2021 views

2021 views If you have no transactions to report for a specific month, it is still mandatory to file a NIL return for GSTR-1 to remain compliant with GST regulations. Filing a NIL return through Munim GST is quick and easy, and this guide will walk you through the process step-by-step.

Follow the steps below to file your NIL GSTR-1 return:

Video Tutorial:

Step-by-Step Instructions:

- Log in to Your Account:

- Open the Munim and log in with your credentials.

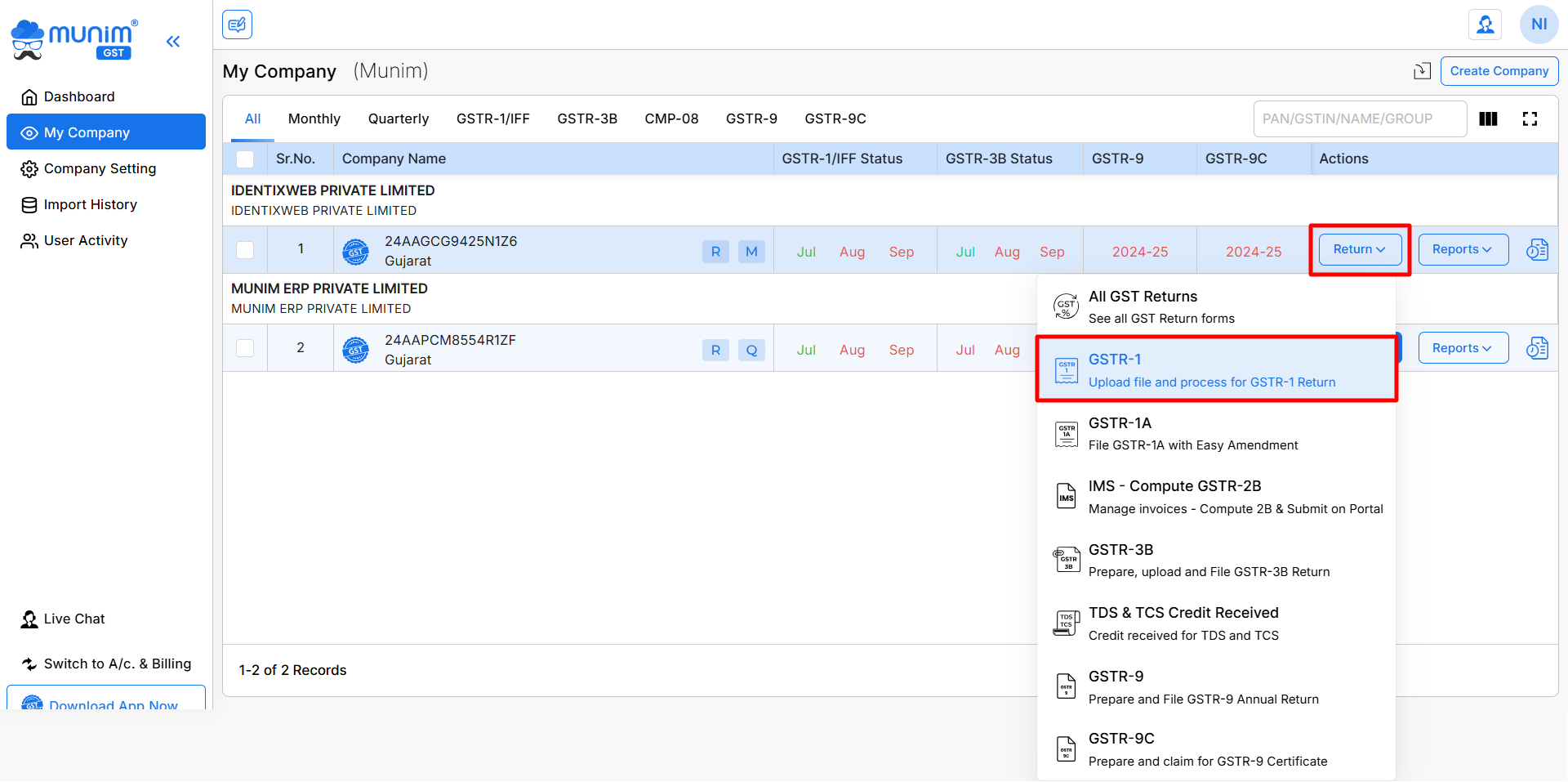

- Navigate to the ‘My Company’ Section:

- On the left-hand side, click on My Company from the dashboard.

