2016 views

2016 views The TDS & TCS Credit Received Filing Module provides an easy and streamlined way to manage your TDS and TCS credits. Below is a step-by-step guide to using this module effectively:

Fetching Data from GSTN Portal

- Access Summary Data:

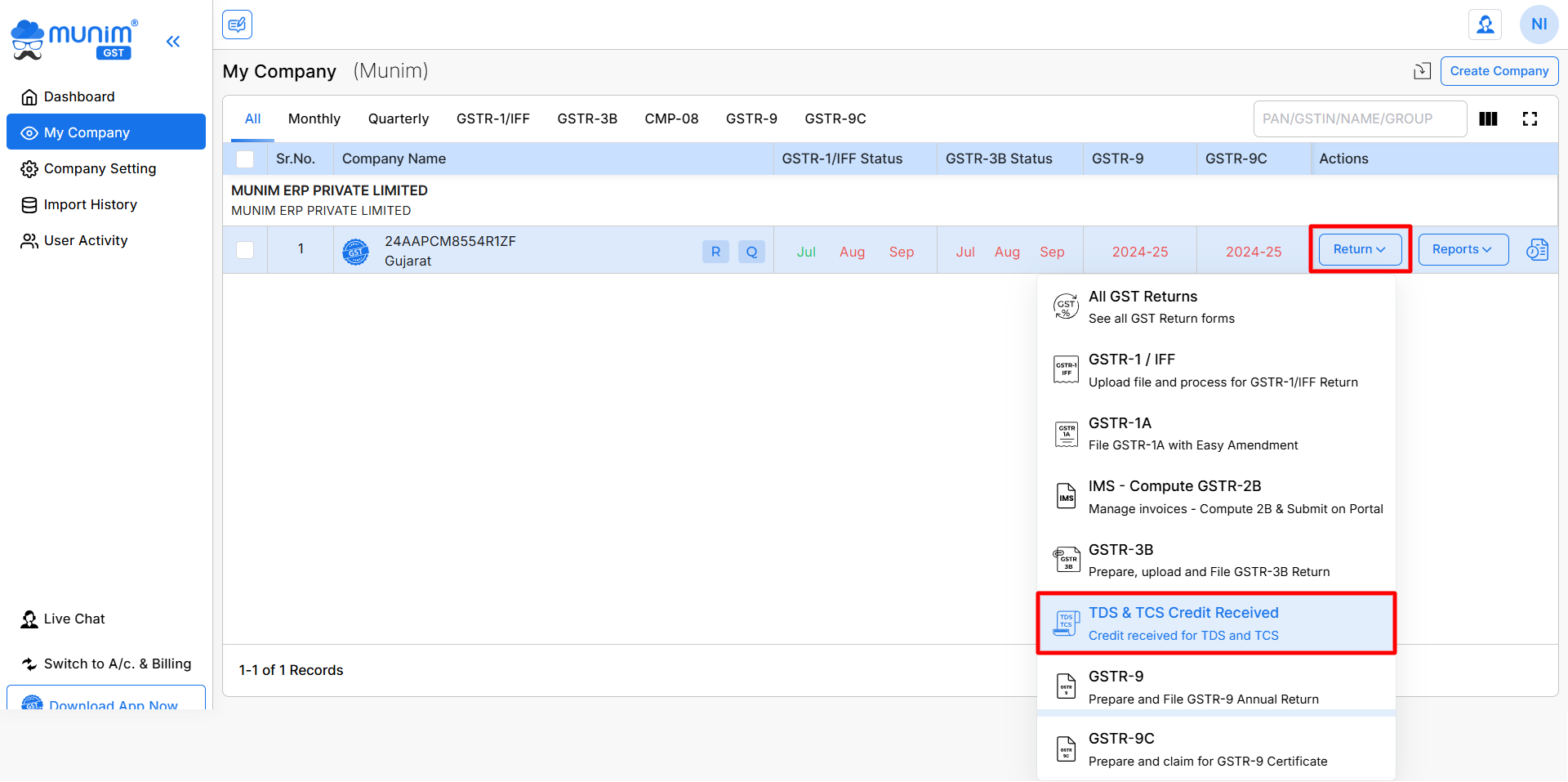

- First, go to the My Company module, here on the company list, click on the Return button and then click the TDS & TCS Credit Received option.

