313 views

313 views The GSTR-1 Vs E-Invoice reconciliation process involves comparing the outward supply data reported in your GSTR-1 return with the invoices generated on the e-invoice portal.

This process helps ensure that all invoices uploaded in the e-invoice system are correctly reflected in GSTR-1, and any missing or mismatched invoices can be identified easily.

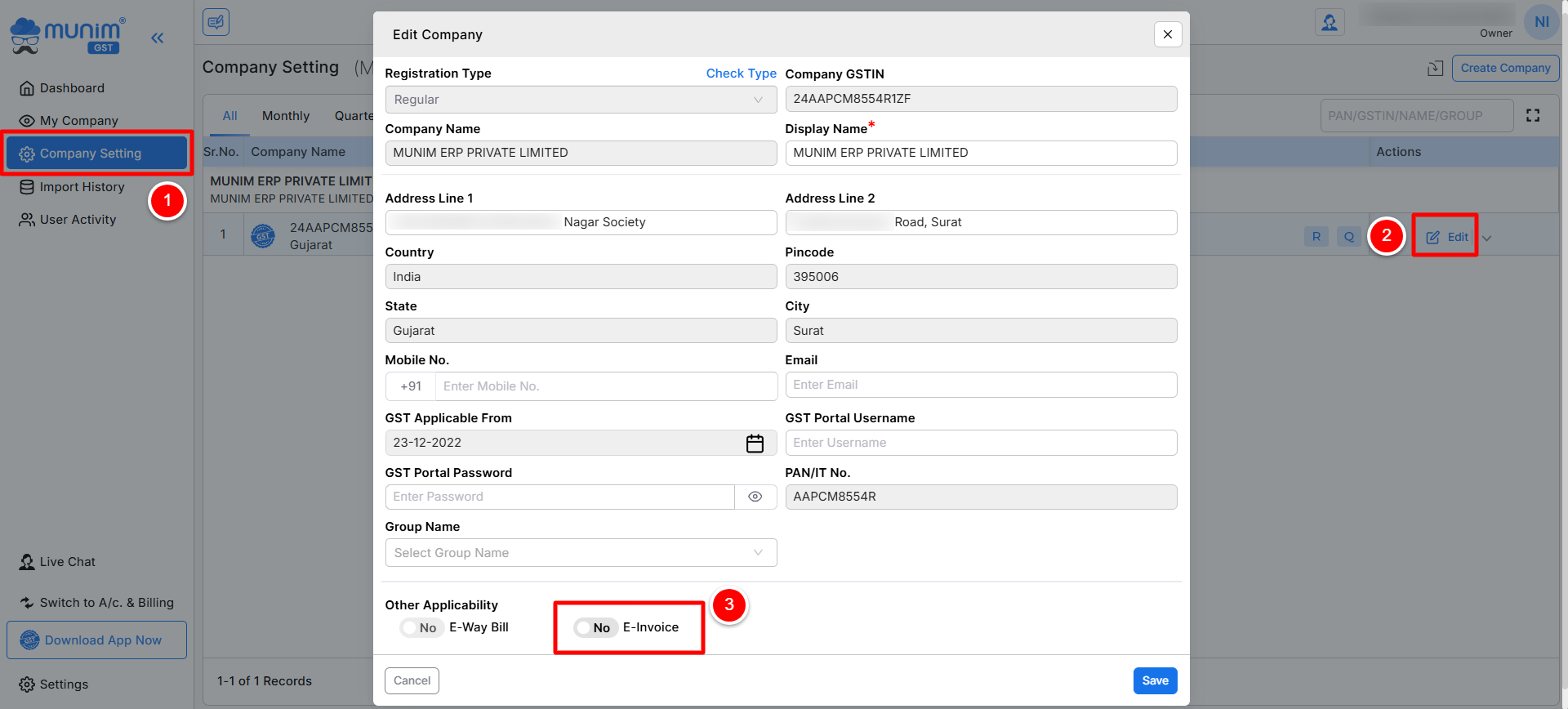

Enable E-Invoice Option First:

- Before starting reconciliation, you must ensure that the E-Invoice option is enabled for the selected company.

- To enable this feature, go to the Company Settings module from the main menu. Locate the company you want to update and click Edit.

