How Our Mobile Shop Billing Software Fixes Your Day-to-Day Issues

Choose the problems you have, and check the solutions we give

Assigning incorrect GST Rates?

- > Different rates for products

- > Incorrect tax calculations

- > Risk of non-compliance

Tax Clubbing

- > Consolidation of input and output tax calculation

- > Ensure error-free GST filings

- > Up-to-date and compliant pricing

Losses from the bottleneck management of stocks?

- > Lost high-demand products

- > Overstocking slow movers

- > Poor inventory visibility

Inventory Management

- > Track real-time stock levels

- > Receive low-stock alerts

- > Prevents stock-outs or overstock

Is it hard for you to track your sales on installment basis?

- > Missed payment collections

- > Unstructured payment records

- > Revenue losses

Accounts Payables & Receivables

- > Maintaining clear and systematic records of payments

- > Track dues efficiently

- > Real-time payment insights

No good insight on your business performance?

- > No data — to guide strategic decisions

- > Manual report creation

- > Delayed business insights

Reports Management Software

- > Access real-time reports

- > View profit & loss statements

- > Make data-driven decisions

Unable to provide quotes for business customers?

- > Calculation that needs lots of time to do manually

- > Incorrect pricing information

- > Missed business opportunities

Quotation Maker

- > Create business quotations

- > Generate with accurate tax calculations

- > Turn Quotation Into Invoice With One Click

Accessories complications?

- > Wrong categories in records

- > Tax compliance issues

- > Inventory confusion

Designate HSN/SAC Code

- > Assign accurate HSN/SAC codes

- > Place accessories in the right categories

- > Seamless GST filing

Manual Entry slowing checkout?

- > Checkout bottlenecks

- > Manual entry errors

- > Customer wait times

Barcode Printing & Scanning

- > Generate and scan barcodes

- > Ensure error-free billing

- > Speed up your process

When Every Mobile Sale Counts, Every Detail Matters

Thousands can be the difference on the same model in a business where we can’t afford to leave profit on the table. So can your current system track the difference? This is where our mobile shop billing software takes care of the complexities instantly.

Features of Our Accounting Software for Mobile Shops

We got a robust mobile shop billing software with features aimed at resolving genuine problems of mobile retailers. Find out what makes the ideal solution for your business:

Invoicing & Billing

- GST-Compliant Invoices: Instant generation of professional tax-compliant invoices for all your mobile phone sales and accessories ensuring every sale done is properly documented.

- Send via WhatsApp: You can share invoices via WhatsApp, which makes transaction processing faster and also creates communication between customers.

- Customizable Templates: Make sure you have a branded invoice template that includes all necessary details so you have records.

Summary Stock Report

- Stock availability: Get a summary of stock availability across all models of mobile phones and accessories in the store for efficient distribution.

- Multi-Store Management: For mobile shops with multiple locations, manage inventory across stores for better distribution.

- Stock Shortages: Detect any potential stock shortages before they turn into a sales problem, and maintain product availability for the shop visitors.

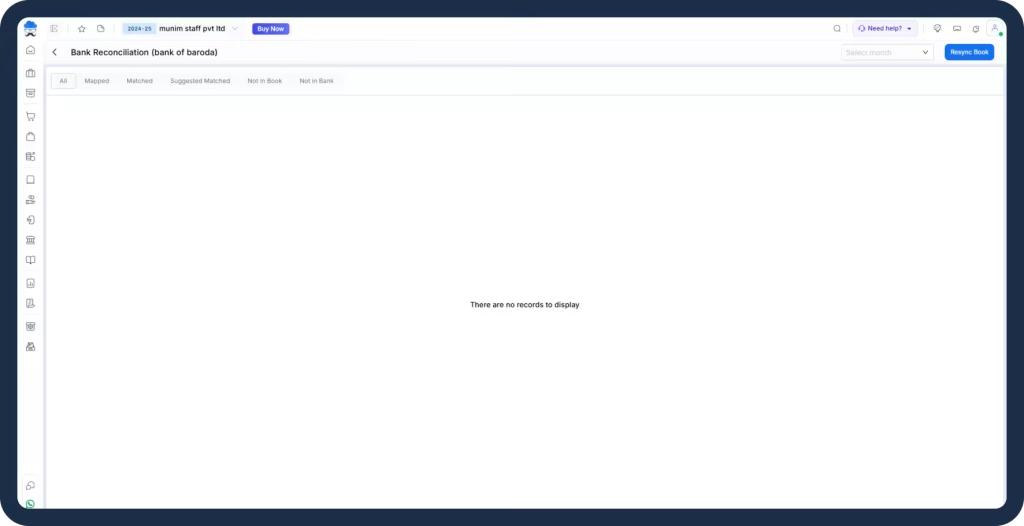

Bank Reconciliation

- Transaction matching: Match your mobile shop sales transactions with bank statements to detect discrepancies without tedious manual comparisons.