- A list of the companies you have added will appear here.

- Find the company for which you want to file the NIL return.

- Click on the ‘Return’ Button:

- On the right side of the screen, you will see a Return button.

- Click on it to open the dropdown menu. From the dropdown, select the GSTR-1 option.

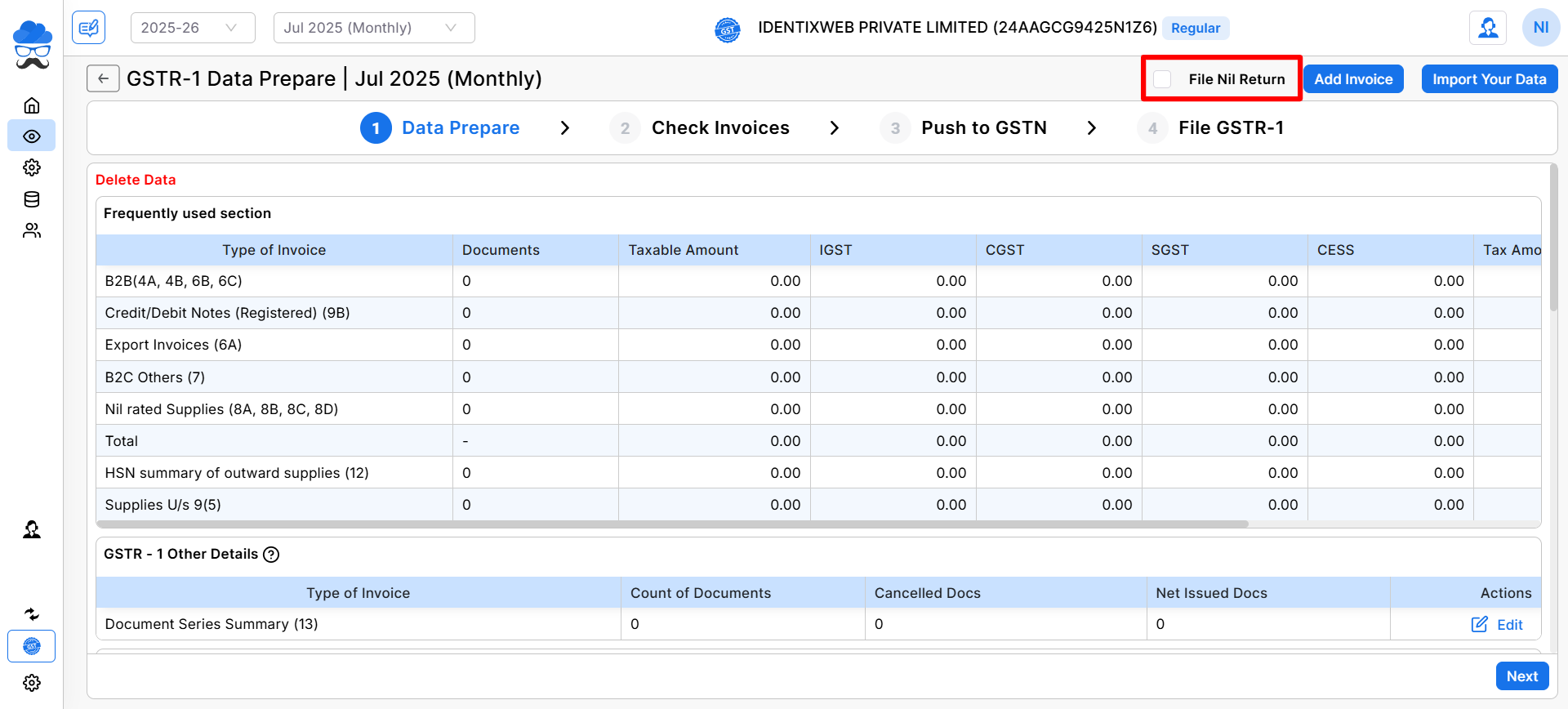

- Now, while on the GSTR-1 Data Prepare page, select the File Nil Return option to proceed with filing a NIL return for GSTR-1.