- Scroll down to the bottom of the settings page, where you will find the Enable E-Invoice option. Turn it on and click Save.

Note: Without enabling this option, you won’t be able to see E-invoice related reports and download or reconcile E-invoice data for the company.

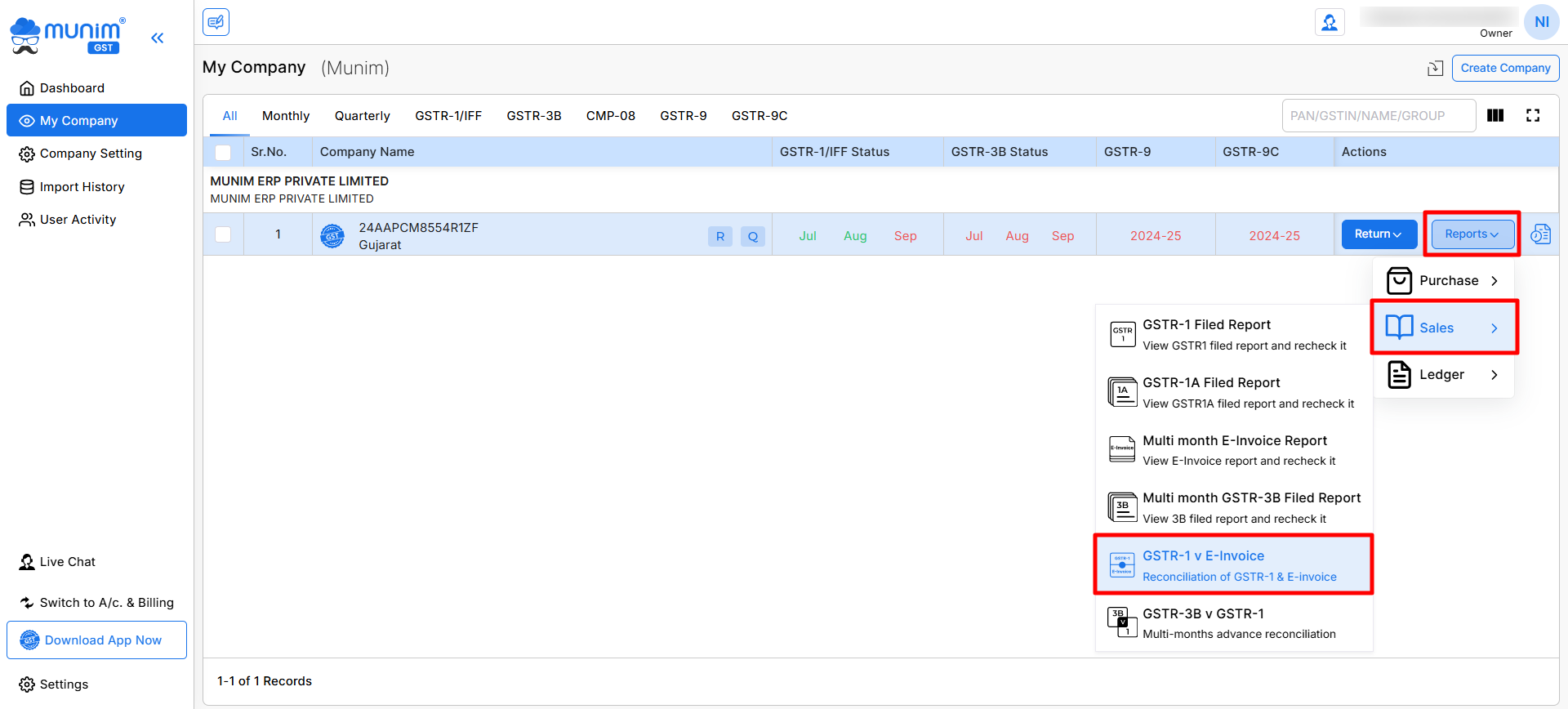

How to Access the GSTR-1 Vs E-Invoice Reconciliation Feature:

- On the My Company page, click the Reports button, then click on the Sales section and select “GSTR-1 v E-Invoice”.

