Here you will get step by step guide to file GSTR-1 in munim GST software

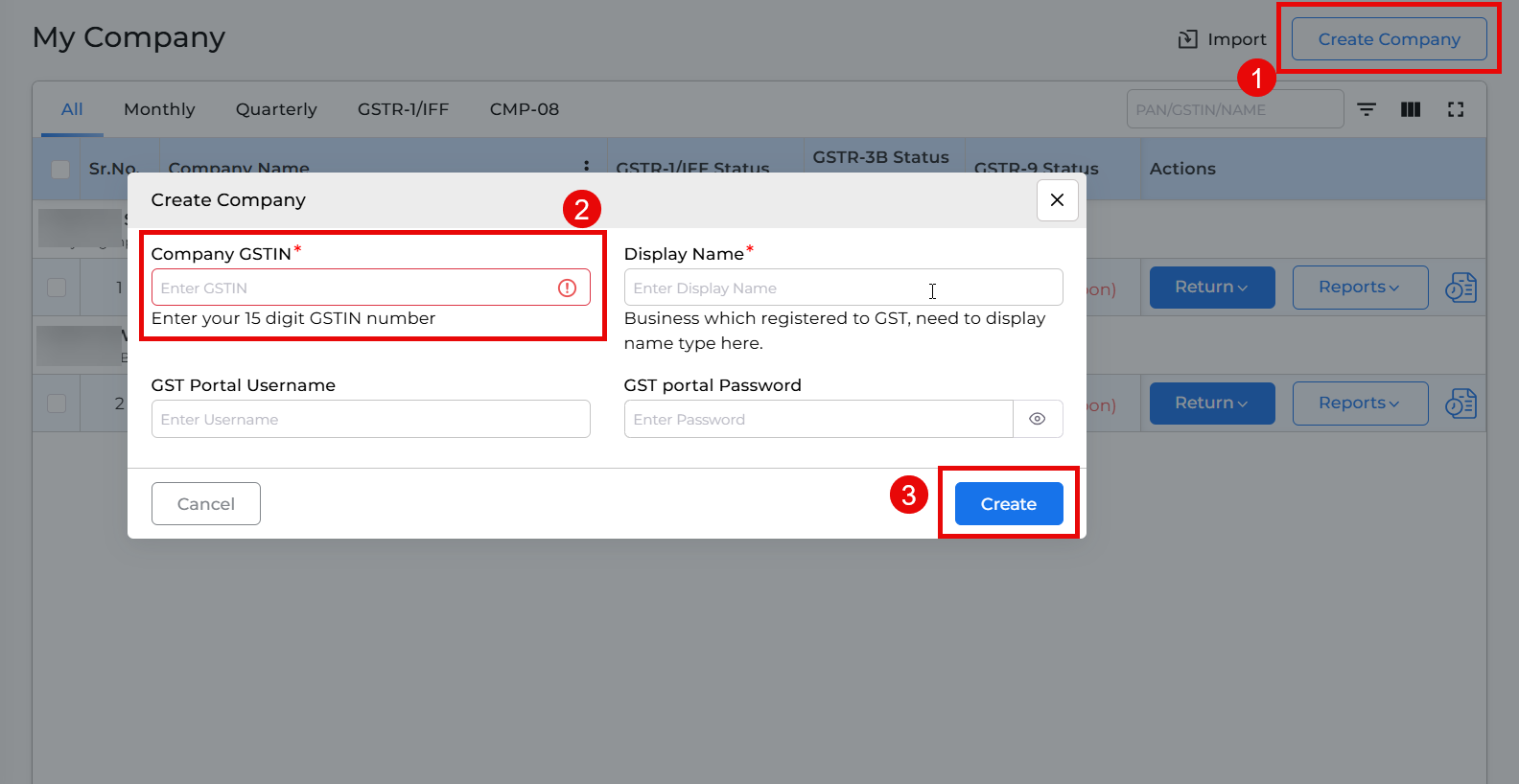

- Add company in munim:

- Go to My Company and click the Create Company option from the top right.

- Enter your GST number and click Create. GST username and password are not mandatory.