- Financial Accuracy: Population-matched transactions based on the amount, date, and reference number to show better-record keeping.

- Reconciliation Reports: Produce in-depth reports for a clear audit trail and help ensure financial records are accurate.

GST Accounting

- Correct Tax Calculation: Calculate the right GST rates for different mobile phones and accessories according to their HSN codes thereby reducing errors in calculation.

- Easy Filing: File your GST Reports with software auto-updated with tax slabs, making your monthly and quarterly filing easy.

- Compliance with Regulations: Our accounting software is updated with the current GST regulations, ensuring that your mobile shop adheres to all tax obligations.

Quotation Maker

- Generate Quotation: Create professional quotations for corporate and bulk buyers with accurate tax calculations speeding up all processes & operations.

- Tax Scope of the Calculation: Get accurate calculating tax for certain device categories and end amounts customers will be paying.

- Single Click Conversion: Turn accepted quotations into proper invoices with just one click saving you from entering all customer data separately.

HSN/SAC Code Compliance

- Assign HSN Code: With Munim attach accurate HSN/SAC codes instantly for mobile phones, parts and repairs to correctly classify and assign GST.

- Category Organization: Products should be classified based on their proper tax category to avoid misclassifications and compliance-related issues.

- Assignment of HSN Codes: After assigning HSN codes, the system applies the relevant tax rates on all products.

Barcode Scanning

- Easy Product Identification: Get barcodes generated and hierarchically scanned for every mobile phone and accessory to ensure faster and error-free identification.

- Reduce Errors: Say goodbye to manual entry errors that can result in pricing mistakes and inventory inconsistencies.

- Quicker Billing: Scan product barcodes to quicken the checkout process and ensure more customers are served during peak hours.

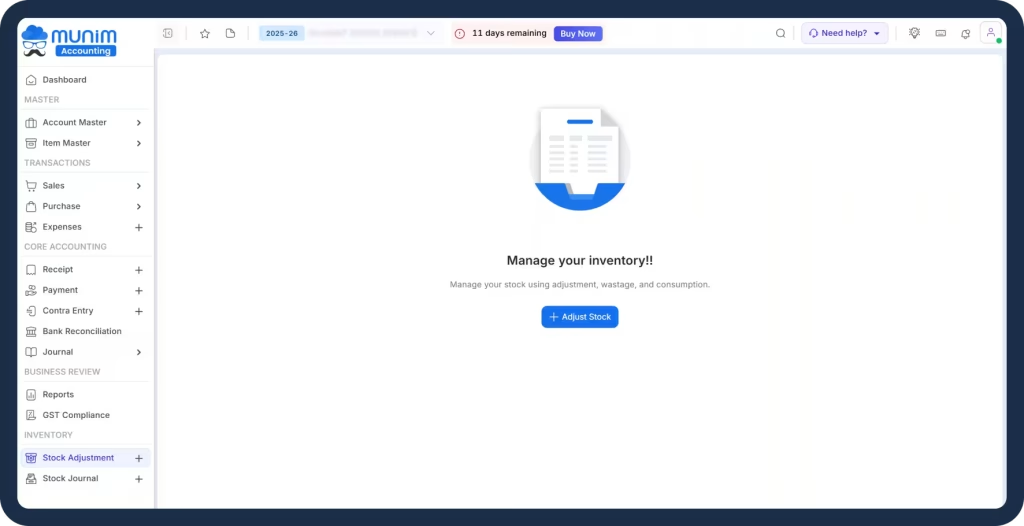

Manage Inventory

- Stock Level Monitoring: Real-time inventory level tracking of mobile phone models, accessories, and components whenever sale takes place during the day.

- Low Stock Alerts: Get alerts as soon as models or high-traffic accessories reach their minimum stock levels, avoiding shortages.

- Stock Analysis: Find slow-moving stock, arriving near-breaking stock, ageing and more with stock tracking reports.

Upgrade Your Mobile Shop’s Efficiency with

Munim Accounting & Billing Software

Your Data Is Secured By Your Mobile Shop

Security Tailored for Smartphone Retailers

Keep your hardware business data secure with our comprehensive protection system. We ensure your inventory records, financial transactions, and customer information stay protected while remaining accessible to authorized personnel.

