2727 views

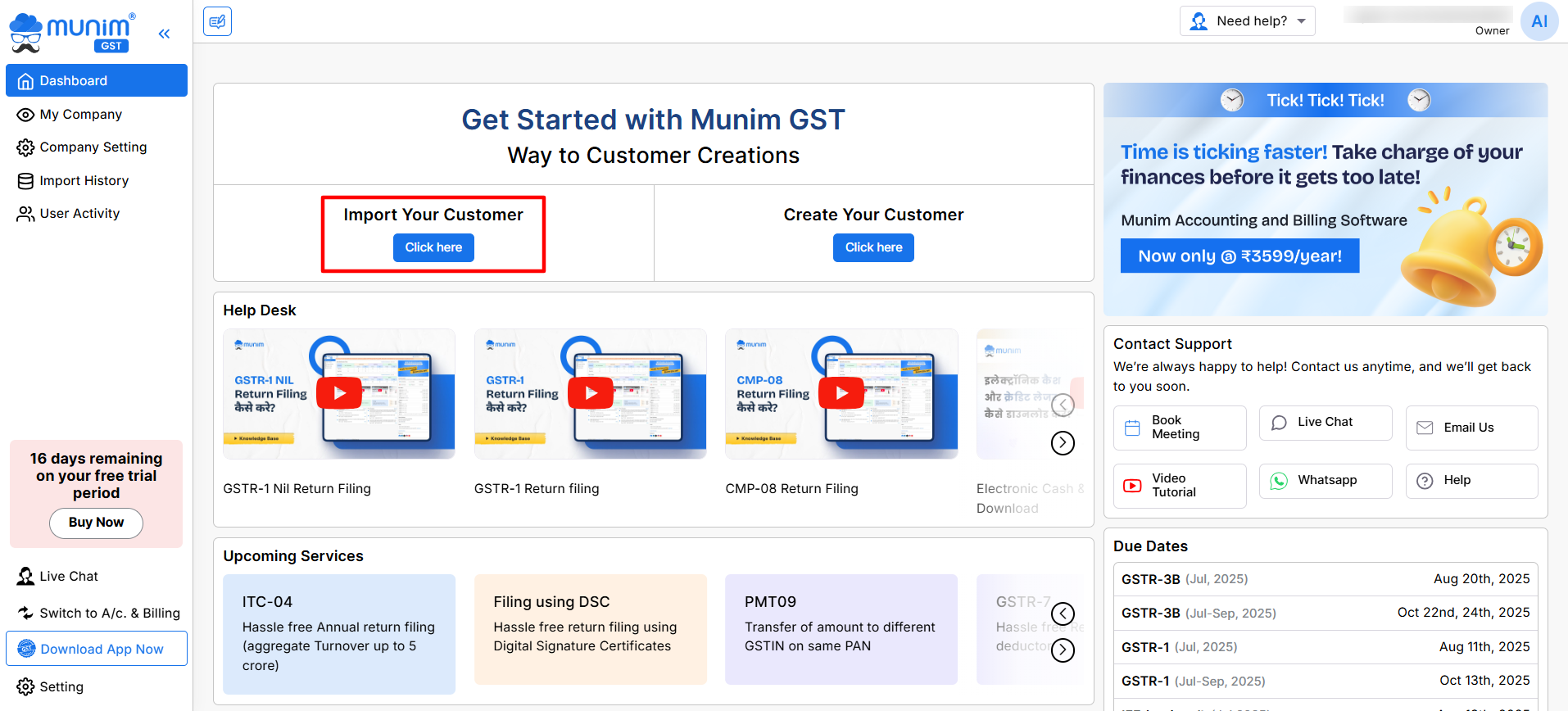

2727 views To begin using Munim GST Filing Software, the first step is to add or import your company details into the system. This enables you to manage GST returns, client data, and filing processes efficiently from a centralized dashboard.

Here, There are two types of initial actions are available: Import your customer and Create your customer

Import your customer:

- If you have a customer list in bulk, then you can import your customers by clicking onthe Import Your Customer button.