+−⟲

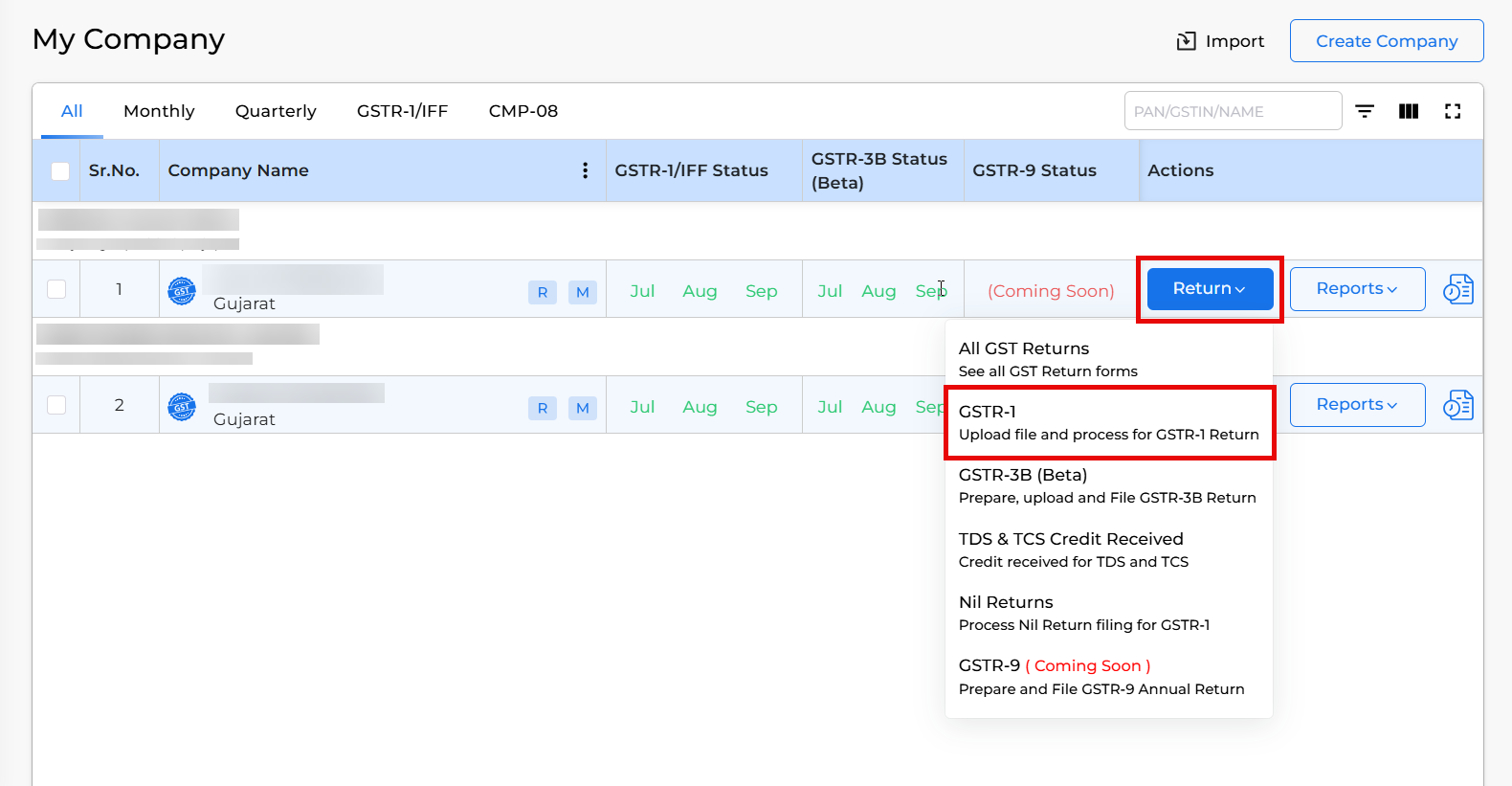

- Select GSTR-1 option:

- After creating the company, click on the Return button.

- Here select GSTR-1 from the list of options.

+−⟲

- Prepare data:

- Prepare your data by adding invoices manually or importing data.

