3356 views

3356 views A Multi Month GSTR-4A Report involves consolidating and reviewing the GSTR-4A data for multiple months. It is primarily useful for composition taxpayers to verify the details of inward supplies (purchases) received from registered suppliers. This helps ensure that the data is accurate and consistent before filing the GSTR-4 annual return.

Here are the steps for performing a Multi month GSTR-4A report.

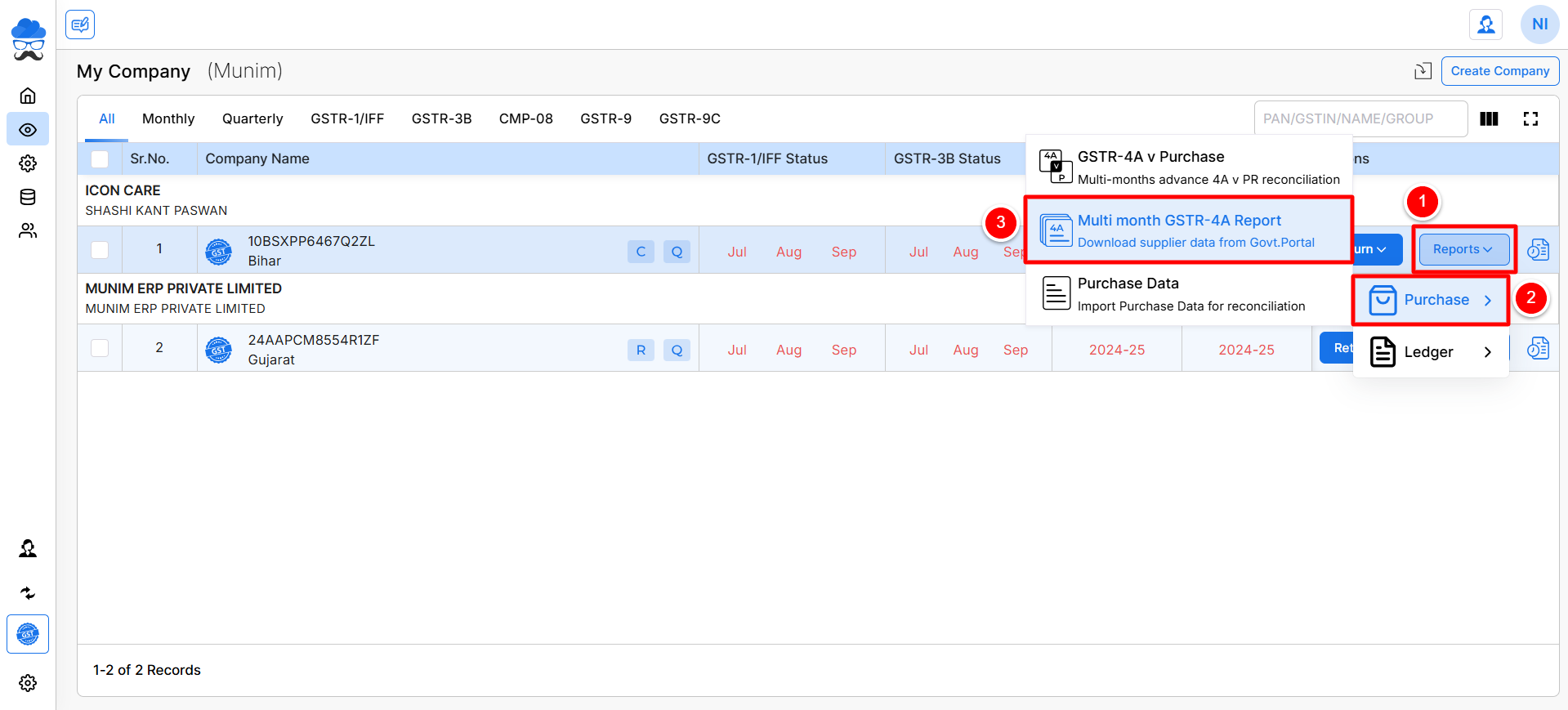

- Select “Multi month GSTR-4A Report” by clicking on the Reports and then the Purchase option on the My Company page.

