1857 views

1857 views GSTR-9 is the annual return for GST-registered businesses, summarizing outward and inward supplies, input tax credit (ITC), and taxes paid during the financial year. The following steps guide you through the filing process in Munim.

GSTR-9 is mandatory only for regular taxpayers whose annual aggregate turnover exceeds ₹2 crore. Taxpayers with turnover up to ₹2 crore are exempted, though they may file voluntarily.

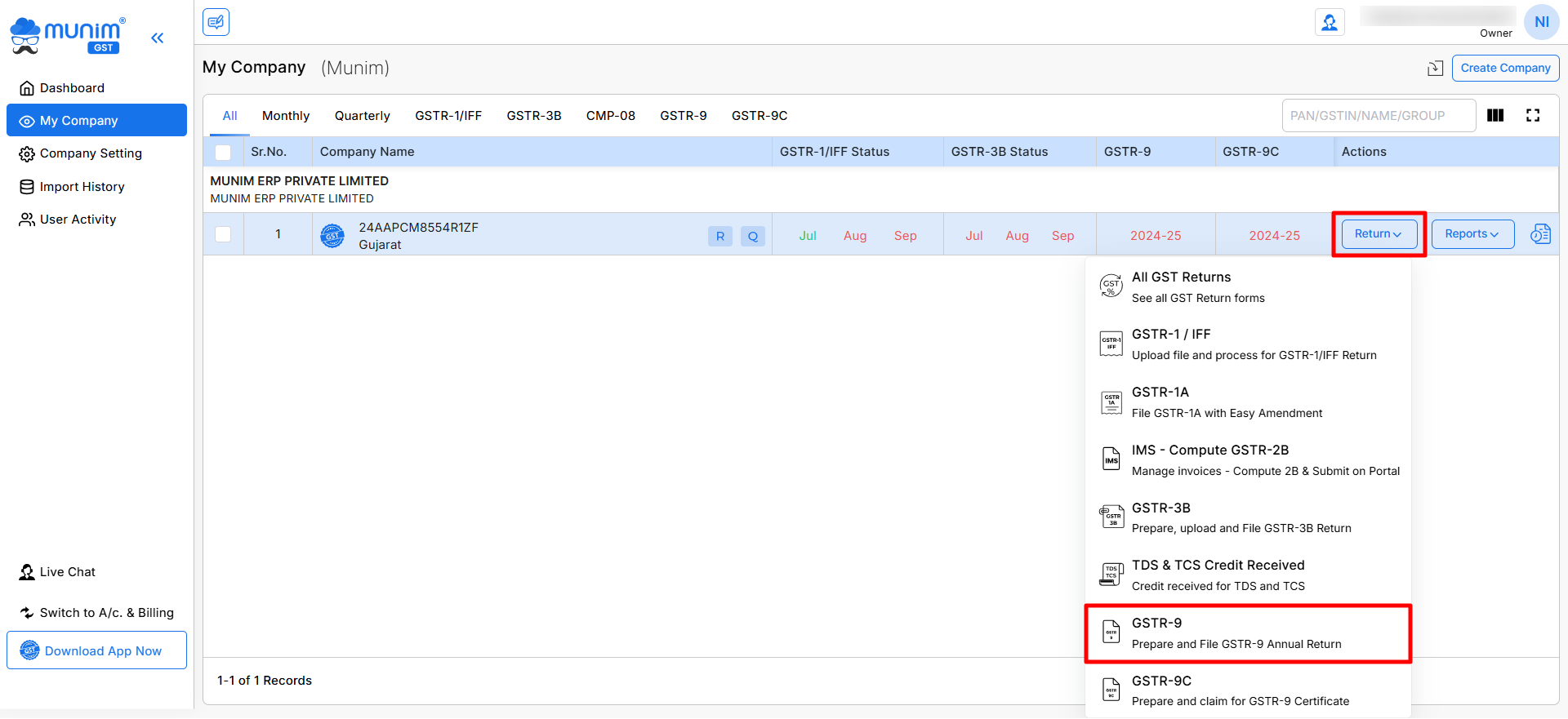

GSTR-9 option:

- First, go to the My Company page and select the GSTR-9 option from the Return button of the company.

