213 views

213 views The GSTR-3B vs GSTR-2A Report in Munim GST Filing Software allows users to perform multi-month purchase reconciliation effortlessly.

This report compares the tax liability reported in GSTR-3B with the input tax credit (ITC) available in GSTR-2A, helping you identify mismatches, supplier non-filing issues, ineligible ITC, and ITC differences across multiple months.

Using this module, users can: Download multi-month GSTR-3B and 2A data directly from the GST Portal. View month-wise and quarter-wise ITC summary. Compare Total, IGST, CGST, SGST, and CESS values. Identify ITC excess/short claims for accurate reconciliation.

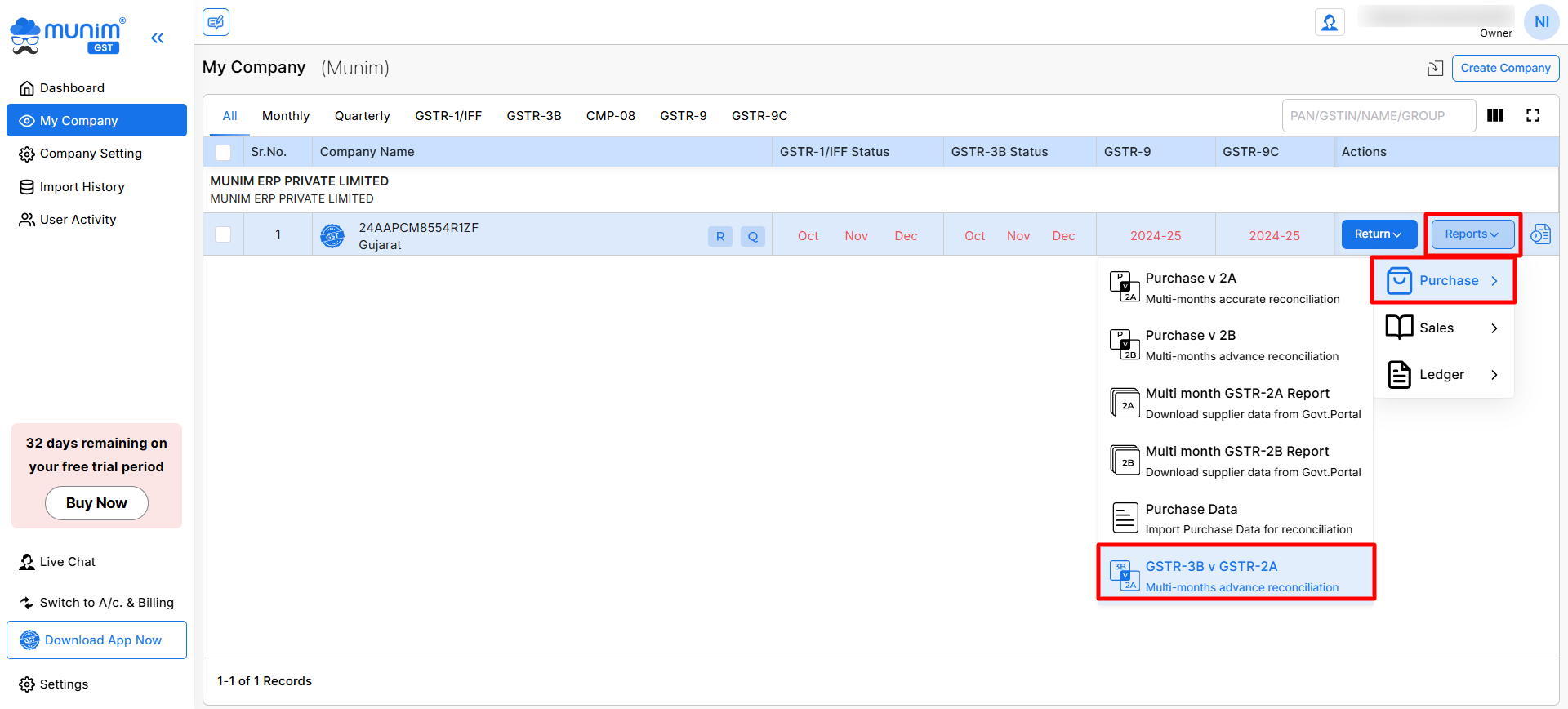

How to Access the GSTR-3B vs GSTR-2A Report

- Go to the My Company section from the left menu.

