2453 views

2453 views Importing Data into Munim GST Filing Software: A Step-by-Step Guide

Importing your data into Munim GST Filing Software is easy and can be done in several ways. Follow the steps below to upload your data efficiently.

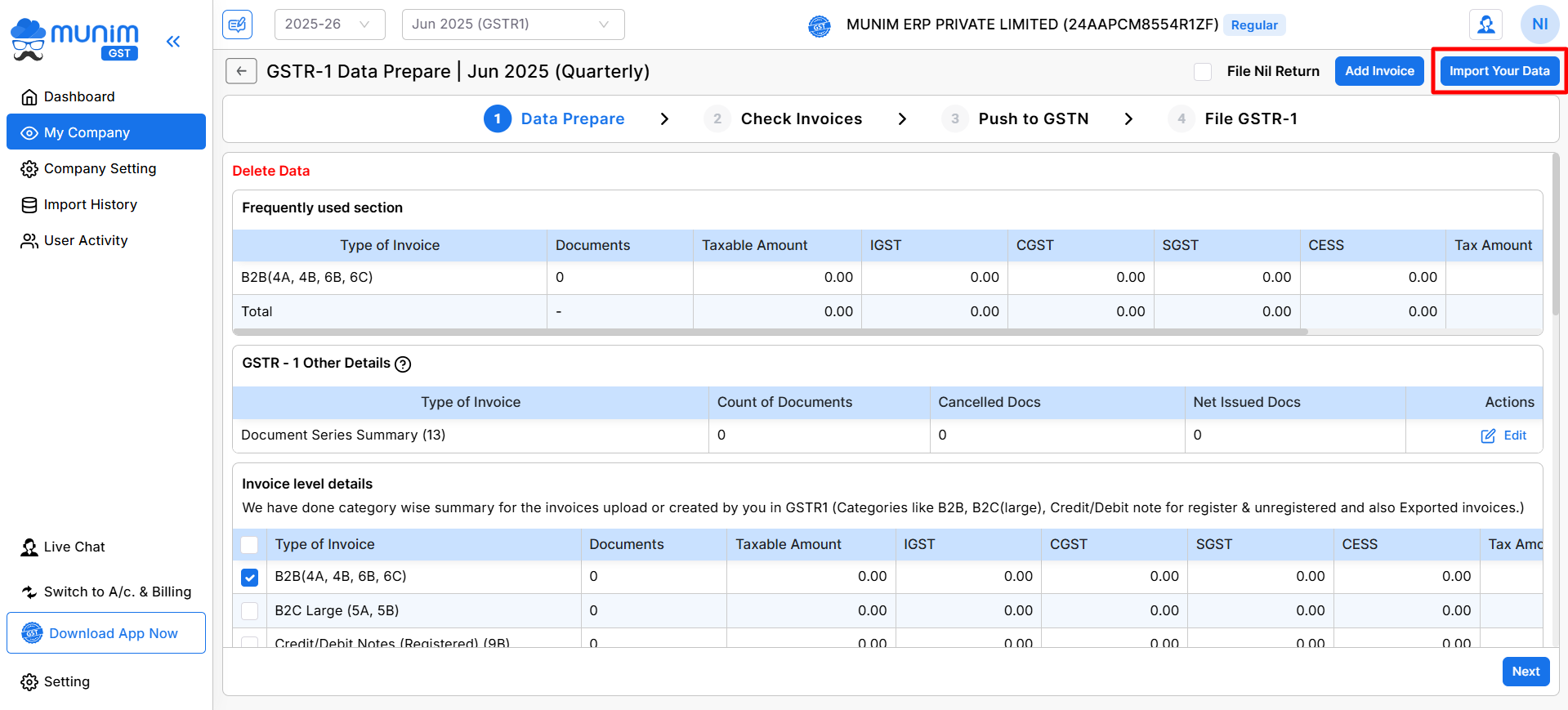

Access the Import Data Module:

- Navigate to

Return > GSTR 1 > Import Your Data. - Import Your Data option is available at the top right corner of the GSTR1 data prepare page