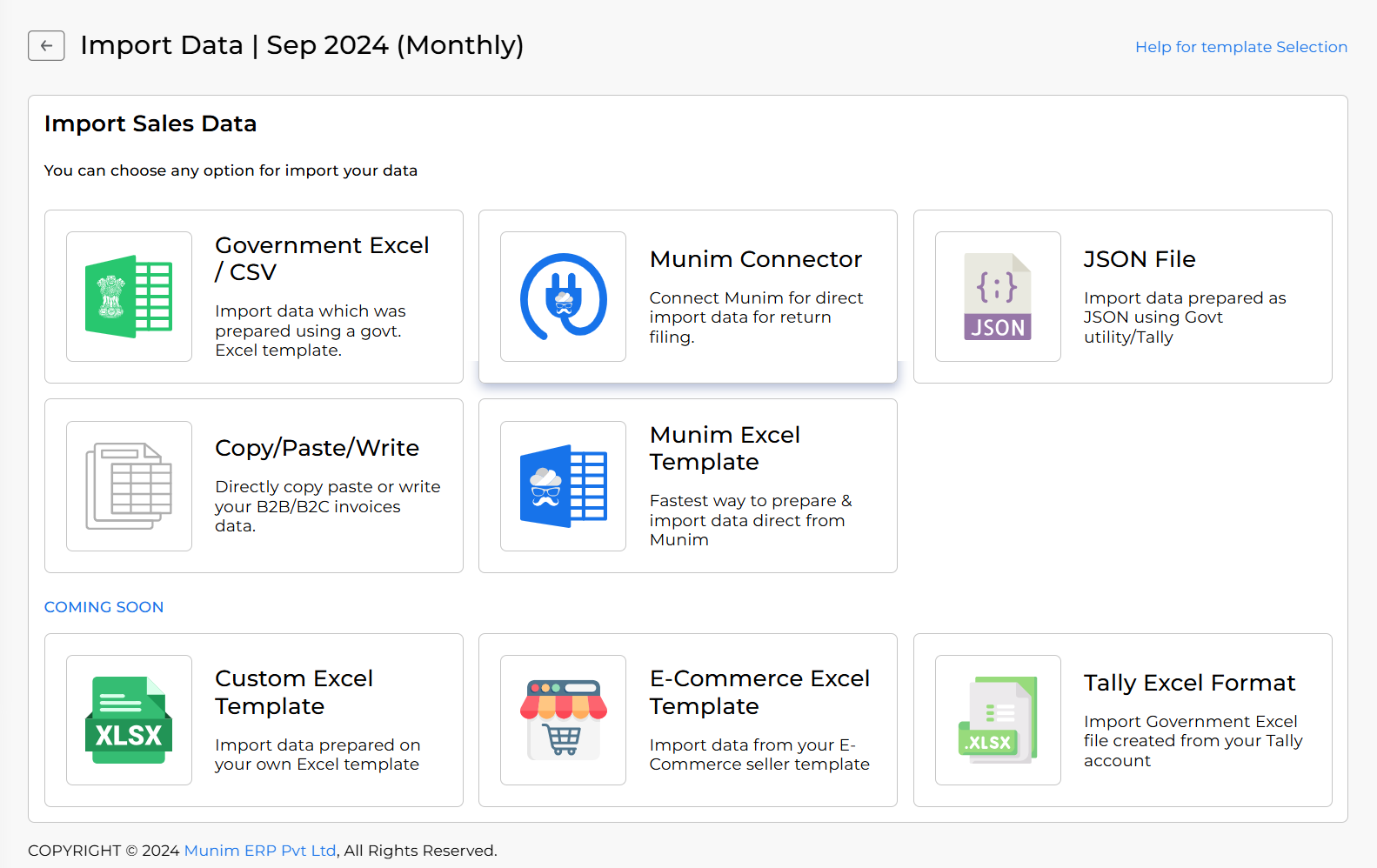

- Import your data:

- Click on the import data button.

- Choose from options like Government Excel/CSV, Munim Excel template, JSON file, Munim Connector, or copy/paste/write.

- To learn the process of data importing in munim GST, check this Import data helpdesk link.

