1852 views

1852 views The GST Return History page in the system provides a comprehensive view of all the GST returns filed for a particular period. This feature helps users track the status and details of returns like GSTR-1 and GSTR-3B to ensure compliance with GST regulations.

Steps to Check GST Return History:

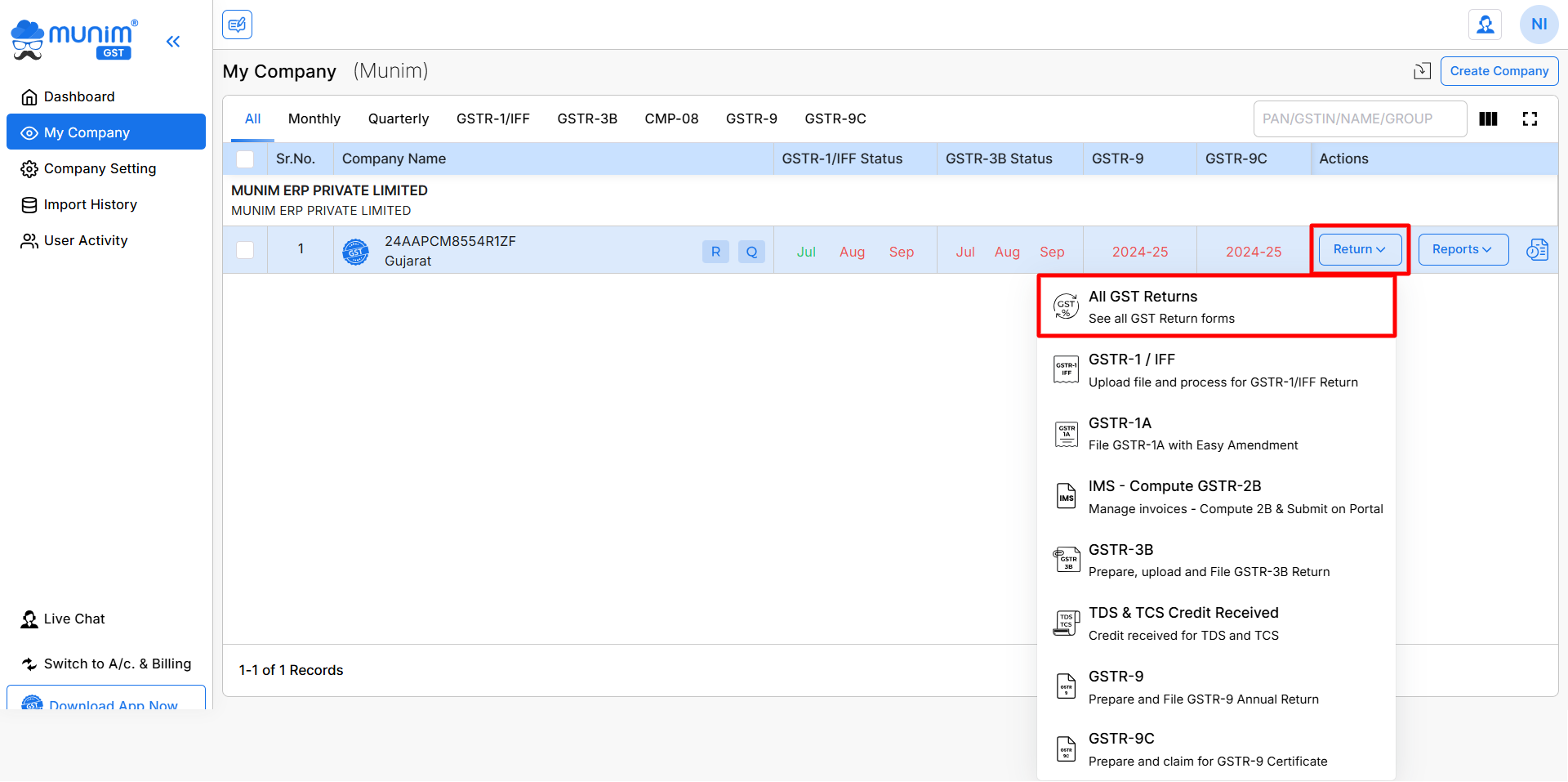

- Navigate to GST Return History:

- From the dashboard, go to the Reports module for a particular company and select the GST Return History option.

