1861 views

1861 views A Multi Month GSTR-3B Filed Report involves consolidating and analyzing the details of the GSTR-3B forms for multiple months. This is useful for businesses that want to ensure accurate and consistent input tax credit (ITC) claims over a longer period. Here’s how to utilize a Multi Month GSTR-3B Filed Report.

Here are the steps for performing a Multi month GSTR-3B report.

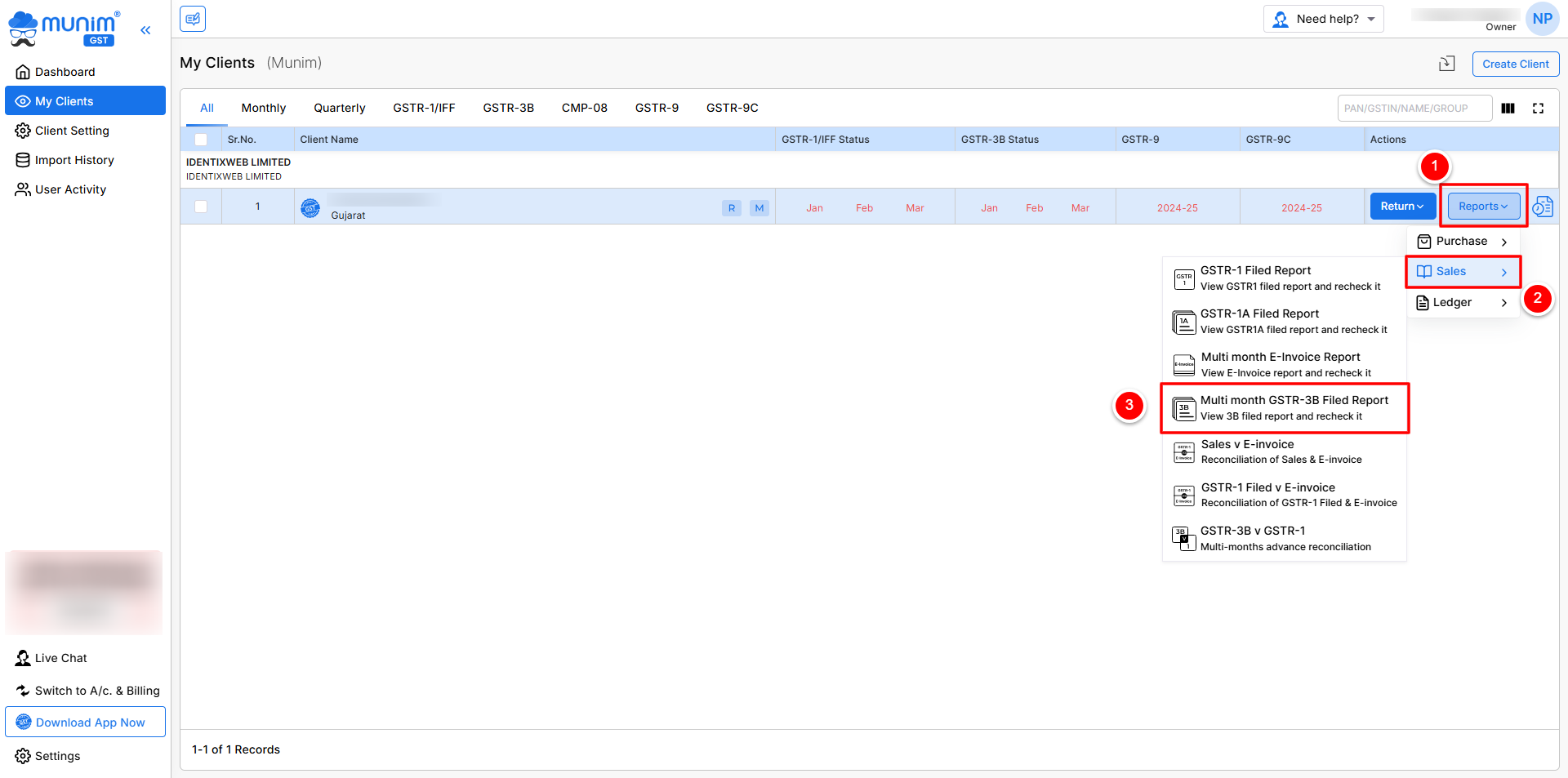

- Select “Multi month GSTR-3B Report” from the Reports option on the My Clients page.