- Select the company for which you want to run the reconciliation.

- Click on the Reports button on the right side.

- Under the Purchase section, select GSTR-3B v GSTR-2A.

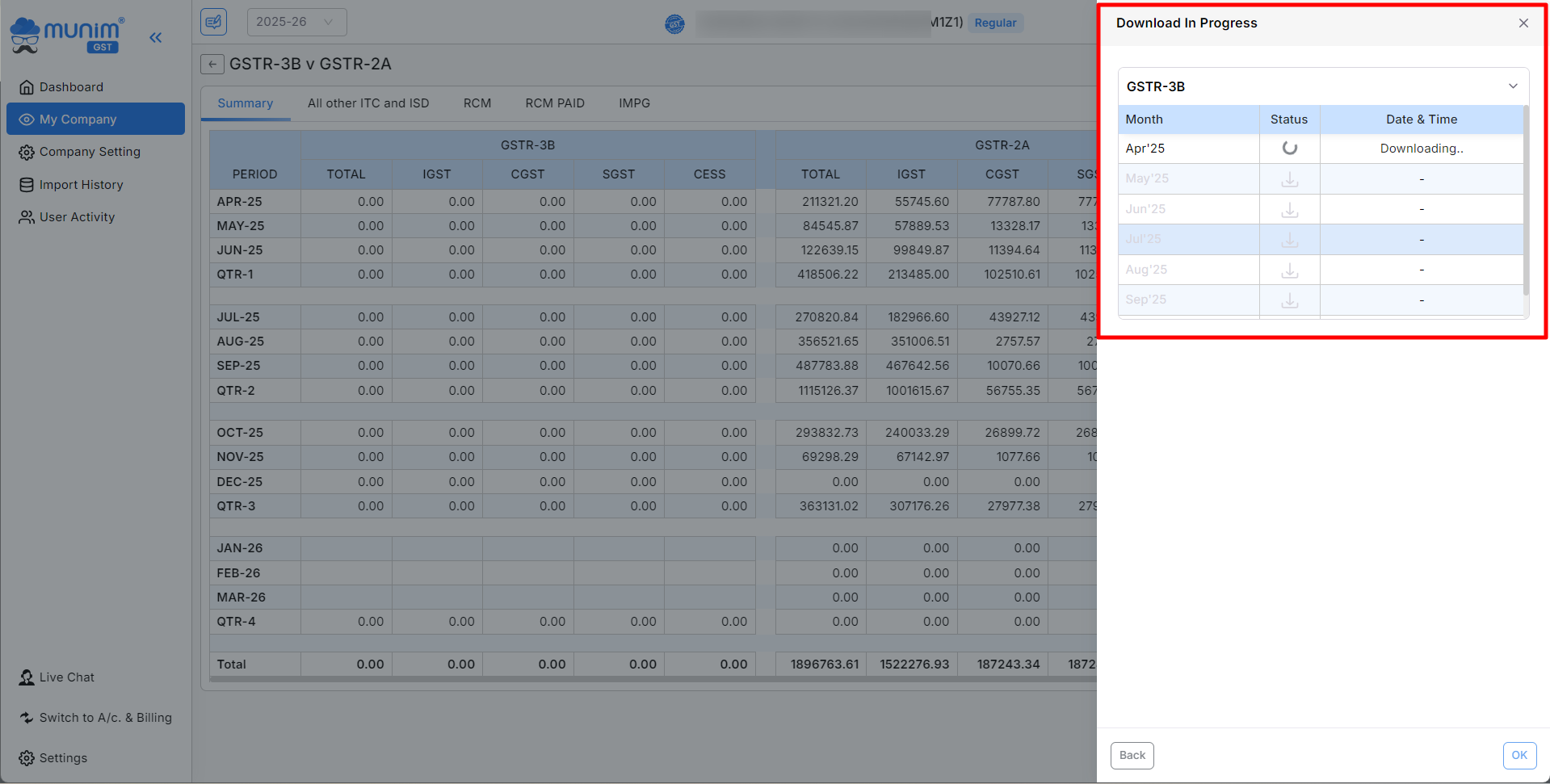

How to Download Multi-Month GSTR-3B & GSTR-2A Data

- After accessing the GSTR-3B vs. GSTR-2A report, a download prompt appears. Click download and enter GSTN credentials.

- A download panel sidebar will appear, and the system will start fetching data while displaying the download process.

