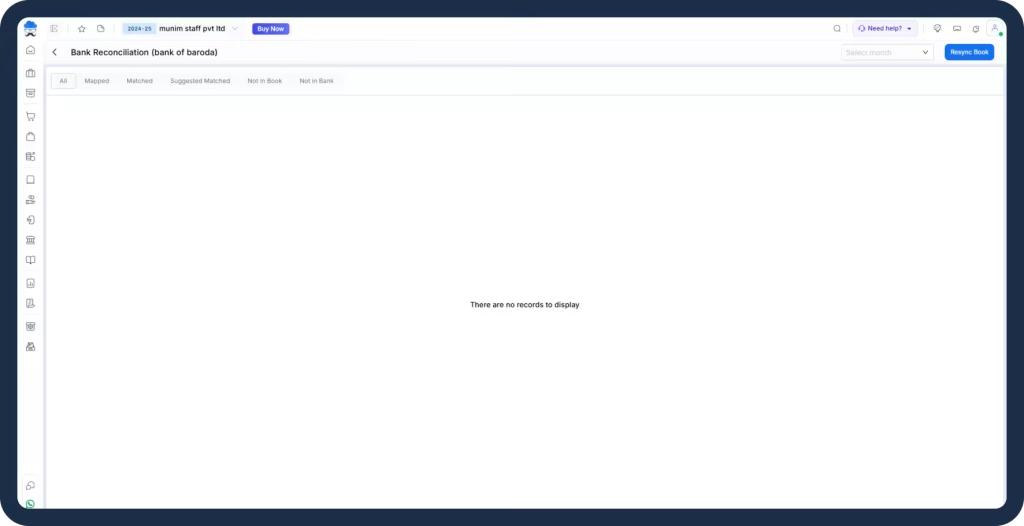

Bank reconciliation for sales?

- > Transaction mismatches

- > Time-consuming process

- > Financial discrepancies

Bank Reconciliation

- > Reconciling records with bank statements

- > Reduce errors in reconciliation

- > Ensure financial accuracy

Need help figuring out how your book is selling?

- > No visibility on bestsellers

- > Unclear revenue patterns

- > Difficult decision-making

Reports Management Software

- > Connect with comprehensive financial reports

- > See sales overviews and trends

- > Make informed business decisions

Facing issues in handling business quotations?

- > Bulk orders for schools and colleges

- > Tax calculation complexities

- > Quote-to-invoice conversion

Quotation Maker

- > Generate custom quotes

- > Include accurate tax details

- > One click conversion to invoices

Lost in book categories?

- > Wrong HSN code assignments

- > Incorrect tax application

- > GST filing problems

Designate HSN/SAC Code

- > Assign appropriate HSN codes

- > Ensure smooth GST filing

- > Maintain tax compliance

Slow checkout process?

- > Manual book entry delays

- > Typing errors at billing

- > Delayed checkouts leading to long customer waits

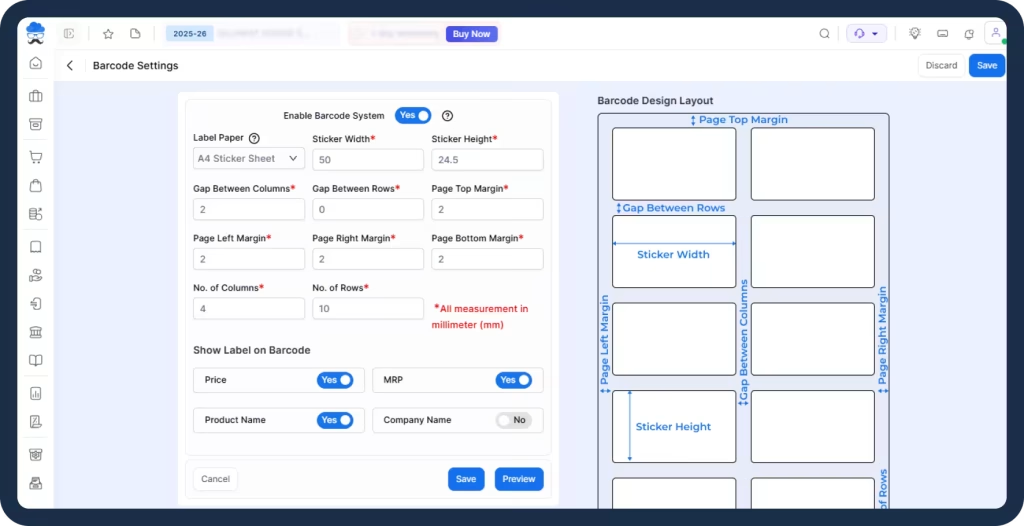

Barcode Printing Software

- > Generate scannable barcodes

- > Ensure error-free billing

- > Optimise your operations & processes

A Bookstore is Built on Passion, Not Accounting Paperwork

Let our billing software take care of the numbers while you stock your shelves with great reading.

