1959 views

1959 views Purpose:

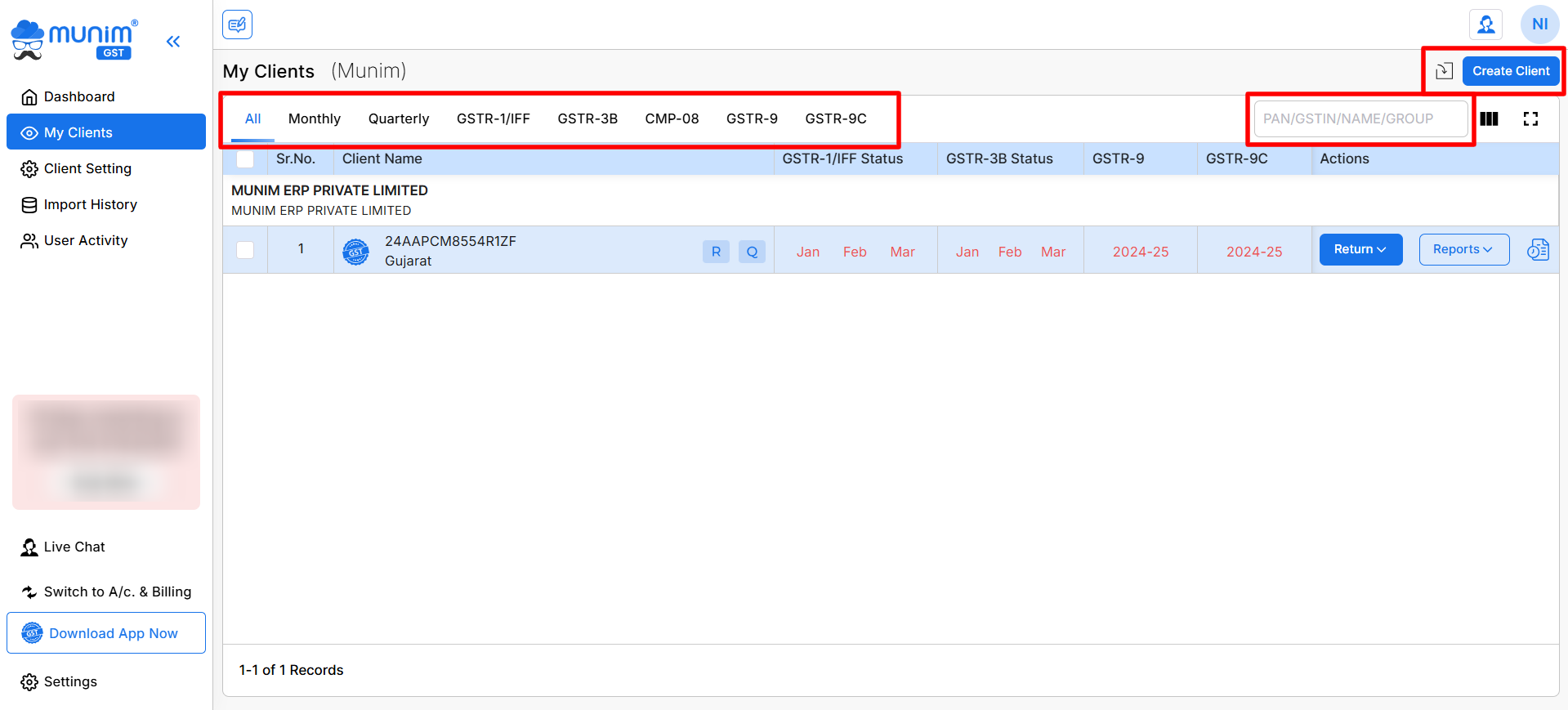

The “My Clients” page is designed to give you a detailed overview of the GST return filing status of various companies registered under your account. It allows you to view company-specific details, filing frequencies, return status, and access important features like return filing, reports, and company history.

Sections Overview:

- Create or Import Company (Top Right):

- Create Client: Add a new client company to your list by filling out its relevant GST details.

- Import: Import client details in bulk using pre-set formats.

- Please check this link to learn more about Client Company creation and the import process. Create Client process

- Client Filter (Top Left):

- Here, you can filter companies by their filing frequencies and Filing statuses. Like, Monthly, Quarterly, IFF, 3B, CMP-08, 9 and 9C.

- Client Search Bar (Top Right):

- You can search for specific companies using various criteria such as PAN, GSTIN, Group or company name for quicker navigation.

- Client Listing (Middle Section):

- Here is the List of all the Client Companies under your account, along with their GSTIN and filing status.

