2473 views

2473 views All the information regarding GST services, government notifications, circulars, FAQs, return due dates, Tutorial videos, Upcoming services and our contact support list can be accessed on the desktop version.

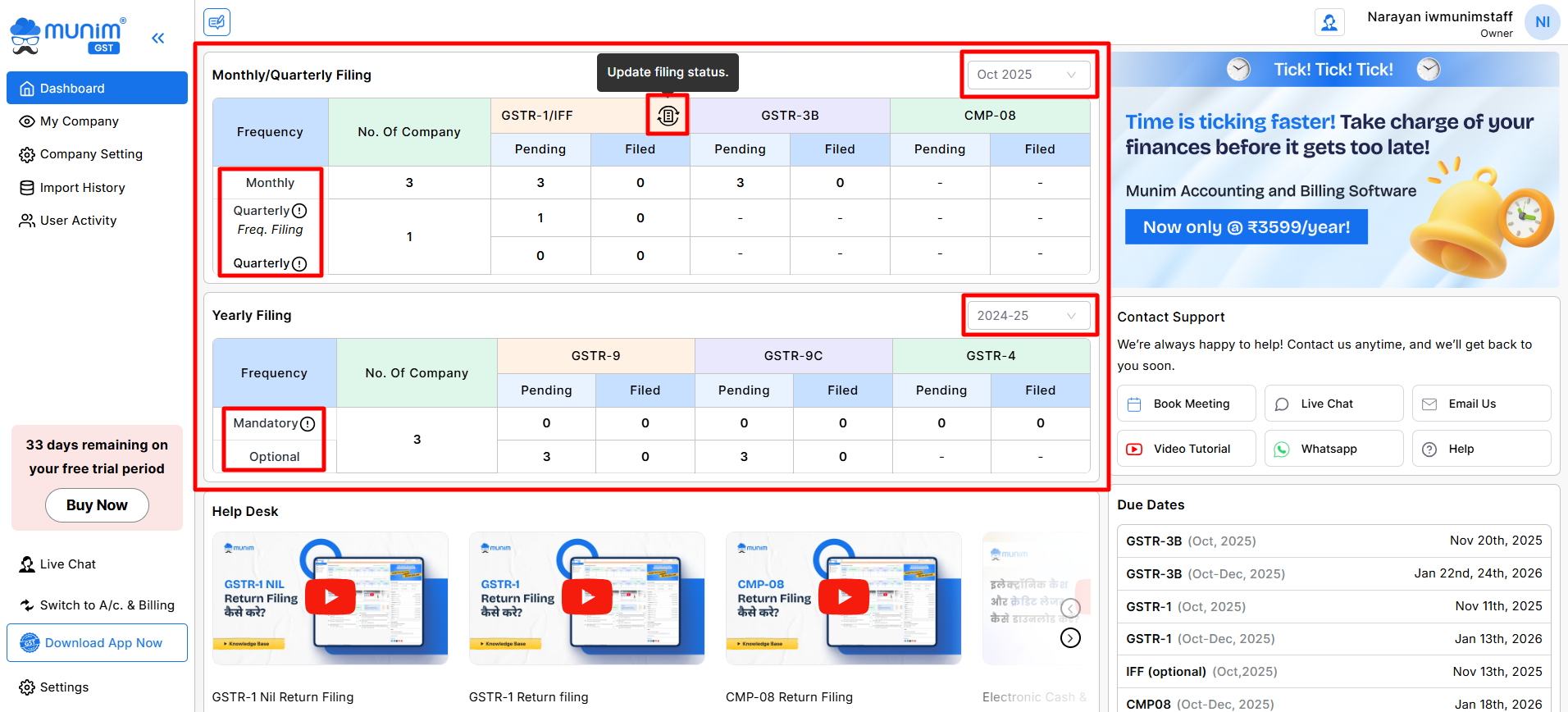

01) Analytics data

- Here, users will find a list of imported companies, categorized by their monthly or quarterly return types, along with their yearly filing status.

- Here, users can review the pending or filed status of companies. Additionally, the Yearly Filing status of companies can be checked here.

- Here you can check Mandatory or Optional fields for GSTR 9 or 9C based on its turnover (from the previous year’s GSTR-3B).

- Companies exceeding 2 Cr are in mandatory GSTR-9, and those exceeding 5 Cr are in mandatory lists for both GSTR-9 and GSTR-9C.