Munim accounting & billing software assists your operations in inventory, GST, and accounting with better efficiency.

Essential & Unique Features of Munim Accounting & Billing Software

Explore Munim’s book store billing software’s useful features that help you run daily bookshop operations.

Here’s what the software can do:

Invoicing & Billing

- GST Compliant Invoice: Instantly generate professional and tax-compliant invoices for all book sales, providing appropriate transaction records.

- Share Invoices on WhatsApp: You can share invoices with customers instantly and process your transactions rapidly for better communication.

- Bulk Sale Processing: Optimize your billing process for large institution orders with solutions ensuring you maintain professionalism and formal format for big corporate orders.

The accounts payable & receivable

- Payment Tracker: Maintain a detailed real-time log of all open payments from individual institutions and bulk buyers.

- Due Date Management: Have a payment milestone following setup for installment based sales to different institutions and library.

- Balanced Cash Flow: Institute and master cash flow management at your bookstore with Munim’s software allowing you to manage payables and receivables to have a healthy business.

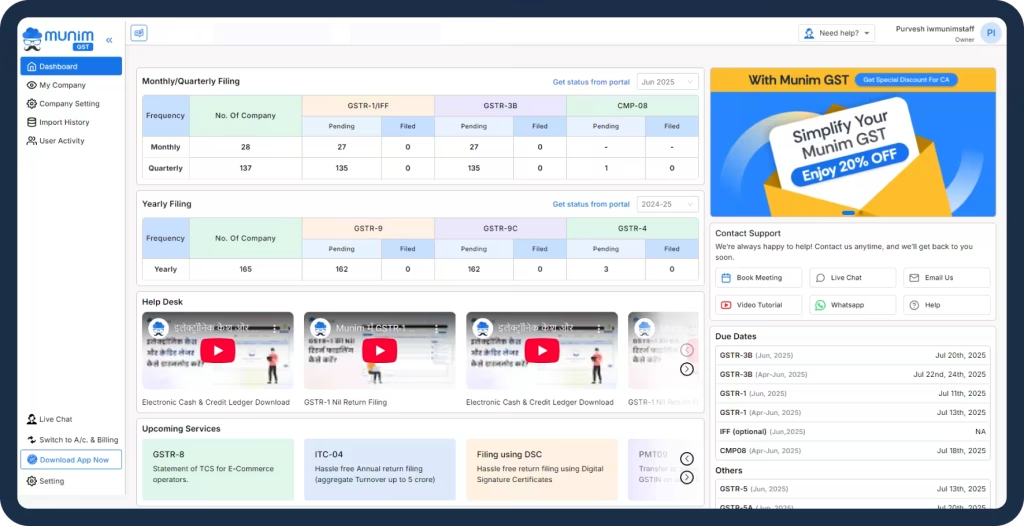

GST Accounting

- Tax Category Management: Manage your taxes based on your book categories or other stationary items allowing you to maintain legal accuracy.

- Compliance Validation: Even verify tax applications in real-time to ensure GST compliance for your bookstore’s varied inventory.

- Prepare for Filing: Generate rearranged & complete tax reports for managing book types and stationery things for GST filing.

Bank Reconciliation

- Transaction Matching: Reconciling your bookstore sales records with bank statements to find and eliminate your errors in sales reporting.

- Check Banking: Reconcile that all sales and purchases of the book are accounted for in your banking records.

- Reconciliation Reports: Generate reports in detail that display matched and unmatched transactions to ensure financial accuracy.

Quotation Maker

- Educational Institution Quotes: Create & send quotes for schools, colleges, and libraries instantly along with accurate prices and tax.

- Bulk Order Processing: Generate professional quotes for bulk book orders with suitable discount structures and delivery terms.

- Instant Invoice Generation: Convert an approved quotation to a formal invoice with just one click of a button; no duplicate data entry is required and this fast-tracks the sales process.

Inventory Management

- Live Stock Control: Have accurate stock levels for your entire book catalogue and get notified for low inventory.

- Edition Management: It enables you to keep track of the books this allows you to be on-point & prevents confusion & pricing errors.

- Stock Alerts: Receive alerts as soon as hot titles hit minimum thresholds to avoid frustrating customers with unavailable stock.

Specify HSN/SAC Code

- Books and Educational Material: Provide appropriate HSN/SAC to books and educational material for proper categorization.

