1996 views

1996 views Purchase data is significant in the GST system for claiming ITC, ensuring compliance, managing finances, and facilitating accurate GST return filing. Businesses must maintain accurate and comprehensive purchase records to leverage the GST system’s benefits effectively.

Here are the steps for performing a purchase data:

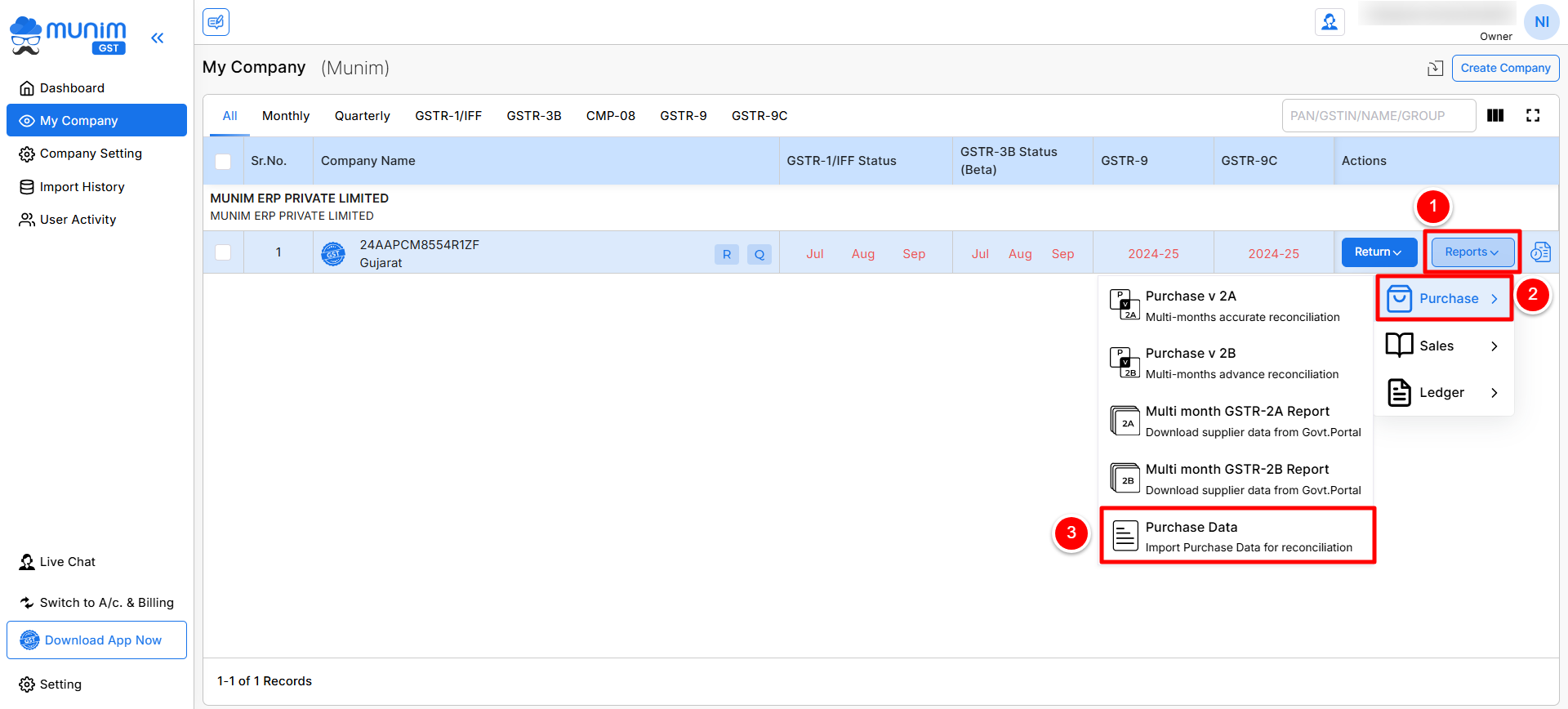

- On the My Company page, click the Reports button, then click on the Purchase section and select “Purchase Data”.