+−⟲

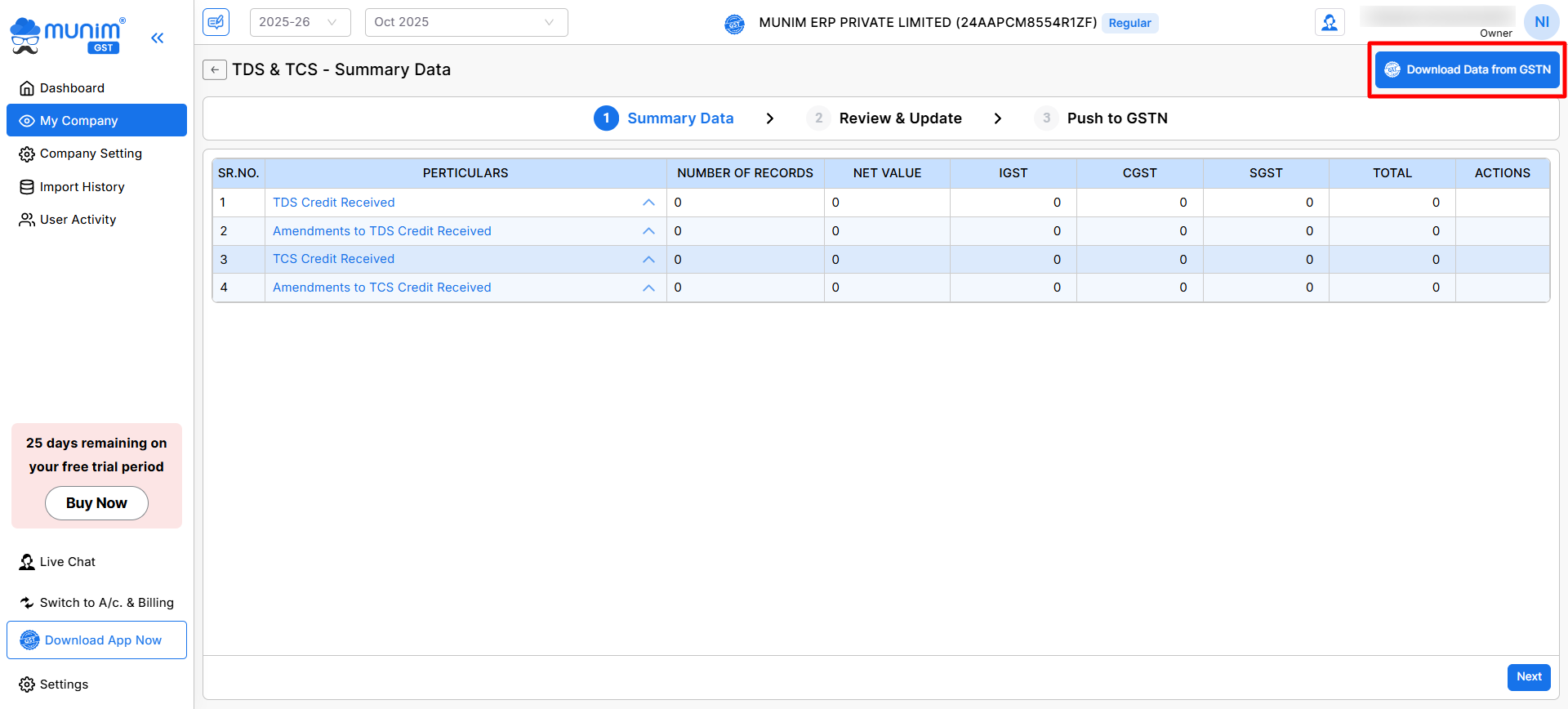

- Start by fetching the TDS & TCS data directly from the GSTN portal by clicking the Download Data from GSTN button from the top right.

