452 views

452 views The GSTR-1A Filing Helpdesk helps you understand, review, and correct your sales return data before final submission. You can check any changes made by your buyers, accept or reject them, and ensure your GST data is accurate.

If you have already filed GSTR-1 but have not yet filed GSTR-3B, GSTR-1A gives you a final opportunity to review and update your GSTR-1 data correctly before 3B filing, ensuring accuracy and compliance.

Here you will get a step-by-step guide to file GSTR-1A in munim GST software:

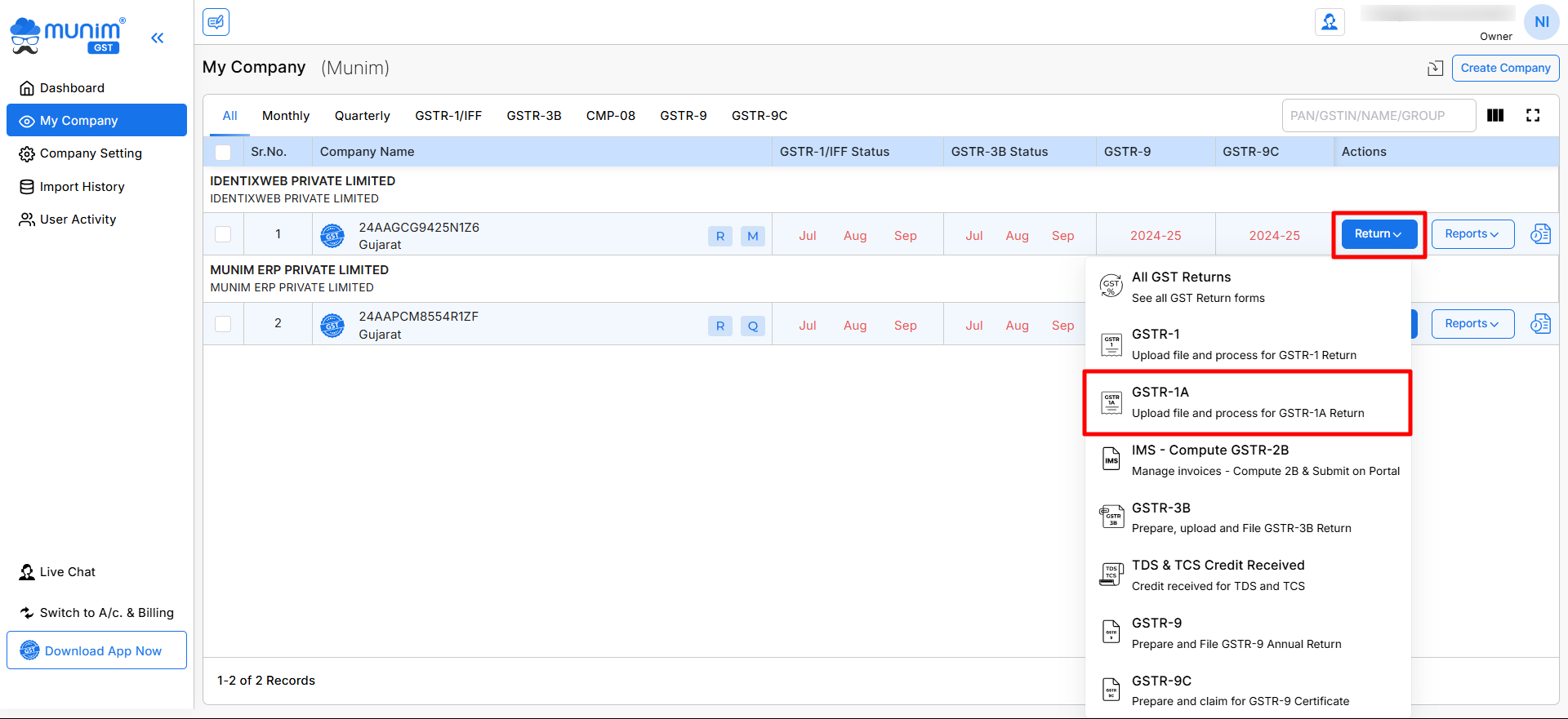

- Select GSTR-1A option:

- On the My Company page, select the company, click on the Return button.

