1336 views

1336 views GSTR‑4 is the annual return form for registered taxpayers under the Composition Scheme. Munim GST gives you a single interface to prepare, review, pay and file.

Before You Begin

- Verify Composition Status

– Your GST registration must be under the Composition Scheme for the selected financial year. - Quarterly CMP‑08 Submissions

– All four quarterly CMP‑08 returns should already be filed. - GST Portal Credentials

– Keep your GSTIN and login/OTP details at hand for data import.

Video Tutorial:

Step‑by‑Step Process

Launch the GSTR‑4 Module

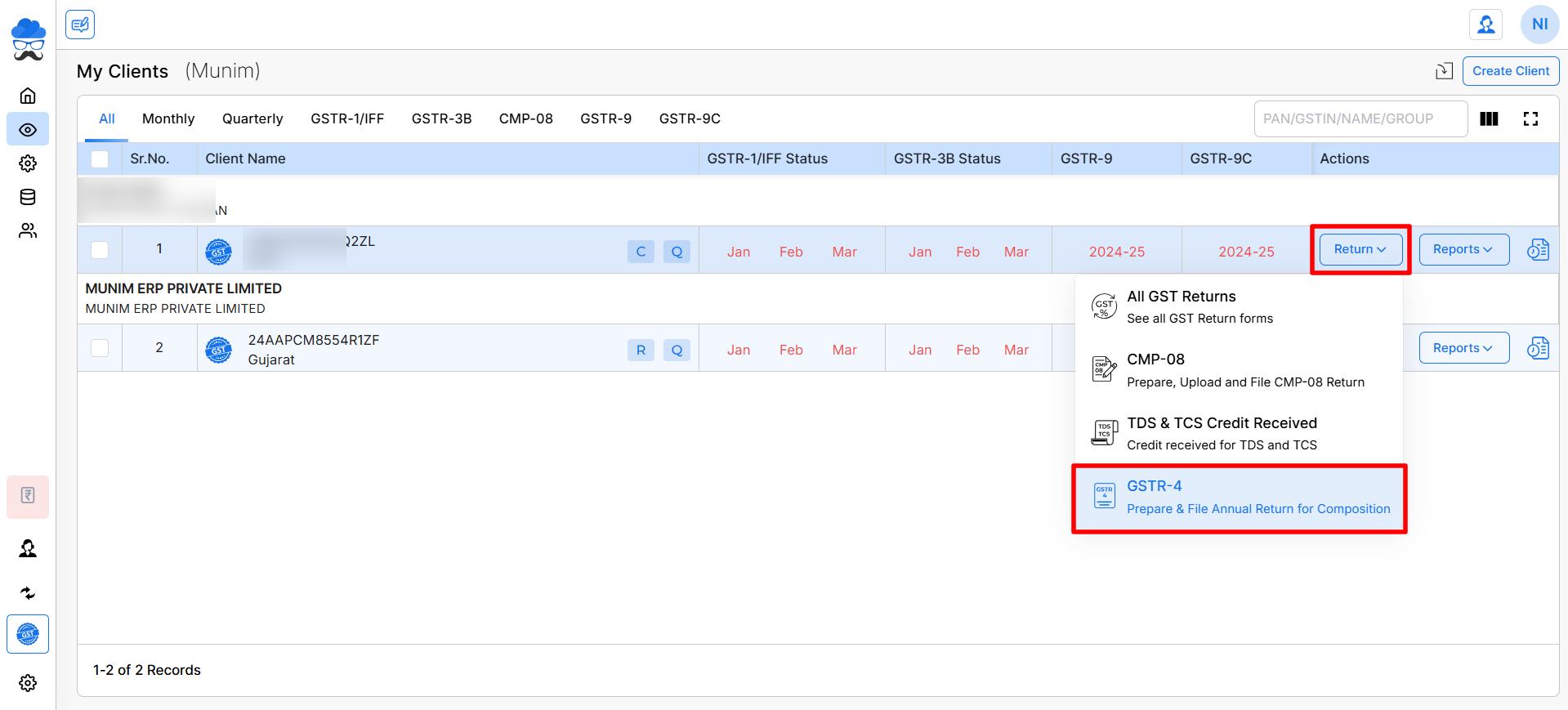

- Navigate to the My Clients module from the main menu.

- Select the target financial year (e.g. 2024‑25 or 2025‑26).

- In the CMP‑08 tab, you will find Composition companies.

- Click Return and then choose GSTR‑4.