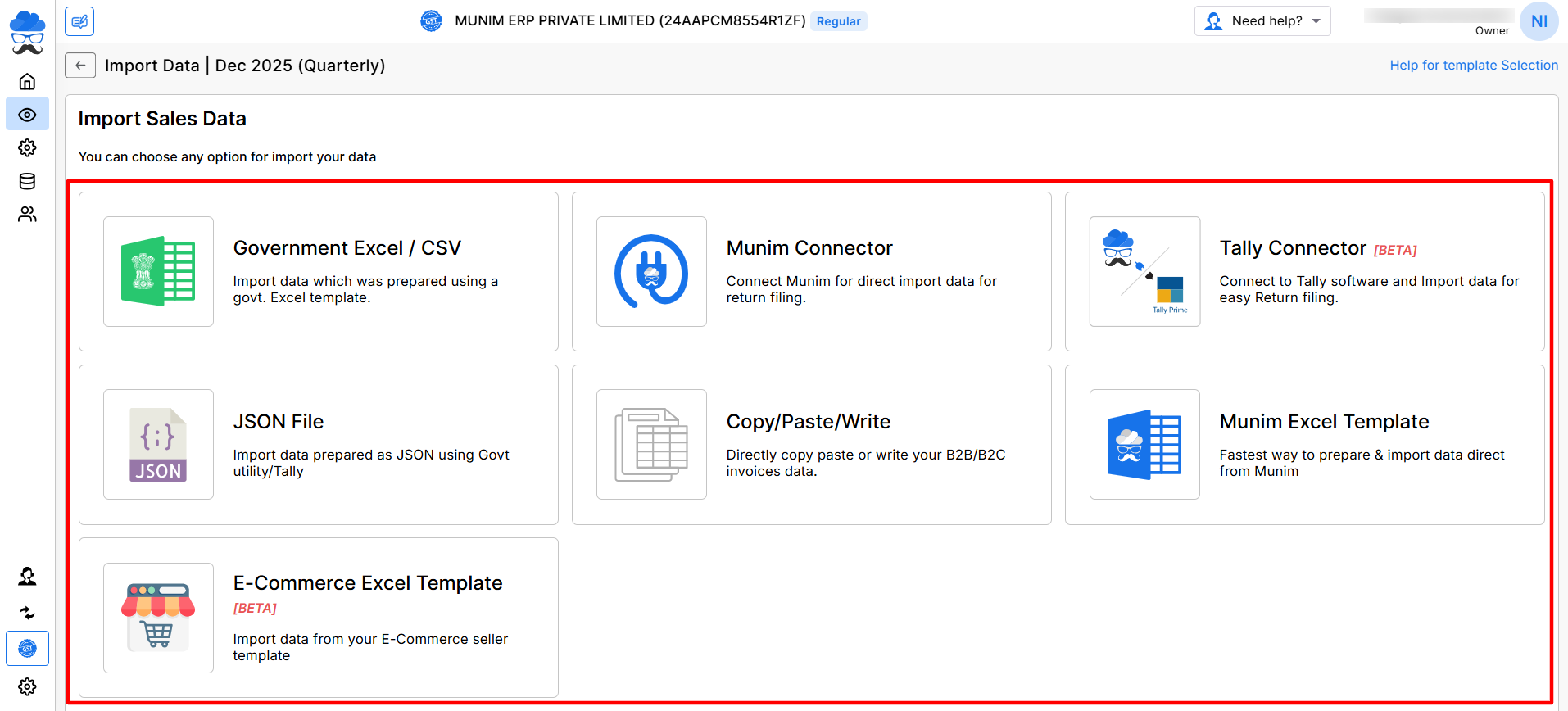

- In the Import Data module, you will find multiple methods to import your data.

Available Data Import Methods:

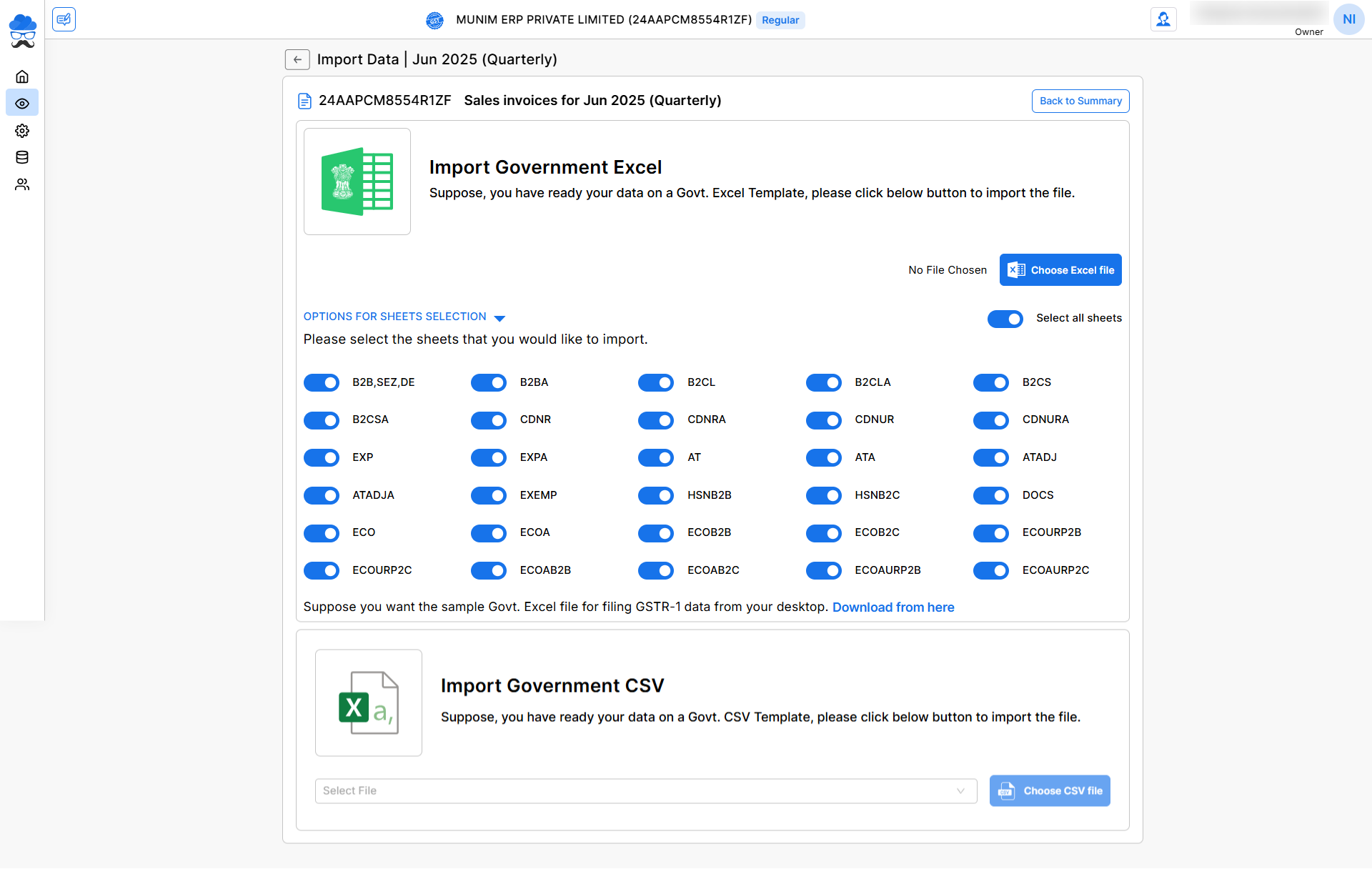

Government Excel/CSV:

- Use this method to import data prepared using a government Excel template.

- Simply upload the Excel or CSV file that you have prepared.

