1847 views

1847 views If you have no transactions to report for a specific month, it is still mandatory to file NIL return for GSTR-3B to remain compliant with GST regulations.

Filing a NIL return through Munim GST Filing Software is quick and easy, and this guide will walk you through the process step-by-step. By following the instructions below, you can ensure that your GST obligations are met even if no sales or outward supplies were made during the return period.

Follow the steps below to file your NIL GSTR-3B return:

Step-by-Step Instructions:

- Log in to Your Account:

- Open the Munim GST Filing Software and log in with your credentials.

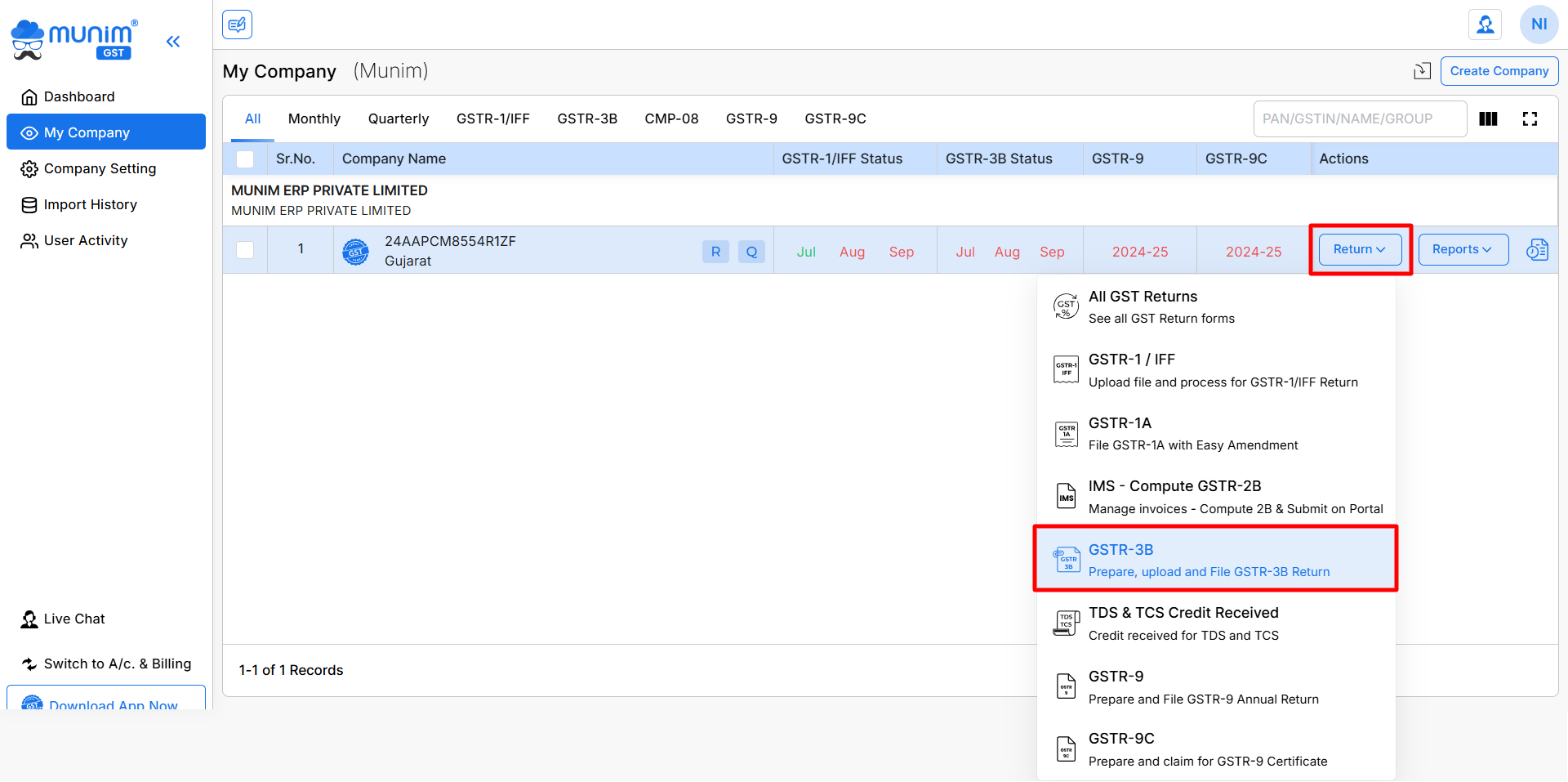

- Navigate to the ‘My Company’ Section:

- On the left-hand side, click on My Company from the dashboard.