- Here, select GSTR-1A from the list of options.

- Prepare data:

- Prepare your data by adding invoices Manually or Importing data.

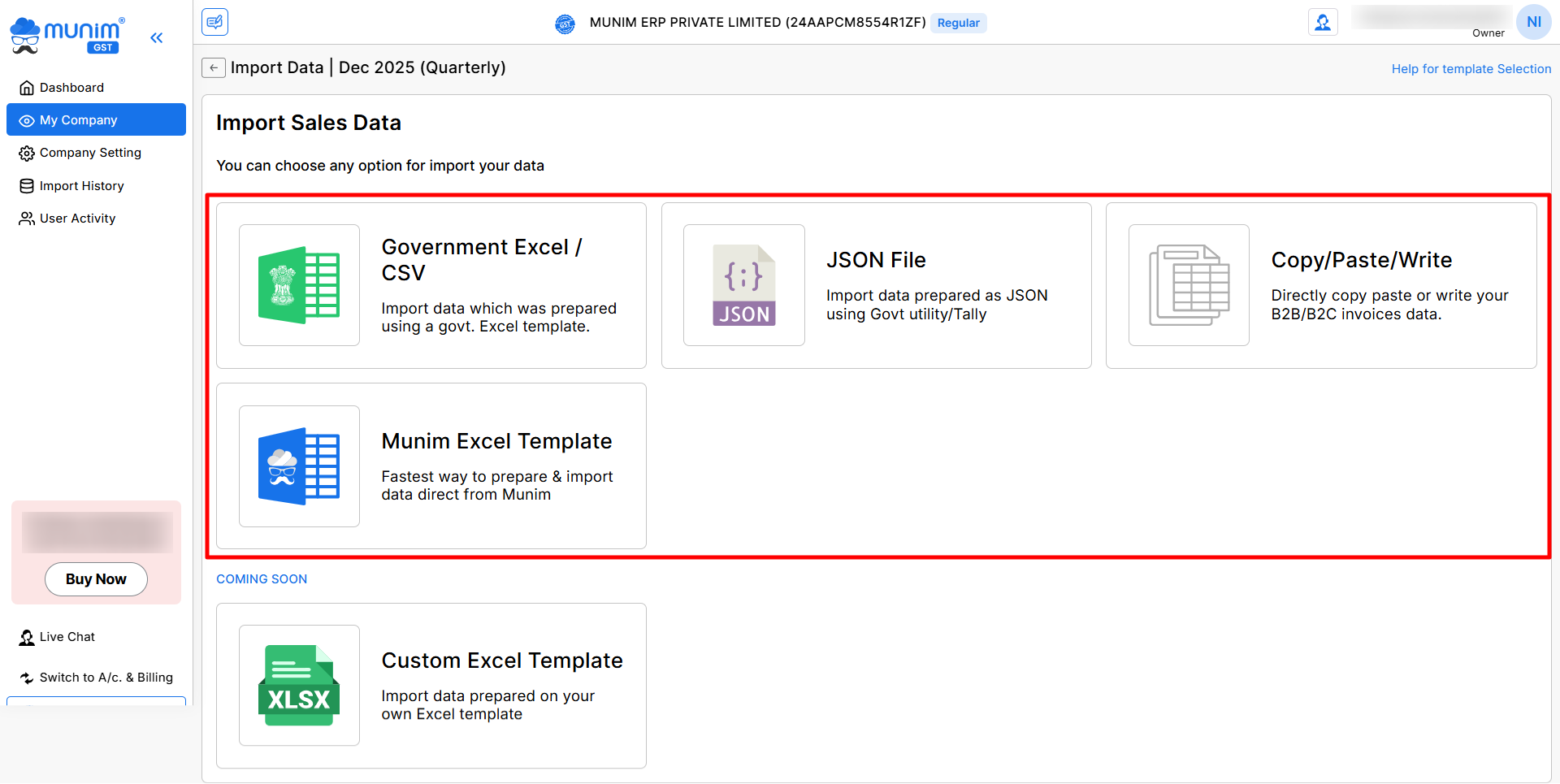

- Import your data:

- Click on the import data button.