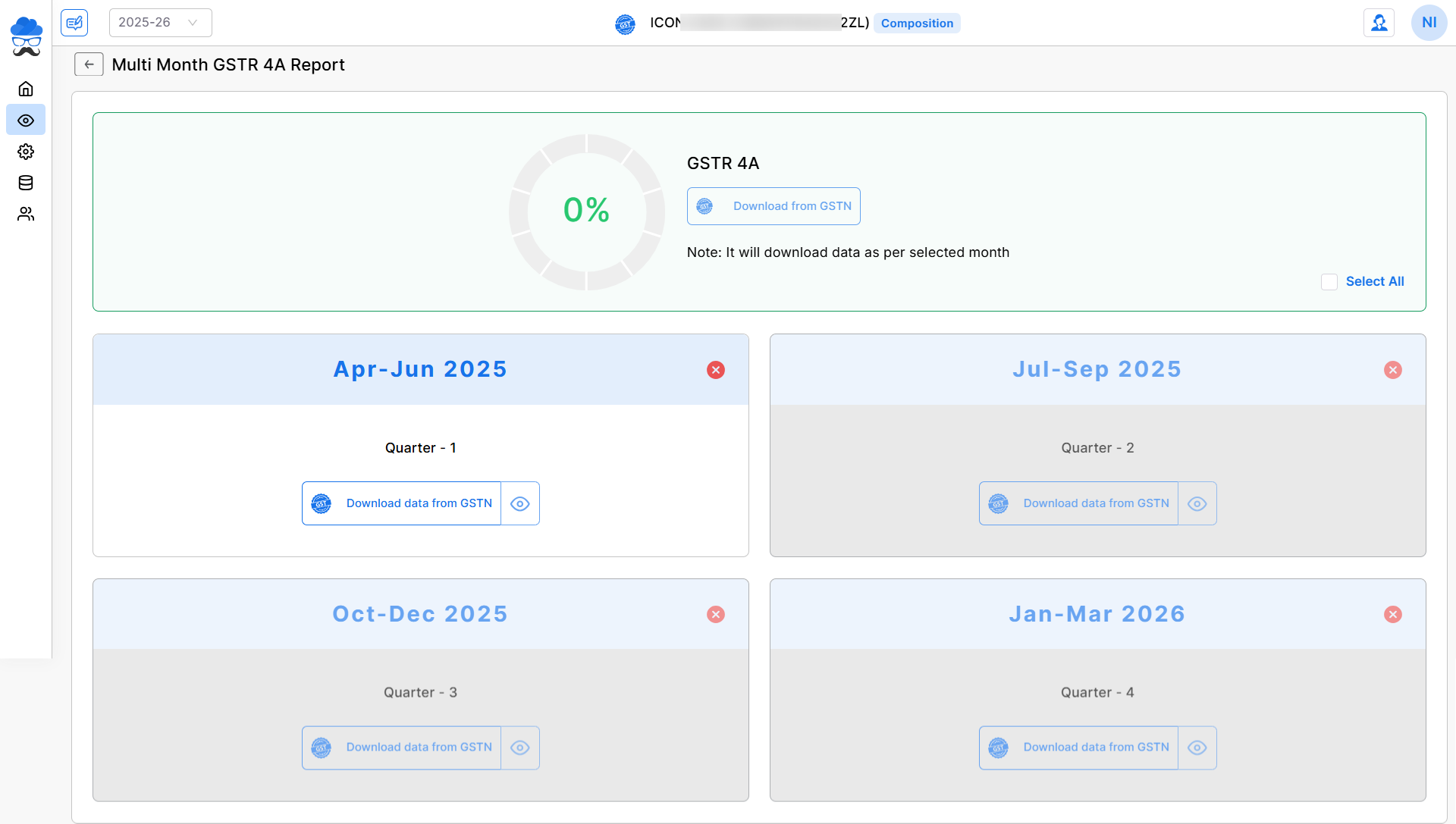

- You have been redirected to the Multi Month GSTR-4A Report page based on the selected financial year.

- In the Quarter Month view page, you can click to select any Quarter, or you can click the Select All option to select available quarters for downloading data.

