2929 views

2929 views The GSTR-1 Filing module in Munim GST allows you to prepare, review, and file your outward supply returns seamlessly.

With this feature, you can ensure that all your sales invoices, debit notes, and credit notes are accurately reported to the GST portal.

This module helps you manage filing across monthly or quarterly returns, track filing status, and avoid errors or mismatches during submission.

Here, you will get a step-by-step guide to file GSTR-1 in Munim GST software.

Video Tutorial:

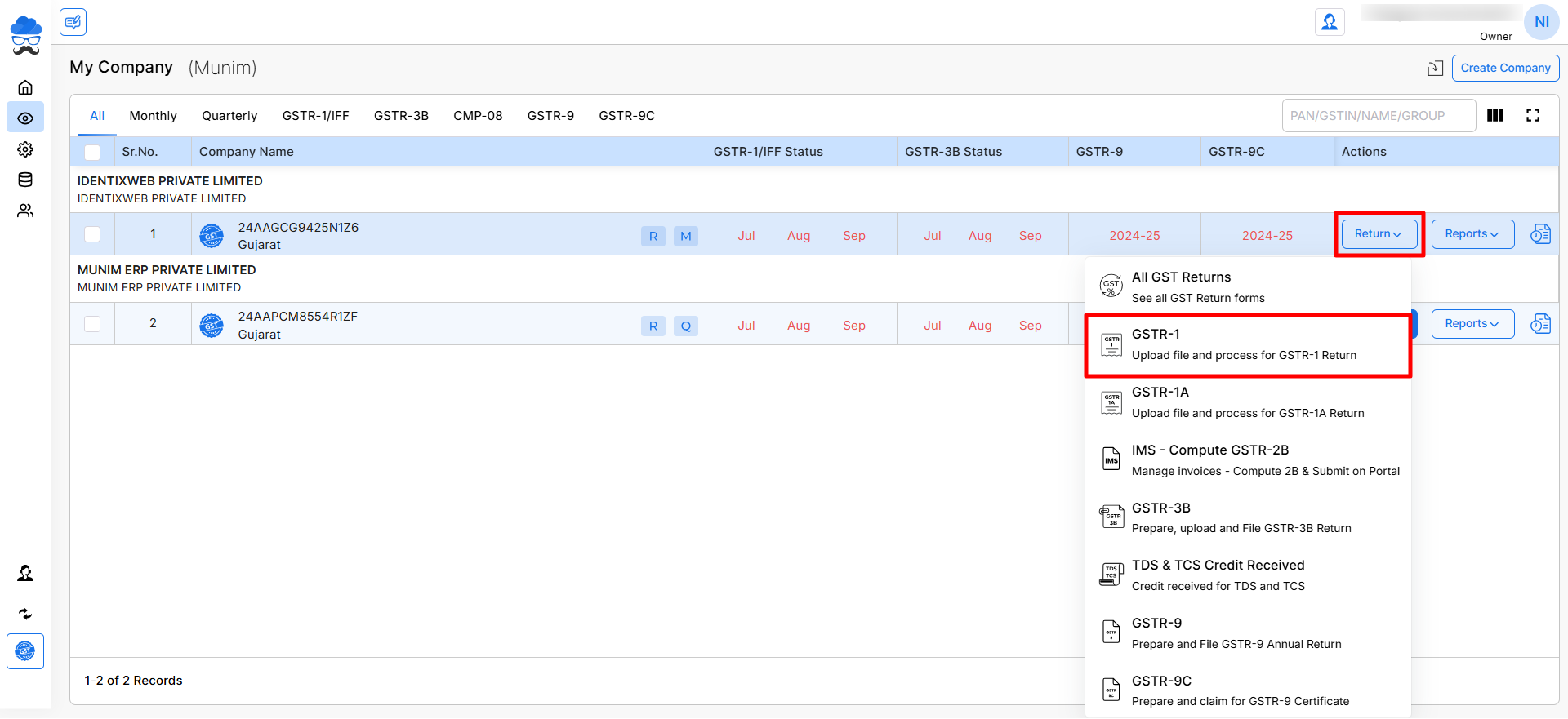

Select GSTR-1 option from My company page:

- Once you have created the company, it will appear on the My company page. Here, click on the Return button.