- Choose from options like Government Excel/CSV, Munim Excel template, JSON file or copy/paste/write.

- To learn the process of data importing in munim GST, check this Import data helpdesk link.

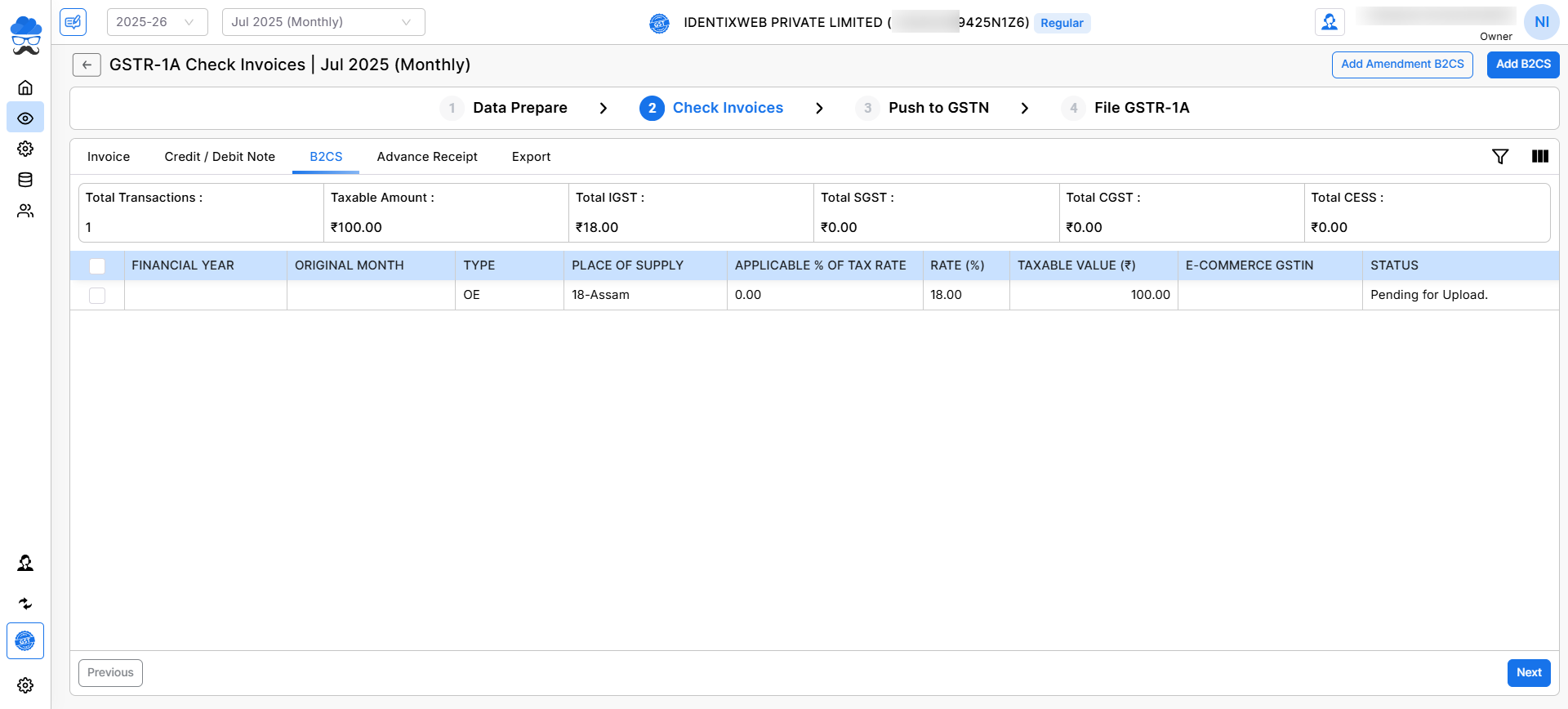

- Check invoices:

- After importing your data, verify the invoices in the second step. where you can check and edit invoices.

