Our Products at a Glance

Send Invoice & Track Finance

Munim Accounting and Billing Software

Redefining business accounting for maximum profitability

No More Worries about Orders

E-Commerce

Management Software

Your e-commerce business third eye

Experience the Munim Magic

Discover how Munim simplifies your daily accounting tasks with smart, intuitive tools. From invoicing to reporting.

Smooth learning curve

Tooltips and ready-made templates are here to guide you through every step.

Easy to use

Our software is designed to provide you with ease of use, even for beginners.

Intuitive interface

Stroll through your way hassle-free — no clutter, no confusion.

Quick company setup

Getting started with Munim Accounting and Billing software takes no more than 5 minutes.

Access anywhere

Whether you are in the office or at home, access our software from anywhere.

Real-time support

Video guides and support team is available to hand-hold you at every step.

Munim’s Ecosystem For Business Growth!

All the tools that you need to succeed in your business

Munim Accounting and Billing Software

Redefining business accounting for maximum profitability

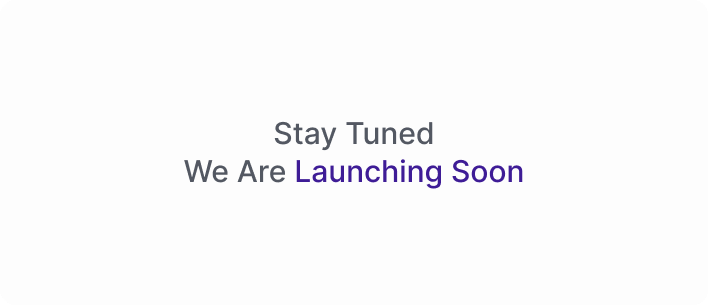

Invoicing

Generate quotes, proforma, sales invoice and share them via Whatsapp. You can also print invoices in A4, A5 and thermal format with brand essentials.

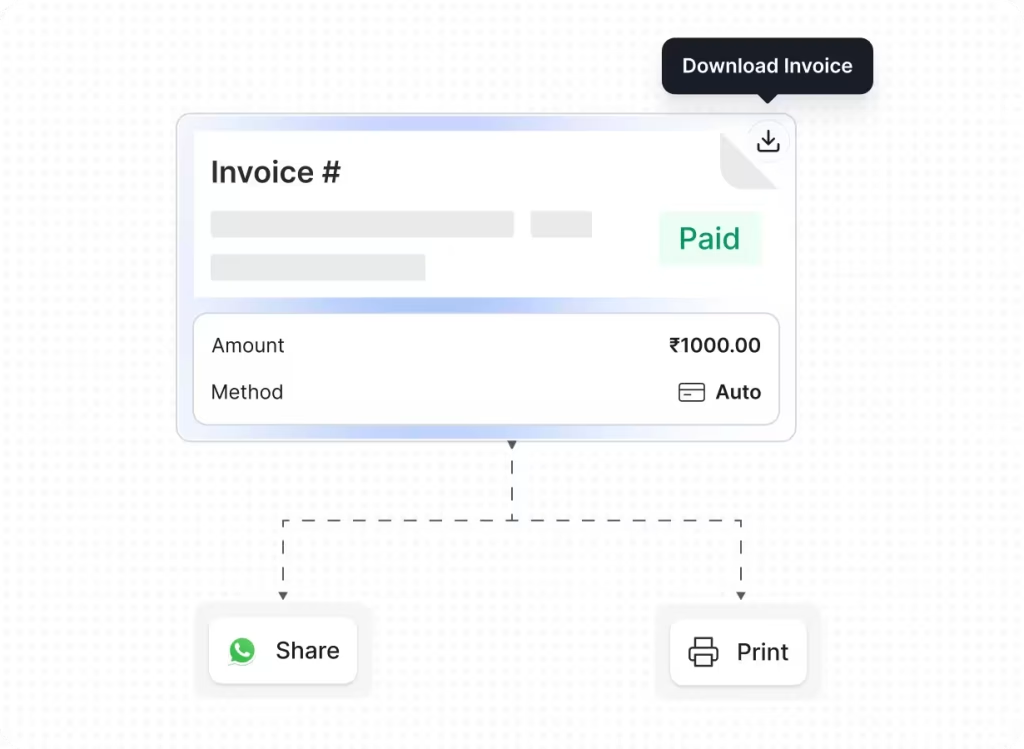

Inventory management

Create and manage inventory like no other. Get stock-out alerts, designate HSN/SAC code, a wide range of units, and convert units for easier billing.