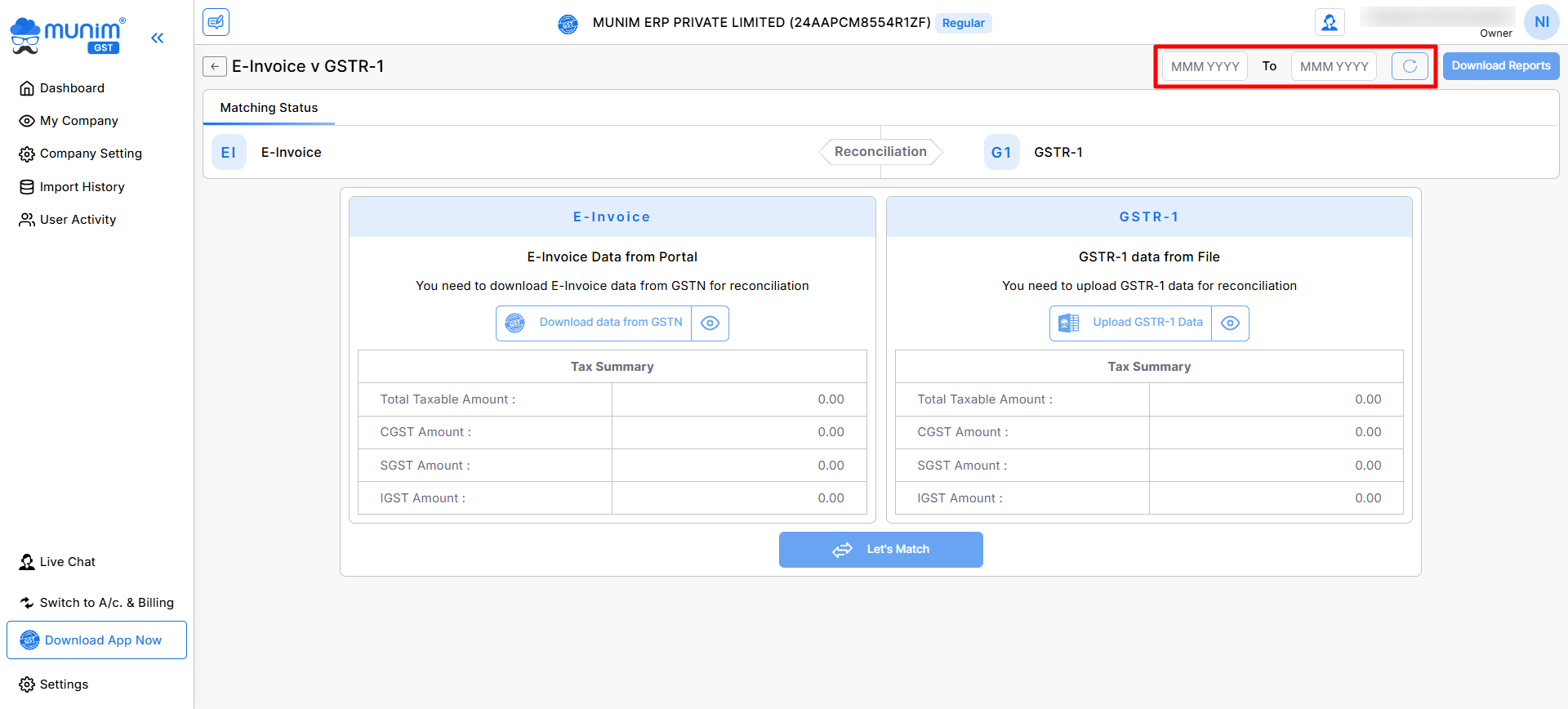

Begin the reconciliation process:

- On the reconciliation page, you will see two sections named GSTR-1 Data and E-Invoice Data.

- Select the return period range from the top right month and year section fields.

- After selecting the return period, click on the Reload button to view the selected range for reconciliation.

Upload GSTR-1 Data:

- In the GSTR-1 Data section, click the Upload GSTR-1 Data option to add the data of outward supplies.

- Make sure you enter the correct data successfully for reconciliation.

Download E-Invoice Data from the portal:

- In the E-Invoice Data section, click the Download Data from GSTN option to fetch the E-invoice data.