Import Your Inward Data

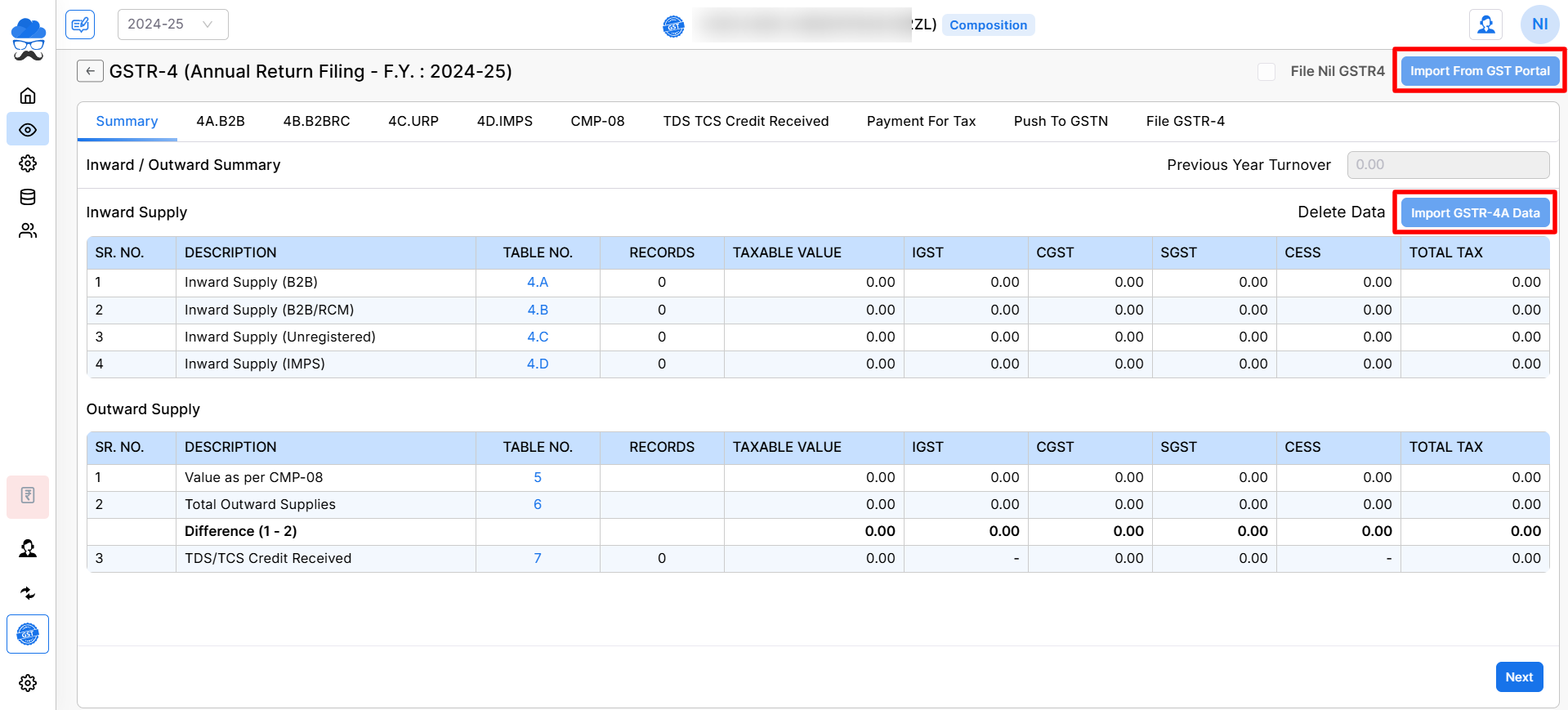

- On the Summary page, click Import From GST Portal to fetch auto‑populated GSTR‑4 data.

- You can also download GSTR-4A data from the portal by clicking Import GSTR-4A Data.

- Check the Inward/Outward Summary table and Outward Supply on the Summary tab.

- You can add your previous turnover in the Previous Year Turnover field.

Review Supply Details

- Move through these other tabs in order:

- 4A.B2B: Inward Supplies Received From a Registered Supplier (Other than supplies attracting Reverse Charge)

- 4B.B2BRC: Inward Supplies Received From a Registered Supplier (Supplies attracting Reverse Charge)

- 4C.URP: Inward Supplies Received From Unregistered Suppliers

- 4D.IMPS: Import of Services

- CMP‑08: Composition company related Inward/Outward and other data

- TDS TCS Credit Received: TDS/TCS Credit Received related data

- Verify that all entries match your accounting records. Manually add or edit lines if required.