+−⟲

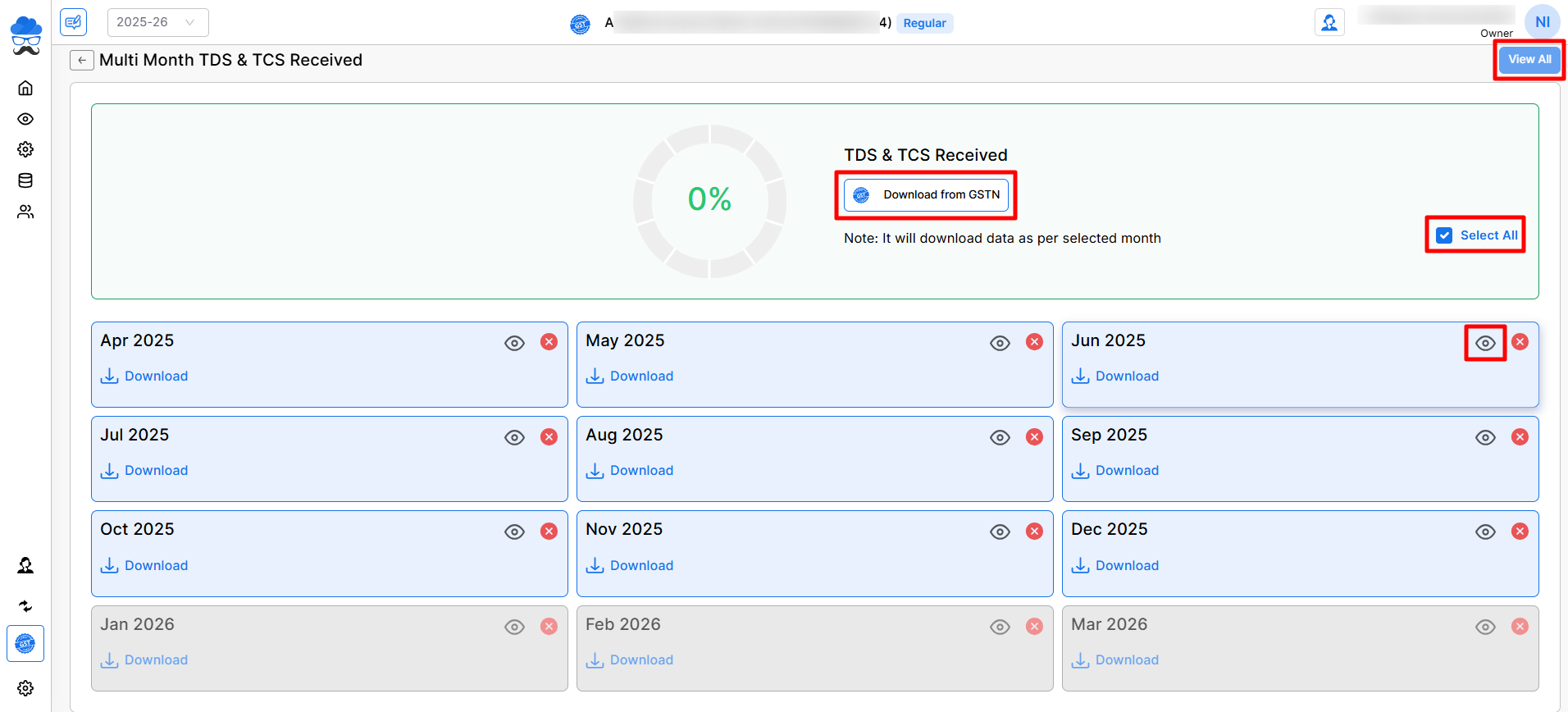

- Once clicked, you can select the required months or click the Select All option and click the Download from GSTN button to fetch data from the portal.

+−⟲

- Here pop-up will appear. Ensure your GSTN credentials are correctly added to fetch data successfully.

- Downloaded data can be viewed by clicking the Eye icon in each month box.

- You can also view all data for the entire financial year simultaneously by clicking the “View All” button located in the top right corner.

- Review Summary:

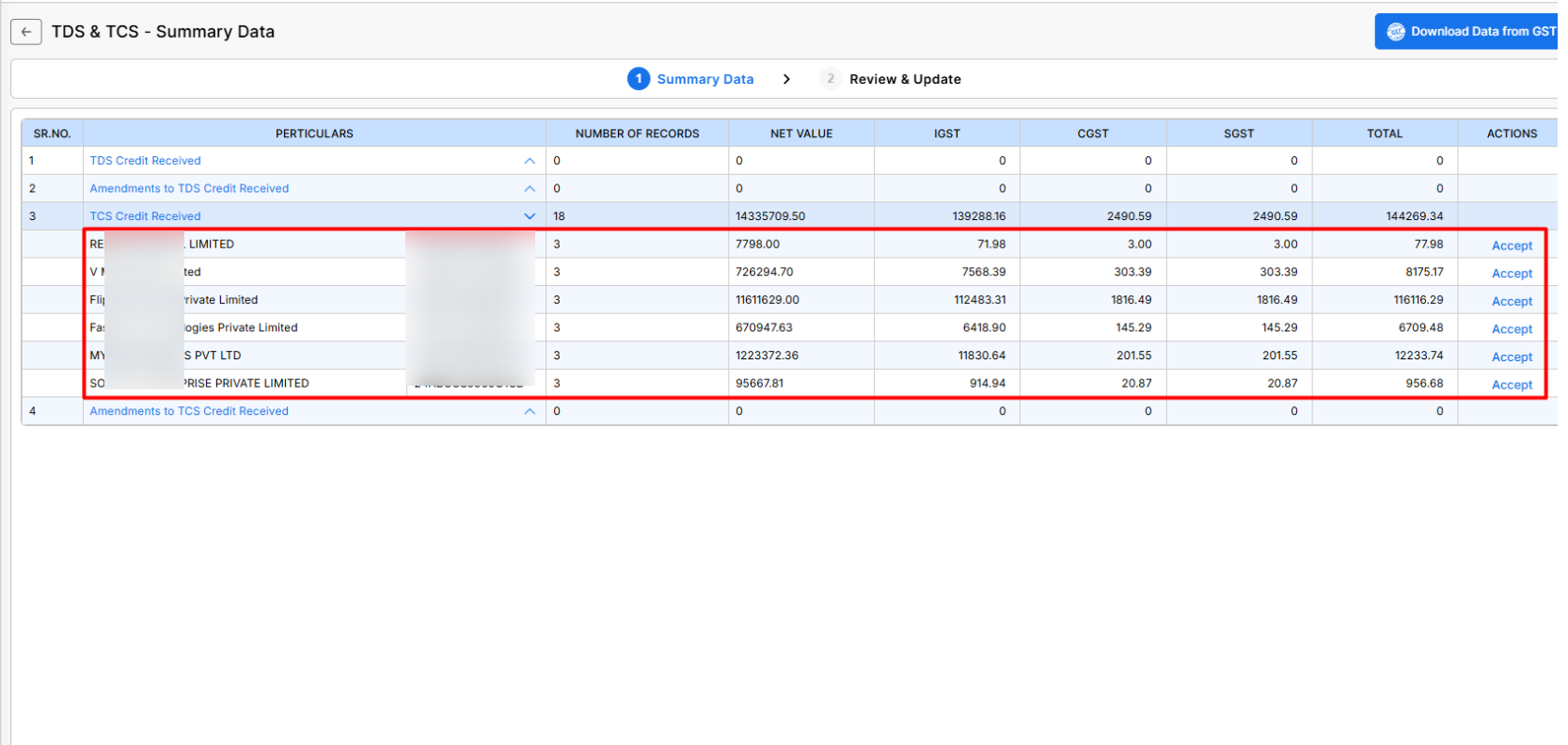

- Once the data is fetched, the summary of TDS and TCS credits will be displayed on the summary data screen.

- Here, you can view more details by clicking the down arrow in the “Particulars” column. You can also accept the downloaded data from the “Actions” column.

+−⟲

- Proceed to the Next Page:

- After verifying the summary data, click the “Next” button located at the bottom-right corner to move to the next step.