- Now select GSTR-1 from the list of options.

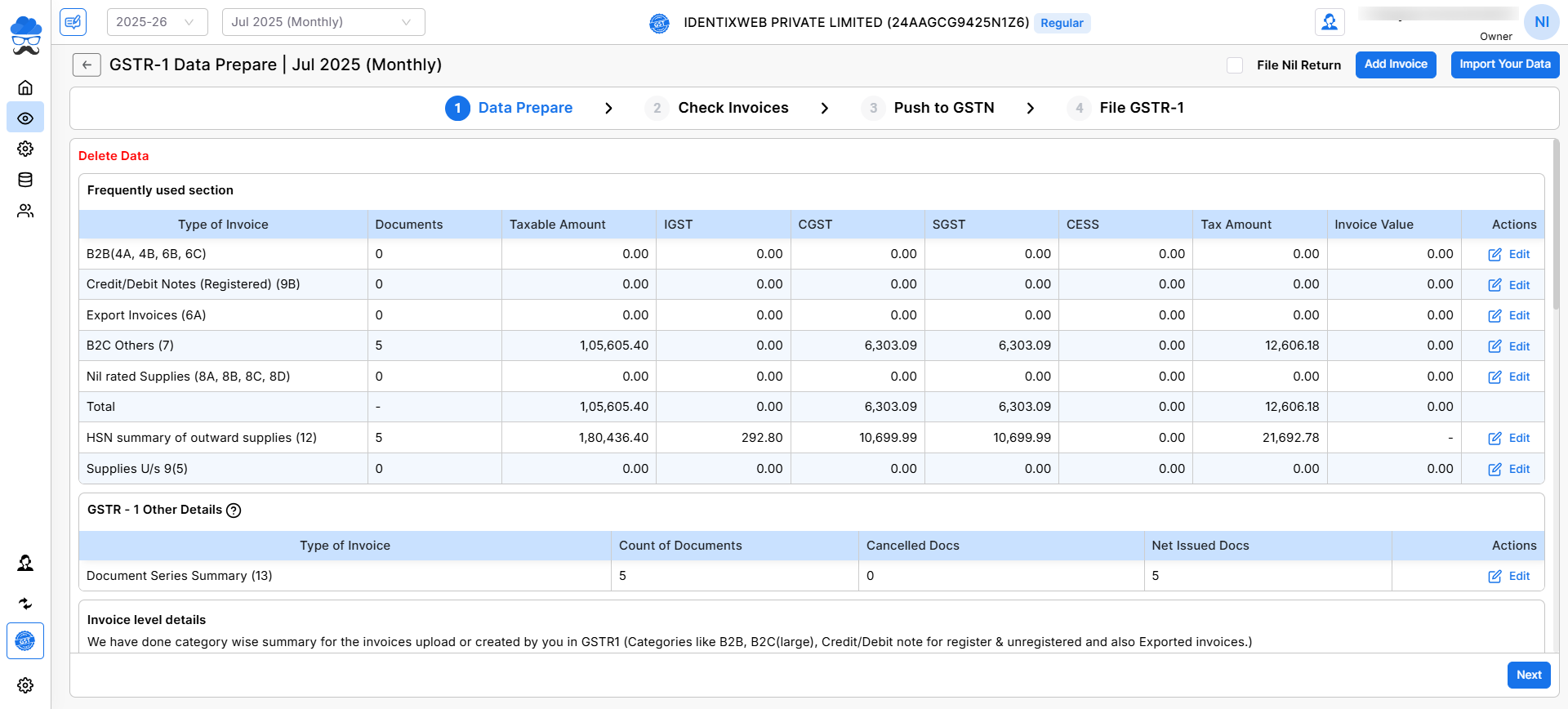

1) Prepare data:

- Prepare your data by adding invoices Manually or Importing data through various options.

- Once you prepare the data, here you will be able to check data of the data added.

Add and prepare data for filing:

- To add invoice data manually, click on the Add Invoice option from the top right corner.