Calculate and Pay Your Tax

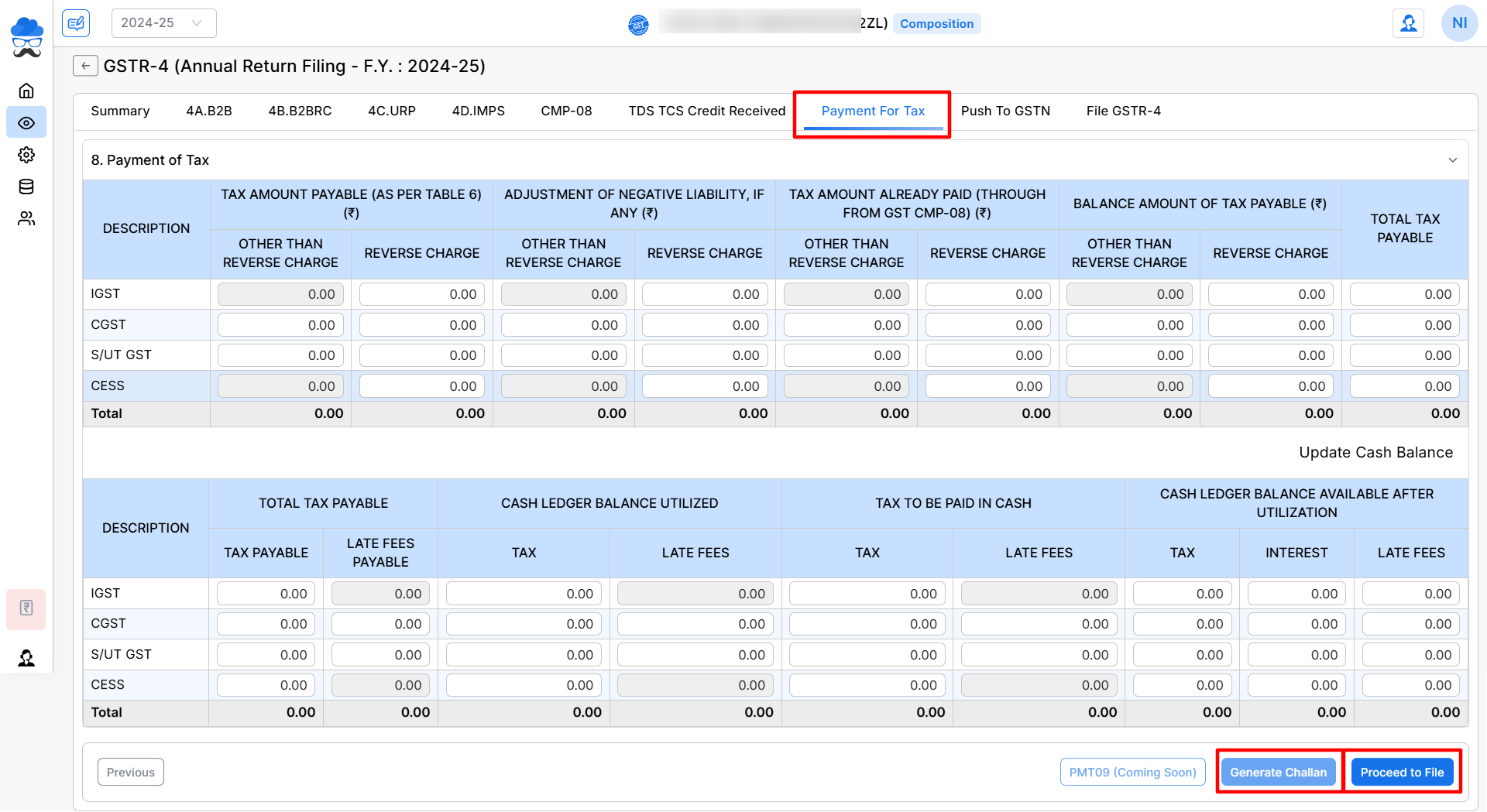

- Open the Payment For Tax section.

- Here Munim computes:

- Tax liability (as per Table 6), Adjustments for negative liability, Tax already paid and Balance Tax Payable

- Also, you will get the Cash Ledger Balance Utilisation Table.

- Click Generate Challan to open the Payment modes section and complete your challan payment.