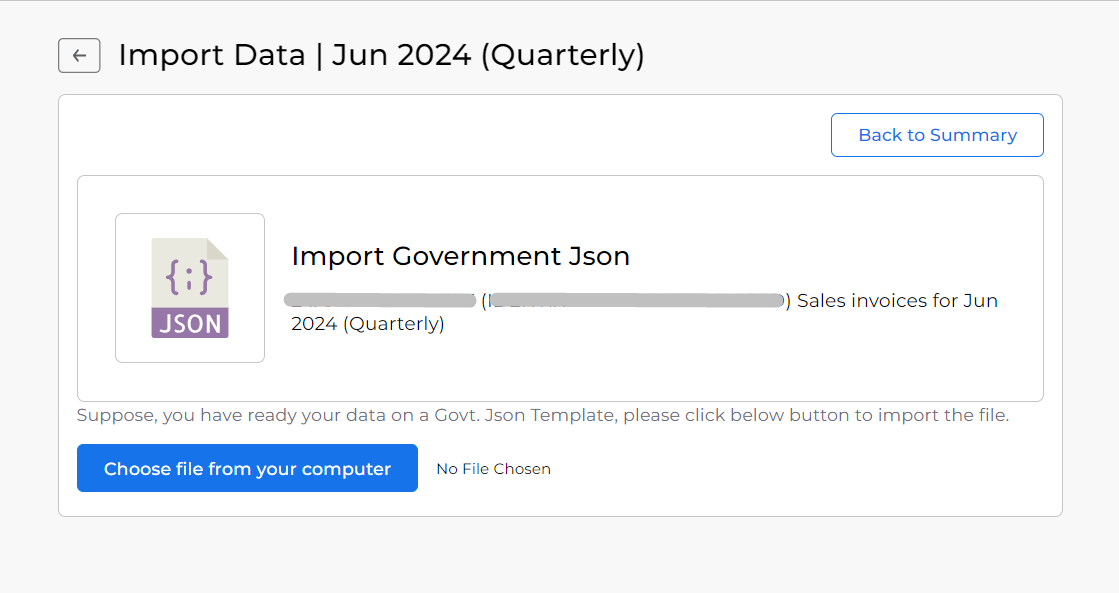

JSON File:

- Import data prepared as a JSON file using a government utility, Tally or other JSON format report provider software.

- Upload the JSON file, and Munim will handle the rest.

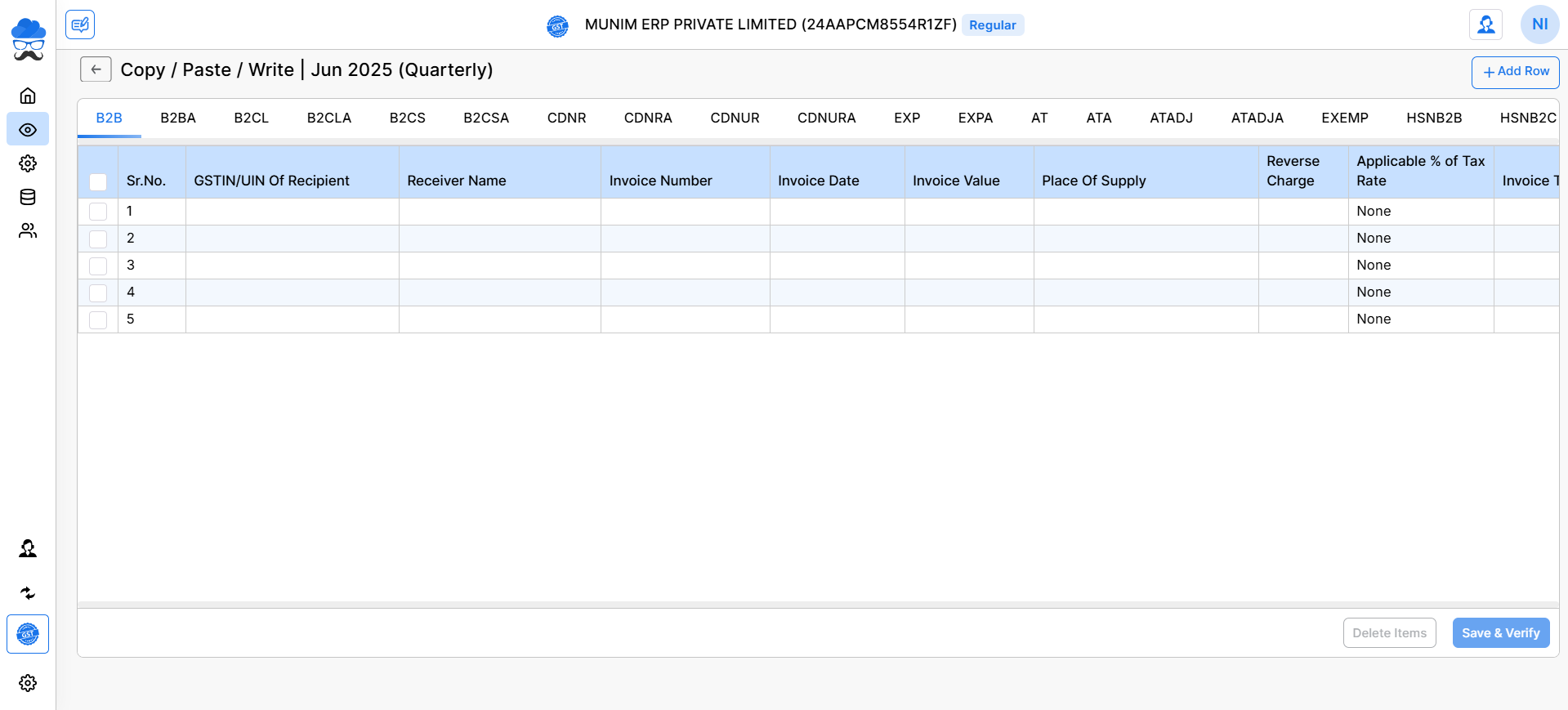

Copy/Paste/Write:

- Directly copy and paste or write your B2B/B2C invoice data.