- To use the Munim Connector option and check its process please check out this helpdesk. Munim connector option

+−⟲

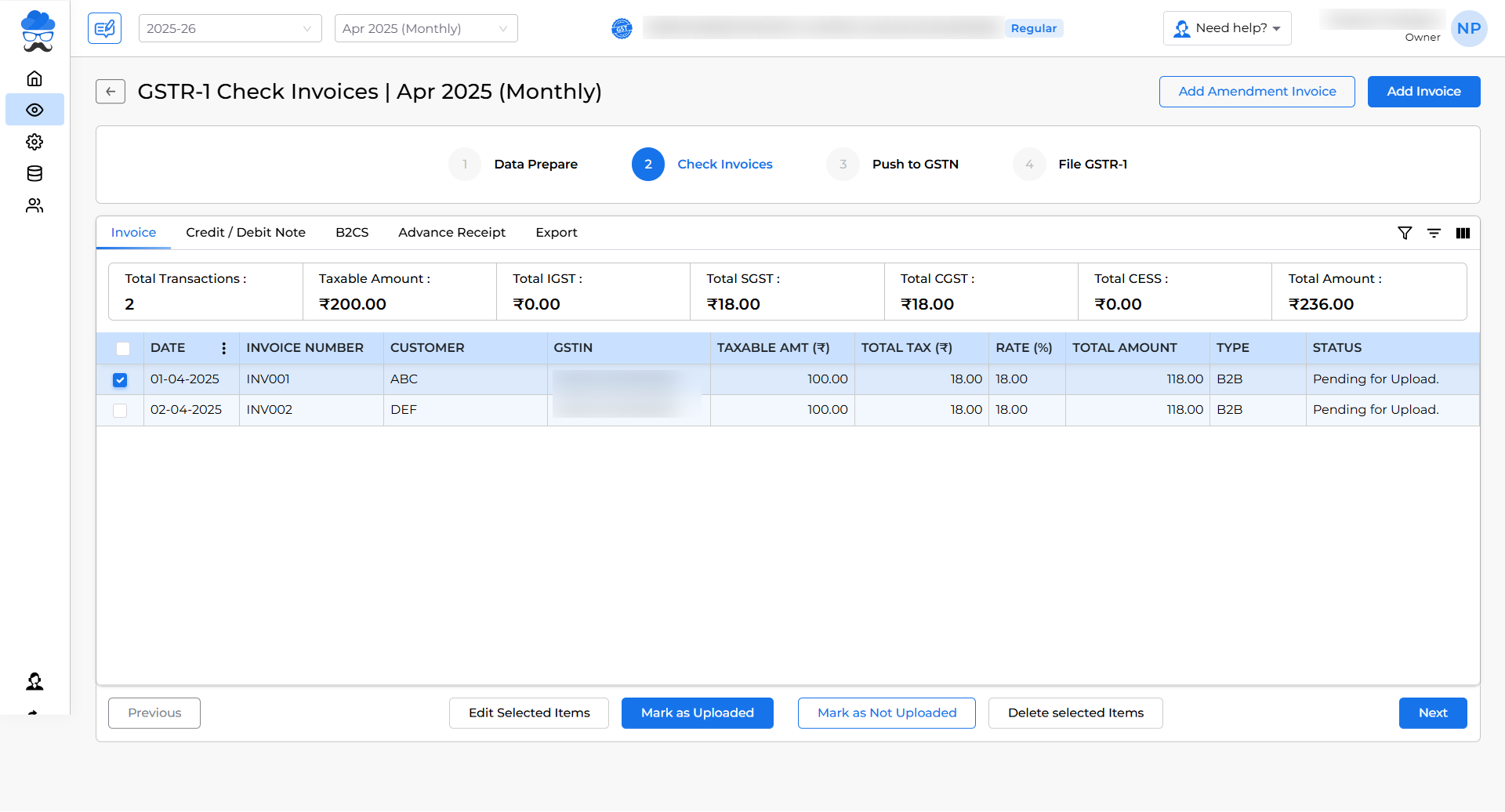

- Check invoices:

- After importing your data, verify the invoices in the second step. where you can check and edit invoices.