- Filings are classified per statutory thresholds. Prior year’s PAN-level turnover is calculated using filed GSTR-3B reports.

- Here, you’ll find an additional option to select the Month to view pending or filed returns for your company.

- You can click on the Update Filing Status icon in every filing type field to update the filing status of all companies at once.

+−⟲

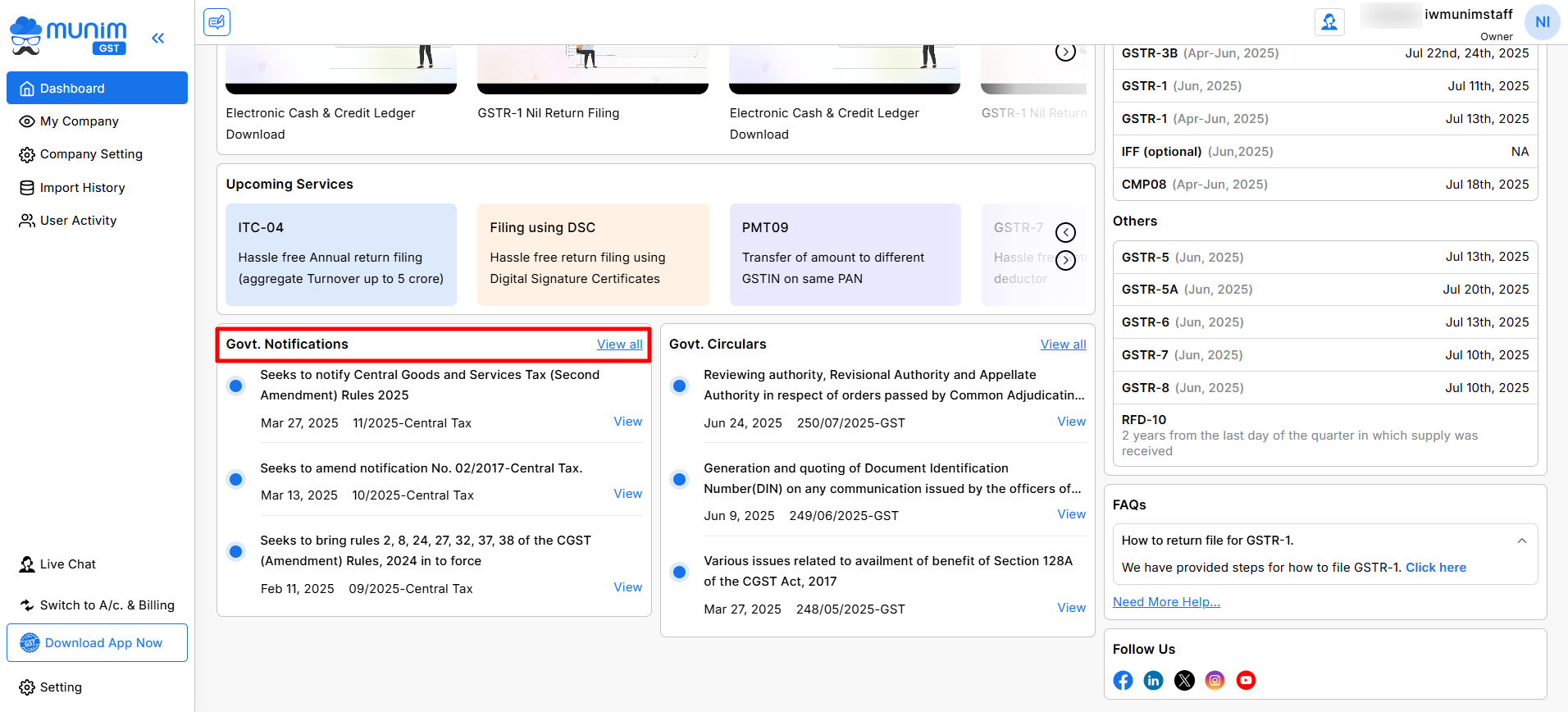

02) Govt. Notifications

- In the context of GST (Goods and Services Tax), a notification refers to an official communication issued by the government or relevant tax authorities.

- To inform taxpayers about GST-related modifications, updates, and significant announcements concerning laws, regulations, procedures, rates, exemptions, deadlines, and compliance matters.