- If some of the Invoices are already uploaded to the portal, you can select them and click Mark as Uploaded. You can check their statuses in the status column.

- Also, you can edit or delete any entries by selecting them here. Once done, you can click the Next button to proceed.

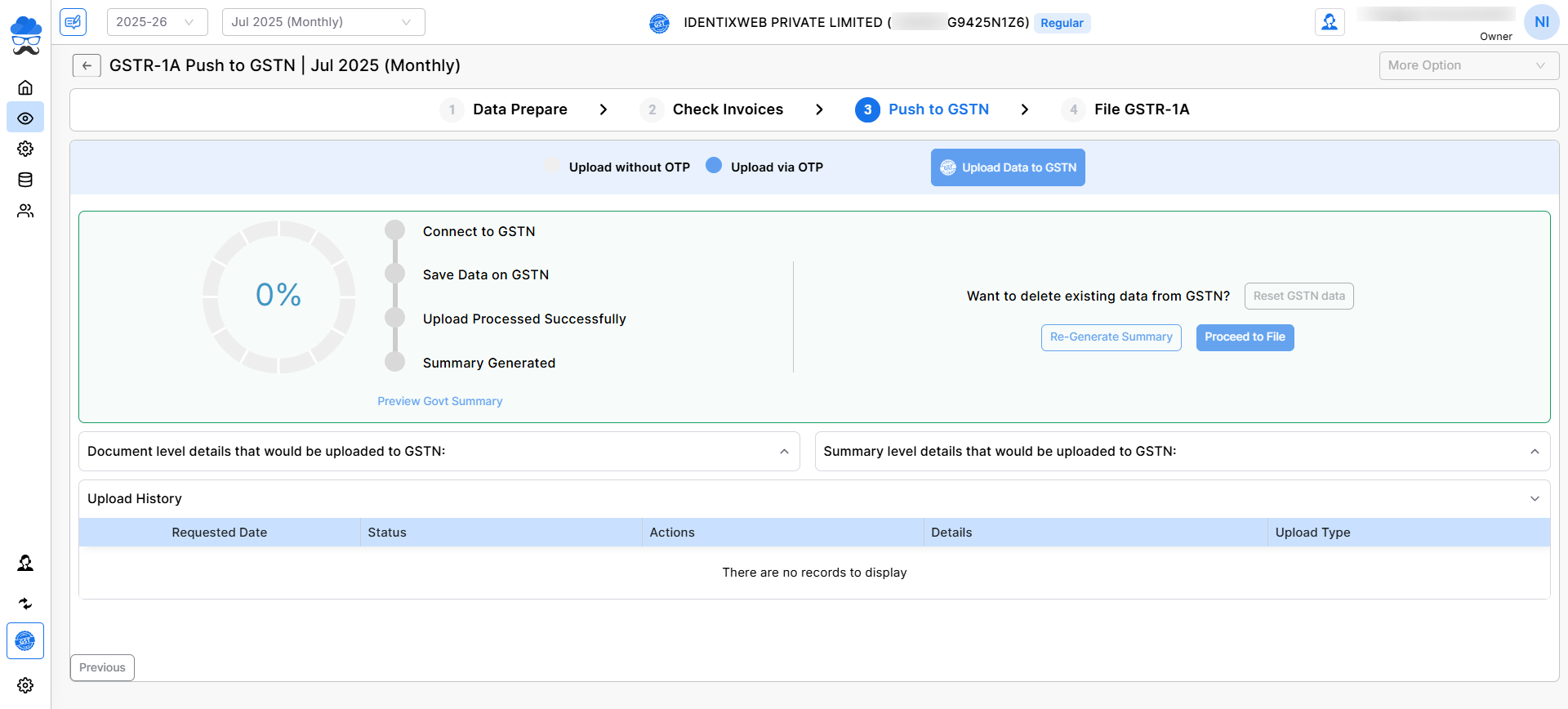

- Push data to GSTN portal:

- In the third step, select either Upload without otp or Upload via otp.

- Now, click on Upload data to GSTN and wait for the summary to be generated.

