1966 views

1966 views GSTR-3B is a summary return that taxpayers are required to file regularly, providing details of sales, Input Tax Credit (ITC) claims, tax liabilities, refunds, and more, recorded under their GSTIN. This article offers a detailed overview of GSTR-3B and its relevance. Munim delivers a complete solution for GSTR-3B filing, ITC reconciliation, and maximizing ITC claims. Read on to learn more about GSTR-3B and its filing process.

What is GSTR 3B?

GSTR-3B is a monthly self-declaration return under the Goods and Services Tax (GST) regime in India. It is used by taxpayers to summarize the total outward and inward supplies, and the tax liabilities for the month, along with claiming Input Tax Credit (ITC) and making tax payments.

GSTR-3B Process:

- Select “GSTR-3B” from the Return menu on the My Clients module.

- You will be redirected to the GSTR 3B Data Preparation page, where you can view your data in the Summary Data section.

- Here, downloaded data from the GSTN portal will be displayed; otherwise, you can download data from the GST portal.

Data Download/Prepare process:

- When filing GSTR-3B, there are two ways to add your data.

(i) Download your data through the portal by clicking on the Download data from GSTN button, review all the tables, and compare them with your own records, going through each table in detail.

(ii) Accurately add all your data to the corresponding tables, and after entering the data, verify that everything is correct. After manually entering your available data into the respective tables, save the data.

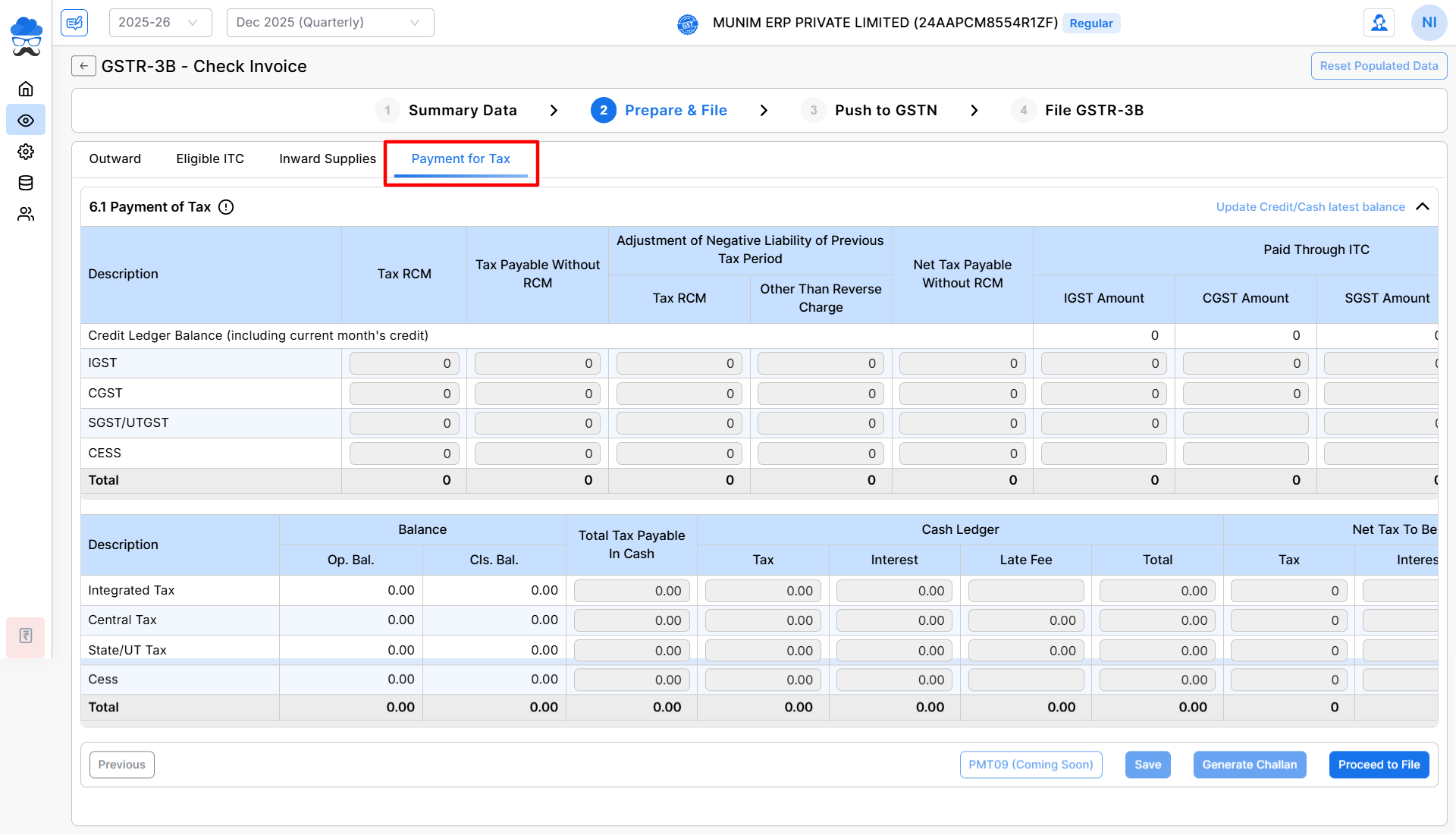

Payment of Tax:

- After preparing and checking all your data, go to the Payment for Tax section. Here, you need to check the data and click on the Save button first to enable the Generate Challan button and complete the payment.

- If sufficient credit is available for tax payment, proceed directly to the final step of filing by clicking Proceed to File.

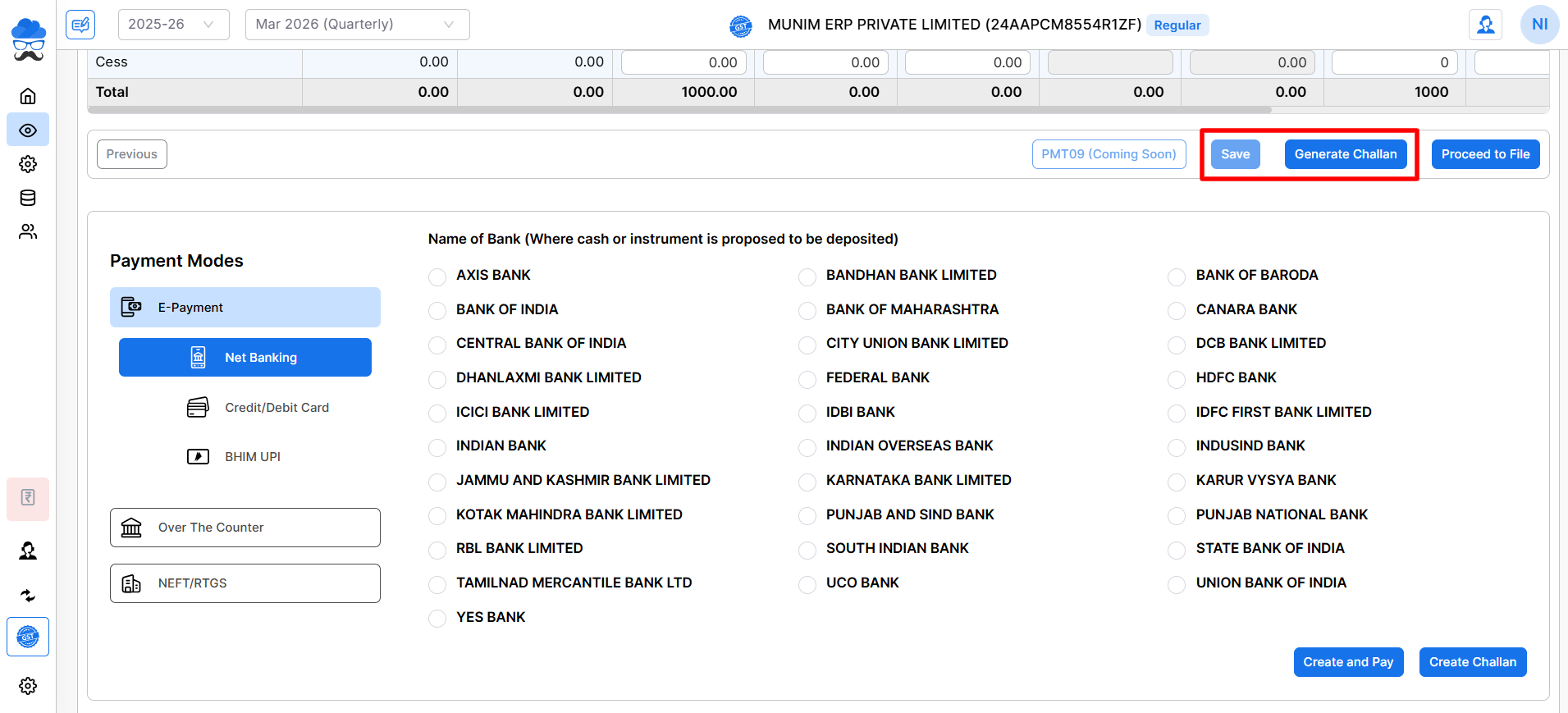

Challan Creation:

- To Pay Tax, you have to click on the Save button first, then click on the Generate Challan button.

- After clicking on the Generate Challan button, you will find a Payment Mode field under it.