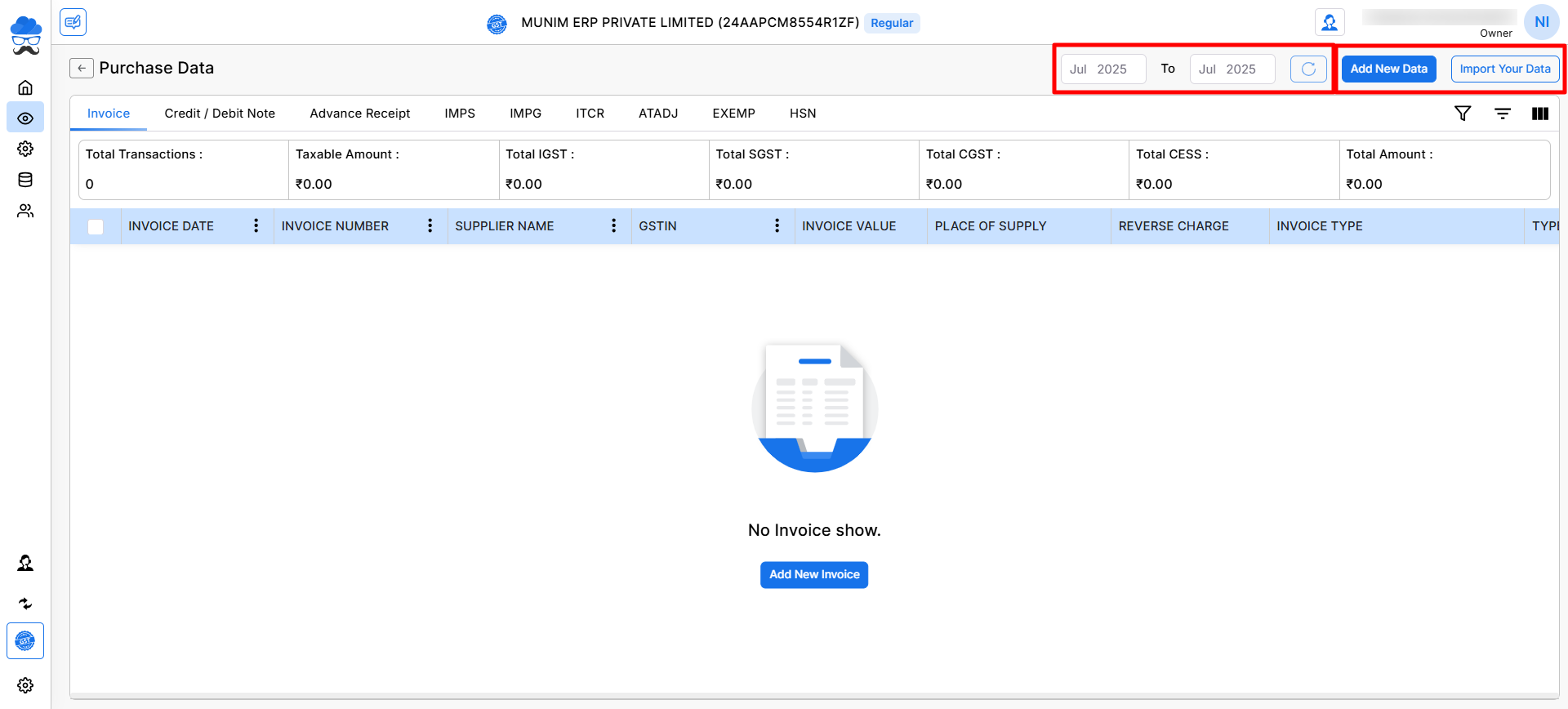

- You have been redirected to the Purchase Data page, which automatically selects and displays the previous month.

- Here, you can set the month for uploading your purchase data or view your uploaded data by using date range fields.

- If you have not uploaded any data, you can select the month period and Import data using two options: Add New Data or Import Your Data.