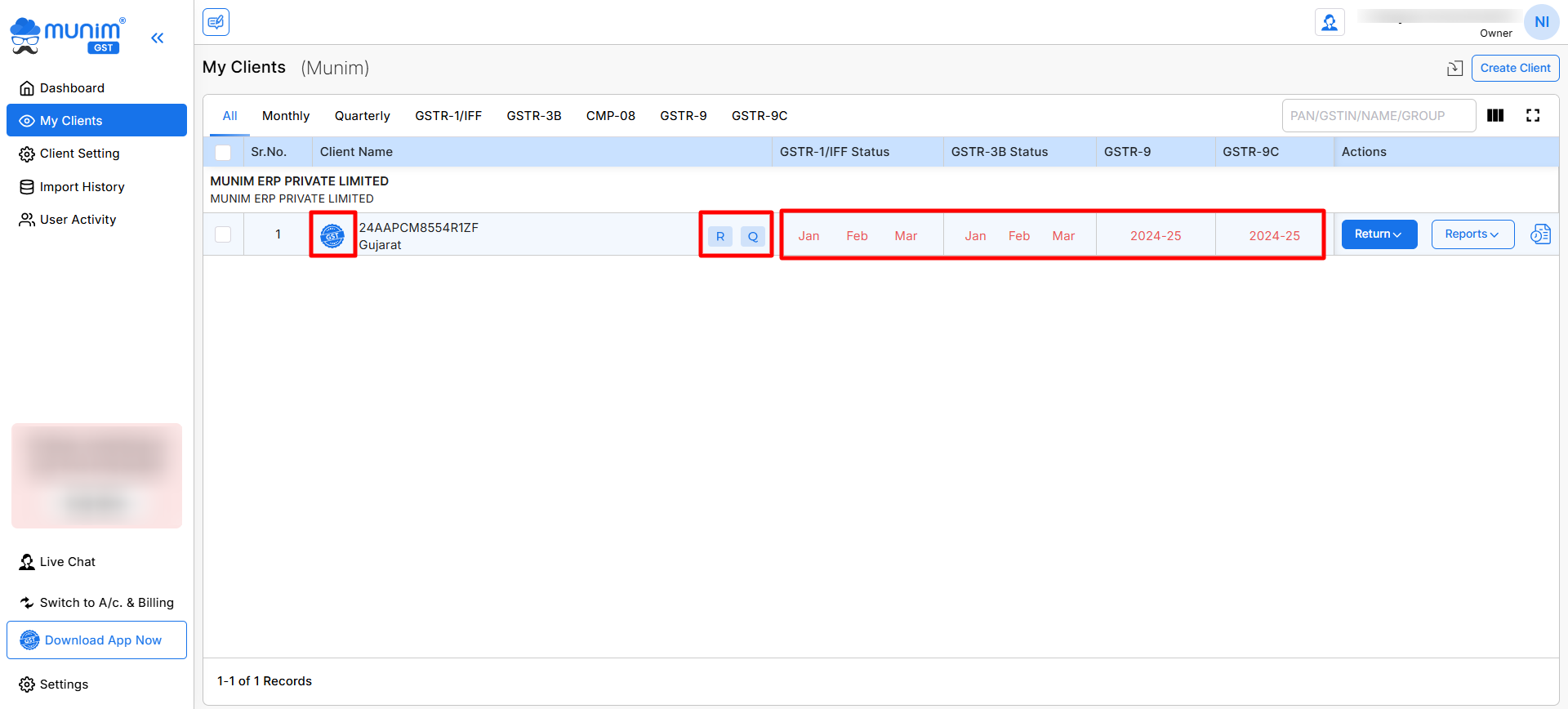

- Company Type: Displays the Company type. The icons indicate a company type, such as a [R] Regular. [C] Composition

- Filing Frequency: Displays whether the company files GST returns monthly or quarterly. The icons [M] for Monthly or [Q] for Quarterly filing frequency.

- Filing Status (Month-wise):

- Each column (e.g., Jul, Aug, Sep) shows the filing status for a specific month.

- Red Status: Filing is pending for that month.

- Green Status: Filing is completed for that month.

- Access GST Portal (GST Icon):

- By clicking the GST icon next to the company’s name, you can directly access the GST portal using the company’s credentials, making it convenient to file returns or check other details.

- Please check this link to learn more about the updating filing status process. Filing Status update