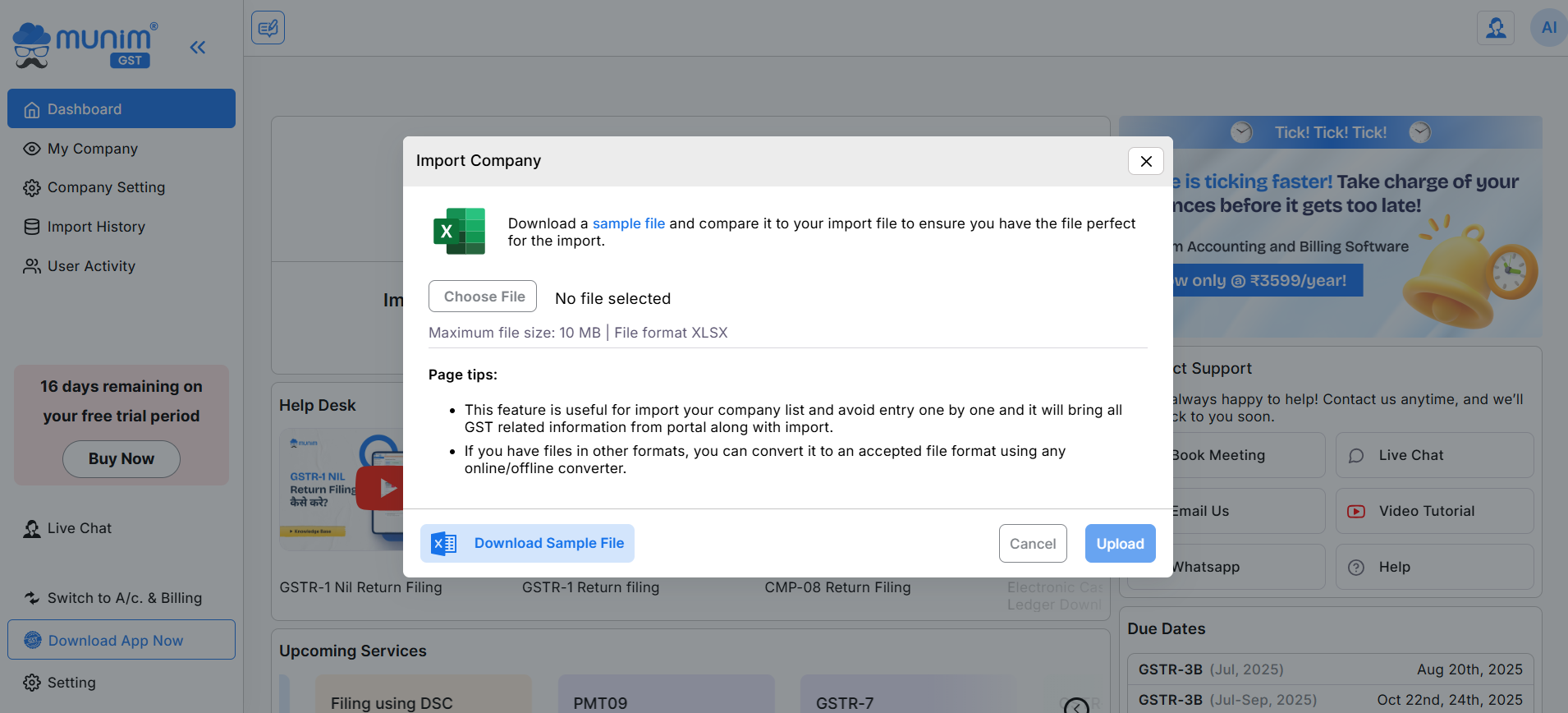

- Import company pop-up will open, and you need to click on the Download Sample file button to add your customer company data.

- Now, select the sample file to edit and insert the data accordingly into it.

- Once you prepare data in the sample file, click on the Choose File option and then click on the Upload button.

- After uploading, go to the My Company page to view the progress bar displayed for the import process at the top.

- Once the data is successfully imported, all your customer companies are displayed on the My Company page.