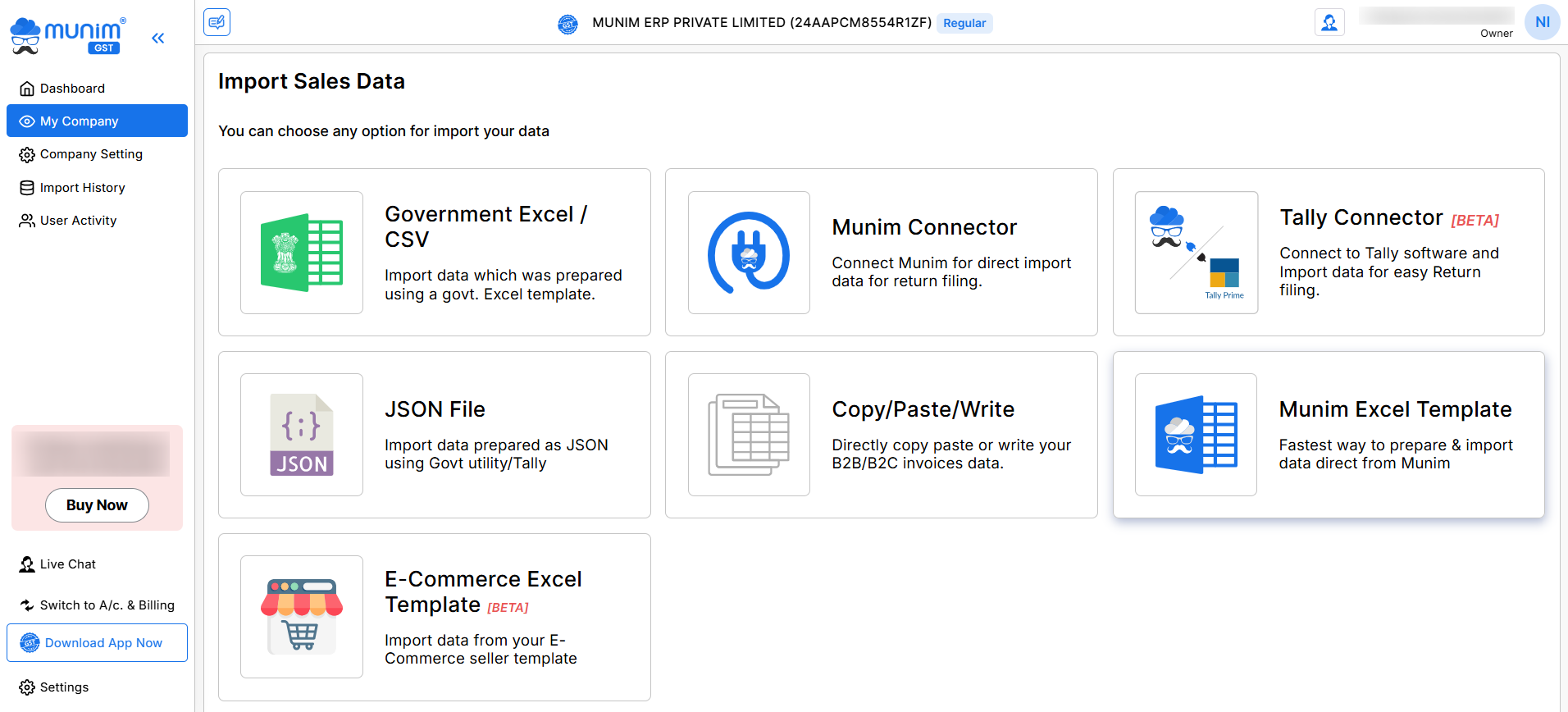

- Or, to add data in bulk, click on the Import Your Data button.

- Choose from options like Government Excel/CSV, Munim Excel template, JSON file, Munim Connector, copy/paste/write, Tally Connector or Ecommerce Excel Template.

- To learn the process of data importing in munim GST, check this Import data helpdesk link.