- If some of the Invoices are already uploaded to the portal, you can select them and click Mark as Uploaded. You can check their statuses in the status column.

- Also, you can edit or delete any entries by selecting them here. Once done, you can click the Next button to proceed.

+−⟲

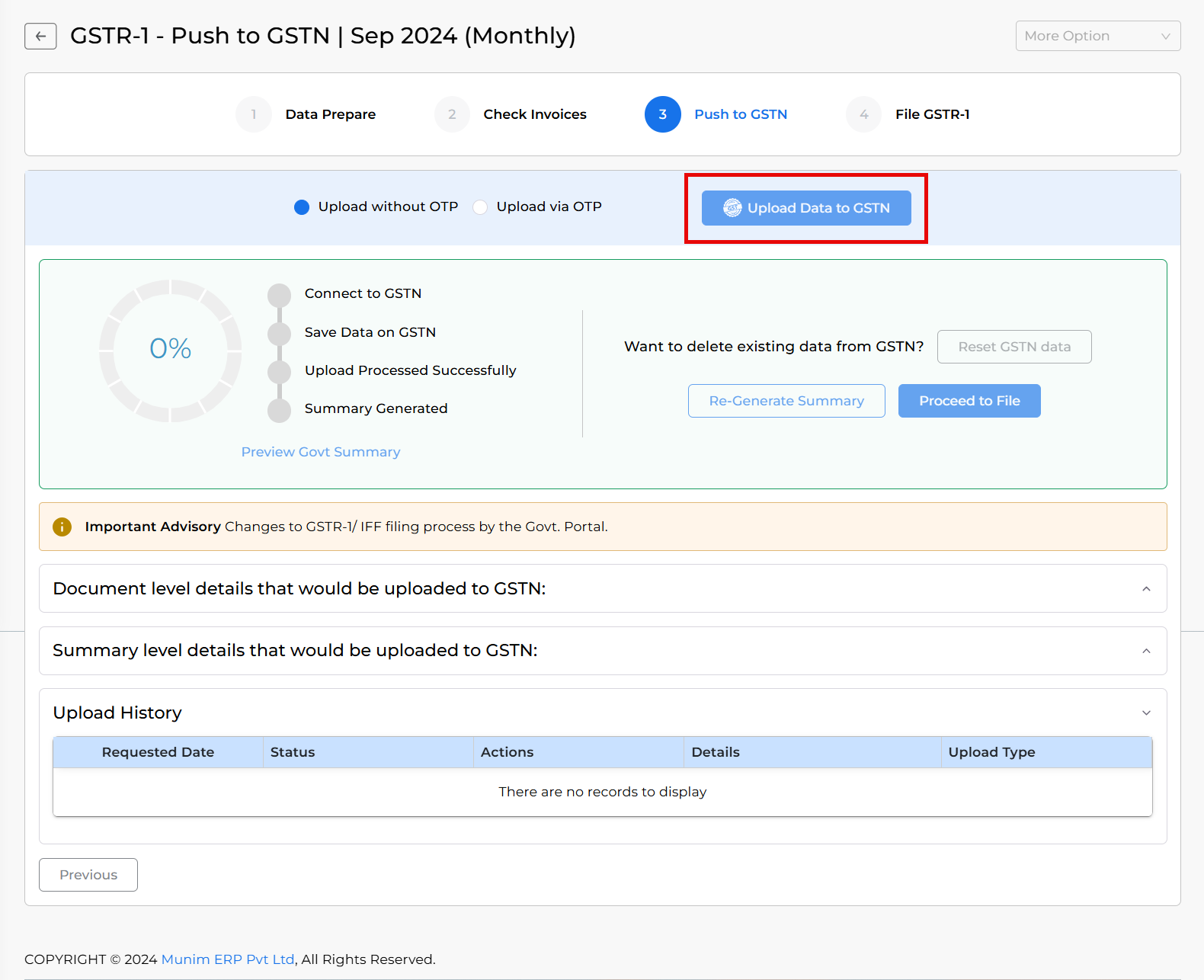

- Push data to GSTN portal:

- In the third step, select either Upload without otp or Upload via otp.

- Now, click on Upload data to GSTN and wait for the summary to be generated.

