1875 views

1875 views GSTR-9C is a mandatory reconciliation statement for taxpayers whose aggregate annual turnover exceeds ₹5 crore.

It reconciles the data reported in GSTR-9 with the figures in the audited financial statements, ensuring accuracy, transparency, and compliance.

This statement must be certified by a Chartered Accountant or Cost Accountant and is filed along with the annual return

GSTR-9C option:

- First, go to the My Clients page and use the GSTR-9C option from the Return button of the client company.

Data Fetch From Portal:

- Import Data from GST Portal

- To begin, click the “Import From GST Portal” button available in the top right section.

- This fetches your GST data directly from the GST portal for the selected Financial Year by entering your GST Portal credentials.

- Import Data from System

- To import data from the system, in case you have prepared data of GSTR-9 in software but have not filed it yet. Then you can click the “Import From System” button to fetch that data.

- Check Imported Data

- Once the data is imported, review the details under the following sections:

- Part-l: Basic Details

- Part-ll: Turnover Reconciliation

- Part-lll: Reconciliation Of Tax Paid

- Part-lV: Reconciliation Of ITC

- Part-V: Additional Liability

- Once the data is imported, review the details under the following sections:

Within each section, users can review and modify the data as necessary, utilising the available correction fields, which are open for editing.

Navigate through the tabs by clicking the Save & Next button at the end of the page to verify and validate the data fetched and move forward.

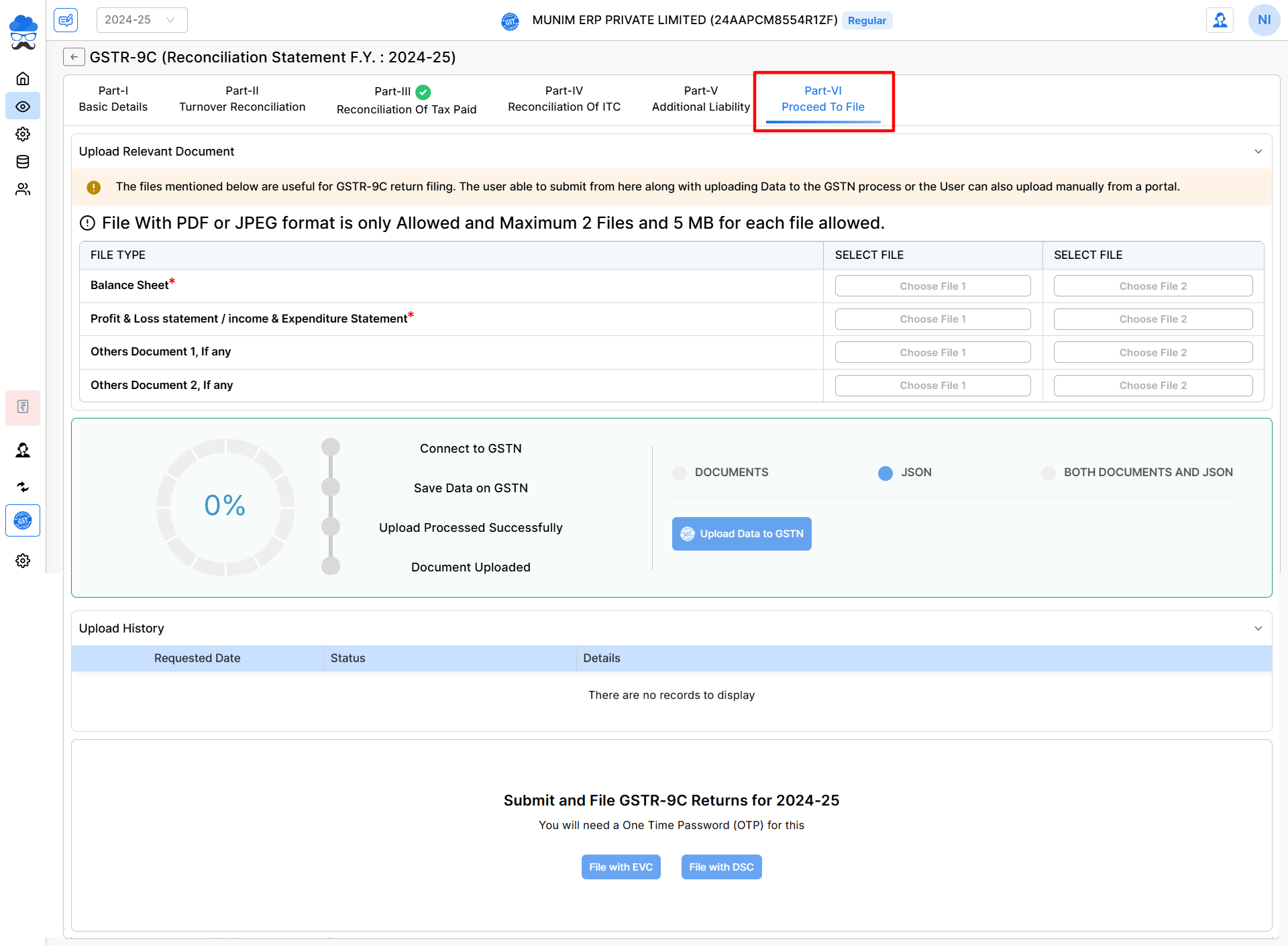

- Part-VI – Proceed To File:

- Here, you have to upload the Relevant Document. You must upload the mandatory Documents to proceed.

- Balance Sheet.

- Profit & Loss Statement.

- Other Documents.

- Here, you have to upload the Relevant Document. You must upload the mandatory Documents to proceed.

- Upload Data to GST Portal

- Once the required Documents are added, begin by clicking the “Upload Data to GSTN” button.

- This will upload all your GSTR-9C data directly to the GST portal for the selected financial year.

- There are three options while uploading data to GSTN:

- JSON: If you want to upload data to the portal only at this stage, you can select this option. This will update the progress bar to 75%.

- Document: Once JSON is uploaded, this option will be enabled when you upload the required Documents for filing.

- Both: This option will be available when you have uploaded the required Documents and you want to file completely at once.

- Fill in your GSTN Portal Credentials to continue the uploading process.

- There are three options while uploading data to GSTN:

- Track Filing Progress:

- The progress section shows a progress indicator with key milestones for smooth tracking:

- Connect to GSTN

- Save Data on GSTN

- Upload Processed Successfully

- Document Uploaded

- The progress section shows a progress indicator with key milestones for smooth tracking:

- View Upload History

- The Upload History table displays the status, requested date, and details of uploads.

- If no data has been uploaded yet, the table will display “There are no records to display.”

6. File Returns:

- Once upload process is done, click “File with EVC” (Electronic Verification Code) to file using EVC.

- (Coming Soon) “File with DSC” (Digital Signature Certificate) for secure filing via DSC.

- Success message: Once you complete the process of filing, You will get a Filing Success page.

If you encounter any issues during the GSTR-9C filing process or need any help, please get in touch with our Support.