- Choose the GSTR-1 Month:

- Here at GSTR1 NIL Return page, look for the correct month and year at the top left to confirm.

- You can change the month for which you need to file the NIL return. The current filing month will be selected by default.

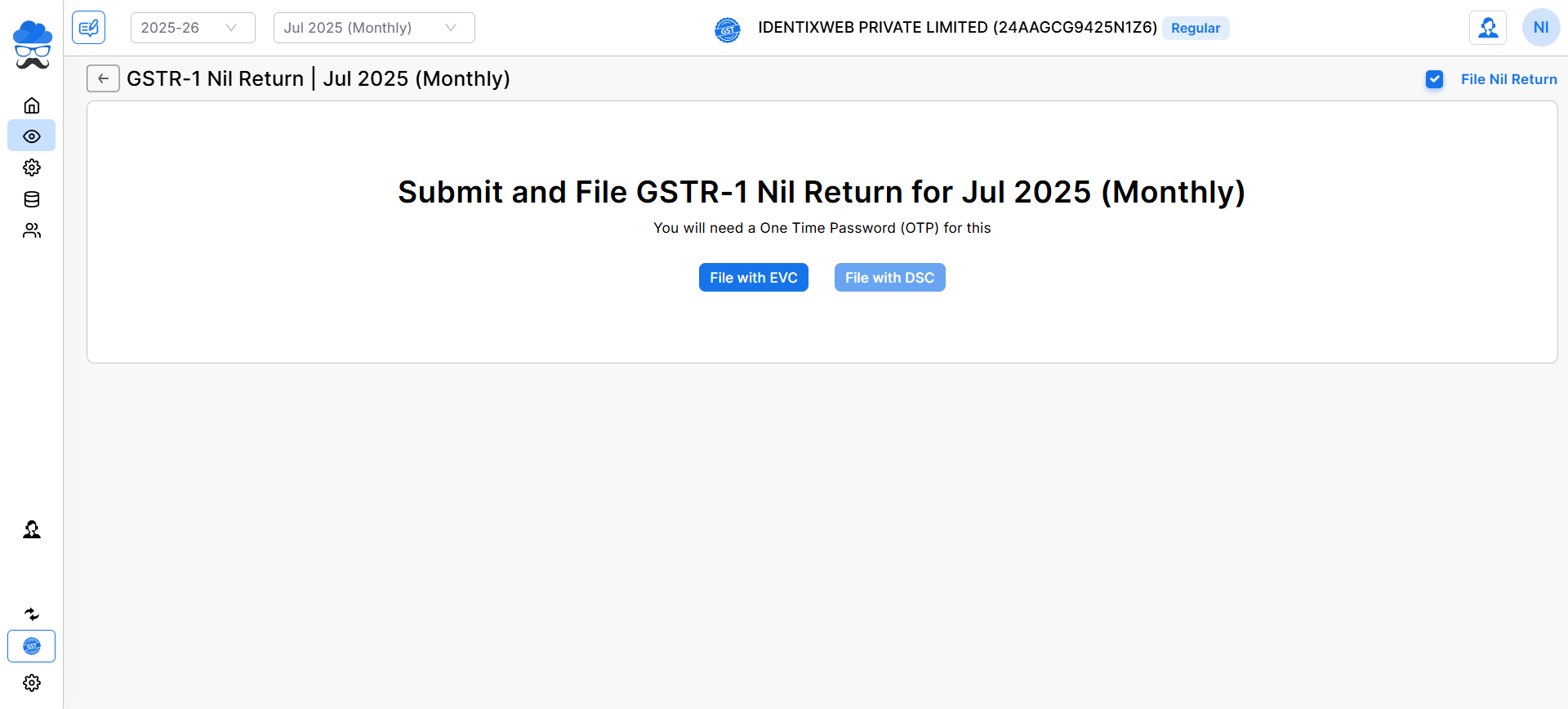

- Confirm and File:

- After selecting Nil Return, Submit and File GSTR-1 Nil Returns with the option available from File with EVC and File with DSC(Coming Soon) option.

- You will need a One Time Password (OTP) to submit the return, and you’ll receive a confirmation of successful filing.

By following these steps, you can easily file your NIL GSTR-1 returns using Munim GST Filing Software.

If you face any issues or need further assistance, feel free to contact our support team via Live Chat or refer to our detailed guides available in the Help Centre.