- These notifications offer clarity, guidance, and awareness to taxpayers regarding their GST rights, obligations, and responsibilities.

- Access the latest notifications to view them collectively or select specific ones for detailed viewing.

+−⟲

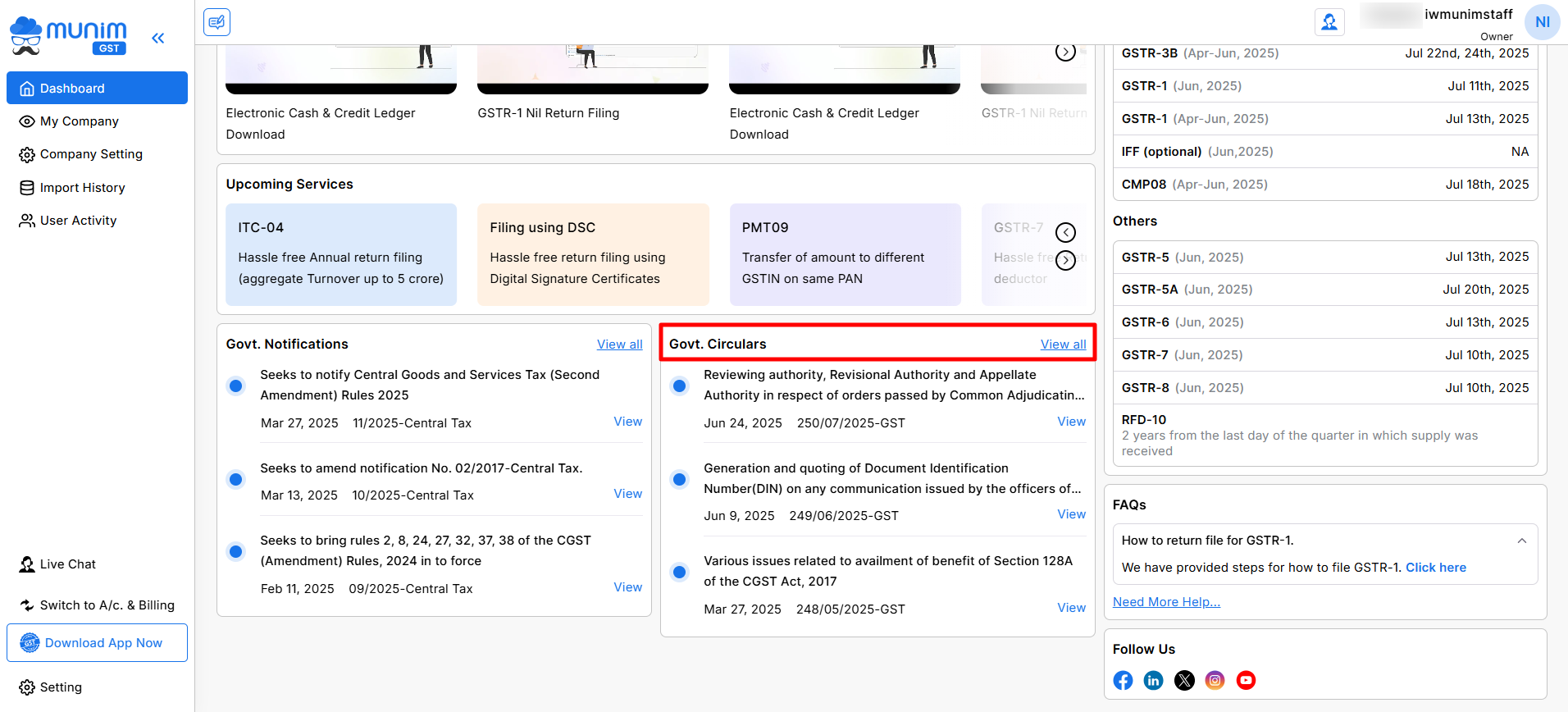

03) Govt. Circulars

- In the context of GST (Goods and Services Tax), a circular refers to an official document issued by the government or tax authorities to provide clarification, interpretation, or guidance on various aspects of GST laws, rules, procedures, or policies.

- These circulars aim to provide thorough explanations or solutions to specific issues, ambiguities, or questions regarding GST implementation, compliance, or administration.

- They serve as authoritative references to ensure uniform understanding and application of GST provisions. Access the latest circulars; view them collectively or select specific ones.