- A list of your registered companies will appear.

- Select the company for which you want to file the NIL return.

- Click on the GSTR-3B option:

- On the right side of the screen, you will see a Return button.

- Click on it to open the dropdown menu.

- From the dropdown, select the GSTR-3B option.

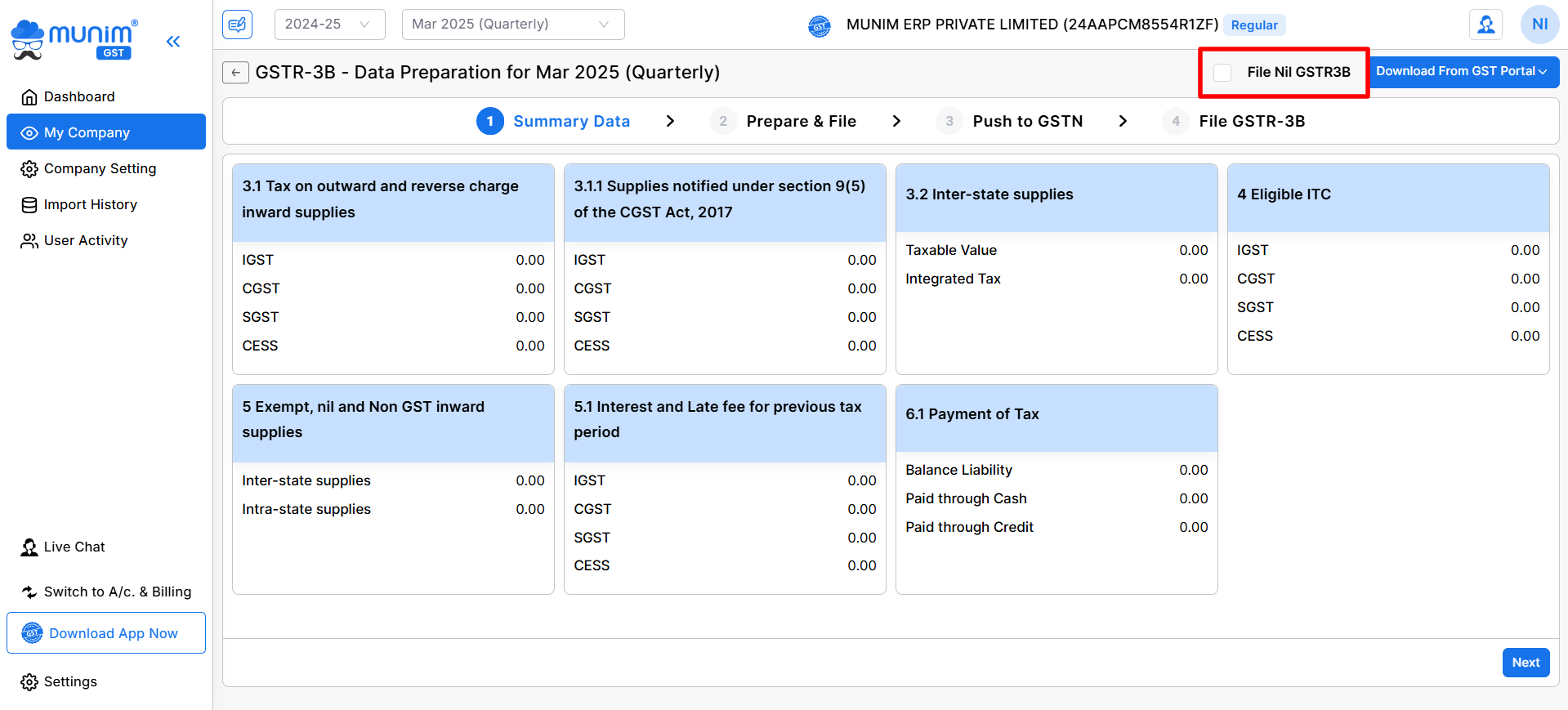

- Choose the GSTR-3B Month:

- On the GSTR-3B Return page, locate the correct Month and Year at the top left to confirm.