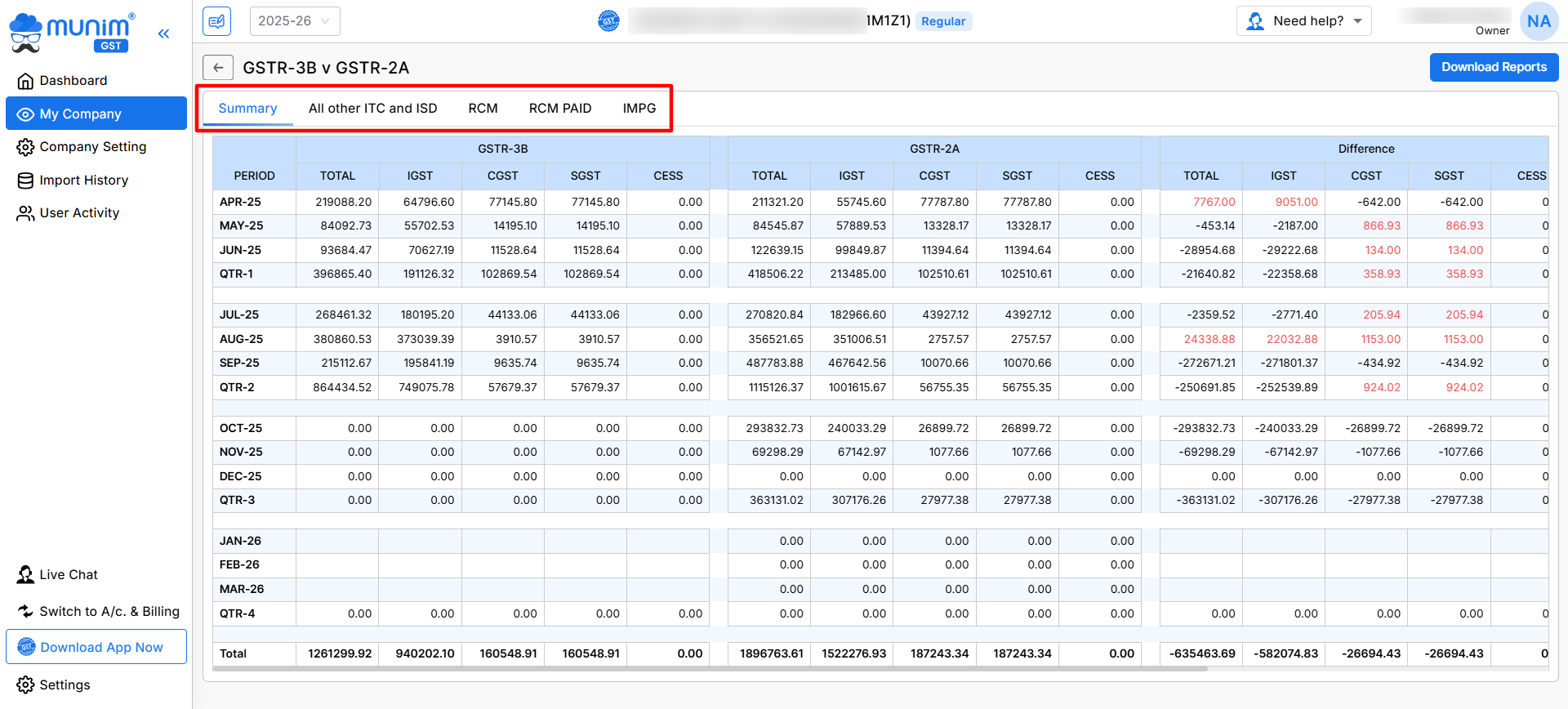

Understanding the Summary Table

- Once the data is downloaded, the main grid will display:

- You can see multiple sections here, like:

- Summary, All other ITC and ISD, RCM, RCM PAID and IMPG

Within each section, four primary columns will be displayed:

- GSTR-3B (ITC Claimed)

- GSTR-2A (ITC Available)

- Difference (Difference in 3B vs. 2A)

- Cumulative Difference (Calculation of the Monthly Difference)

The summary also shows month-wise, quarter-wise, and annual totals, helping you quickly assess ITC match or mismatch trends.

The report can be downloaded in Excel format by clicking the “Download Report” button located in the top right corner.

For any inquiries or assistance, please contact our support team.