Prioritising Security

Protect your premium device data & inventory from all insecurities.

Product Protection

Protecting your mobile shop against inventory shrinkage with monitor display units.

Business Continuity

Cloud backup for billing and inventory software for mobile shops.

User Access

You can manage to whom you want to share your accounting & billing software with different access.

Staff Action Tracking

Every transaction and change is logged based on the users you have added to your accounting software.

Information Security

Sensitive business data and customer details are processed and stored securely.

Explore Your Mobile Shop’s Accounting Software Features

See how easily e-way bills can be generated while creating the invoice for transport of mobile stock. For your mobile inventory, the system guarantees fitting logistics and observes GST transport rules.

Setting Up Your Mobile Shop Billing Software in 3 Steps

Create Your Account

2-minute quick signup for your mobile store’s accounting & billing software.

Access Dashboard

Set up your store information and your product categories.

Begin Operations

Get started with your accounting software having unlimited features.

GST Made Easy & Fast For Your Mobile Shop

Incorrect GST Calculation on Mixed Items

GST is calculated wrong for mixed sales- A customer purchases a cell phone(18% GST) & an airpods(28% GST) at the same time , but the cashier applies 18% GST for everything.

Feature: GST Invoicing & Billing

GST prescribed rates for phones and accessories.

Prevention of manual errors.

Prepares GST-compliant Invoices for quick audits.

Billing Calculation Errors

Not Levying GST on Cash Transactions – For example, a customer buys a smartphone paying ₹50,000 in cash, in which case GST is not charged. The mismatch between revenue at the end of the month and the filing for the GST triggers scrutiny.

Feature: Sales Module

Makes sure that GST is applicable for all transactions done in your mobile shop.

Puts a stop to problems with undeclared revenue.

Keeps your business tax compliant.

Accurate tax calculation for each sale.

All records to maintain accuracy for your mobile shop billing software.

GSTR-1 & GSTR-3B Mismatched

GSTR-1 Filing Deadline Missed – If the GSTR-1 filing deadline is missed then you are facing a compliance issue and potential penalties for your mobile shop.

Feature: Easy GSTR Filing

GSTR-1 summary with all the details on one page.

Maintain GST compliance for all your transactions.

Never miss any deadline anymore.

Platform-based direct filing in mere clicks.

E-Way Bill Delays & Errors

Manual GSTR-3B Preparation – The work of preparing GSTR-3B returns is tedious & error-prone for mobile retailers.

Feature: GSTR-3B Filing Solution

Summary of GSTR-3B in a single-screen view.

Data prefilled from the GSTN portal.

Intelligent validation to catch errors early.

Easier filing process for mobile shop owners.

Reasons Why Mobile Shop Owners Prefer Our Billing Software

Focus on Mobile Industry

Munim accounting & billing software is designed for smartphone sellers.GST Compliance

Mobile shop billing software with correct GST rates for phones and accessories.Inventory Knowledge

Billing and inventory management software with specialized tracking capabilities.Business Insights

Mobile shop billing software with 20+ various business reports.

Happy Customers

We Measure Our Success with Your Smile!

We used Tally to maintain our accounts for the past 15 years, and we were looking to adopt new technologies to manage our accounts. Finally, in 2022, we switched to Munim. Since Munim is cloud-based, the financial dashboards are updated on a real-time basis, which helps us in making faster decisions.

Nainesh Acharya

Consultant – 20 years exp.

This software has already saved many many hours reconciling our accounts, having previously done this manually for our business. 5 STARS!

Bhavesh Gohil

Munim User

I’m very much impress with this software, very light and easy to use, even fresher can use this, best part is that if get minor to minor issue u will get prompt response, Naryan alwz theier to help you. I will recommend this app.

Nuraveda Care

Business Owner

I have used this application, and its really good compare to other products Also, Mr.Manish and NArayana help always to understand the application .really appriciated both of them. they have available always whenever i required help. they came online and share the screen and try to resolve the issue immediately.

Pragati Solar

Business Owner

Wonderful software. Have been using their services for the last few days and it is extremely professional and hassle-free! Thank you. Keep up your good work.

CA Rahul Mistry

Practicing Chartered accountant

Premium Accounting, Billing & GST Software — Now with

No Premium Pricing

7 days free trial, then just ₹3,599/year – less than your single accessory sale. The end-to-end mobile business management platform.