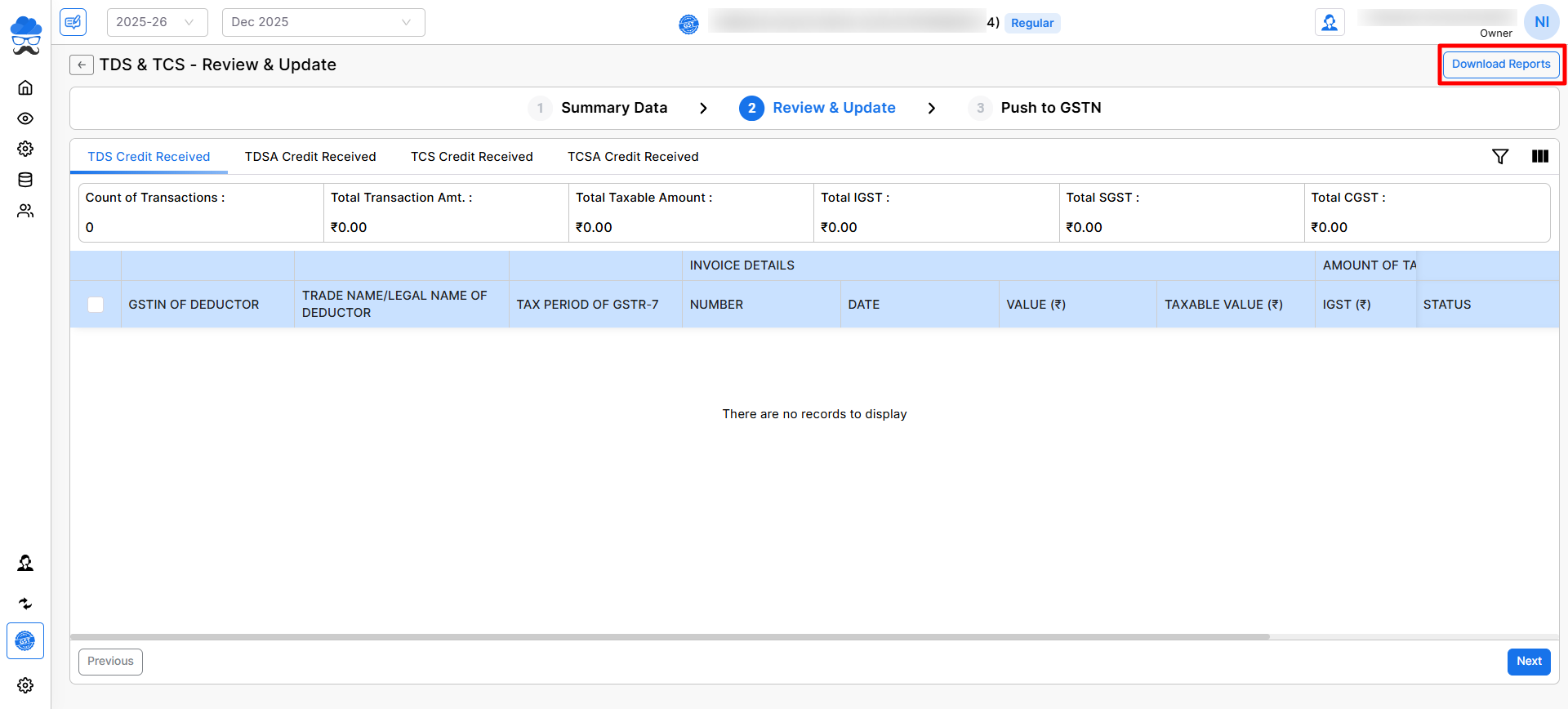

Review & Update Data

- Record-Wise Review:

- The fetched data will be displayed record-wise for easy review.

- Verify each record thoroughly to ensure accuracy.

- You can download data in Excel format by clicking the Download Reports button from top right.