Data Fetch From Portal:

- Import Data from the GST Portal

- Once you are on the GSTR-9 page, click the “Import From GST Portal” button on the top right side.

- By clicking here, you have to choose from one of the options available:

- Download With OTP: Download data by requesting OTP on the registered number by adding the GST portal Username.

- Download Without OTP: Download data by adding GST portal credentials and captcha; this process depends on the GST portal.

- This fetches your GST data directly from the GST portal for the selected Financial Year.

- Check Imported Data

- Once the data is imported, review the details under the following sections:

- Part-I: Summary of GSTR-9.

- Part-II: Outward & Inward Supplies.

- Part-III: Input Tax Credit (ITC).

- Part-IV: Tax Paid and Declared.

- Part-V: Transactions Reported in the Next Year.

- Part-VI: Other Information.

- Navigate through these tabs available at the top to verify and validate the data fetched by clicking the Save & Next button at the end of the page.

- Once the data is imported, review the details under the following sections:

- Add and Review HSN Summary of Outward and Inward Supplies in Part-VI:

- In the Part-VI section, add HSN Summary of outward supplies data in Table No. 17, such as Outward Supply with GST. Outward Supply without Payment of GST. HSN Summary by clicking the Add/Edit HSN/SAC Details option.

- On this page, you can retrieve this data from the GST portal by selecting the “Fill Data From GSTR-1 Filed” button. You may also upload the data in Excel format using the Import Data button.

- Also, you can add HSN Summary of inward supplies data in Table No. 18, like ITC availed, reversals, and any adjustments. Click on the Add/Edit HSN/SAC Details option to add HSN summary manually.

- Download Report and Validation of Data

- We have provided a Download Report option at the top right corner, where you can download and check the report in Excel format in two variations: Draft G9 Report and System Generated G9 Report.

- You may review the Excel report or share it with others for verification purposes. It comes with a detailed data sections and tabs.

- Validate the taxable amounts, CGST, SGST, IGST, and CESS values in the table to ensure accuracy.

- Make corrections if required before proceeding to the computation.

