India’s Simplest

GST Return Filing Software

Reduce errors and save time on GST compliance. Munim GST Return Filing software helps you calculate, manage records,

and file GST returns easily. A simple, reliable platform for hassle-free GST filing.

India’s Growing GST Filing Community

25,000+

Professionals Registered

50,000+

Returns Filed

₹500 Million

Aggregate GST Filing Value

95%

On-Time Filing Rate

Best GST Return Filing Software in India for Growing Practices

File your GSTR-1, GSTR-3B, GSTR-9/9C, CMP-08 easily with cloud-based online GST return filing software. Register now to manage your GST compliance smoothly.

- GSTR-1 Filing

- GSTR-1 NIL Filing

- GSTR-1/IFF Filing

- GSTR-3B Filing

- GSTR-3B NIL Filing

- GSTR-9 Filing

- GSTR-9C Filing

- GSTR-4 Filing

Quick NIL GSTR-1 filing with Munim

- File NIL GSTR-1 returns in just a few clicks.

- Submit returns directly within the Munim platform.

- Stay compliant and meet deadlines effortlessly.

Fast and accurate GSTR-1/IFF filing with Munim

- File GSTR-1/IFF easily from a single platform.

- Import data from Munim, Tally, Excel, and JSON files

- Reconcile data in real time to avoid errors.

- Submit returns directly within Munim in a few clicks.

Effortless GSTR-3B filing with Munim

- View your complete GSTR-3B summary on a single screen

- Auto-populate data directly from the GSTN portal

- Detect and fix errors early with smart validation checks.

Quick and effortless NIL GSTR-3B filing with Munim

- File NIL GSTR-3B returns in just a few clicks.

- Avoid errors with built-in eligibility checks.

- Submit returns directly within the Munim platform.

Accurate and stress-free GSTR-9 filing with Munim

- View a consolidated annual GSTR-9 summary on a single screen.

- Auto-populate data from filed returns for faster preparation

- Validate data to ensure accuracy before submission.

Accurate and audit-ready GSTR-9C filing with Munim

- Prepare reconciliation statements with clear and structured data.

- Auto-fetch data from annual returns for faster filing

- Validate data to ensure accuracy and compliance before submission.

Easy and accurate GSTR-4 filing with Munim

- View a clear summary of GSTR-4 on a single screen.

- Auto-populate data for faster and smoother filing

- Validate details to ensure compliance before submission.

GST Compliance Software for CAs, Tax Consultants & Businesses

Ensure error-free GST compliance using an online GST return filing software trusted by professionals. Munim enables quick return preparation, GST calculations, and smooth filing of GSTR-1, GSTR-3B, and other returns.

CAs can manage multiple clients, streamline monthly or quarterly GST filings efficiently with smart validations and clear reports.

Sign up today and streamline GST return management.

Tax consultants can file GST returns online quickly using GST compliance software with seamless reconciliation and GST calculations.

Sign up now and get started with Munim.

Why 25000+ CAs Trust Us?

5 Differentiators of Munim GST Return Filing

Zero Hidden Charges

Smart Reconcialitions

99.99% Uptime

Proactive Customer Support

Enterprise Grade Security

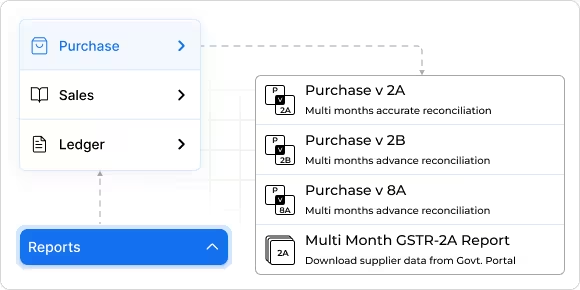

Advanced GST Reporting, Reconciliation & Integrations for Accurate Filing

Insightful Reports

- Get a report on Purchase vs 2A and 2B.

- Get multi-month e-invoicing, GSTR-3B filed reports and much more.

- View the cash and credit ledger balance.

- Download the reports in customized formats.