+−⟲

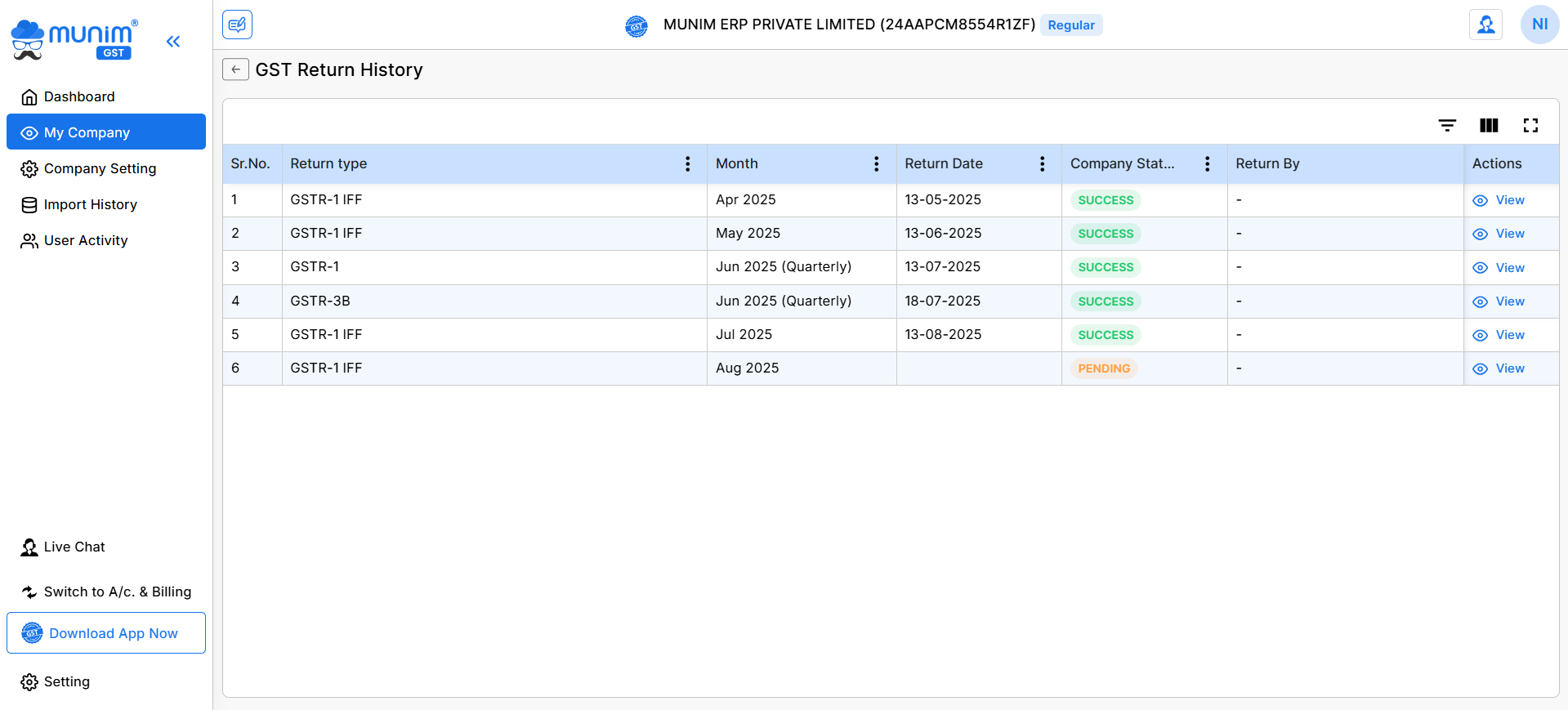

- View GST Return History:

- The page lists all returns filed by your company. The details displayed include:

+−⟲

- Return Type: Shows whether the return is GSTR-1 (Sales Return) or GSTR-3B (Summary Return).

- Month: Indicates the month and filing frequency (Monthly).

- Return Date: The date when the return was filed.

- Company Status: Displays the status of the return (e.g., SUCCESS, PENDING).

- Return By: Shows who filed the return.