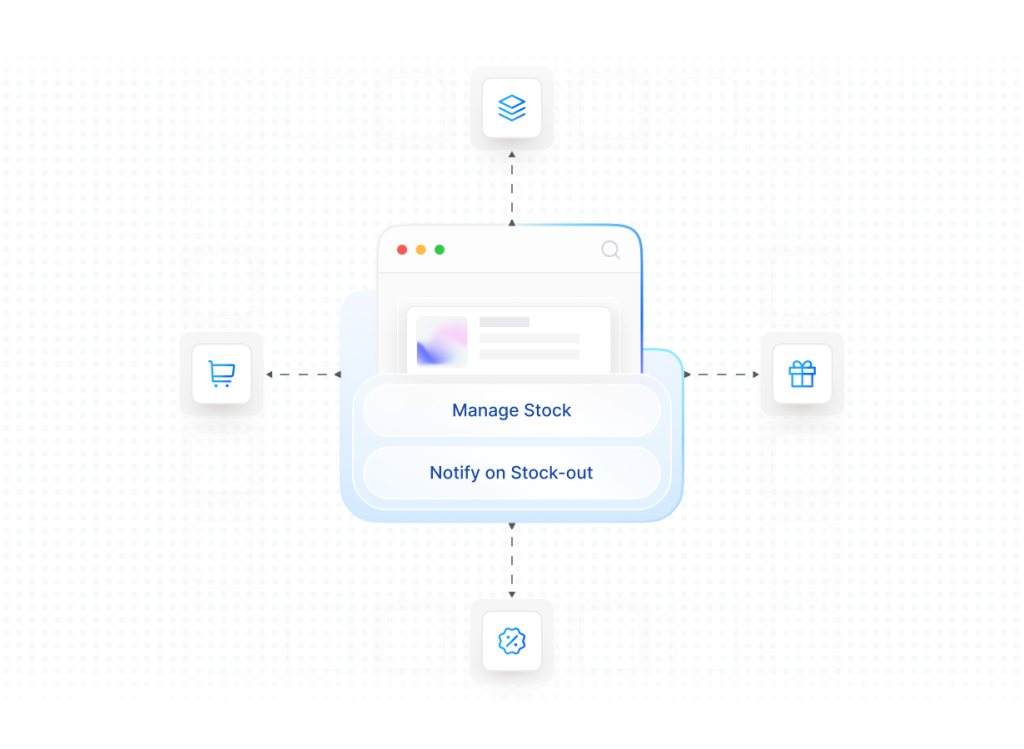

Barcode

Designate barcodes to products for easier storage, identification and billing. This system helps you reduce billing time, and leads to lesser queuing time.