- Here you have two options,

- Create and Pay: Generate a challan and complete payment from the software by the preferred payment method.

- Generate Challan: Generate a Challan and download it to share it with the client so he can complete the payment.

- After paying the challan, proceed to the final step of filing by clicking on the Proceed To File button.

- Here you have two options to upload your data to the portal:

- Upload Without OTP: Upload your data by adding your GST portal credentials and captcha to complete the process through the portal.

- Upload via OTP: Upload your data by adding GST portal credentials and requesting for OTP on the registered mobile through API access.

- By clicking on the Upload Data to GSTN button, the upload process will start and show its status in percentage.

- After uploading data successfully to the portal, a Preview Govt Summary option will be available for checking the data after uploading.

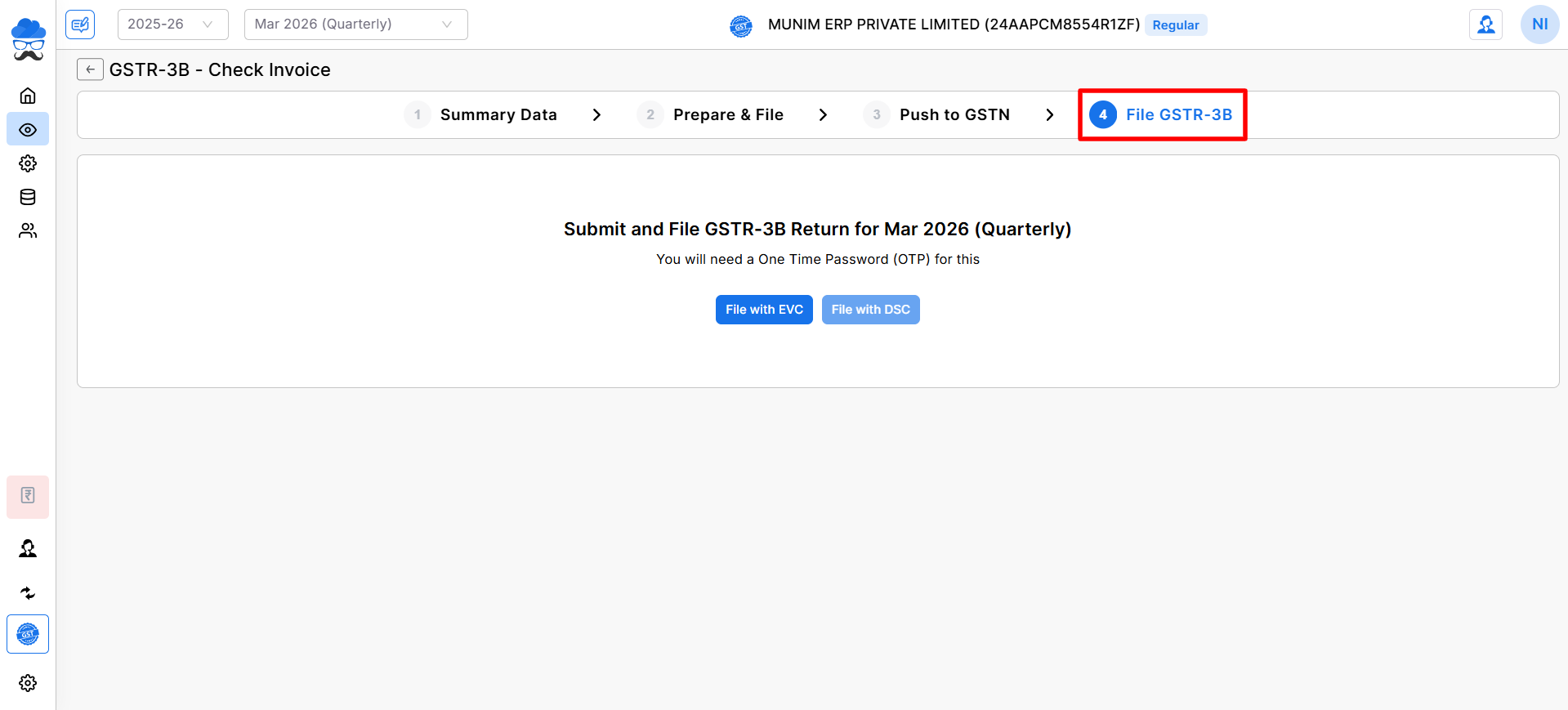

- Now go to the section of File GSTR-3B to select the filing method of File with EVC.

- After successfully uploading your data, you will see a message stating, GSTR-3B return has been successfully filed.

By following these simple steps, you can file your GSTR-3B from Munim GST Filing Software.

For any assistance or inquiries, reach out to our support team.