- To use the Munim Connector or Tally Connector option and check its process, please check out this helpdesk. Munim connector option , Tally Connector option

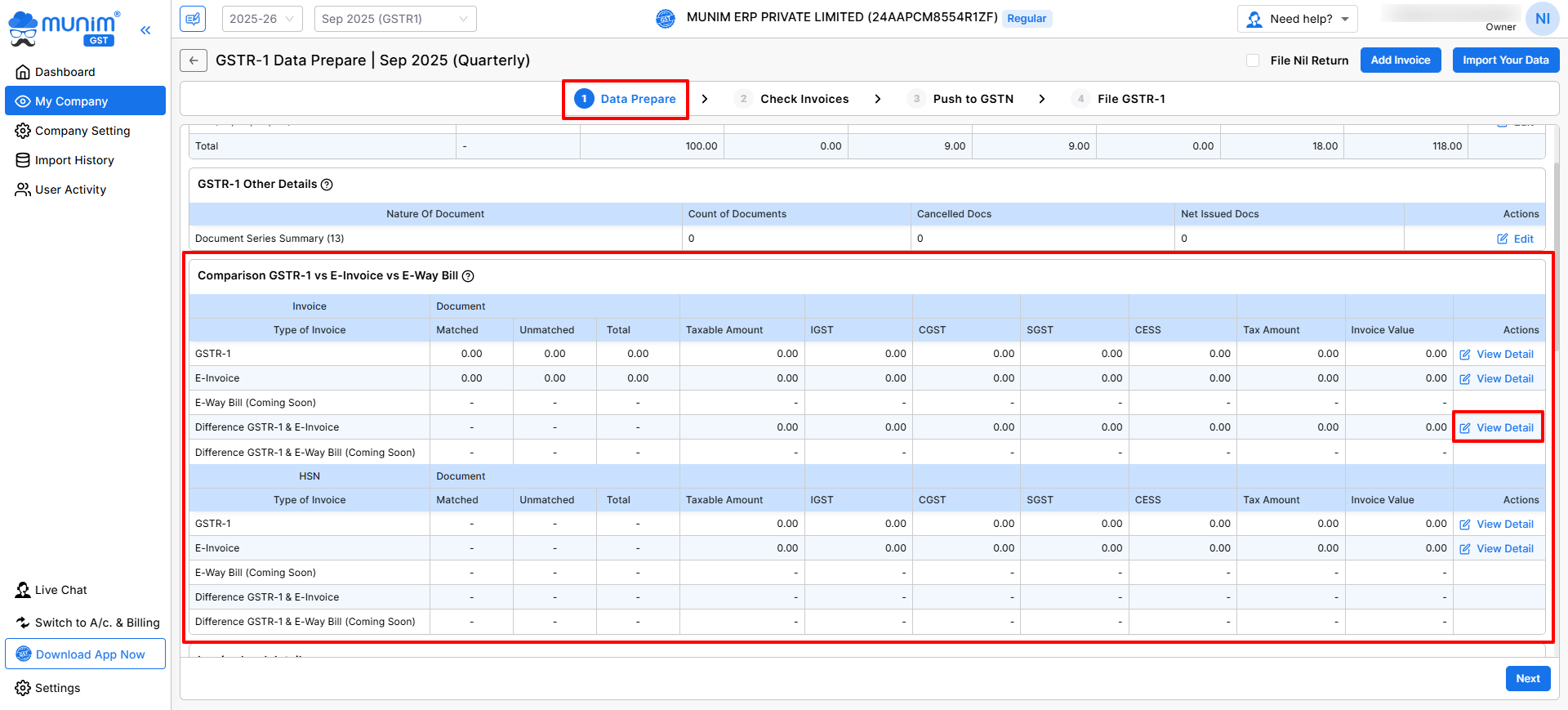

E-Invoice/E-way Reconciliation:

- To proceed, ensure the relevant option is enabled for the company within the Company Settings module.

- Following the preparation of GSTR-1 data, you may utilise E-Invoice/Eway-Bill data for reconciliation purposes on the Data Prepare page.

- You can review the comparison of GSTR-1 vs E-Invoice vs E-WayBill here, and further, you may click on the “View Detail” option to either download or reconcile the data Invoice-wise and HSN-wise.