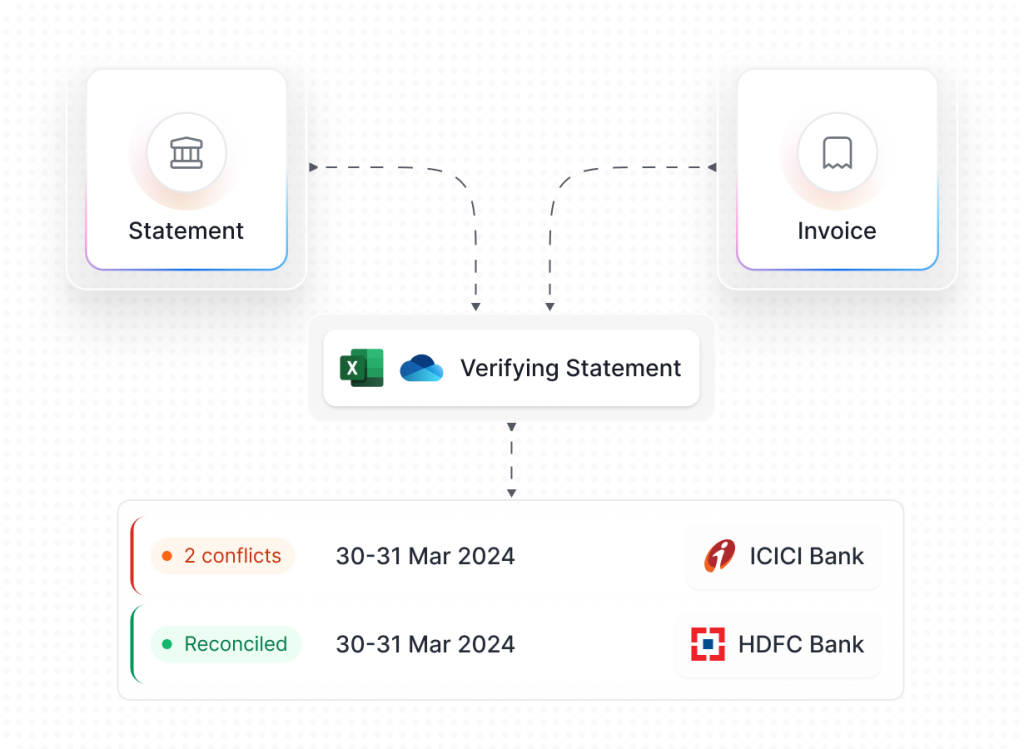

Bank reconciliation

Compare the entries in your ledger with the entries in your bank account. It helps you find missing transactions and tally the balance in both the records.

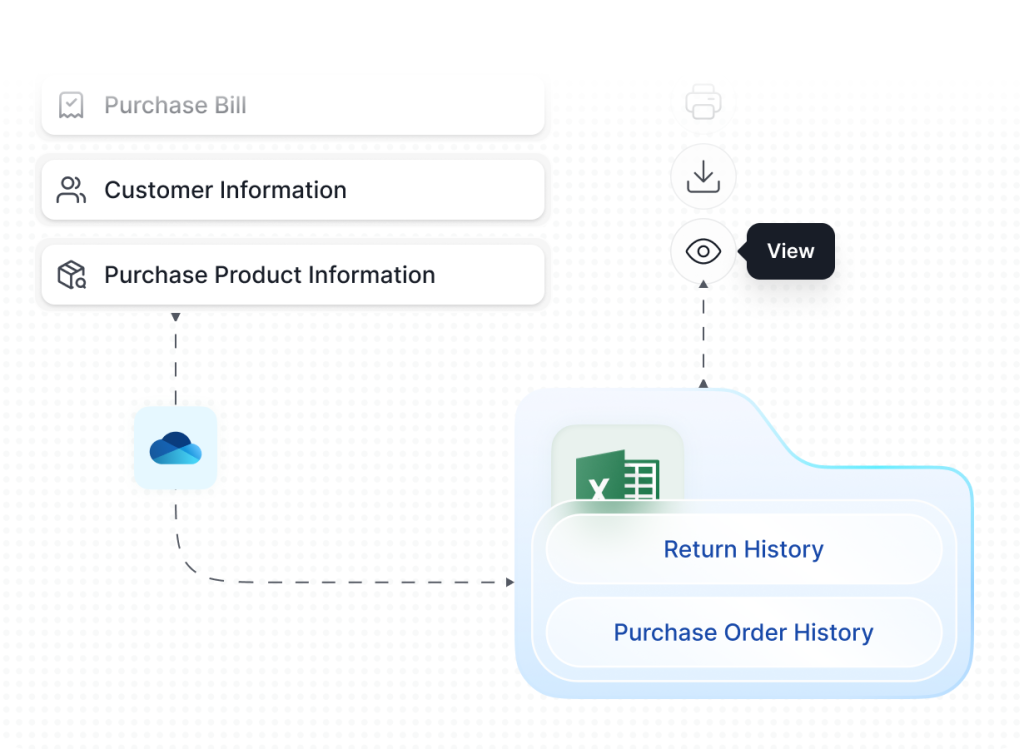

Purchase management

From the purchase bill, purchase orders to purchase returns record all the data at one place and retrieve with a few clicks whenever needed.