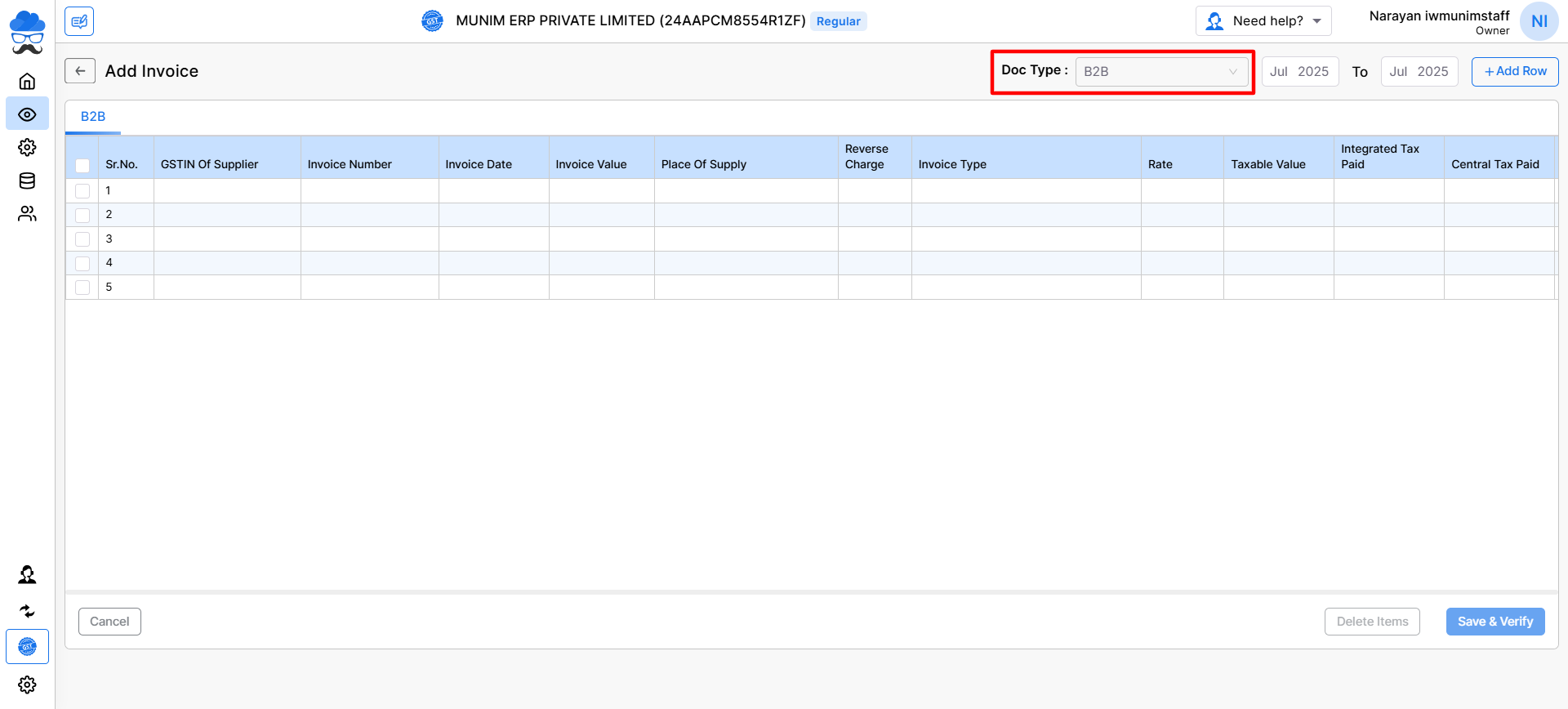

- Here, click on the “Add New Data” button to add Purchase Bill data manually by typing or copy/paste.

- In the Add New Data option, you can select the Doc Type option to specify the type of data being added.

- You can change the Date range to add data for a specific period, also you can click on the +Add Row option to add more rows.

- Or, click on the “Import Your Data” button to import data through an Excel file.