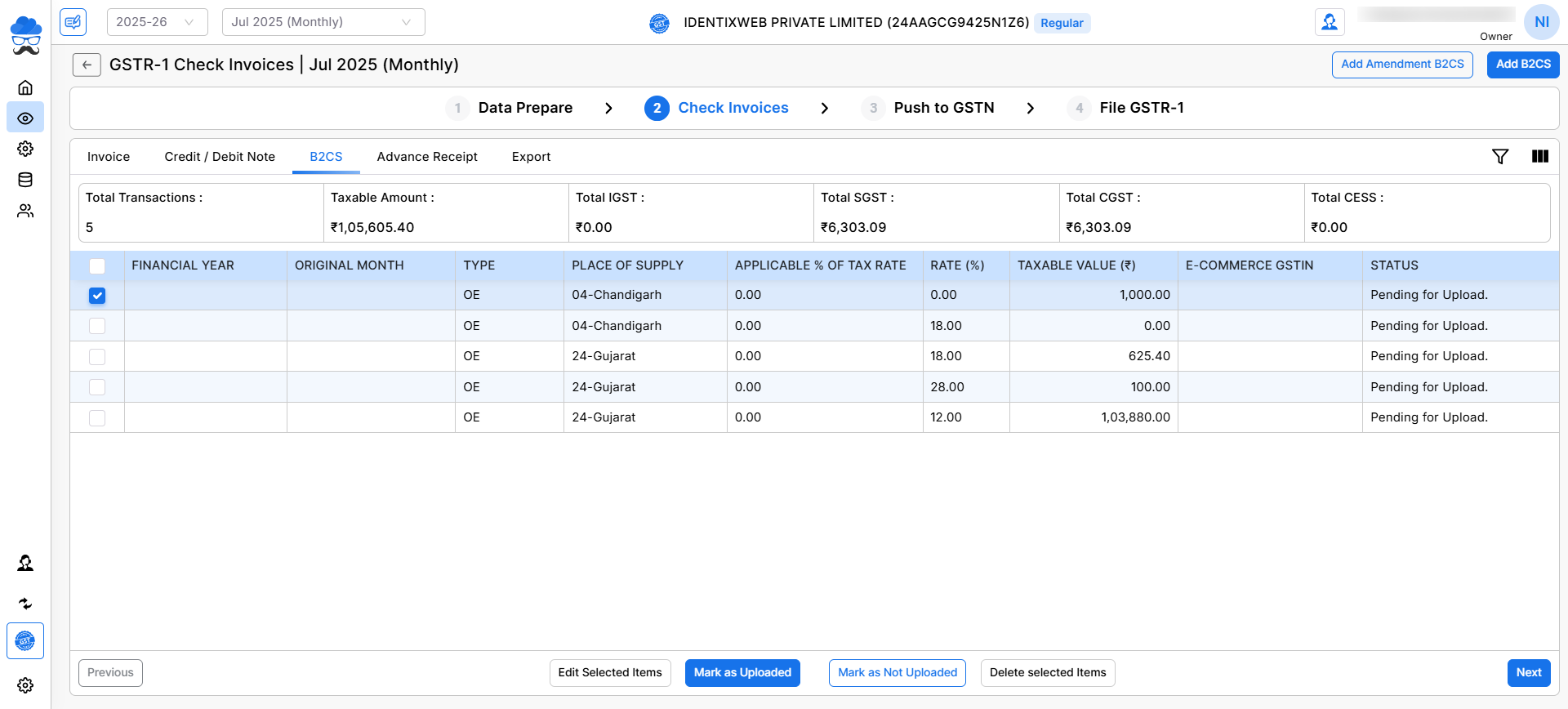

2) Check invoices:

- After preparing your data, verify the invoices in the second step. where you can check and edit invoices.

- If some of the Invoices are already uploaded to the portal, you can select them and click Mark as Uploaded. You can check their statuses in the status column.

- Also, you can edit or delete any entries by selecting them here. Once done, you can click the Next button to proceed.

