363 views

363 views In Munim GST, before you can use E-Invoice and E-Way Bill related reports, you need to ensure that these options are enabled for the respective company. Enabling this setting allows you to generate, view, and reconcile E-Invoice and E-Way Bill data seamlessly.

Steps to Enable E-Invoice / E-Way Bill Reports:

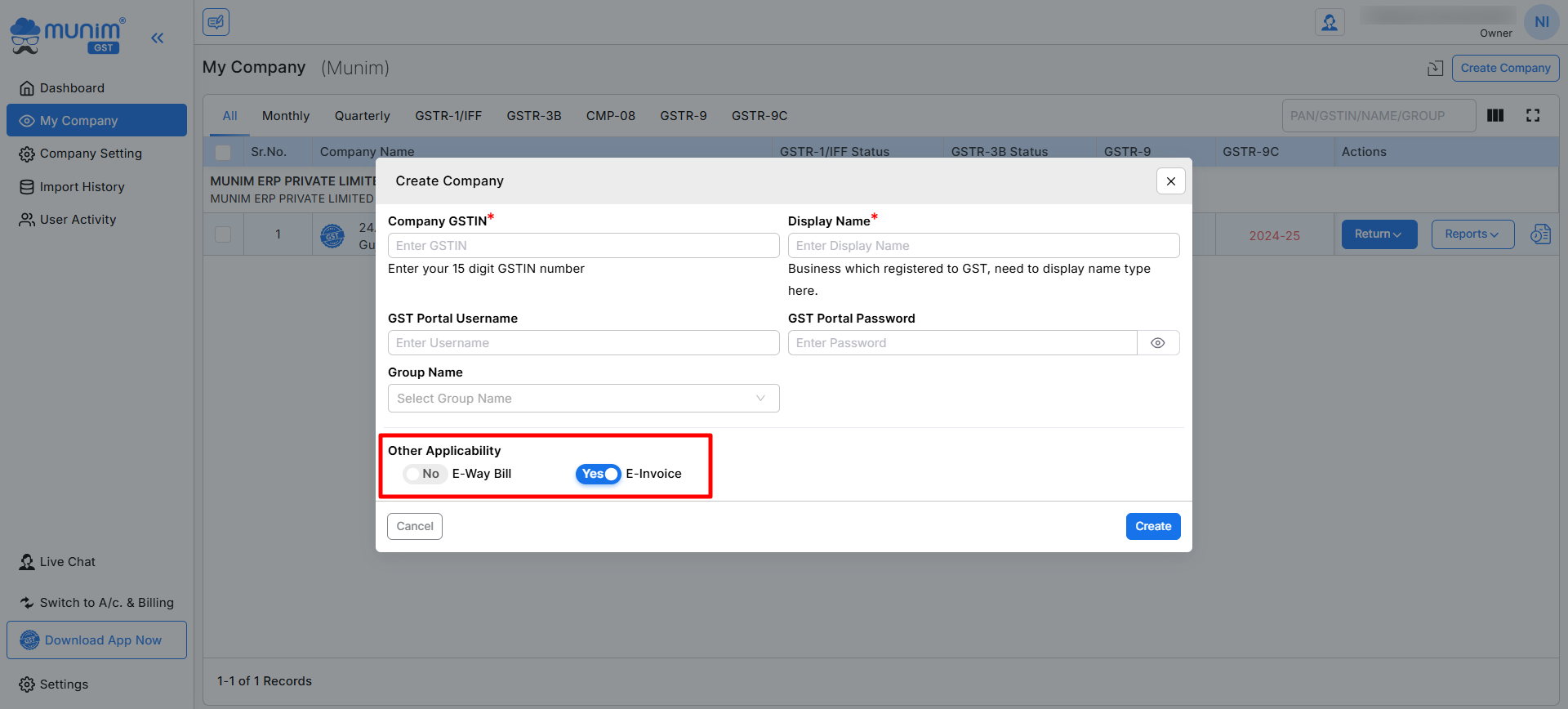

- When creating a company for the first time for GST filing, we have provided the option to enable E-Way Bill and E-Invoice.