- Identify or change the month for which you need to file the NIL return. The current filing month will be selected by default.

- Confirm and File:

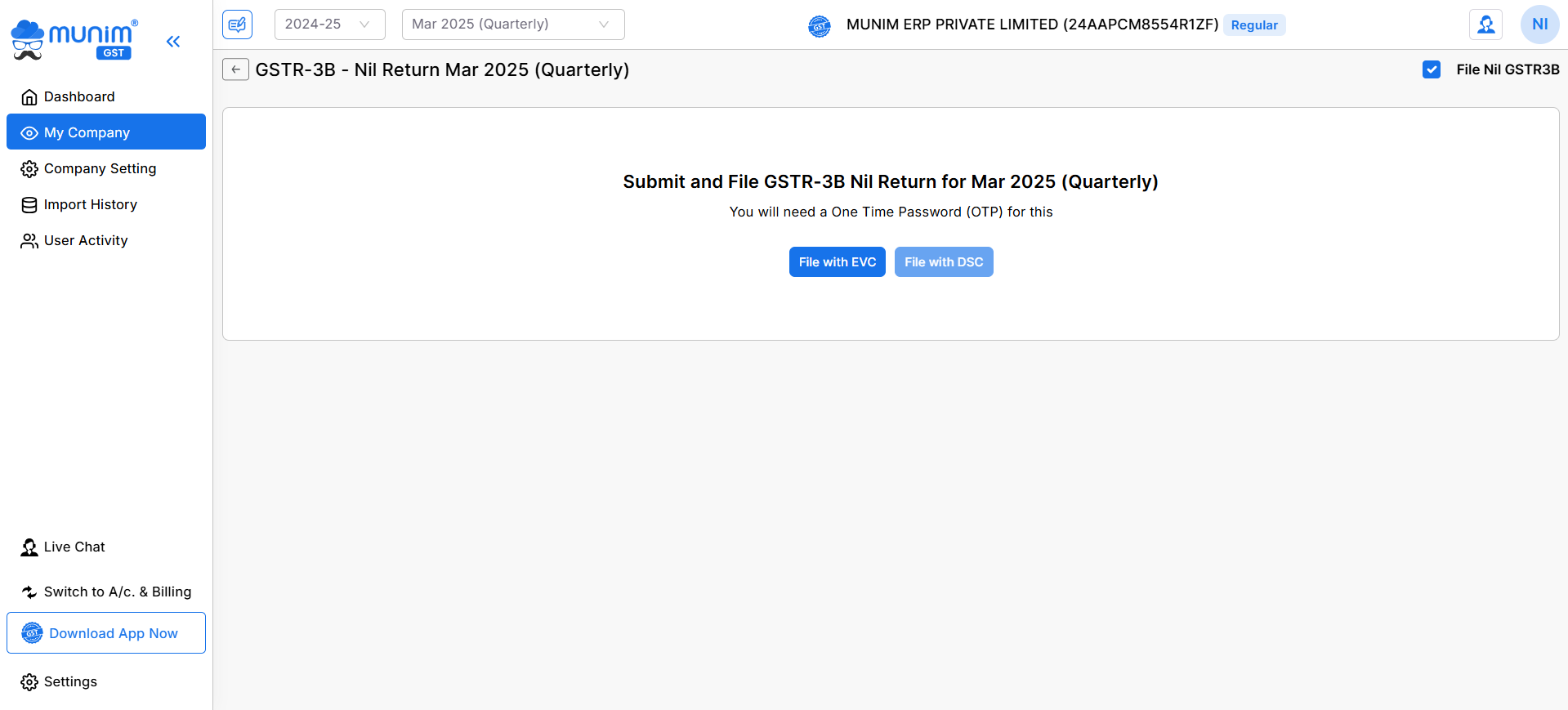

- Now select the Nil Return option from the top right of the screen. It will redirect you to the final submission page.

- Submit and File GSTR-3B Nil Returns with the option available from File with EVC and File with DSC(Coming Soon) option.

- You will need a One-Time Password (OTP) to Submit the return, and you’ll receive a confirmation of successful filing.

By following these steps, you can easily file your NIL GSTR-3B returns using Munim GST.

If you face any issues or need further assistance, feel free to contact our support team via Live Chat or refer to our detailed guides available in the Help Center.