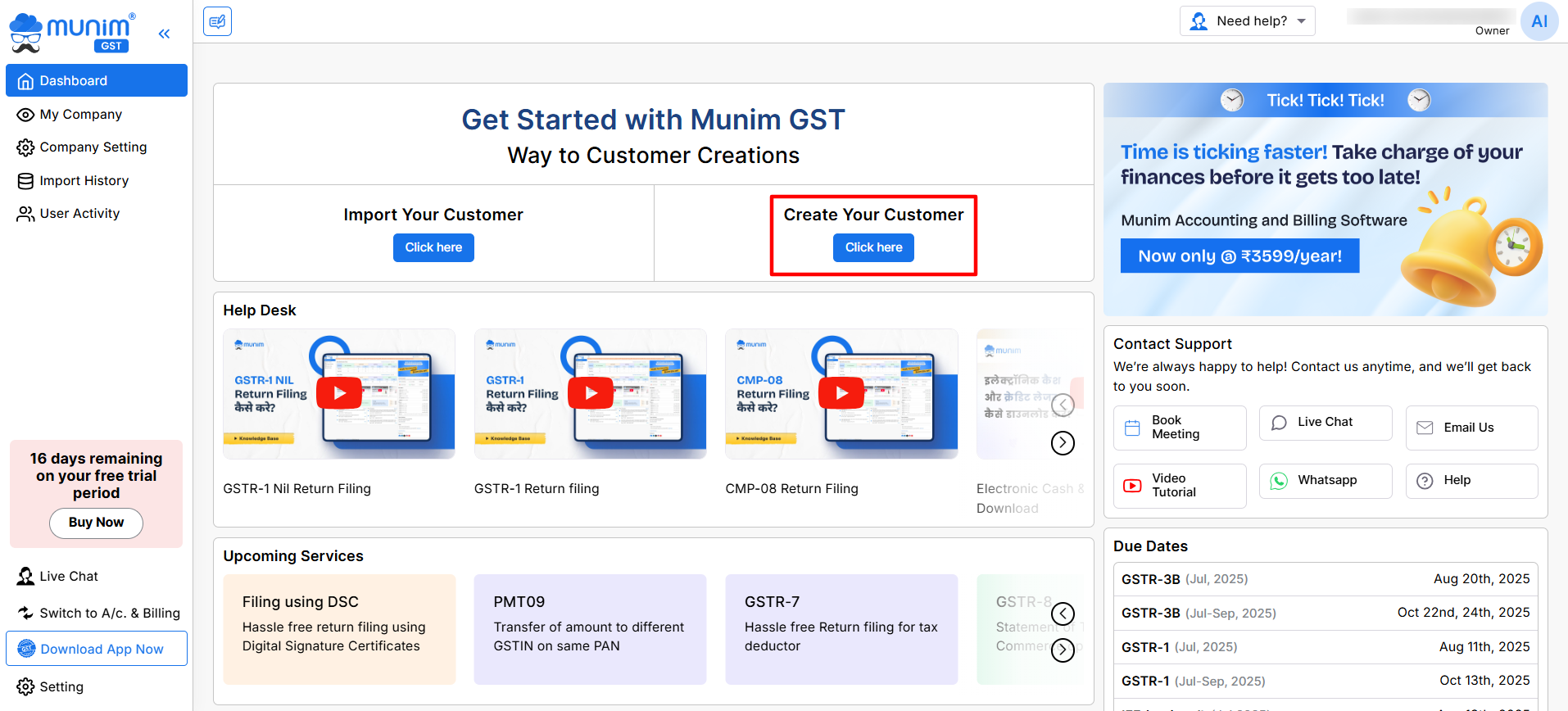

Create your customer:

- If you have limited customers and want to add them manually, then click on the Create your Customer button.