- After the summary is generate,d you can check for any errors below it.

- Once the summary generation and checking are done, click the Proceed to File button to continue the process.

+−⟲

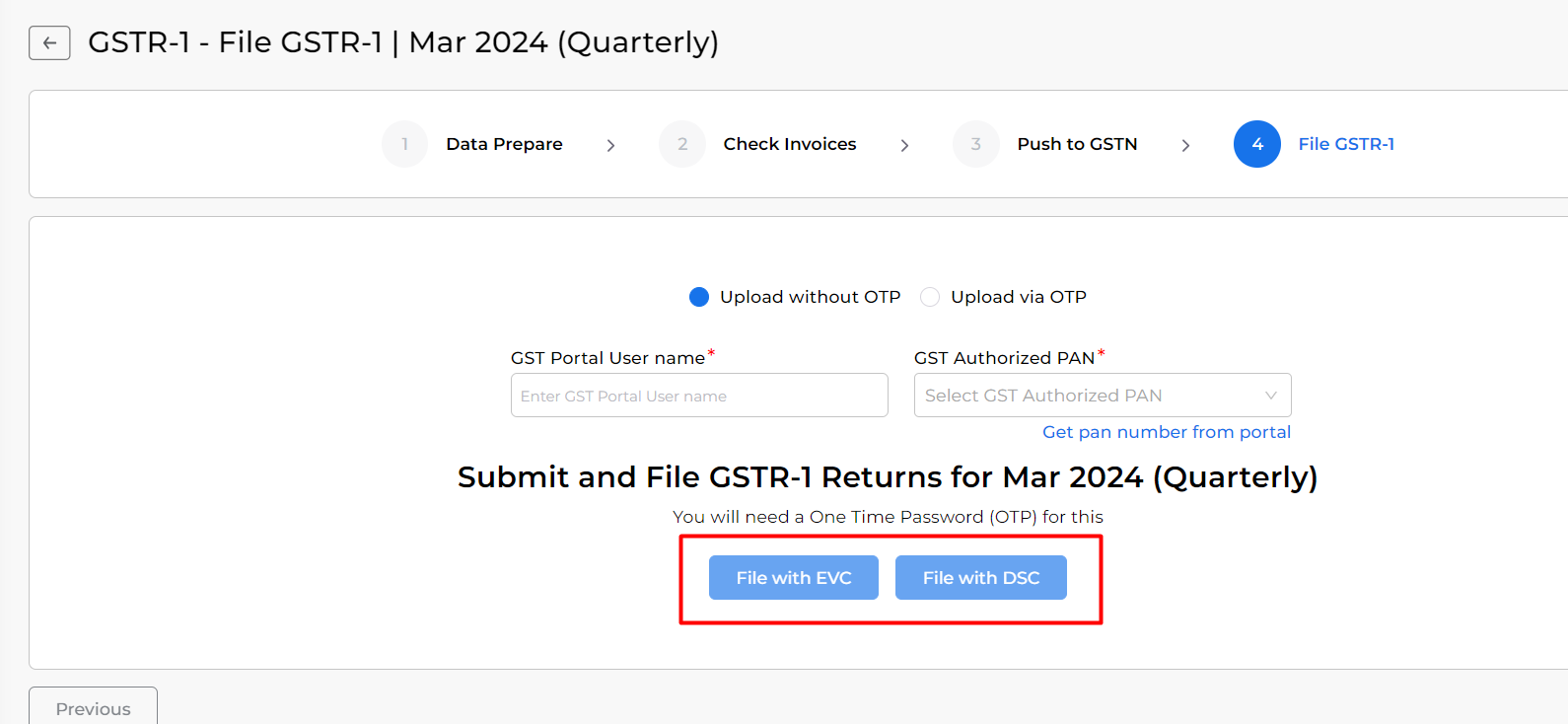

- File GSTR-1:

- In the fourth step, file GSTR-1 using the File with EVC or DSC method(coming soon).

- Enter the required username and otp to Proceed.

- Once done, a Success message page will appear.

+−⟲

By following these steps, you can easily file your GSTR-1 using Munim GST Return Filing Software. For further assistance, please contact our support team.