- After the summary is generated, you can check for any errors below it.

- Once the summary generation and checking are done, click the Proceed to File button to continue the process.

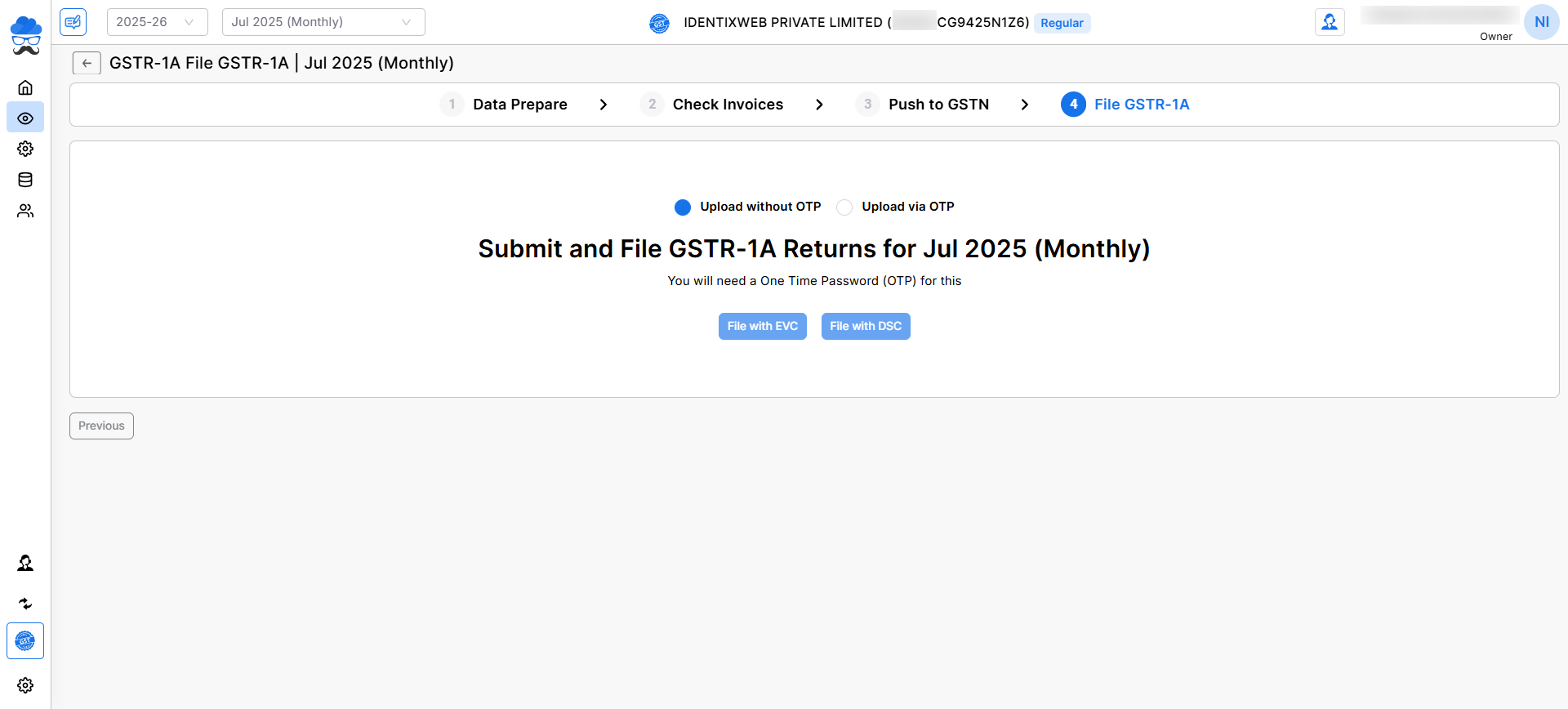

- File GSTR-1A:

- In the fourth step, file GSTR-1A using the File with EVC or DSC method(coming soon).

- Enter the required username and otp to Proceed.

- Once done, a Success message page will appear.

By following these steps, you can easily file your GSTR-1A using Munim GST Return Filing Software. For further assistance, please contact our support