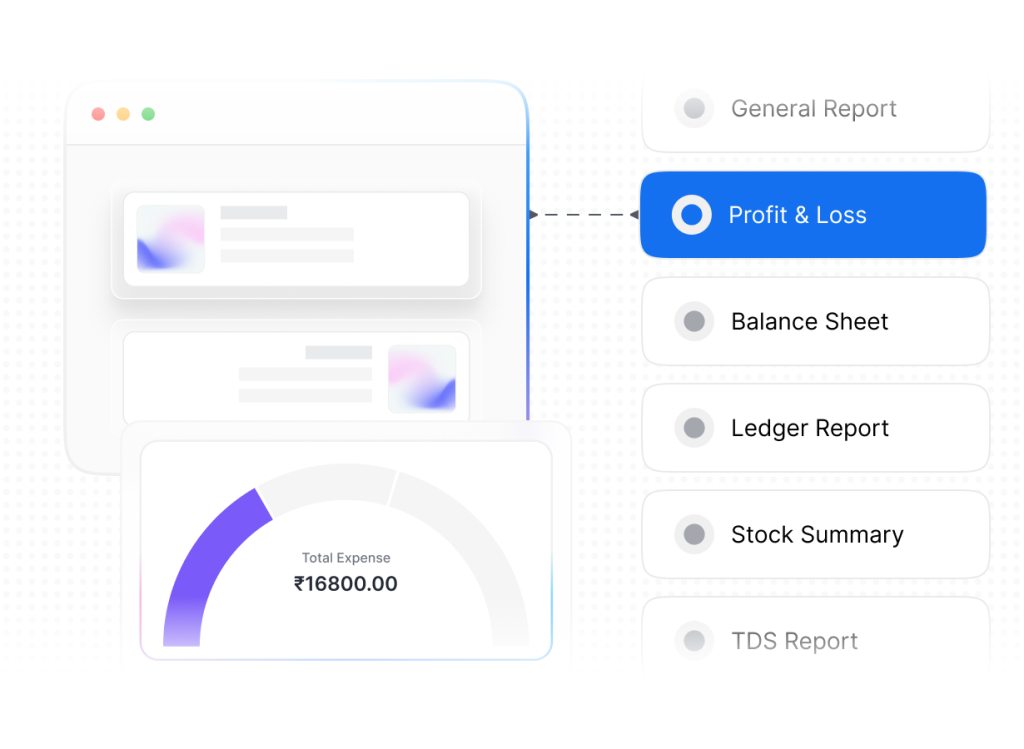

Reports

Get access to 35+ reports that help you in understanding your business better. It is generated from real-time data, enabling you to make calculated decisions.

Munim GST Return Filing

Stay 100% compliant with GST regulations

GSTR-1/IFF

GSTR-1/IFF filing with Munim GST Return Filing has become easier than before. Import data either from MS Excel or our accounting software, and file returns in minutes.

Tally Integration [BETA]

Simplify your GSTR-1 filing with Tally Integration. Import data from Tally prime on a single click and make quick return filing.