- After you’ve paid the challan amount, hit Proceed to File.

Upload Your Data to the GSTN

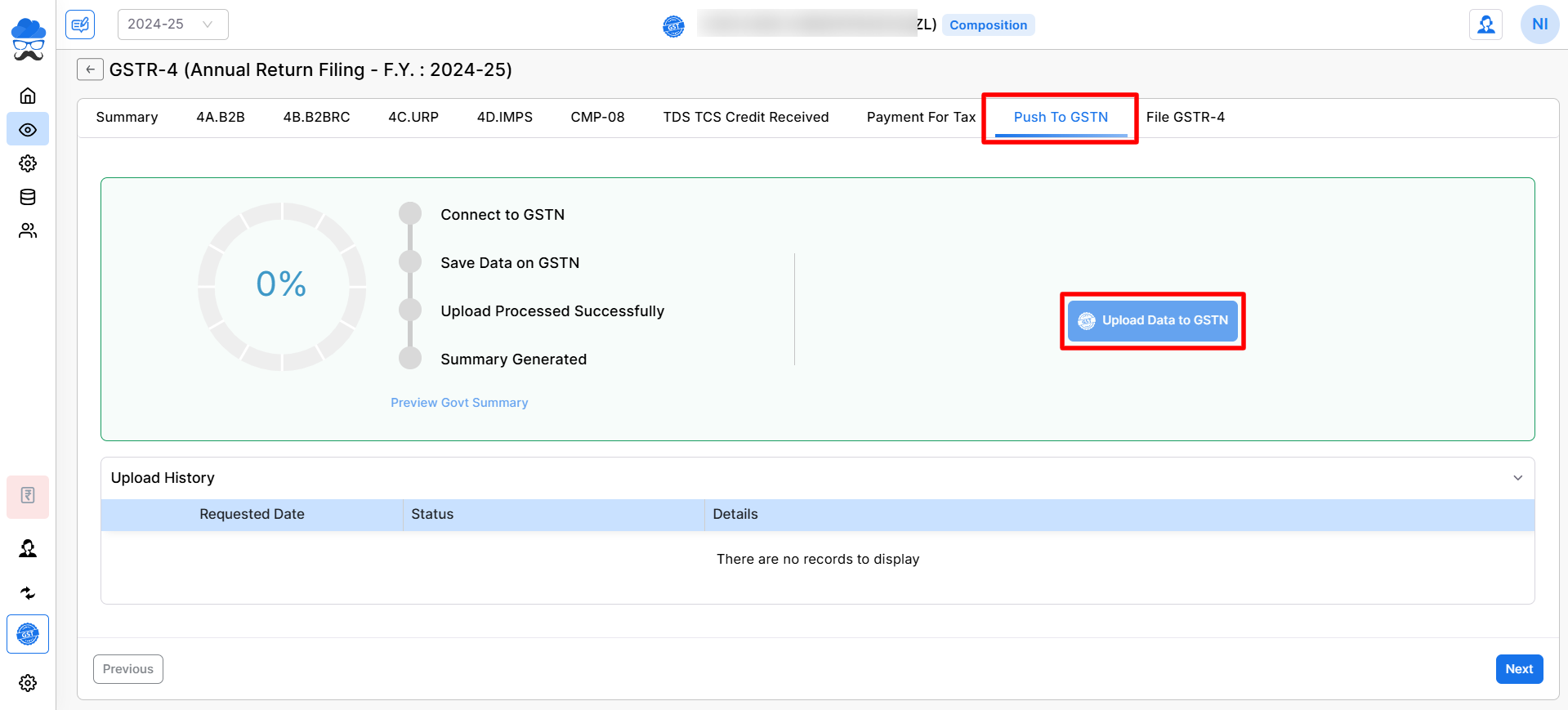

- You will be redirected to the Push To GSTN tab.

- Click Upload Data to GSTN.

- Follow the on‑screen progress indicators:

- Connect to GSTN

- Save data on GSTN

- Upload processed successfully

- Summary generated

- Upon successful data upload, you will get the Preview Govt. Summary option to check the summary of the data uploaded

Finalise and File

- Click Next at the bottom right to Switch to File GSTR‑4.

- Click on File with EVC option. (File with DSC option coming soon)

- Software will start the automated process of filing on the GST portal. Complete authorisation with OTP to complete filing.

- Your GSTR4 Filing process is completed now, and an ARN number will appear with Success message.

If you encounter any issues or have questions, check our helpdesk or reach out to the support team for further assistance.