- Actions: You can click on the View button to see detailed information about the specific return filed.

- Check Return Status:

- SUCCESS: If the return is marked as “SUCCESS,” it means the GST return has been successfully filed for the period.

- PENDING: If the status is “PENDING,” it indicates the return is yet to be filed for that period.

- View Return Details:

- The View button under the Actions column is to view each return’s detailed submission and filing details.

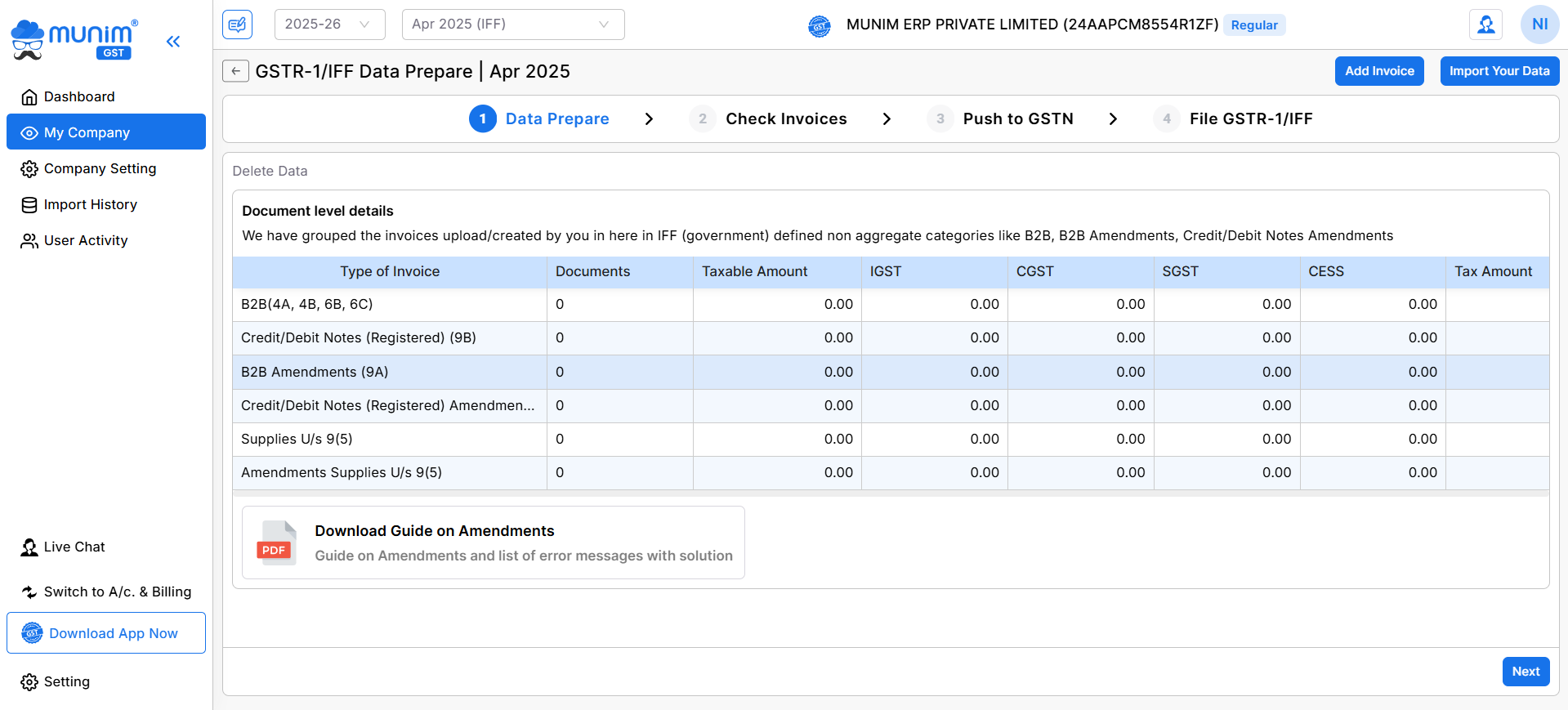

- When you click on the View button, it will show the filed data for a particular month with complete details. Check the image below.

+−⟲

By following these steps, users can easily monitor the filing history and ensure that all required returns have been submitted to GSTN on time.