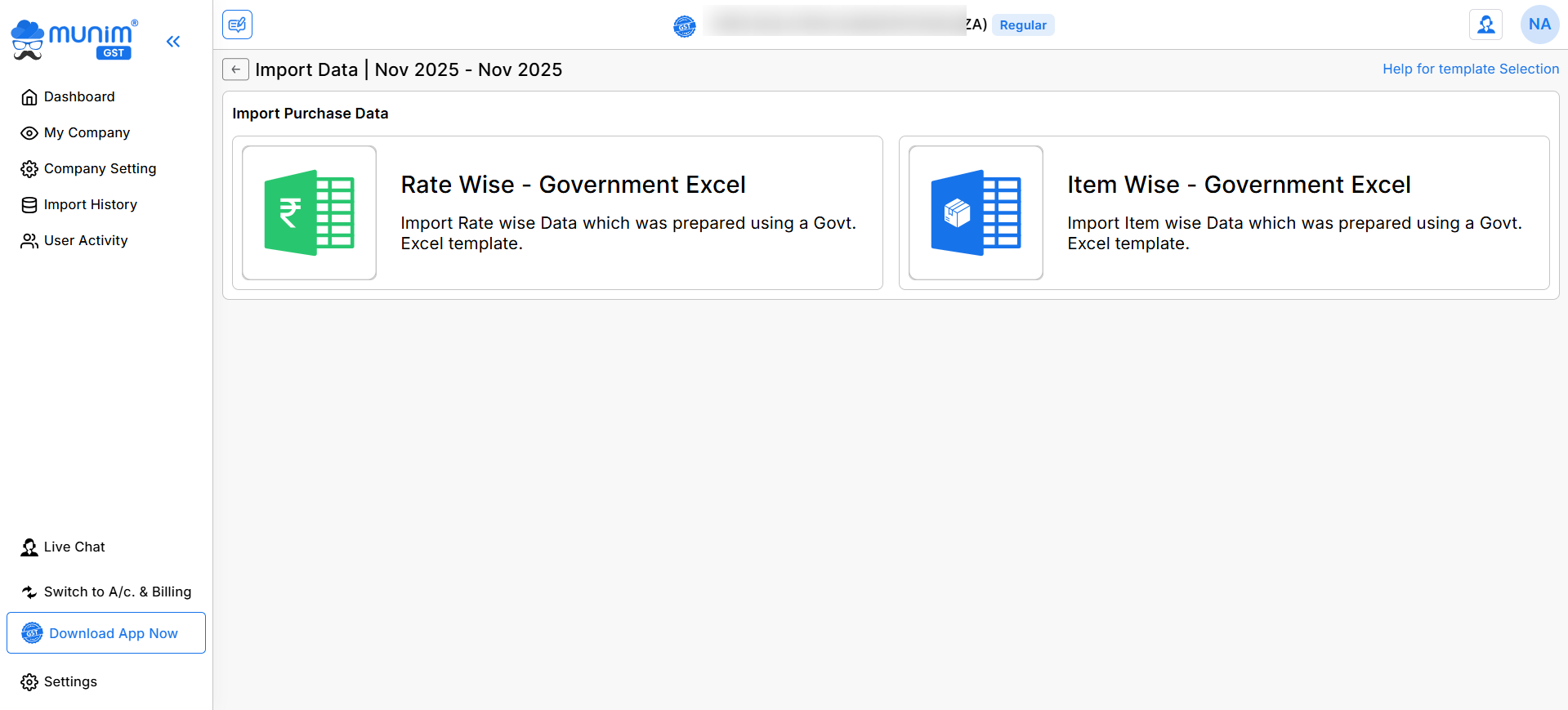

- After clicking the “Import Your Data” button, you will be redirected to the Import Purchase Data screen.

- Here on this page, you will get two upload options, Rate wise (Add data with ratewise colums) and Item wise (Add data with Item wise details).