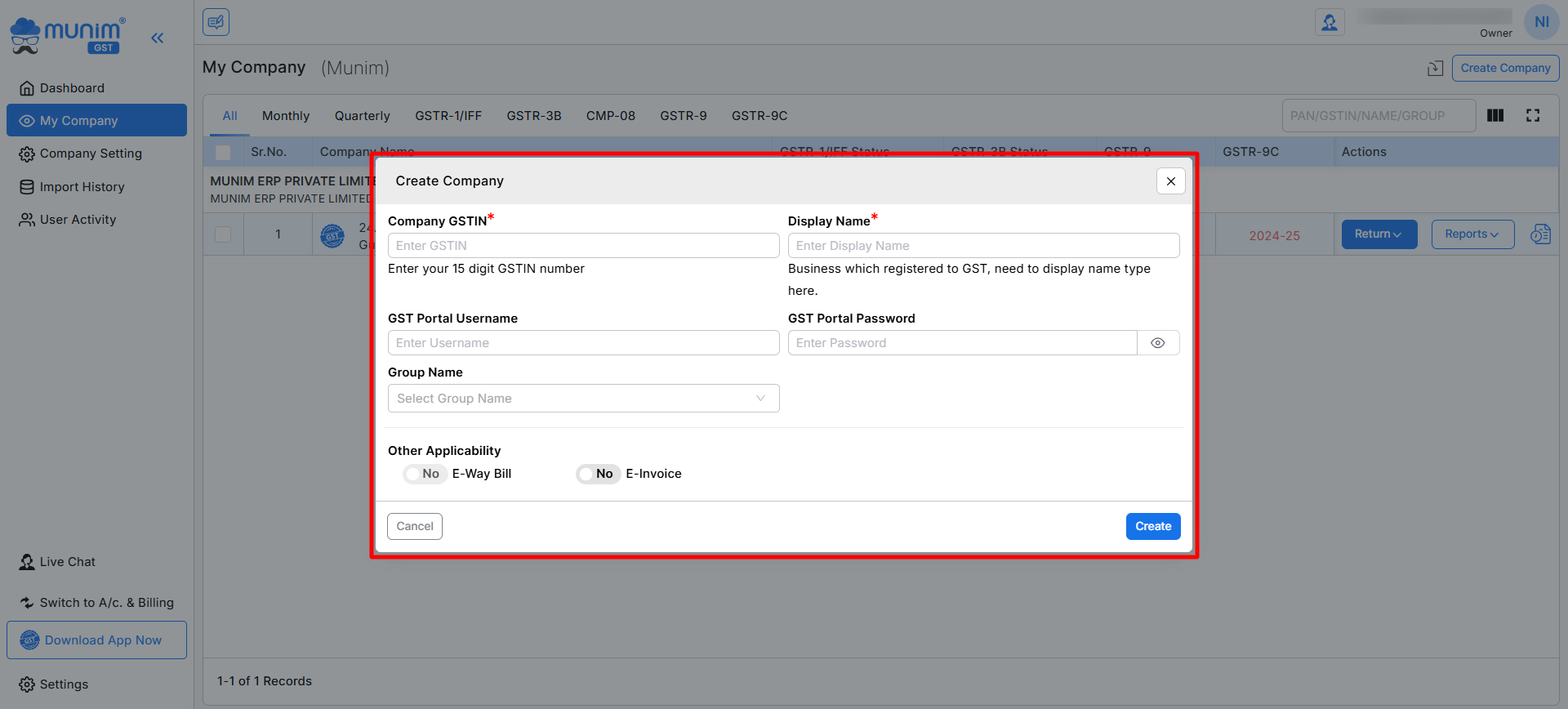

- Now, a pop-up will be shown where you can enter your client’s GSTIN Number and other details.

- Once you enter the Company GSTIN, it will automatically fetch and display the name of your customer company.

- Here, you can add optional data like GST Portal Username & Password and Group name if you want to add the company to any group.

- Now, click on the Create button to create a new company, and it will display your company on the My Company page successfully.

Both actions are also available on the My Company page, making it easier to process the company creation process.