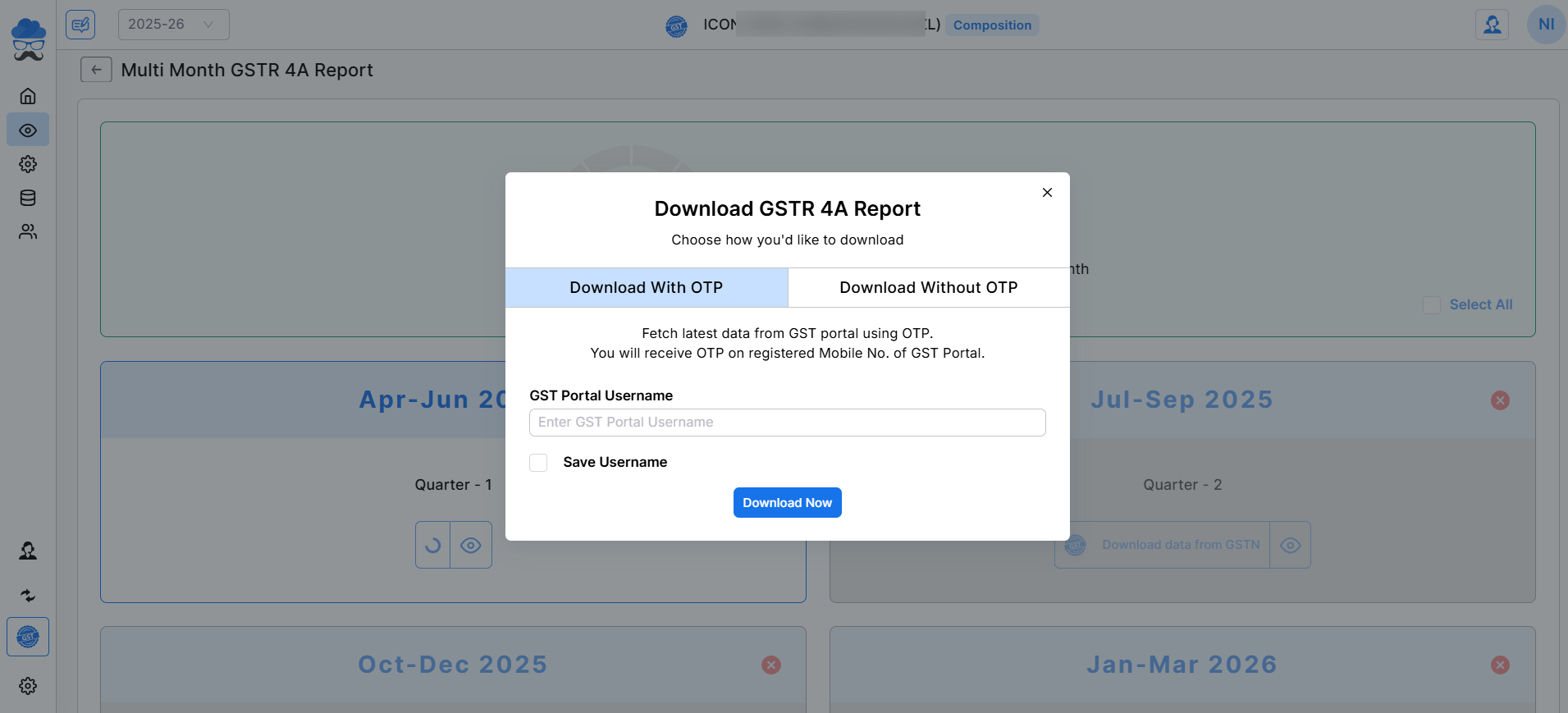

- Now you can click on the Download from GSTN button to download data through two options. Download With OTP or Download Without OTP.

- Download With OTP: Enter the GST portal Username and enter the OTP received on the registered mobile number to download the GSTR-4A data.

- Download Without OTP: Enter the GST portal credentials and captcha to download the GSTR-4A data from the GST portal.

Note: You must use the Munim desktop app to download the data. Also, if you have saved the GST portal username and password with the Company details, they will be automatically filled in the screen below.

- After downloading the data, you will see a page indicating which month’s data has already been downloaded and which month’s data is still pending to download.

- If the data for a month has not been downloaded, you will see a “Download data from GSTN” button.

- After successfully downloading your data, you can view it month-wise by clicking on the View icon (👁) and use it for Purchase vs. GSTR-4A reconciliation.