+−⟲

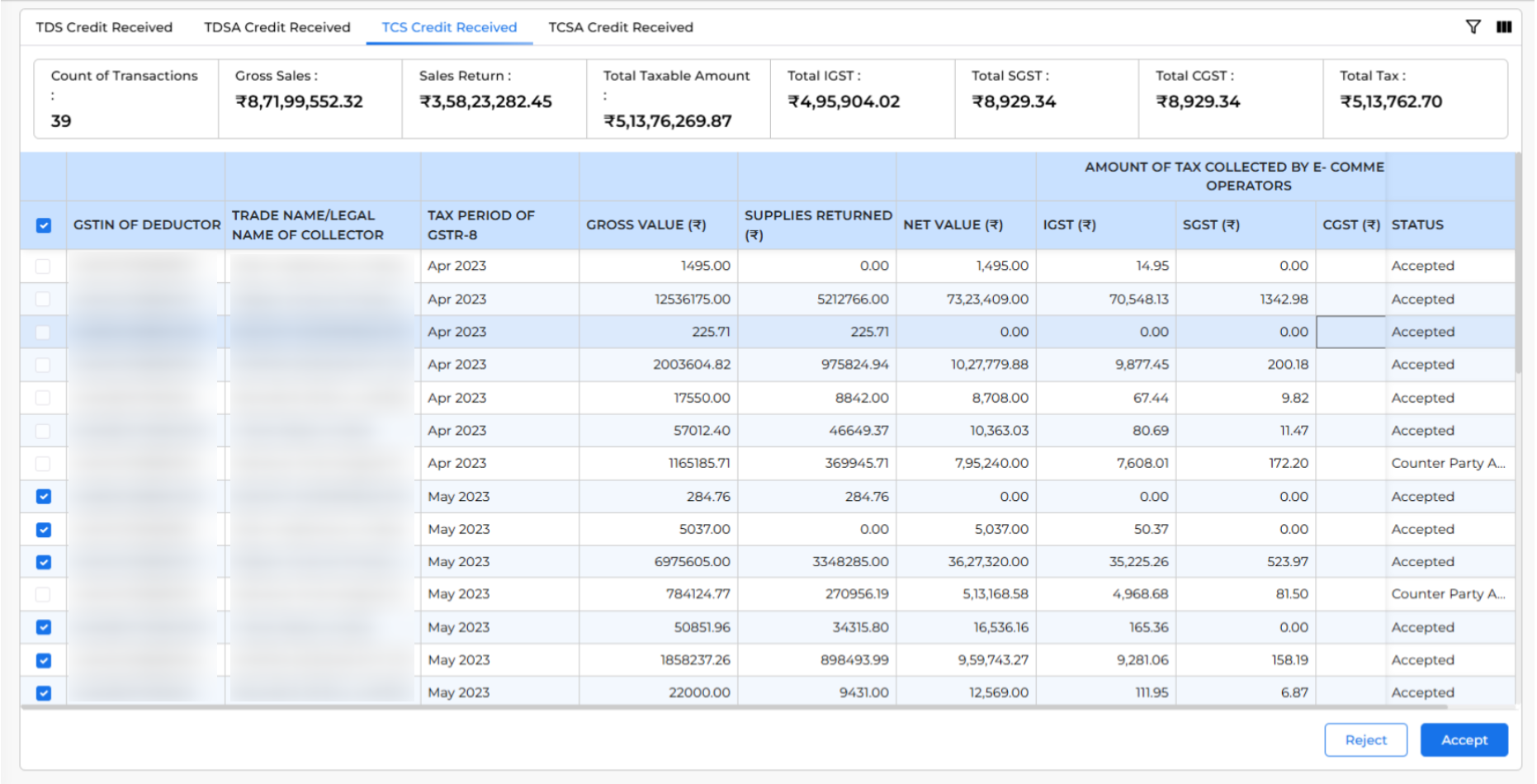

- Update Data:

- Make necessary edits or updates to the records directly within the module.

- You can select multiple entries and update their status as Reject or Accept by clicking the available buttons at the bottom.

- Here, you can not change the status of entries that already have a status of Counter Party Accepted.

- Ensure all details match your business’s internal records.

+−⟲

- Proceed to Upload:

- After reviewing and updating the records, click the “Next” button to proceed to the final step.