- This method allows for quick manual entry of your invoice data.

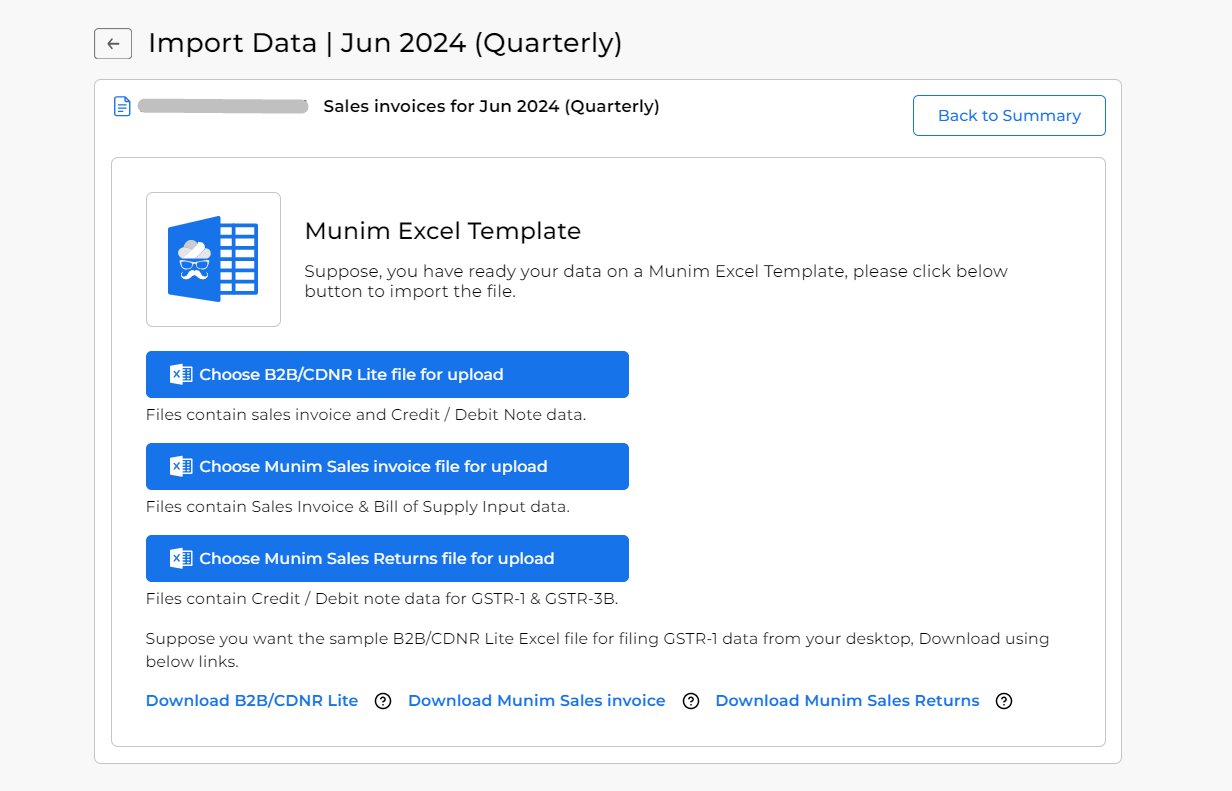

Munim Excel Template:

- The fastest way to prepare and import data directly from Munim.

- Download the Munim Excel template, fill it with your data, and upload it back to Munim.

- Here, we have provided three different sample files for different types of data upload options.

- B2B/CDNR Lite: Here, you can prepare with basic data of B2B, B2C and B2CL, as well as data of Credit/Debit Notes only. Without HSN, Amendment or Export data.

- Munim Sales Invoice: Here, you can prepare all Invoice data like B2B, B2C, B2CL, HSN, Amendment and Export in detail.

- Munim Sales Return: Here, you can prepare all Credit/Debit Note data like CDNR and CDNUR in detail.

- As per the sample file formats, you can prepare your data into three different files and upload them one by one to get your data on the data prepare page.