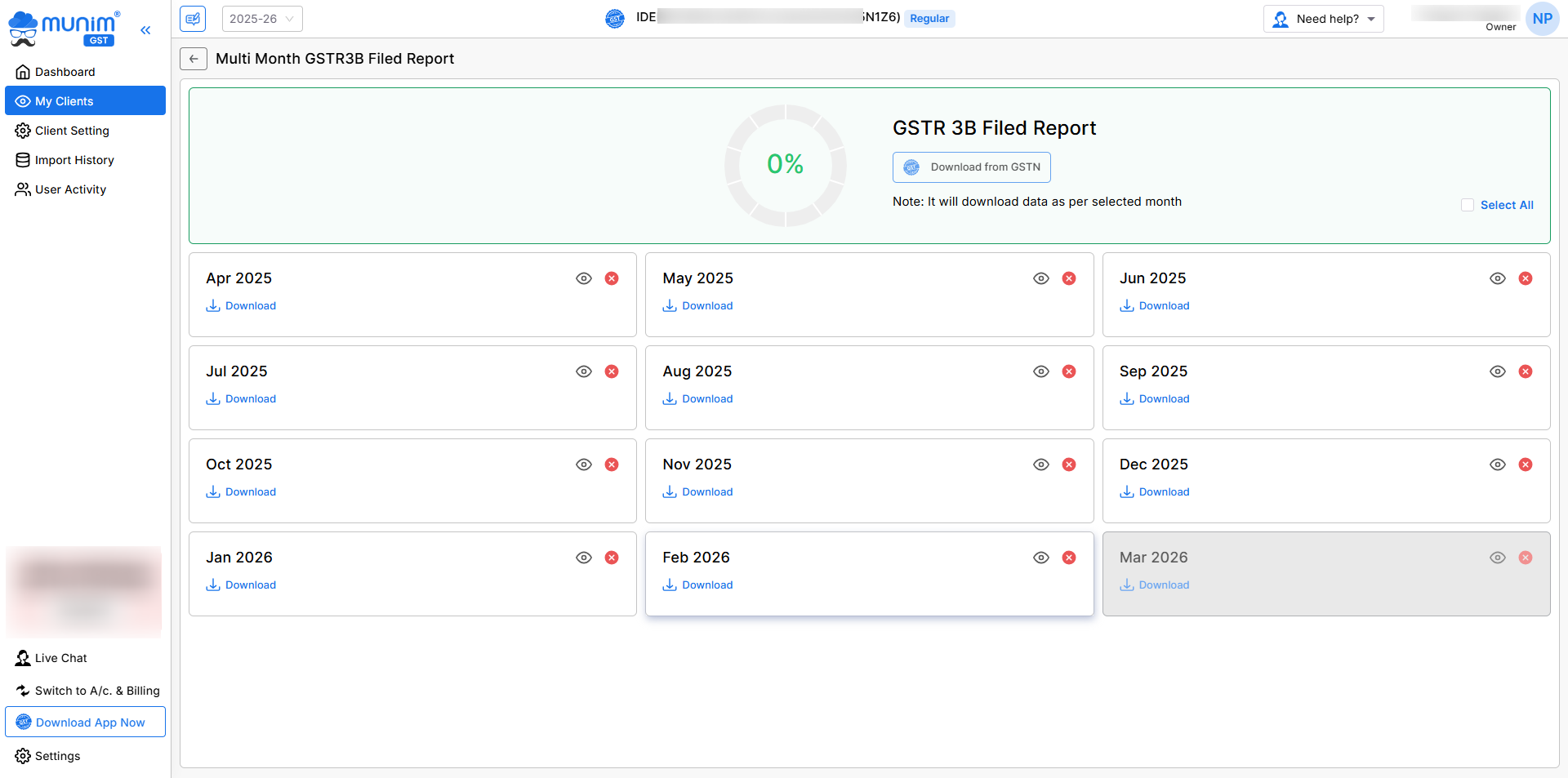

- You have been redirected to the Multi Month GSTR-3B Filed Report page based on the selected financial year.