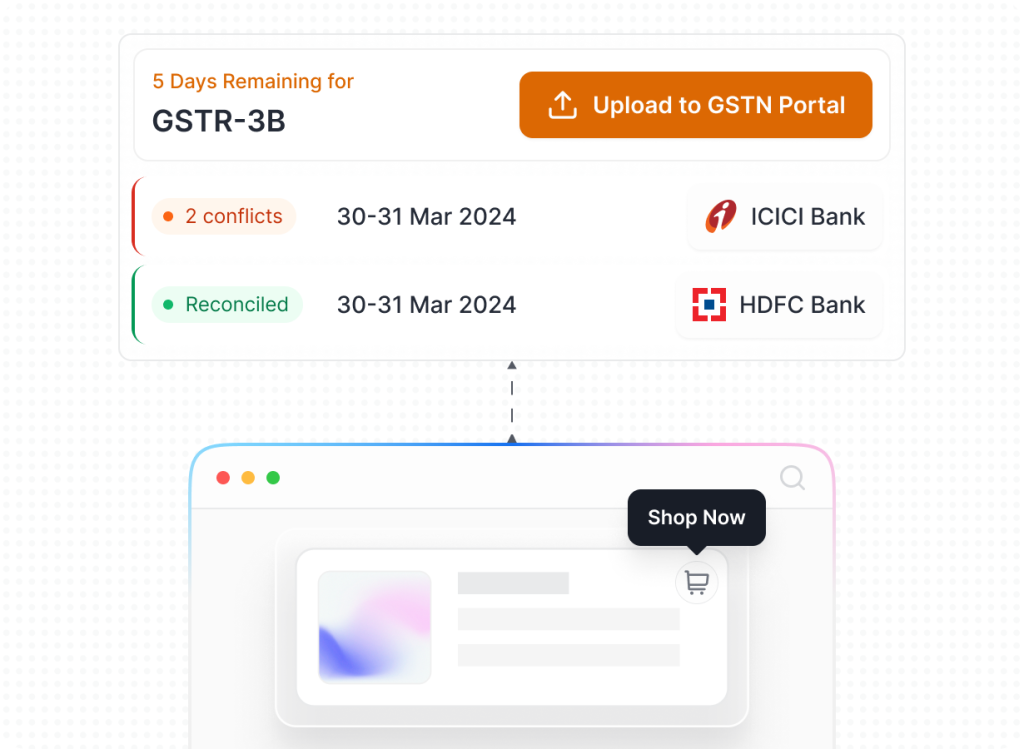

GSTR-3B

Experience the seamless GSTR-3B filing process with Munim. The software is designed to cater for the needs of businesses, accountants and CAs.

GSTR-9/9C

Speed up your year-end GSTR-9/9C filing with Munim. Handling and processing data for an entire year can be overwhelming. Munim makes it simplified.

GSTR-4

File your GSTR-4 annual return with Munim GST Return Filing software effortlessly. Never miss your deadline when you have our software.

Invoice Management System

Managing supplier’s invoice has become easier with Munim’s IMS feature in GST return software. Accept, reject or hold invoices for reviewing later with just a click.

TDS/TCS

Filing TDS/TCS returns requires precision; Munim with stands that level of trust of its users with our accurate TDS/TCS return filing module.

Munim eCommerce Management

Your e-commerce business third eye

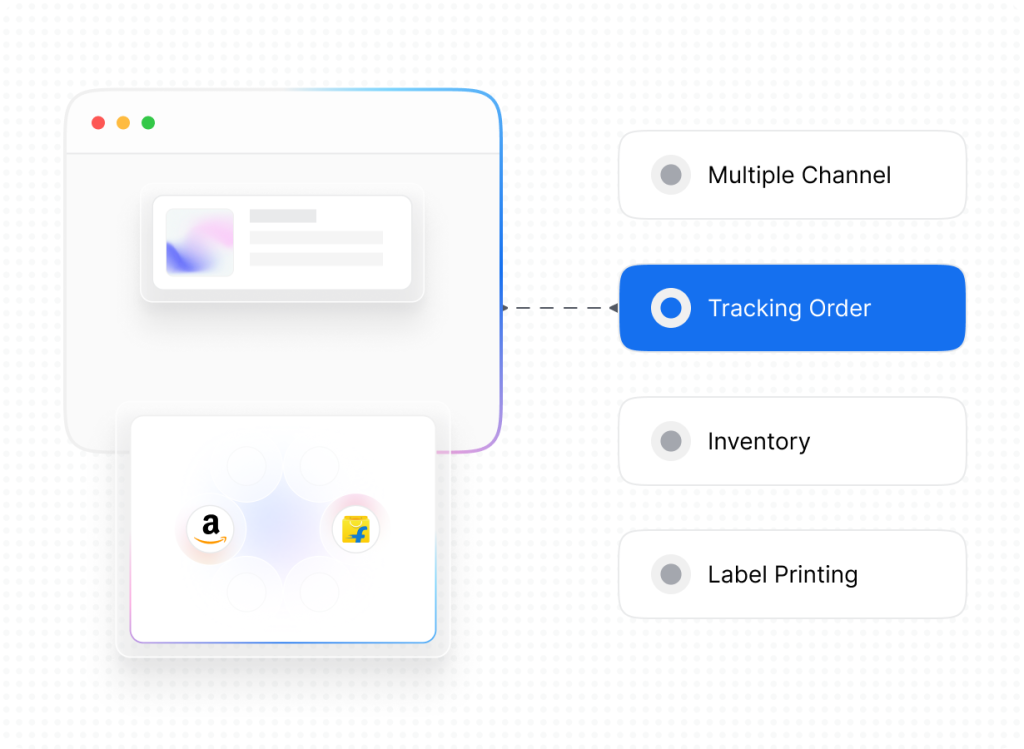

Order management

Manage your orders from multiple e-commerce marketplaces in one place with Munim. It simplifies the workflow; tracking orders, inventory, label printing, and everything else can be done from a single window.