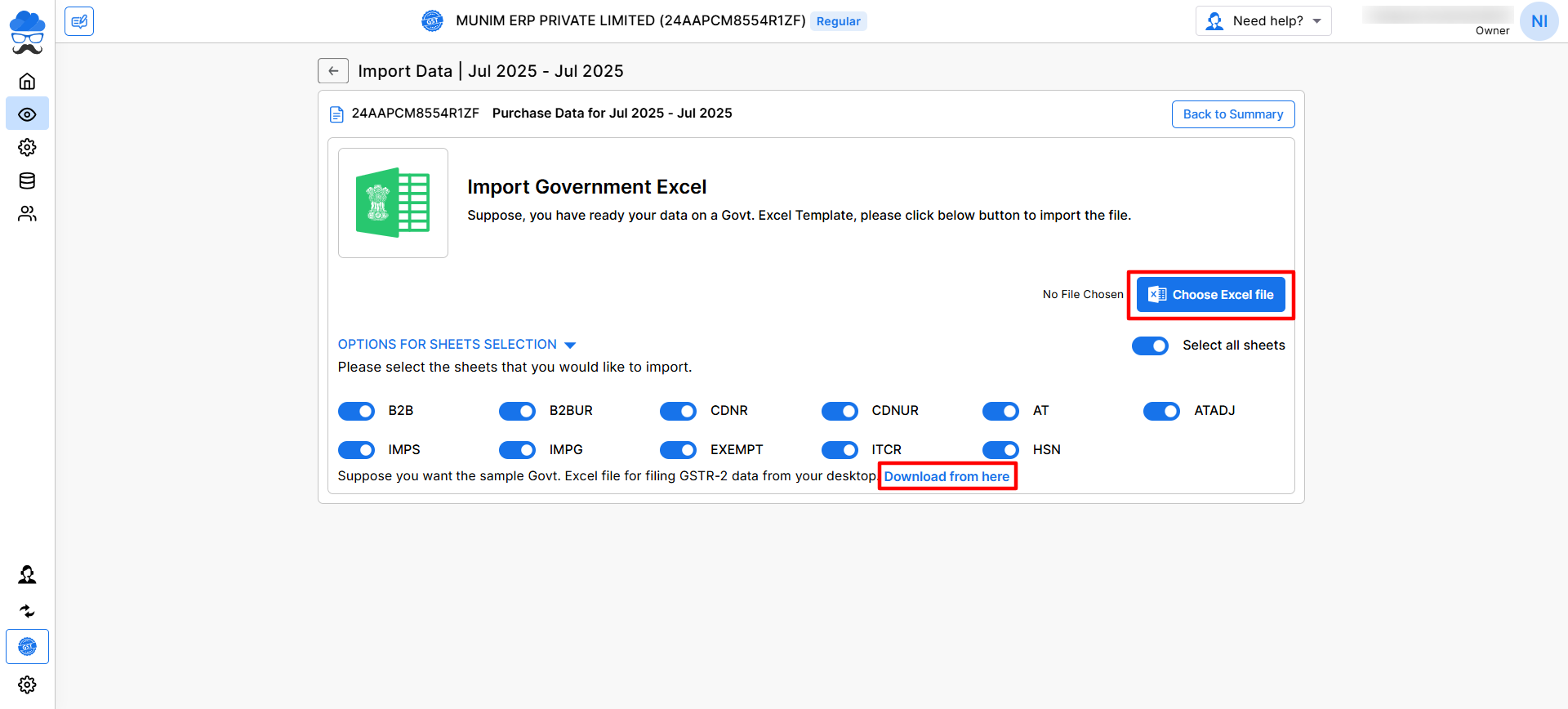

- Now, after selecting any Government Excel option, you will be redirected to the screen where you can upload your Excel file.

- You can download the Sample file for it if you want from the bottom of the section. After preparing your data, you can import the file by selecting the Choose Excel file button.

- Following a successful data import, users can view all data according to the selected month period.

Also, you can use this Purchase Bill data for Purchase Vs GSTR-2B Reconciliation or Purchase Vs GSTR-2A Reconciliation reports.

For comprehensive assistance and specific inquiries, users can contact our dedicated support team for personalised guidance and issue resolution.