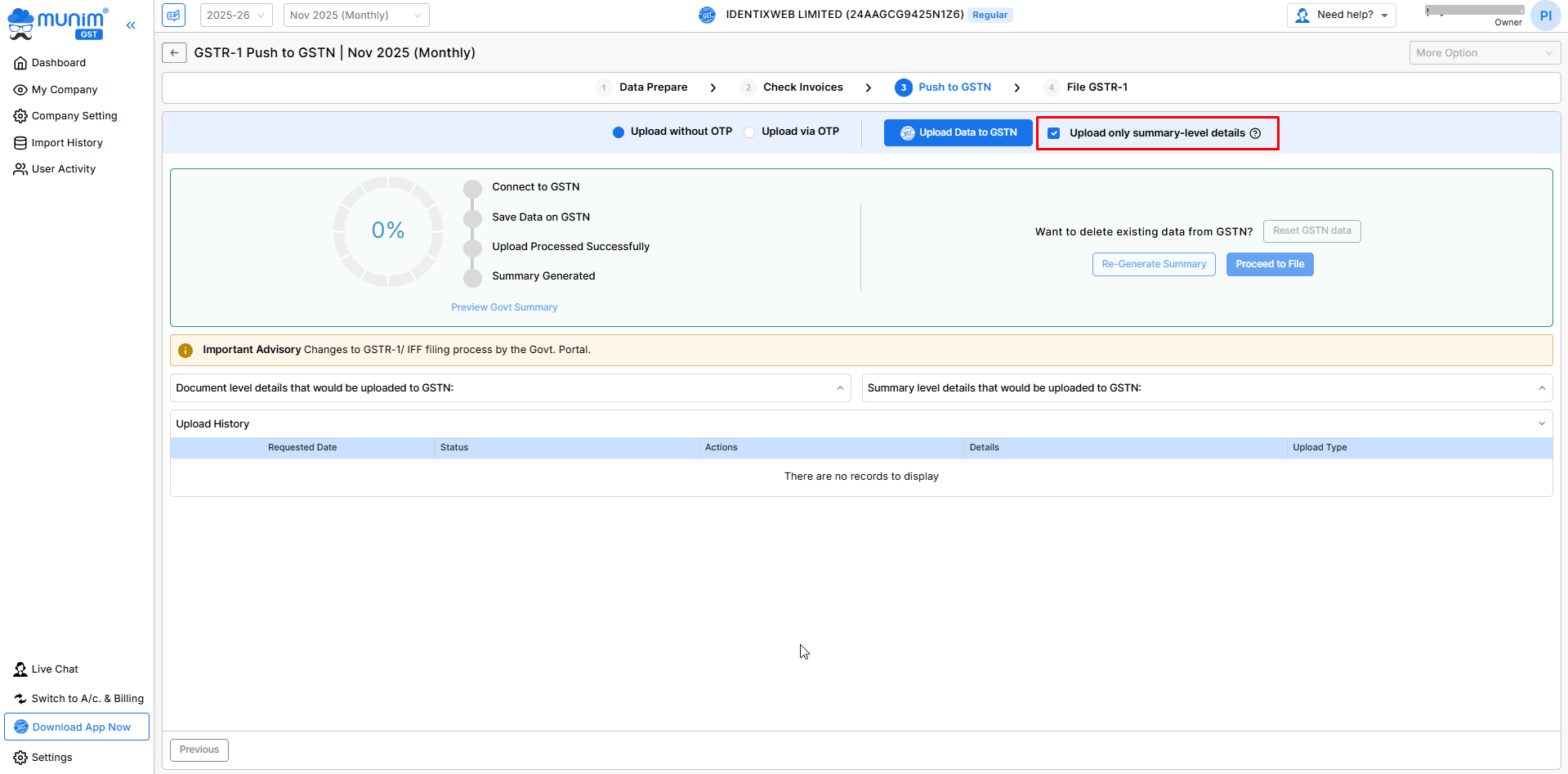

3) Push data to GSTN portal:

- In the third step, select either Upload without otp or Upload via otp.

- Now, click on Upload data to GSTN and wait for the summary to be generated.

- Upload only summary-level details – This option uploads only the summary data to GSTN instead of full invoice-wise details.