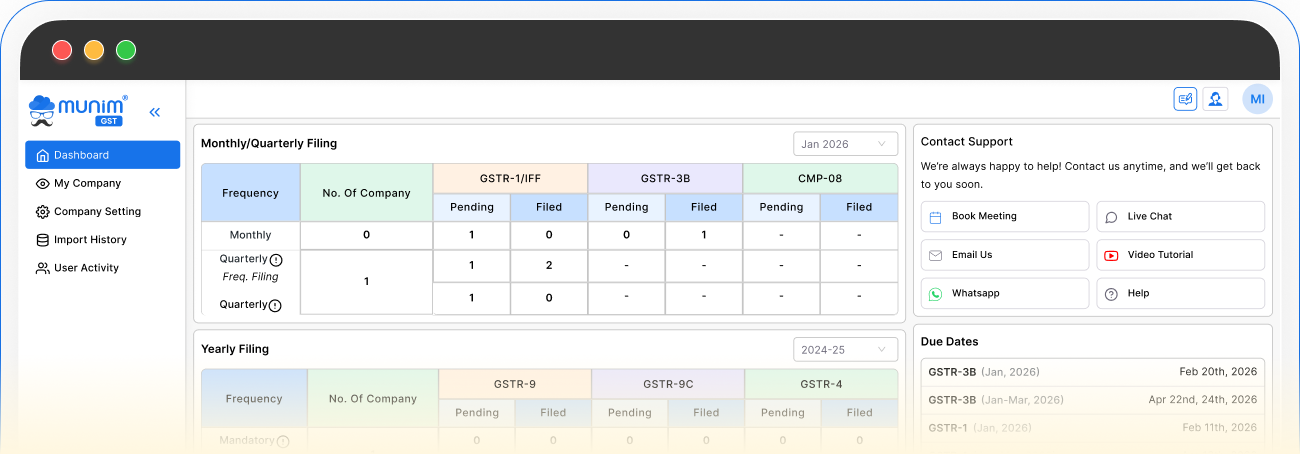

Stay in Control of GST Deadline

- View GST filings and compliance status in real time.

- Track return progress, due dates, and pending actions easily.

- Stay updated with the government notifications.

- Get clear insights to avoid errors and stay compliant.

Tally Connector

- Import sales and purchase data from Tally.

- Prevent manual data entry errors.

- Ensure consistency between accounting and GST records.

- Save time with faster data sync.

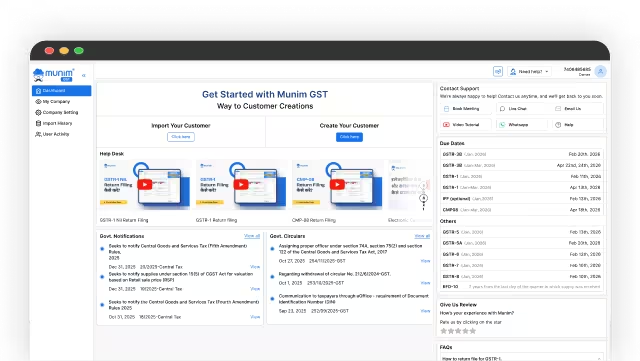

Simple Interface for Complex GST Return Filing

With a user-friendly and easy-to-use interface, GST filing becomes simple for users of all experience levels.

All-in-One GST Software for Return Filing

Manage GST filings, reconciliation, and reporting with accuracy, all from a single dashboard.

Multi-GSTIN & Client Dashboard

Easily manage multiple GSTINs and clients from one centralized dashboard.

No Extra Filing Cost

Munim GST return filing comes with 100% transparent pricing – There are no hidden fees and per-return charges.

Advanced Reporting

Access the essential GST reports that give you clear insights into your tax liabilities, returns and compliance status.

Client Password Repository

Store and manage your clients’ GST portals’ login credentials securely in one place.

Clean Dashboard

Work efficiently with a user-friendly dashboard. Access all your client status, reports, Govt Circular and notifications from a single place.

Smart Reconciliation

Instantly identify mismatches with multi-level GST reconciliation across purchases, GSTR-1, GSTR-3B, e-invoices, and GSTR-2A/2B.

From Sign-Up to GST Filing in Just 5 Easy Steps

Unleash the potential of our cost-efficient GST filing platform in one go! With zero cost registration, Munim becomes one of the most preferred tax filing software in India. Download our solution to your desktop or register online and get started with your tax filing journey right now.

Pricing Plan

Simple pricing to get started and grow with Munim.

₹ 5,999/ Year

7-day free trial available

Price Exclusive of GST @18%

An Affordable Way to Stay GST Compliant

Manage up to 40 GSTINs with seamless GST return filing

Experience fast and reliable GST filing

Includes 1 Admin + 1 User access

Frequently Asked Questions on Online GST Return Filing Software

These are the most commonly asked questions about Munim Products. Can’t find what you’re looking for?

Chat to our expert team!