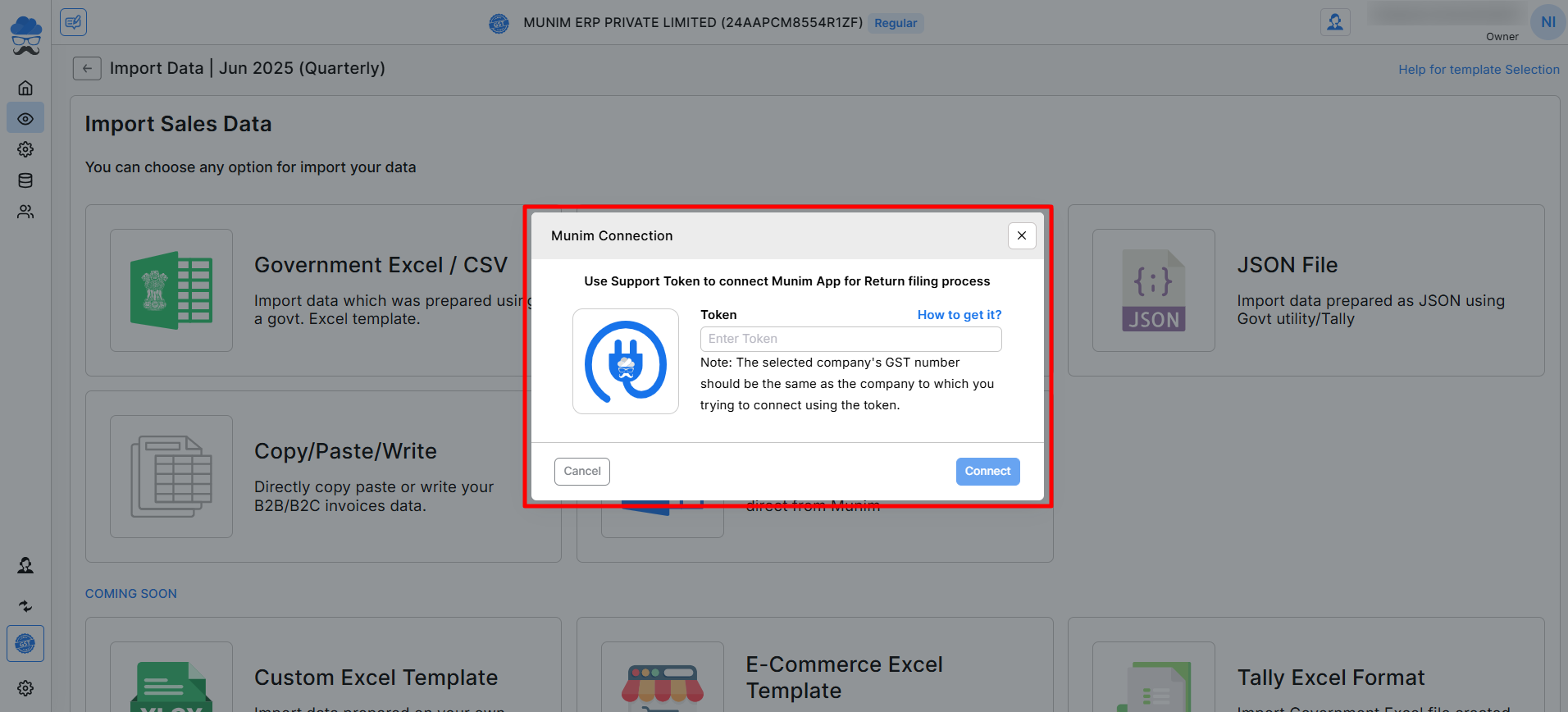

Munim Connector:

- Connect Munim Accounting for direct data import for return filing. You can check the Detailed helpdesk here: Munim Connector Feature

- This method streamlines the import process by connecting Munim directly to your data source.

- Once you click on the Munim Connector option, you will get a pop-up to enter a Token number from the Accounting software and click Connect.