- In the Month view page, you can click to select any months or you can click the Select All option to select available months for downloading data.

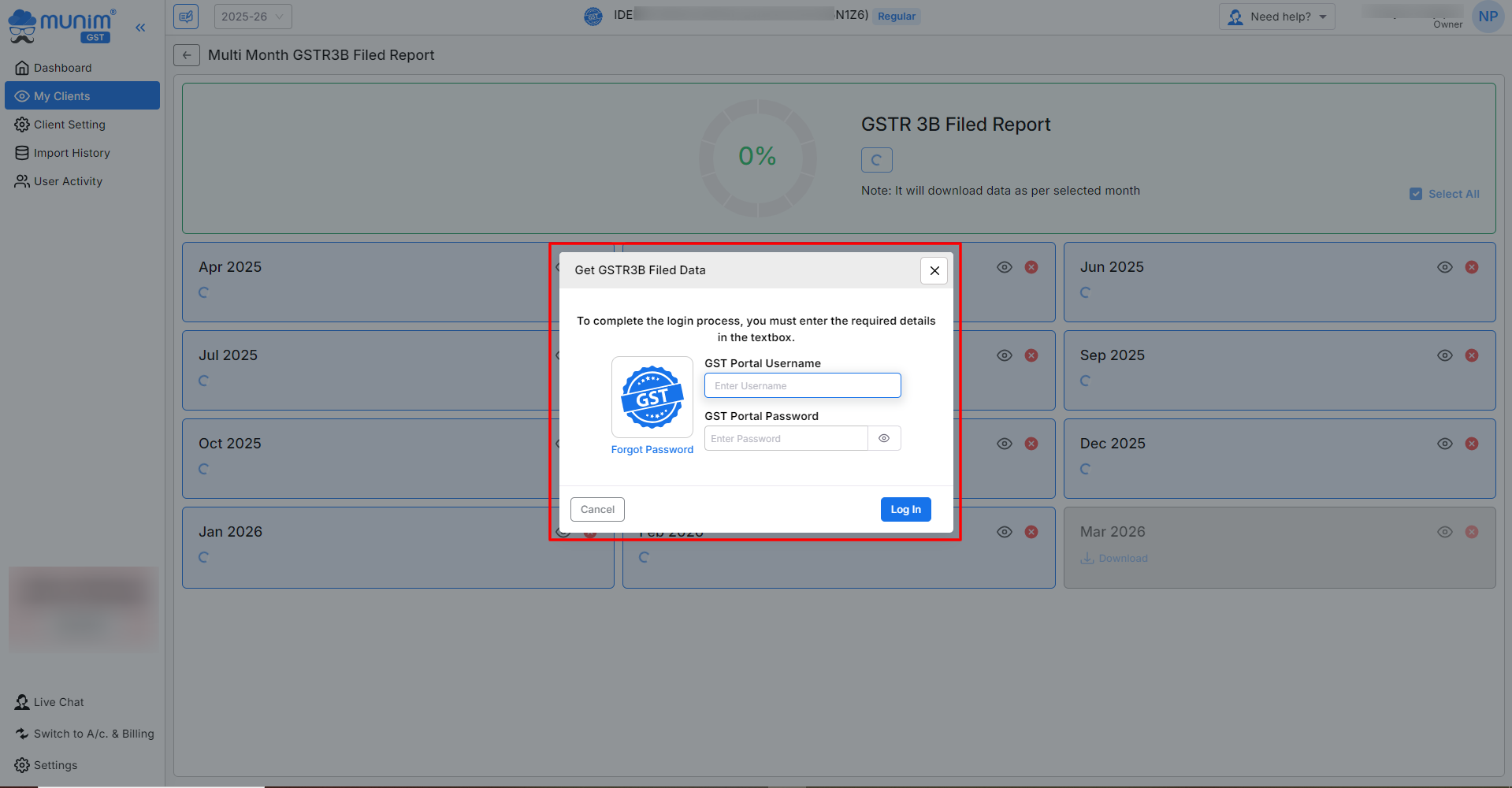

- Now you can click on the Download from GSTN button to enter the government portal credentials and download the GSTR-3B data from the GST portal. (You must use the Munim desktop app to download the data).