Payment reconciliation

Reconcile the payments received from the marketplaces against the sales and identify the discrepancies. It flags the payments with discrepancies so that you can raise a concern with marketplaces.

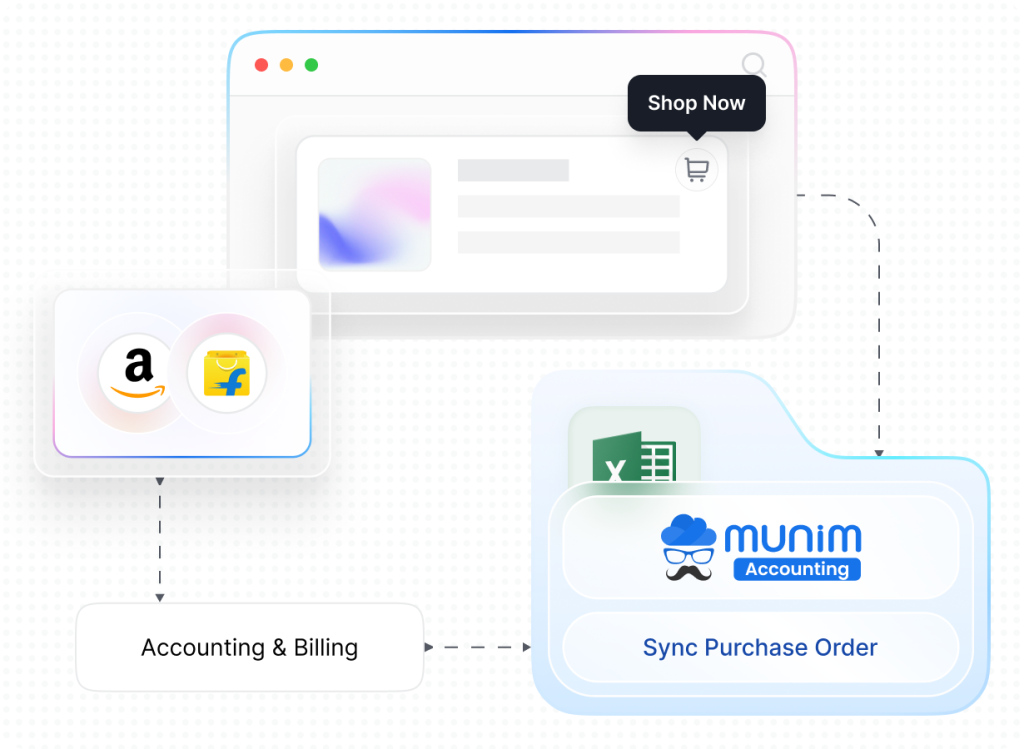

Integrated accounting

Munim eCommerce Management software is integrated with Munim Accounting and Billing software, which handles all your accounting tasks. No data export. No discrepancies.