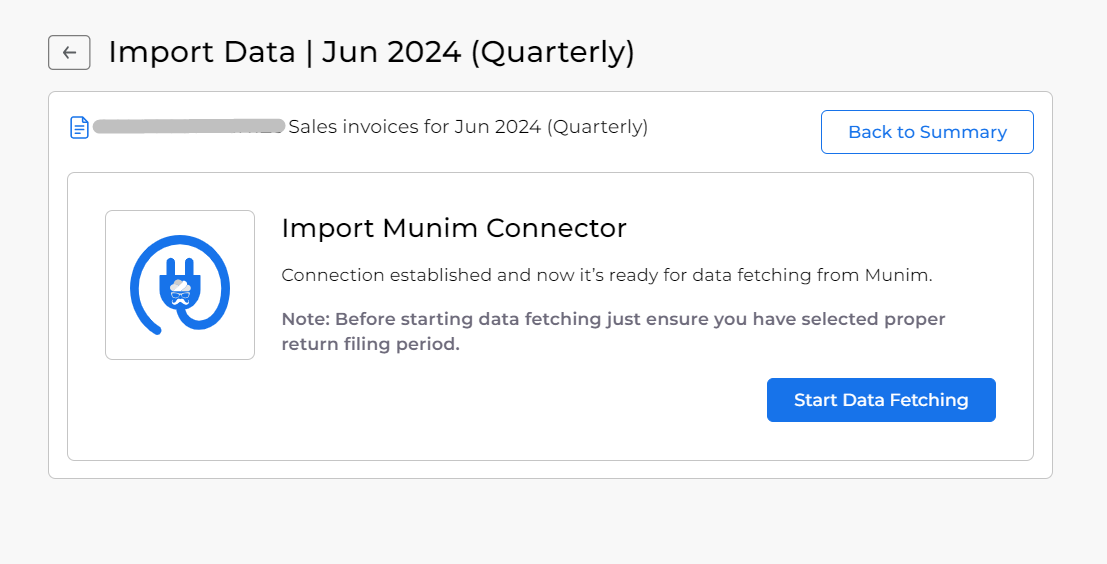

- Once you accept the request from Accounting software, you will be able to fetch data from it by clicking Start Data Fetching.