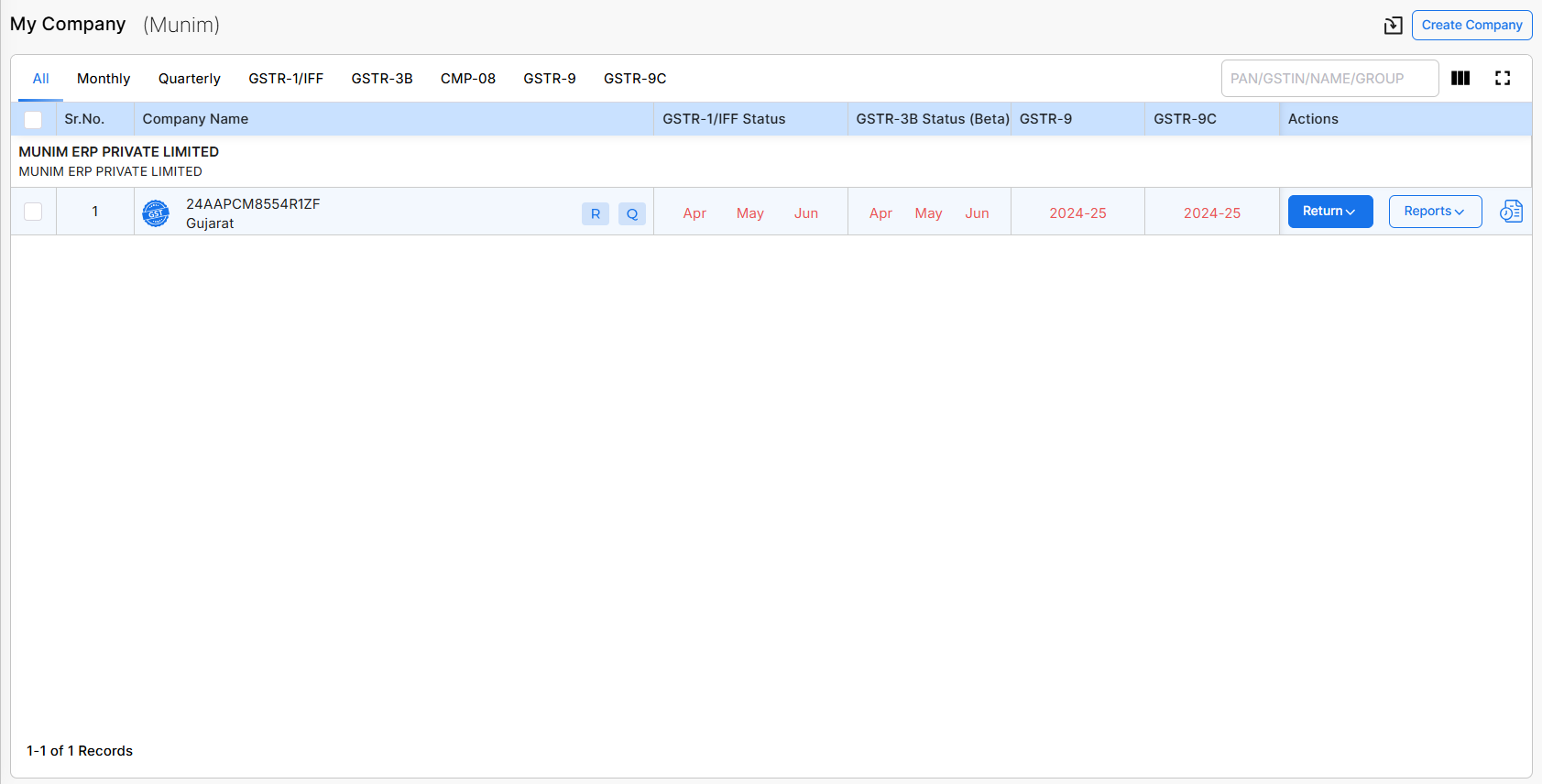

Once added, you can check companies in the My company page.

| Name | Description |

|---|---|

| Import icon | Here you can Import your Companies in bulk through Excel file format. |

| Create Company | Here you can create a new Company by adding GST number. |

| Company Type Tabs | Here you can check companies with predefined Filters tabs according to company types like Monthly, Quarterly, GSTR-1/IFF, GSTR-3B, CMP-08, GSTR 9 and GSTR 9C. |

| Search field | Here you can search companies with their PAN no., GSTIN or Names. Also, you can use Column search and show/hide column options next to the search field for more search related activities. |

| GST Icon | This icon can redirect you to GST Portal with preset Credentials you have added for the company. |

| Company name | Here you can see Company name and its details. Here R identifies as a Regular for company type and Q identifies as a Quarterly for company’s filing frequency. It changes according to company type. |

| GSTR-1/IFF Status | Here you can check status of the current quarter months. Red fonts indicate as not filed and Green indicates as filed. |

| GSTR-3B Status | Here you can check status of the current quarter months. Red color fonts indicate as return not filed and Green indicates as filed. |

| GSTR-9 Status | Here you can check status of the current financial year. Red color fonts indicate as return not filed and Green indicates as filed. |

| GSTR-9C Status | Here you can check status of the current financial year. Red color fonts indicate as return not filed and Green indicates as filed. |

| Return | Here you will get Return filing options like GSTR1, GSTR3B, TDS/TCS Credit Received, Nil and GSTR9. |

| Report | Here you can check multiple reports related to the return filing and Electronic Ledger. |

| Filing Status Check | By clicking this icon, you can update and check the current filing status of the particular company. |