- Again, ensure the correct portal credentials are added before downloading.

Continue to Data Overview:

- Once all data is downloaded, click on the Let’s Match button to set an acceptable mismatch difference value for reconciliation.

- After accepting the mismatch value and clicking Continue, again click on Continue to Overview from the matching data pop-up to proceed to the matching summary page.

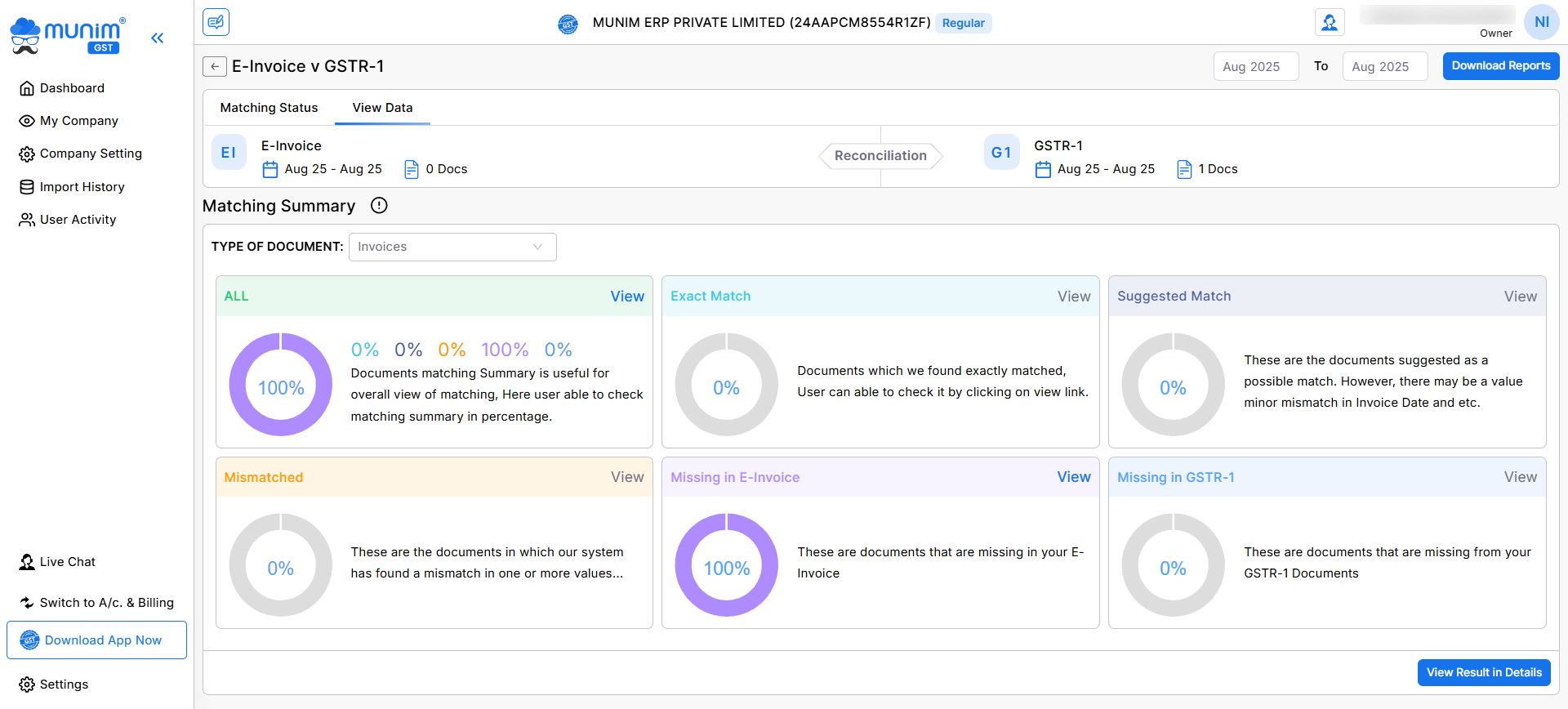

Matching Summary page:

- Here on the Matching Summary page, you can select Type of Document from the top left dropdown menu.