+−⟲

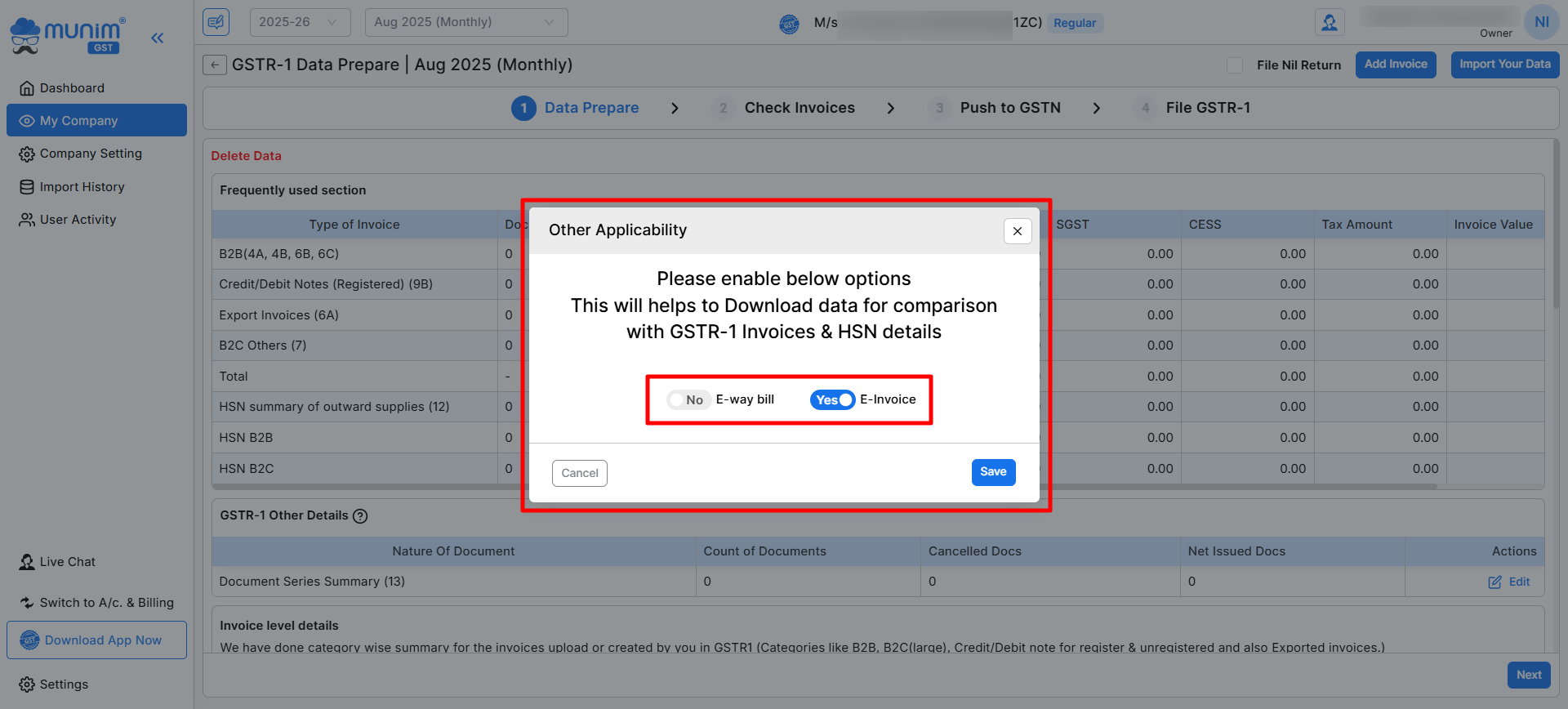

Enabling from GSTR-1 Filing Popup

- When you open a company first time for GSTR-1 filing in Munim, a pop-up message will appear if the E-Invoice / E-Way Bill option is not yet enabled for that company.

- Once enabled, you can continue filing GSTR-1 smoothly with E-Invoice / E-Way Bill features available.

+−⟲

- The pop-up will prompt you to enable E-Invoice / E-Way Bill directly.