- After the summary is generated, you can check for any errors below it.

- Once the summary generation and checking are done, click the Proceed to File button to continue the process.

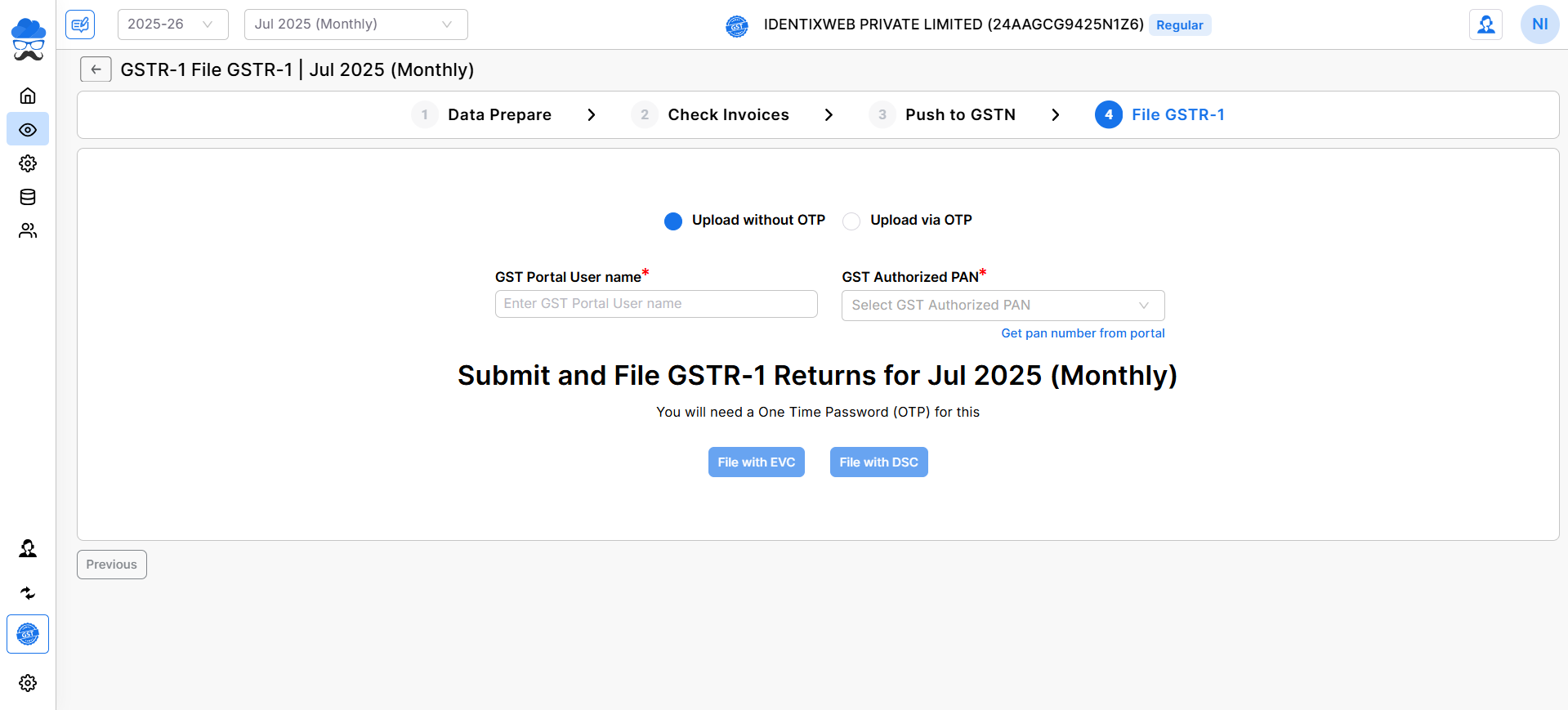

4) File GSTR-1:

- In the fourth step, file GSTR-1 using the File with EVC. (DSC method coming soon).

- Enter the required username and otp to Proceed.

- Once done, a Success message page will appear.

By following these steps, you can easily file your GSTR-1 using Munim GST Return Filing Software. For further assistance, please contact our support team.