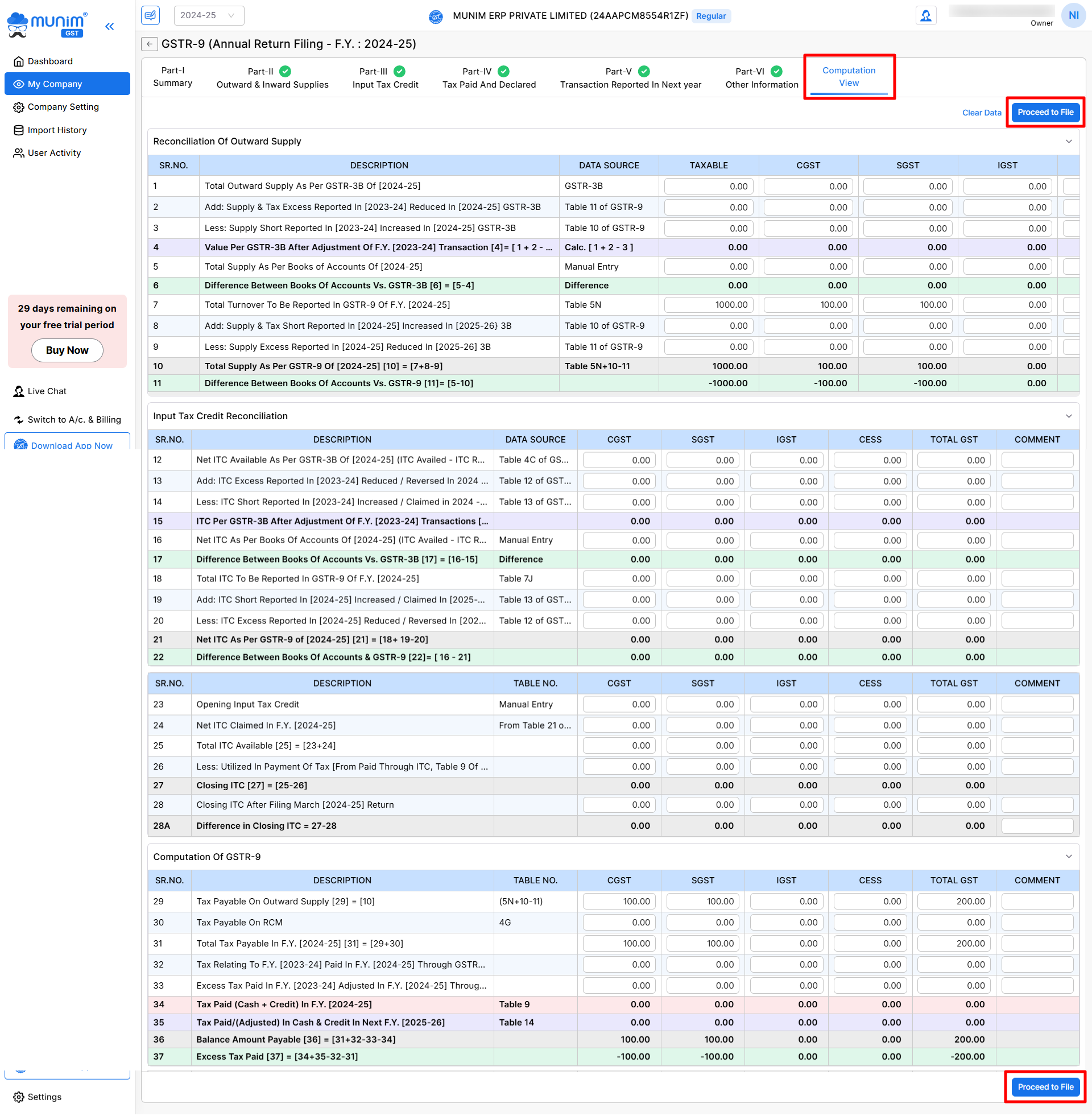

- Computation and View

- Click on the Computation View tab, last in the section tabs, to check a summary of the total tax liability, ITC, and other figures.

- Ensure that the computed values match your internal records. In case of any differences, you can make manual entries to correct them in some tables like 5, 16 and 23.

- Finalise & Export Data

- Once validated, you can finalise the filing return.

- Click the Proceed to File button to go to the Upload Data to GSTN option on the Return submit page.

Return Filing process:

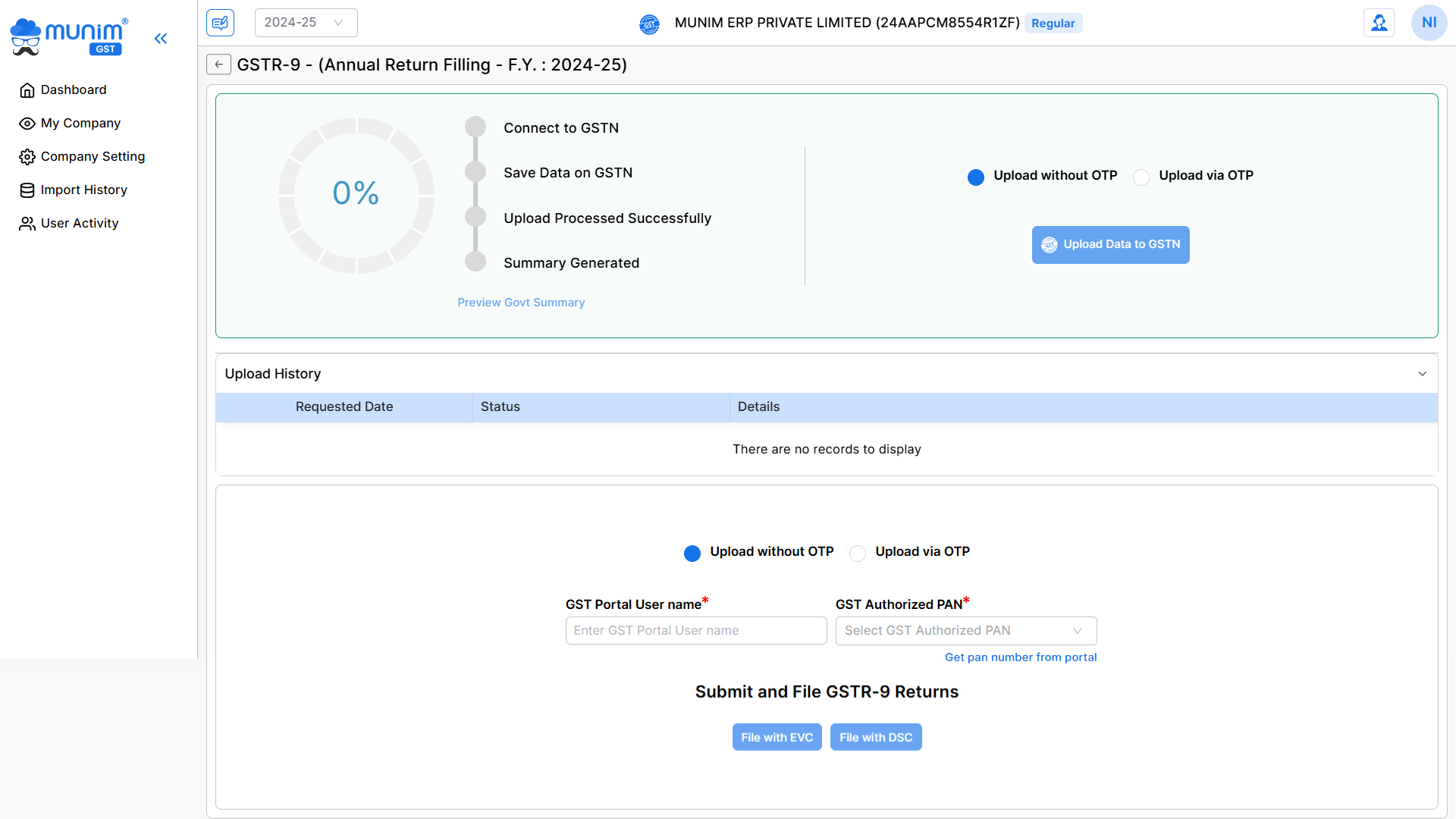

1. Upload Data to GST Portal

- Begin the upload process, click the “Upload Data to GSTN” button by selecting any option from:

- Download With OTP: Download data by requesting OTP on the registered number by adding the GST portal Username.

- Download Without OTP: Download data by adding GST portal credentials and captcha; this process depends on the GST portal

- This will start to upload all your GSTR-9 data directly to the GST portal for the selected financial year (2023-24).

2. Track Filing Progress

The top section shows a progress indicator with key milestones for smooth tracking:

- Connect to GSTN

- Save Data on GSTN

- Upload Processed Successfully

- Summary Generated

You can preview the summary anytime by clicking on “Preview Govt Summary” to verify your data after successful uploading.

3. View Upload History

- The Upload History table displays the status, requested date, and details of previous uploads.

- If no data has been uploaded yet, the table will display “There are no records to display.”

4. Submit & File GSTR-9 Return

Follow these steps to file your returns:

- Choose Upload Method:

- Upload without OTP

- Upload via OTP

- Enter Mandatory Details:

- GST Portal Username: Enter your registered GST portal username.

- GST Authorised PAN: Select the authorised PAN from the dropdown. If unsure, use the “Get PAN Number from Portal” option to fetch it directly.

- File Returns:

- Click “File with EVC” (Electronic Verification Code) to file using EVC.

- (Coming Soon) “File with DSC” (Digital Signature Certificate) for secure filing via DSC.

- Success message:

- Initiate the submission process and complete the required procedures to finalise the filing process.

- Once you complete the process of filing, you will get a Filing Success page.

If you encounter any issues during the GSTR-9 filing process or need any help, please get in touch with our Support.