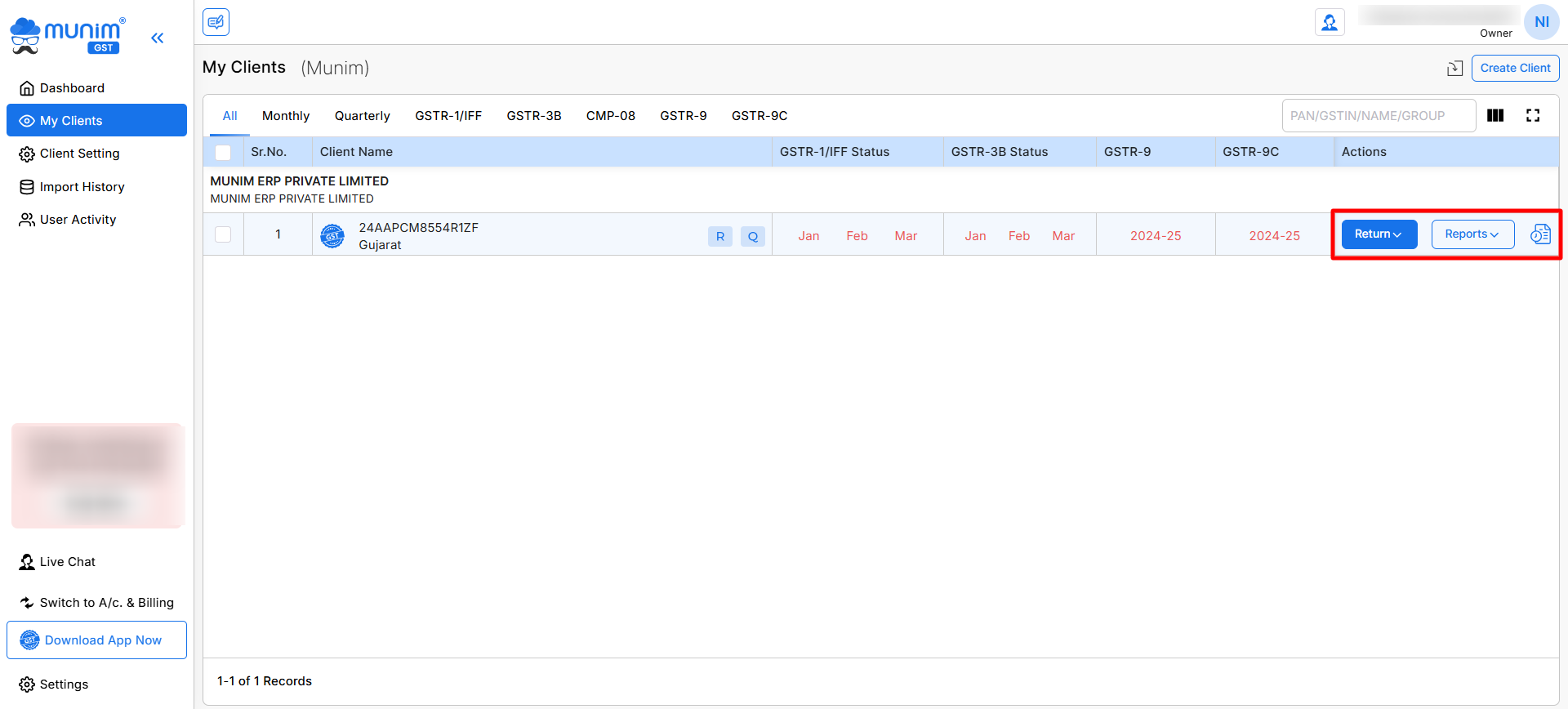

- Return Filing Options (Right Side – Return Button):

- The Return button provides various return filing options. From here, you can directly initiate or complete pending GST returns.

- Return Related Reports (Right Side – Reports Button):

- The Report button allows you to generate detailed reports related to the return filings, which can be useful for auditing or record-keeping.

- Company Filing Status (Right Side – Icon):

- The icon fetches past return filing records of a company, providing a comprehensive view of previous filing statuses.

| Name | Description |

|---|---|

| Import | Here you can Import your Companies in bulk through Excel file format. |

| Create Company | Here you can create a new Company by adding GST number. |

| Company Type Tabs | Here you can check companies with predefined Filters tabs according to company types like Monthly, Quarterly, GSTR-1/IFF, GSTR-3B and CMP-08. |

| Search field | Here you can search companies with their PAN no., GSTIN or Names. Also, you can use Column search and show/hide column options next to the search field for more search related activities. |

| GST Icon | This icon can redirect you to GST Portal with preset Credentials you have added for the company. |

| Company name | Here you can see Company name and its details. Here R identifies as a Regular for company type and Q identifies as a Quarterly for company’s filing frequency. |

| GSTR-1/IFF Status | Here you can check status of the current quarter months. Red fonts indicate as not filed and Green indicates as filed. |

| GSTR-3B Status | Here you can check status of the current quarter months. Red color fonts indicate as return not filed and Green indicates as filed. |

| GSTR-9 Status | Here you can check status of the current financial year. Red color fonts indicate as return not filed and Green indicates as filed. |

| GSTR-9C Status | Here you can check status of the current financial year. Red color fonts indicate as return not filed and Green indicates as filed. |

| Return | Here you will get Return filing options like GSTR1, GSTR3B, TDS/TCS Credit Received, Nil and GSTR9. |

| Report | Here you can check multiple reports related to the return filing and Electronic Ledger. |

| Filing Status Check | By clicking this icon, you can update and check the current filing status of the particular company. |

Common Actions:

- Check Filing Status:

- Use the month columns (e.g., Jul, Aug, Sep) to quickly check if returns have been filed or are pending for each month. Red color fonts indicate as return not filed, and Green indicates as filed.

- File a GST Return:

- Click on the Return button next to the company for which you want to file a return. This will provide options for filing based on the company’s return type and frequency.

- Generate Reports:

- Click on Reports to access detailed data about the company’s GST filings, which can help in tracking return history and compliance.

- Importing Companies:

- If you manage multiple companies, you can use the Import button to bulk upload company details rather than adding them one by one.

This page provides an all-in-one interface for managing multiple companies’ GST return filings, ensuring that deadlines are met, and compliance is maintained.