- Click Enable Now to activate the option without navigating to Company Settings separately.

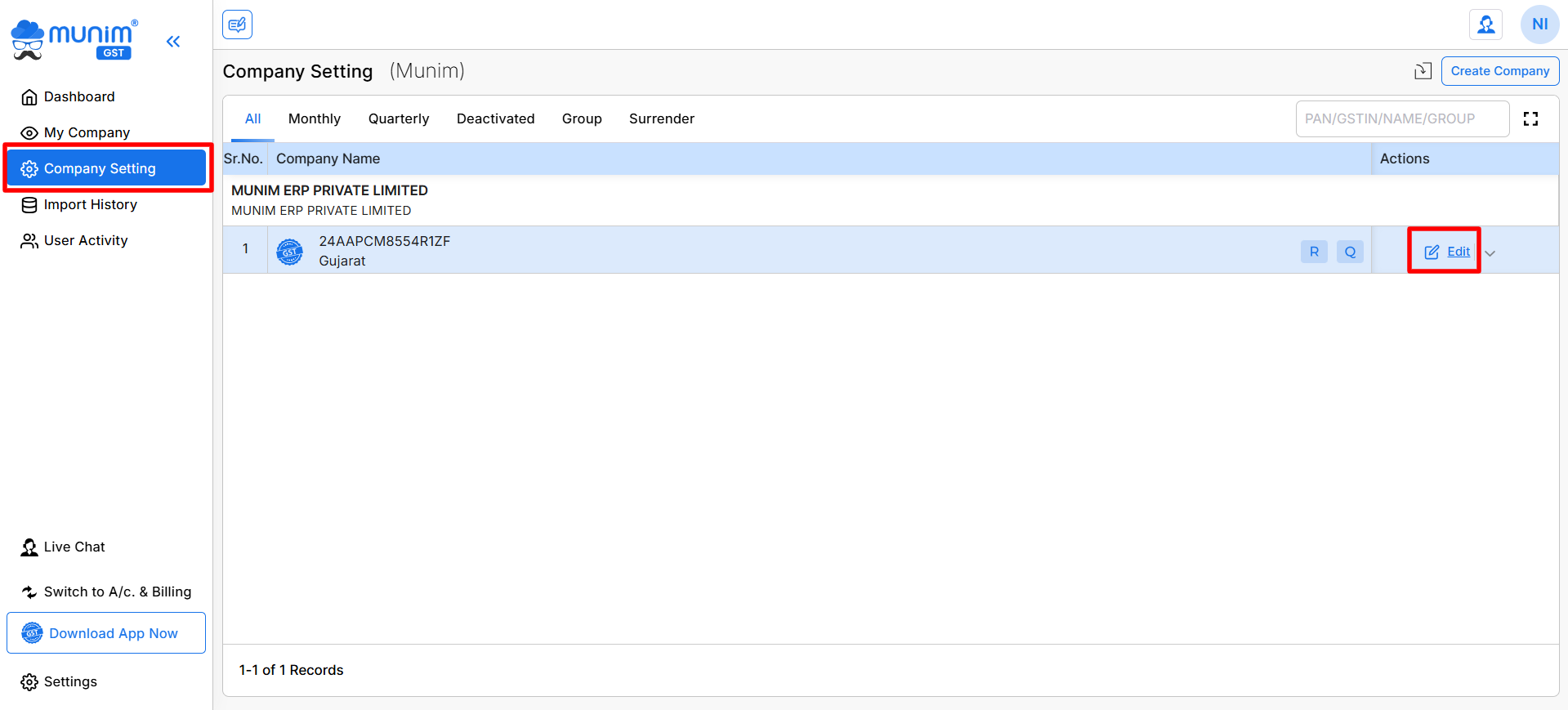

Go to Company Settings

- Log in to Munim GST and navigate to the Company Setting page.

- Find the company for which you want to enable the option.

- Click on the button next to the company.