- You will see filter boxes such as:

- All

- Exact Match

- Suggested Match

- Mismatched

- Missing in E-Invoice

- Missing in GSTR-1

- Click View Result in Details to see the detailed comparison of the data.

View Result in Details page:

- Here you can choose between Supplier View and Document View.

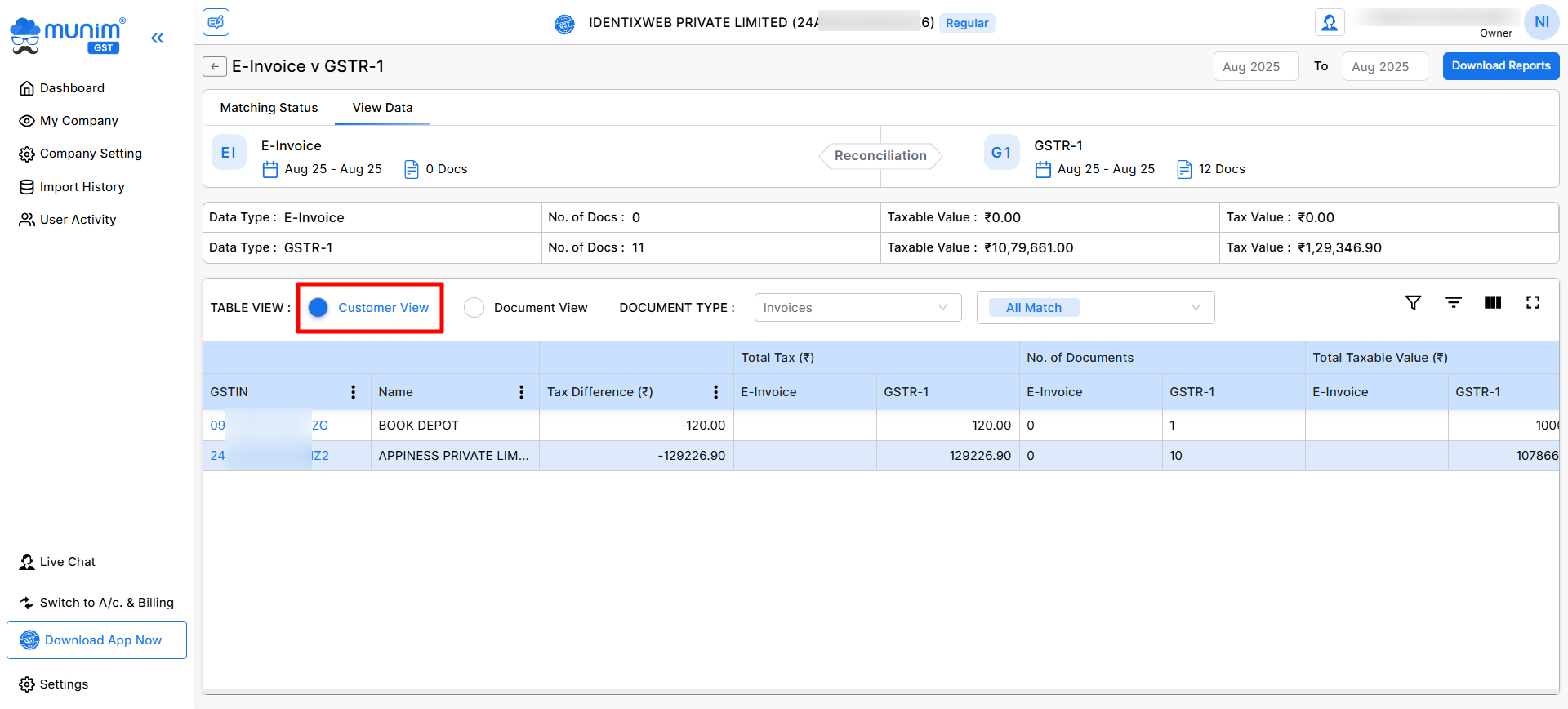

Customer View:

- Data is shown by the supplier’s GST number.

- You can filter data by Document Type and Summary Type.

- Reports can be downloaded using the Download Reports option at the top right.