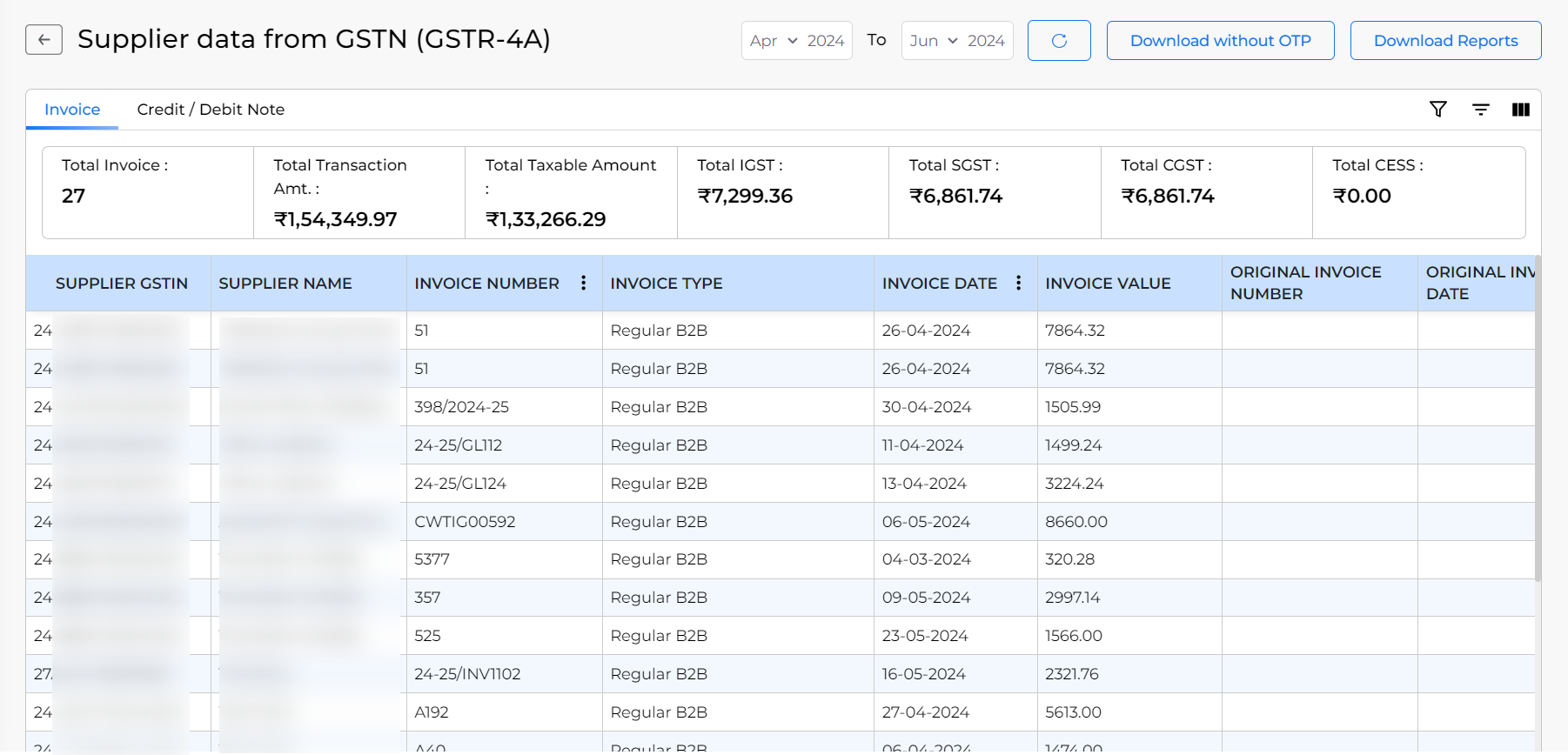

- Here on this page, you will find the data of the GSTR-4A in detail

- All data is shown in two sections: Invoice and Credit/Debit Note.

- Also, you can select multiple months from the month selection field on the top right side to see multiple or annual data at once.

Data Download:

On this page, we have provided a Download Reports button at the top right corner to download GSTR-4A data in Excel format.

Need Help:

For any queries or questions regarding this feature, please contact our support team.