- GST Filing & Compliance: Munim GST return filing software makes sure your GST is filed correctly and complied with as they fall under goods and services.

- General Compliance: Munim accounting & billing software automatically updates the tax rate codes to keep your inventory tax compliant.

Upgrade Your Book Shop’s Efficiency with

Munim Accounting & Billing Software

Our Accounting Software Keeps Your Bookstore Data Safe

Security Built for Book Retailers

Keep your hardware business data secure with our comprehensive protection system. We ensure your inventory records, financial transactions, and customer information stay protected while remaining accessible to authorized personnel.

Protecting the Collection

Log stock movements and sales and keep track of book inventory.

Sales Protection

Maintain transaction and pricing details for the book store billing software.

Business Continuity

Data for your books inventory software is protected by cloud data backups.

Staff Management

See and control access in your accounting & billing software.

Complete Tracking

Record price changes and stock varies through your book shop billing software.

Prioritising Privacy

Protect all information within our billing software for book shop.

Witness Key Features You Need for Your Book Store Accounting & Billing

How our billing software for bookshop manages editions of a book along with tracking aspects through barcode scanning, generation and inventory tracking.

3 Simple Steps to Start Using Your Accounting, Billing & GST Software

Create Your Account

Get started with your bookstore’s accounting, billing & GST management in 2 minutes.

Access Dashboard

Enter your store information and book categories.

Begin Operations

Get your bookshop accounting & billing up and running fast.

Making GST Simple Through Munim GST Return Filing &

Billing Software

Incorrect GST Calculation on Mixed Items

Incorrect GST Calculation on Mixed Items – A customer purchases an educational book (0% GST), a fiction novel (5% GST), and also buys stationery items (12-18% GST).

Feature: GST Billing & Invoicing

GST rates are predefined under every category of the book.

Inputs used to apply for products to tax.

Prevention of manual errors.

Simplified billing for your GST compliance.

Billing Calculation Errors

Incorrect categorization of books – Different products fall under different GST slabs, in case of the wrong categorization, the correct GST rate cannot be applied leading to tax penalties.

Feature: HSN/SAC Code Designation

The different book types and their proper categorization.

GST rate for books inventory software.

Ready to use software that complies with tax regulations.

Organized products in our inventory management software.

Get audit-ready documentation.

GSTR-1 & GSTR-3B Mismatched

Missed GSTR-1 Filing Deadline: Not filing GSTR-1 on time can jeopardize your bookstore’s compliance and may result in heavy penalties.

Feature: Easy GSTR Filing

GSTR-1 summary at a glance on a single screen.

Extract billing data from book shop software.

Data accuracy through accurate validation & process.

Reduce your manual effort & do direct filing.

E-Way Bill Delays & Errors

Cash Sale from the customer on which GST was not charged properly. The customer came in and paid cash for books, but GST was missing. Scrutiny comes when sales in GST filings do not match at month-end.

Feature: Sales Module

Make sure GST is applied through all book transactions.

Tax compliance within our GST billing software for the bookshop.

Book shop GST management software is a complete record keeper.

Why Bookstore Owners Prefer Our Billing Software

Industry Expertise

Designed from the ground to up for Indian book retailers, after listening to retailer feedback.Proven Solution

Our system is used daily by many bookstores across India.Complete Support

Our team has insights into how bookstores operate and identifies the solutions.Iterate

Regular updates always provide useful features for the book business.

Happy Customers

We Measure Our Success with Your Smile!

We used Tally to maintain our accounts for the past 15 years, and we were looking to adopt new technologies to manage our accounts. Finally, in 2022, we switched to Munim. Since Munim is cloud-based, the financial dashboards are updated on a real-time basis, which helps us in making faster decisions.

Nainesh Acharya

Consultant – 20 years exp.

This software has already saved many many hours reconciling our accounts, having previously done this manually for our business. 5 STARS!

Bhavesh Gohil

Munim User

I’m very much impress with this software, very light and easy to use, even fresher can use this, best part is that if get minor to minor issue u will get prompt response, Naryan alwz theier to help you. I will recommend this app.

Nuraveda Care

Business Owner

I have used this application, and its really good compare to other products Also, Mr.Manish and NArayana help always to understand the application .really appriciated both of them. they have available always whenever i required help. they came online and share the screen and try to resolve the issue immediately.

Pragati Solar

Business Owner

Wonderful software. Have been using their services for the last few days and it is extremely professional and hassle-free! Thank you. Keep up your good work.

CA Rahul Mistry

Practicing Chartered accountant

Want to Try Before You Buy?

You have an option to begin with a 7 days free trial of our books inventory software and continue at just ₹3,599/year.