+−⟲

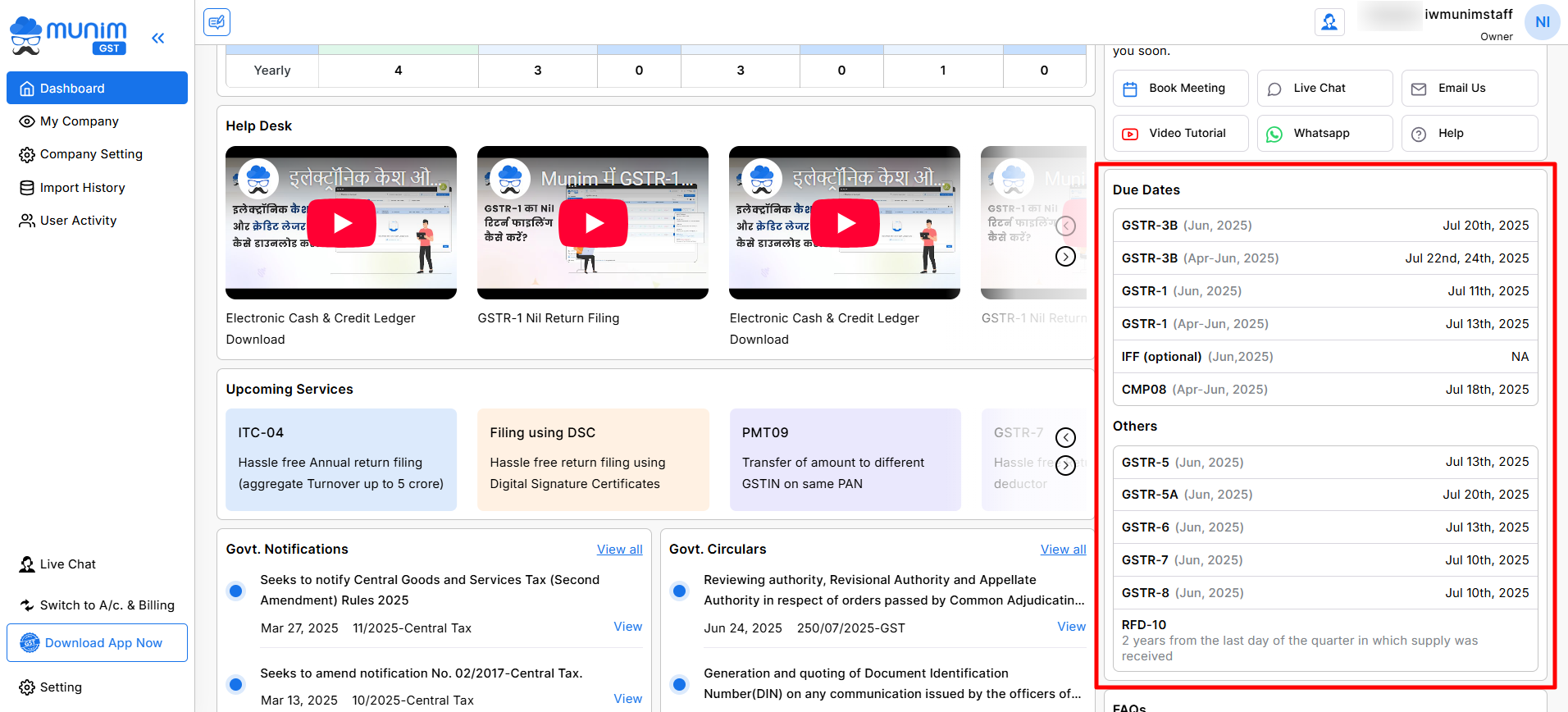

04) Return due dates

- Here, users can access all updated return dates, specifically tailored to their company’s return filing type.

- You can monitor your filing dates and ensure timely submissions. helping you maintain complete compliance and avoid potential penalties or complications arising from late submissions.

+−⟲

05) Contact Support

- If you have any questions about the Munim GST app, several options are available to reach our support team. You can use the “Do you Need Help?” button (top right) or the “Contact Support” section (right side).

- If you have any questions about any process within the Munim GST app, you can quickly find solutions by referring to the extensive FAQ section available.

- Feel free to connect with our support team; we’re here to assist you with any inquiries or concerns you may have. Your satisfaction is our priority!