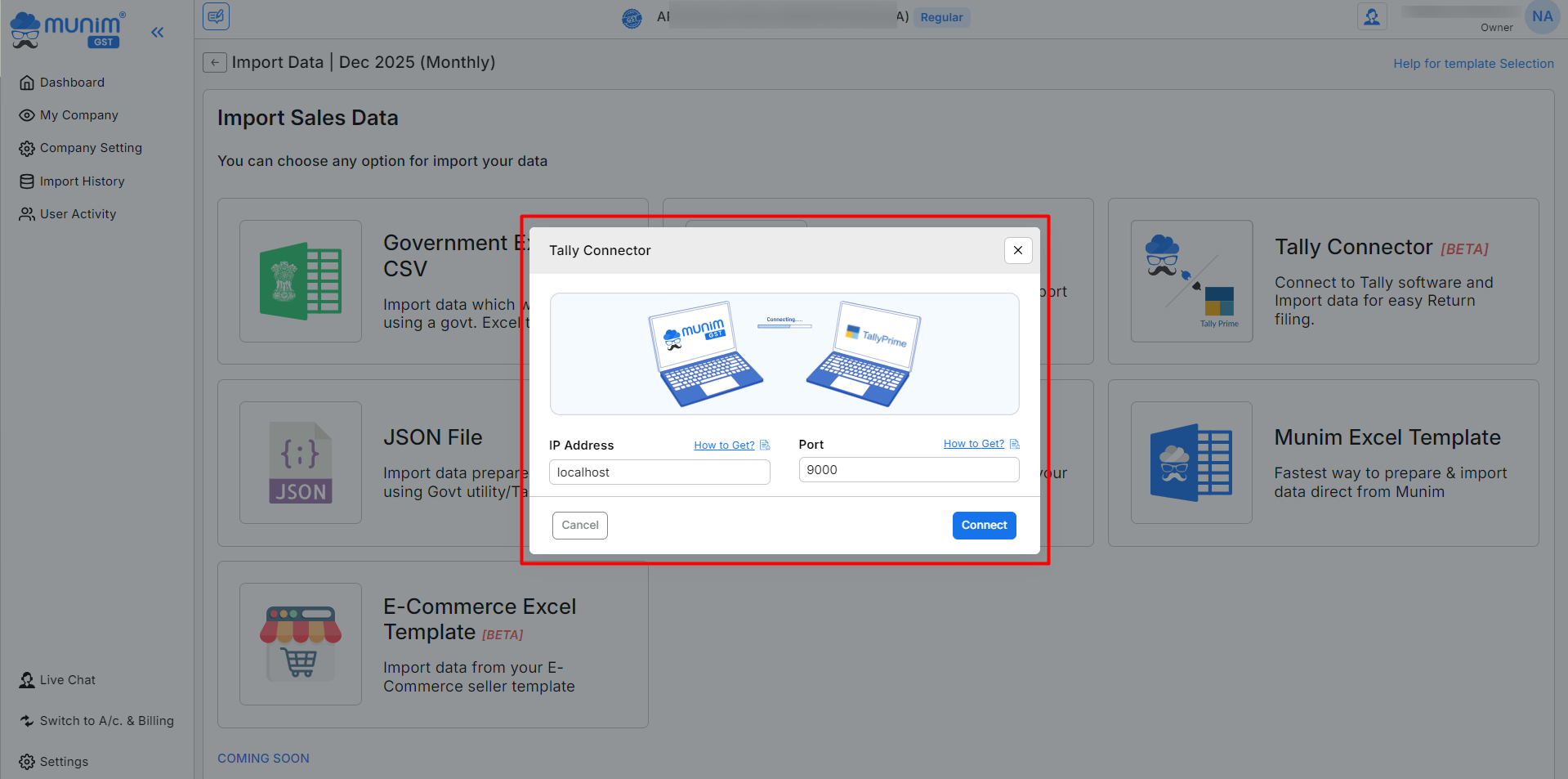

Tally Connector:

- The Tally Connector feature in Munim GST allows you to directly import your accounting data from Tally Prime into Munim for preparing and filing your GST returns.

- Establish a connection with Tally Prime by inputting the IP address and Port number associated with the shared company profile in both systems, thereby enabling data fetching.

- For further details, please refer to the Tally connector helpdesk here: Tally Connector

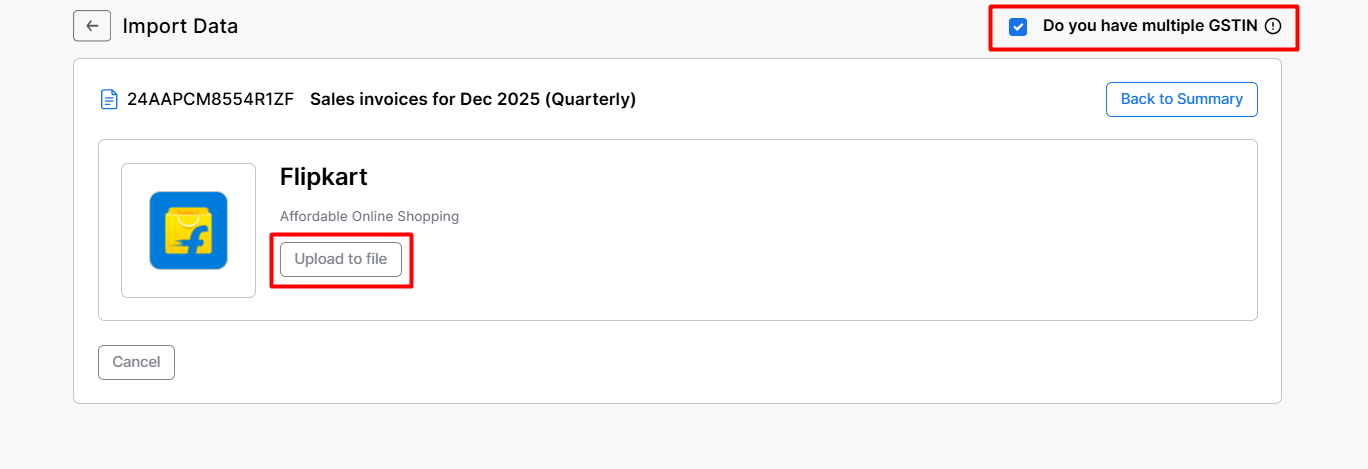

E-Commerce Excel Template:

- The E-Commerce Excel Template facilitates the import of sales data directly from e-commerce operators via an Excel file into Munim software.

- If you possess multiple GSTINs for a single company, you may select the option located in the top right corner to upload the consolidated data, which is accessible in Excel format.

- Click the “Upload to file” option to upload the Excel file downloaded from the e-commerce operator.

- Your data will be validated and uploaded into the software.

Data Validation while Importing Data:

- To ensure data accuracy, we have implemented validations during the import process across all methods.

- These validations are designed to identify and rectify any errors within the uploaded data, guaranteeing that only accurate information is processed.

- During data import or return preparation, Munim allows you to:

- Update incorrect tax rates

- Identify and correct invalid or cancelled GSTINs

- Remove or manage duplicate entries

- Convert B2B entries to B2C if the GSTIN is cancelled

- Update incorrect HSN codes

- Overwrite or merge HSN codes where required

- These options help ensure accurate data before final GSTR-1 filing.

Need Assistance?

If you have any questions or need further assistance, please contact our support team. We’re here to help!