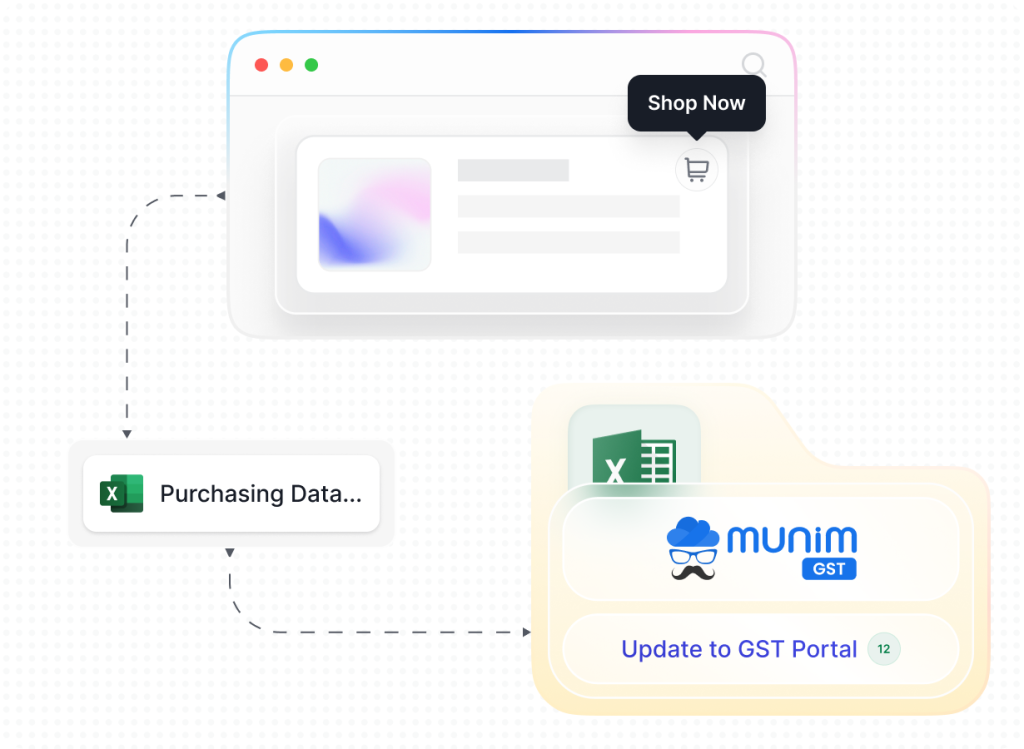

Integrated GST filing

Munim eCommerce Management software is integrated with Munim GST Return Filing software, enabling you to file GST returns with export data to any third-party software.

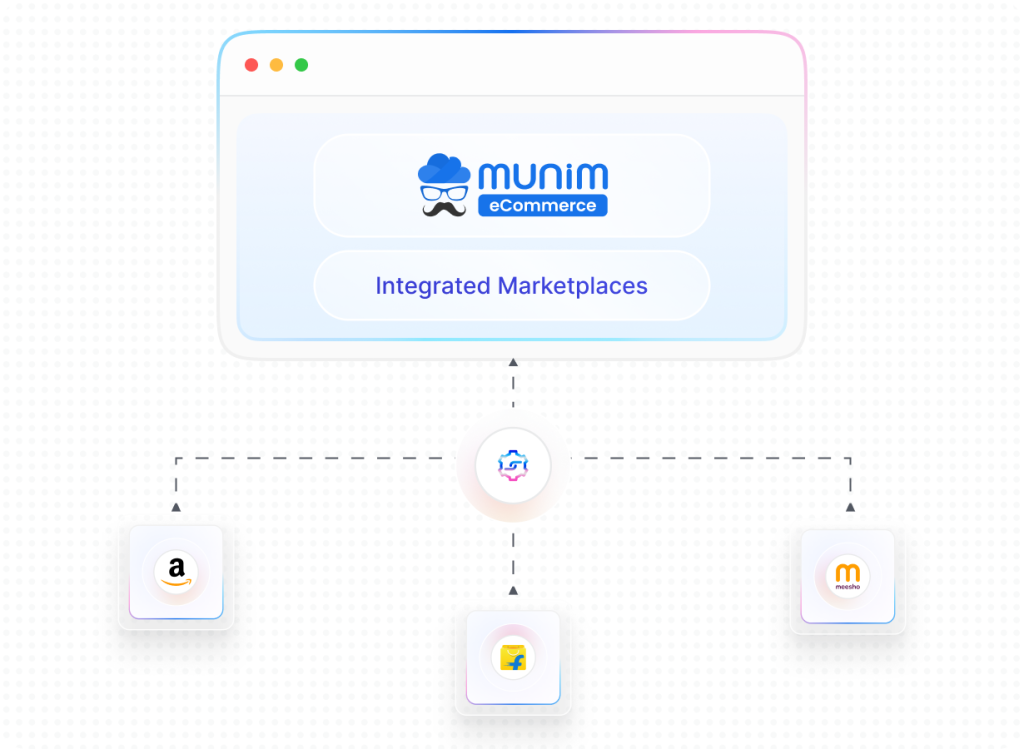

Integrated Marketplaces

Munim eCommerce Management software is integrated with India’s top e-commerce marketplaces such as Amazon and Flipkart, enabling you to sell your products hassle-free.

Numbers That Reflect Our Success

Registered Users

50,000+

Customer Reviews

800+

Support Response Time

Less than 5 minutes

Operational Efficiency

Up to 70% improvement

Industries We Empower

Omnipresence: Available across various devices

Scan To Get the Munim App

Frequently Asked Questions

These are the most commonly asked questions about Munim Products. Can’t find what you’re looking for?

Chat to our expert team!