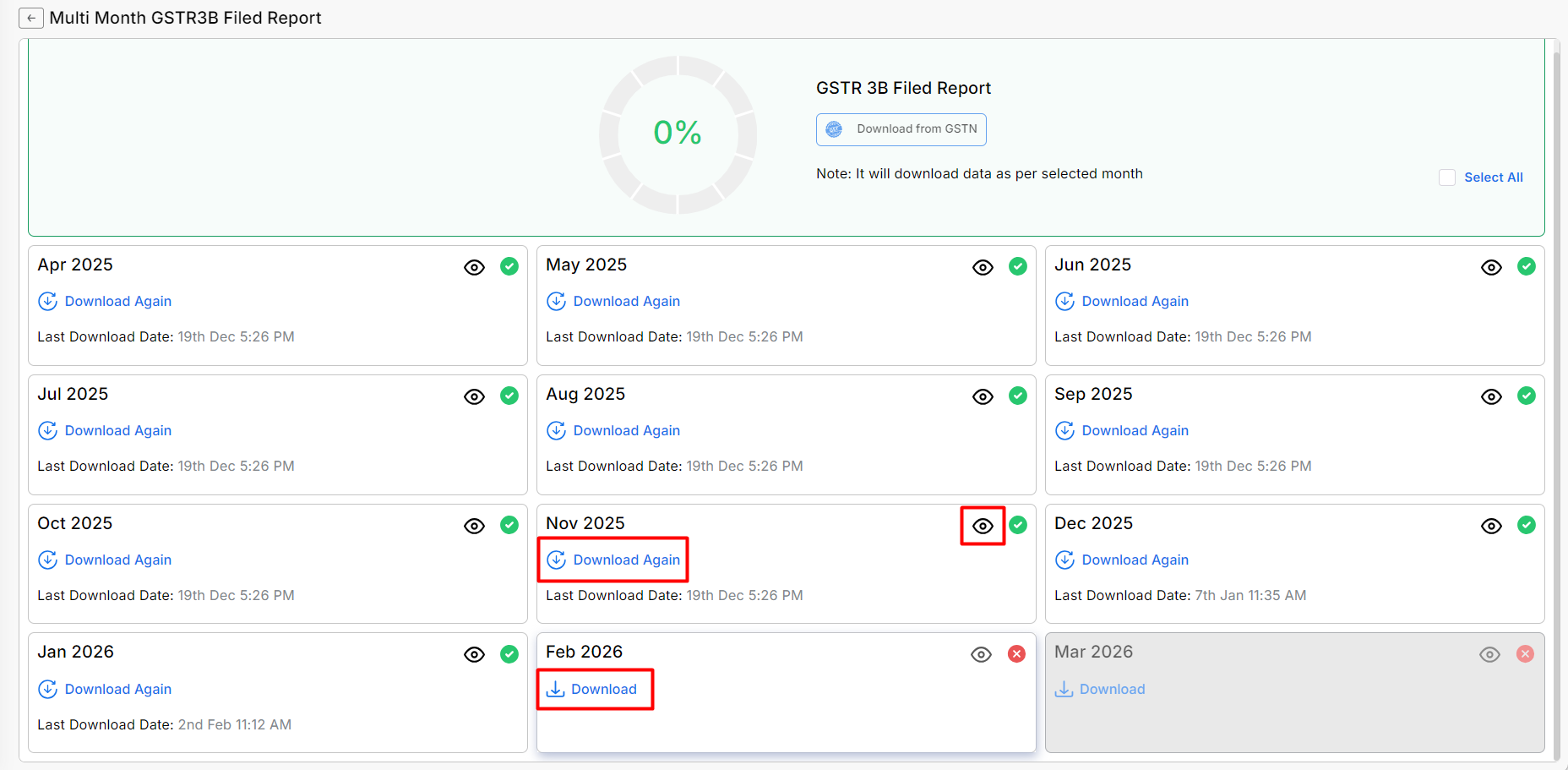

- After downloading the data, you will see a page indicating which month’s data has already been downloaded and which month’s data is still pending to download.

- If the data for a month has not been downloaded, you will see a “Download” button.

- You will see a “Download Again” button if the data has already been downloaded once.

Multi month GSTR3B Filed report

- After successfully downloading your data, you can view it month-wise by clicking on the View icon (👁).