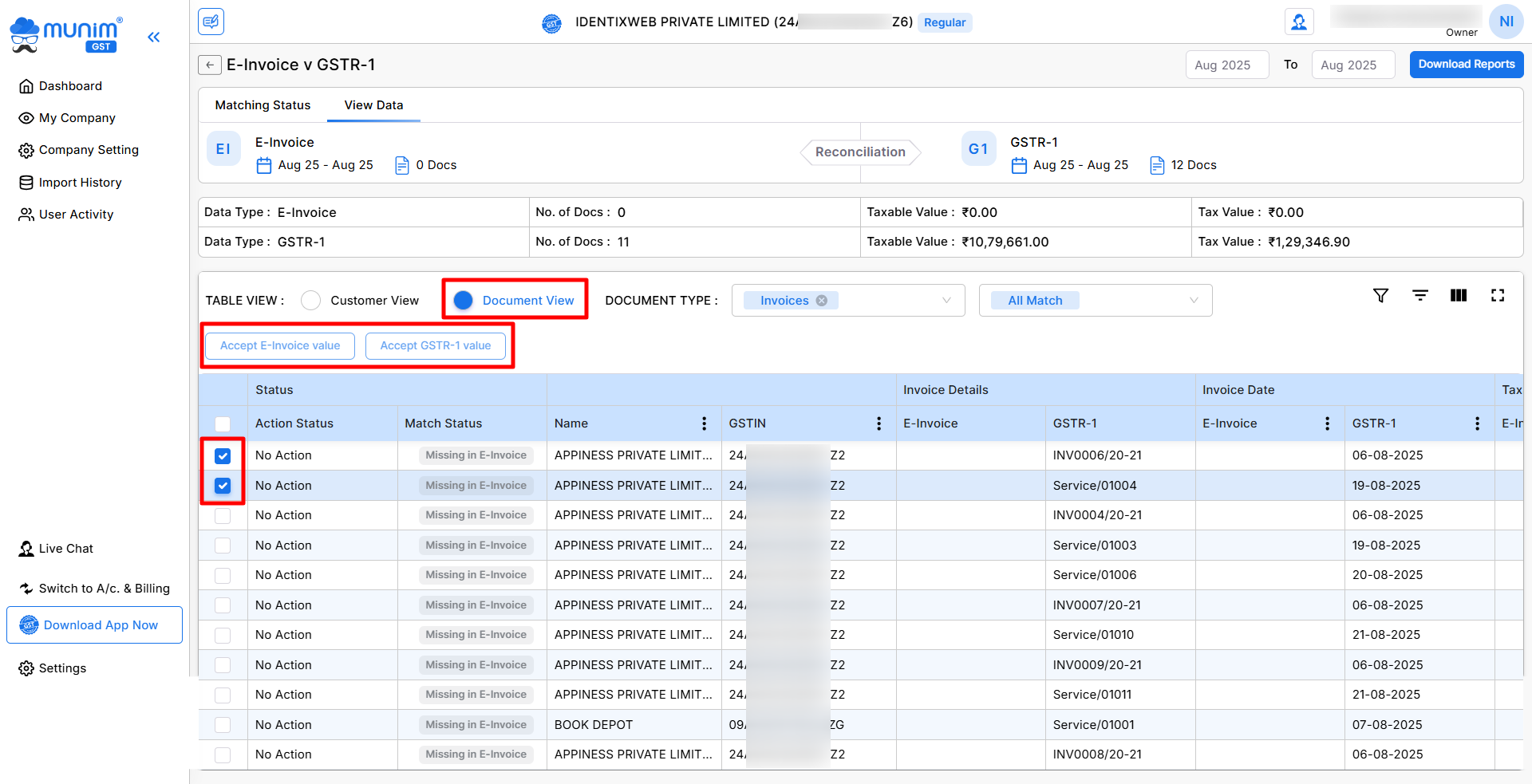

Document View:

- Data is shown by Document number.

- You can filter by Document Type and Summary Type.

- You can also change the status of a particular document:

- Accept E-Invoice value → Accepts the value reported in E-Invoice

- Accept GSTR-1 value → Accepts the value reported in GSTR-1

- Reports can also be downloaded from the Download Reports option at the top right.

Need Assistance?

If you have any questions or need further assistance, please contact our support team. We’re here to help!