+−⟲

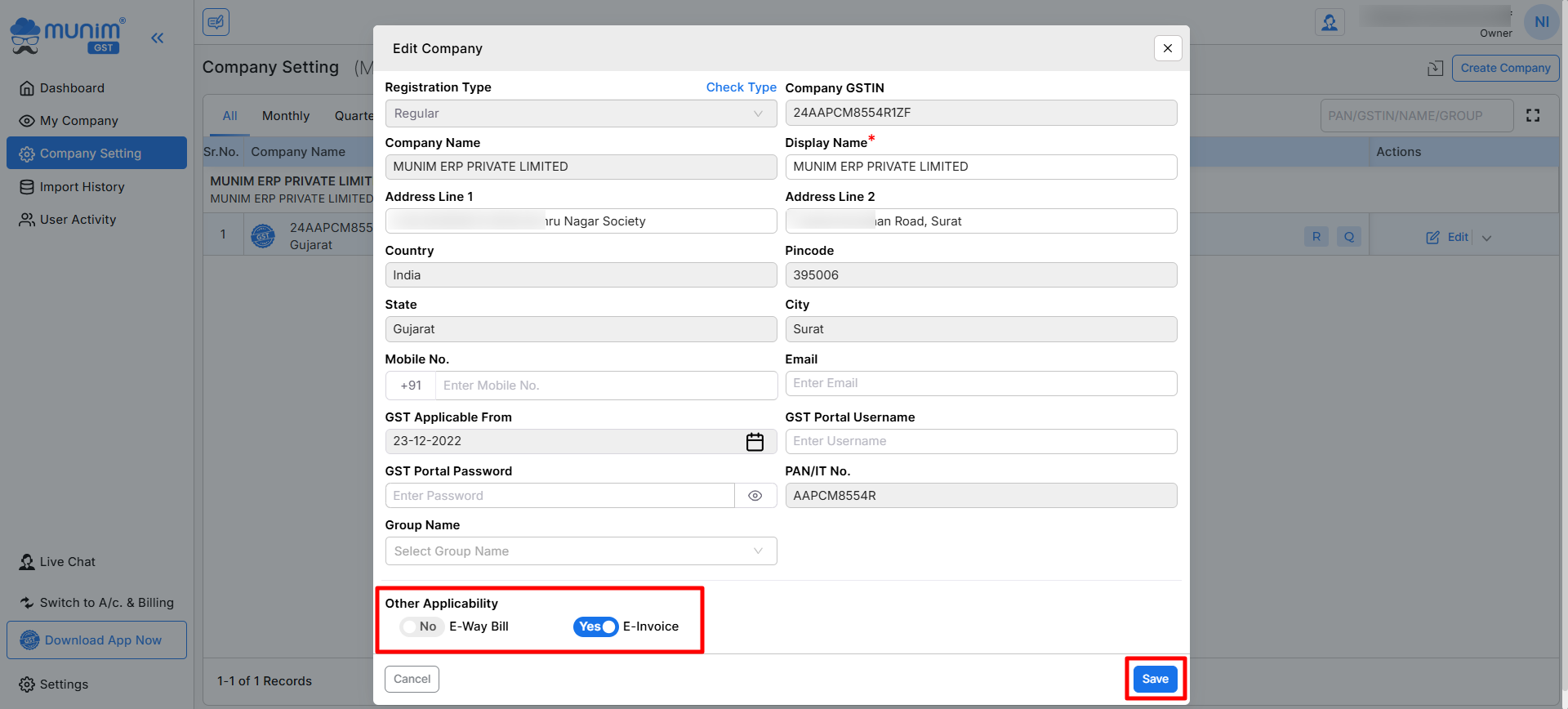

Enable E-Invoice / E-Way Bill

- In the Edit Company Settings form, scroll down to the bottom Other Applicability section. You will see two toggle options:

- Enable E-Invoice

- Enable E-Way Bill

- Set the options to “Yes” based on your specific needs.

+−⟲

Save Changes

- After enabling, click the Save button to update your company profile.

Important Notes:

- Enabling these options is mandatory to access E-Invoice and E-Way Bill reports in Munim GST.

- Without enabling them, the system will not show you download or reconcile related data.

- Once enabled, you can directly use the Reports section to generate your E-Invoice / E-Way Bill reports.