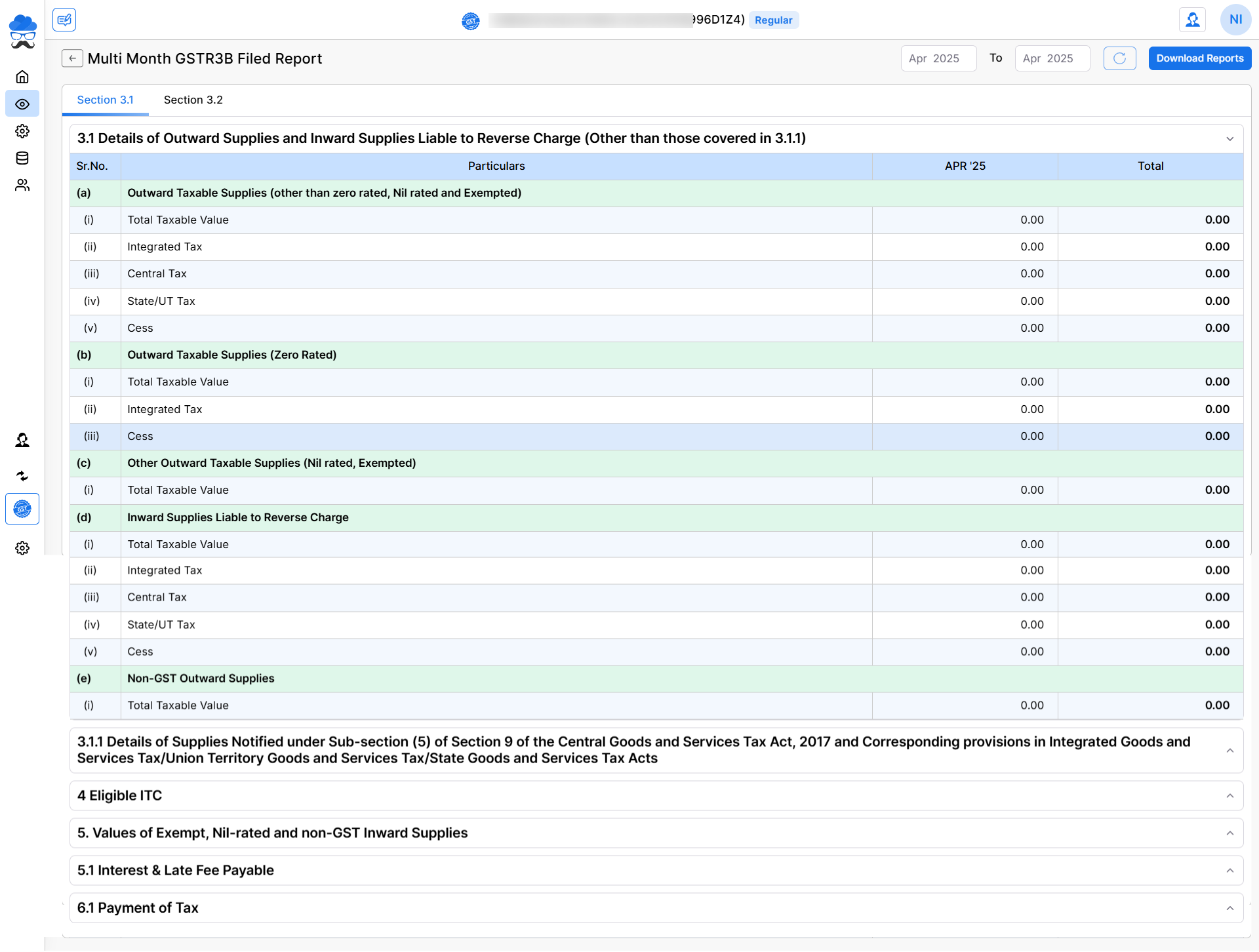

- Here on this page, you will find the data of the GSTR-3B filed report in detail

- All data are shown in two sections, Section 3.1 and Section 3.2.

Download Report and Multi-month selection option:

- You can select multiple months from the month selection field at the top right side to see multiple or annual data at once.

- On this page, we have provided a Download Reports button at the top right corner to download GSTR-3B data in Excel format.

For any queries or questions, you can contact our support team.