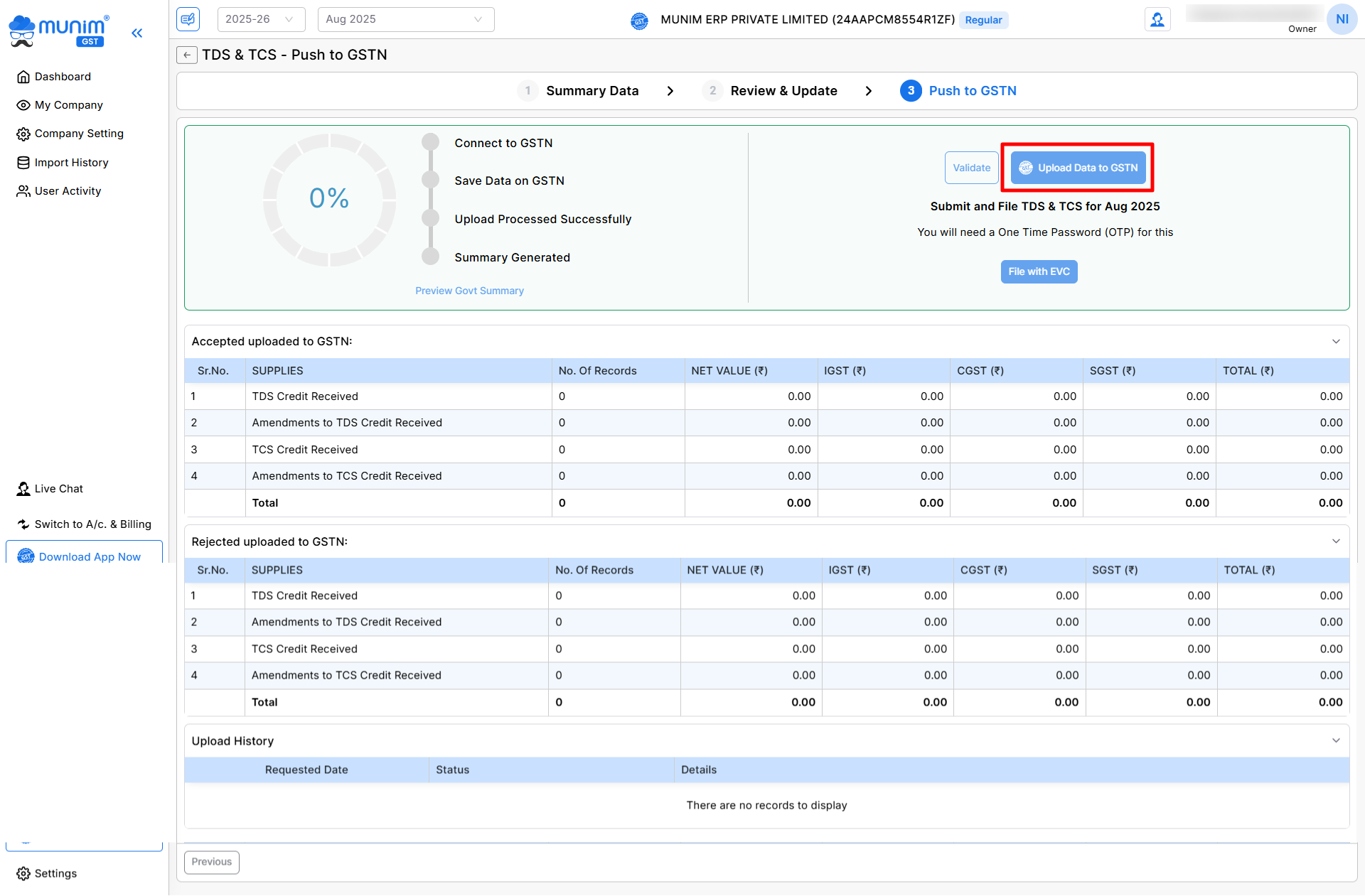

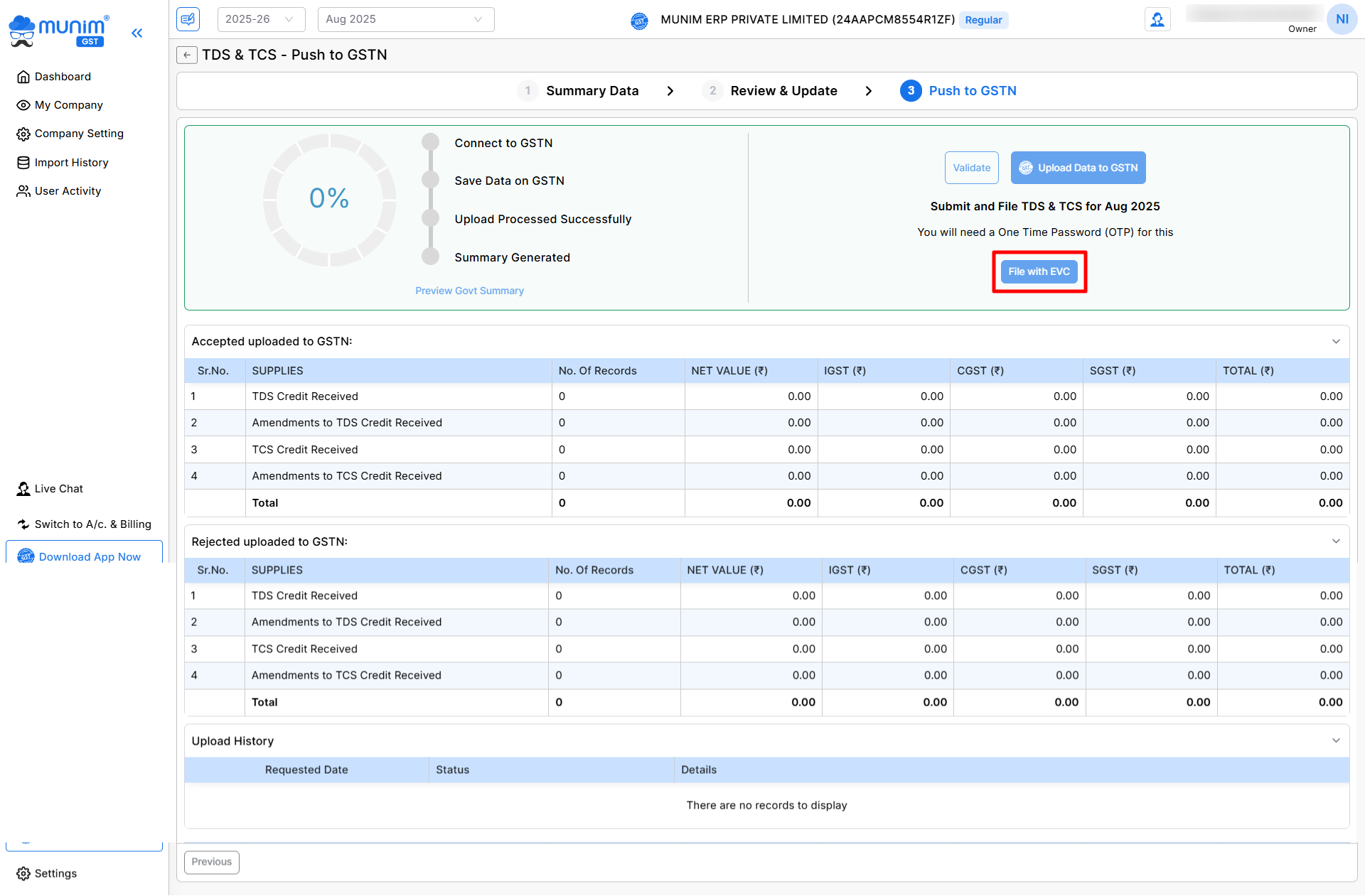

Upload to GSTN Portal

- Upload Data:

- Click the “Upload Data to GSTN” button to submit the updated TDS/TCS data to the GSTN portal.

- The uploading process will start, and it will give you the status of the process here in percentages and stages.

- Under that, you can check the table of Accepted and Rejected data with details and values.

+−⟲

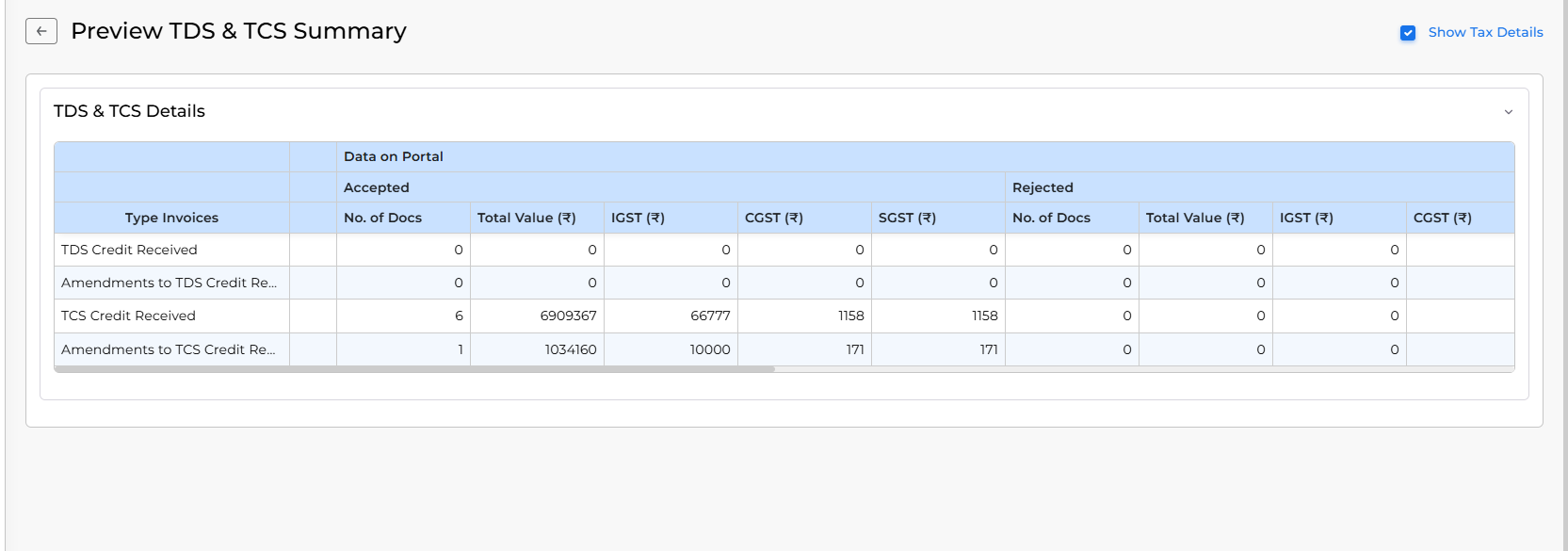

- Preview Summary:

- Once data is uploaded to the GSTN portal successfully, here you can check Govt. summary of uploaded data by clicking the Preview Govt Summary option under the upload status section.

- Also, you will get more details regarding your uploaded data here on this page with values.

+−⟲

- File Return:

- Once the review is done, proceed to file the return as required.

- Click the File with EVC button to proceed further by adding GST portal credentials and complete the process of filing.

+−⟲

This module simplifies the filing process, ensuring compliance and accuracy in managing TDS and TCS credits. For further assistance, feel free to reach out to our Support.