144 views

144 views The GSTR-8A Report allows you to download supplier-wise purchase invoice data directly from the GST Portal (GSTN). This data is used for purchase reconciliation and verification of Input Tax Credit (ITC).

Purpose of GSTR-8A Report

- To view auto-populated supplier invoices uploaded by vendors

- To verify purchase details before filing annual or reconciliation returns

- To reconcile purchase data with books and other GST returns

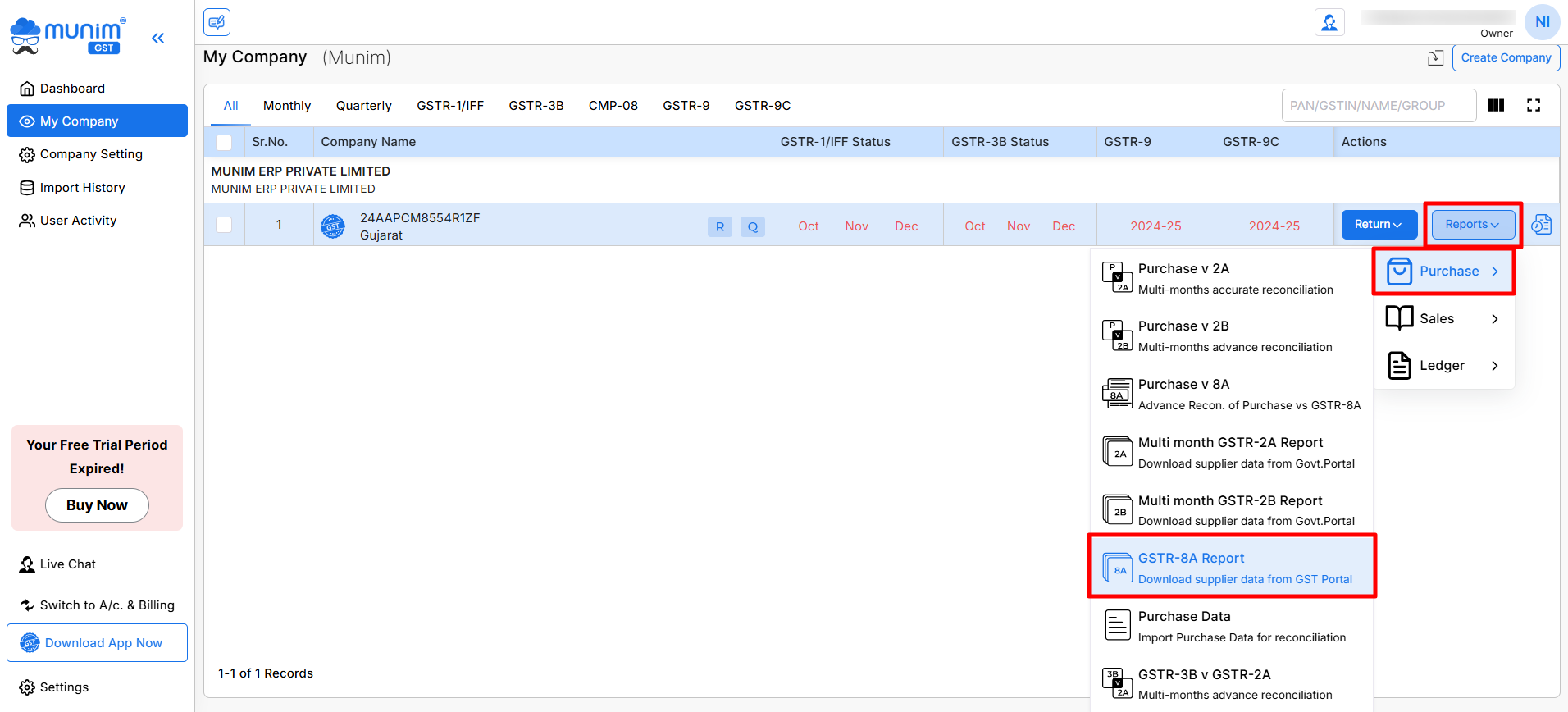

How to Access GSTR-8A Report

- Go to My Company and on the required Company, click on Reports

- Navigate to Purchase and select GSTR-8A Report from the list

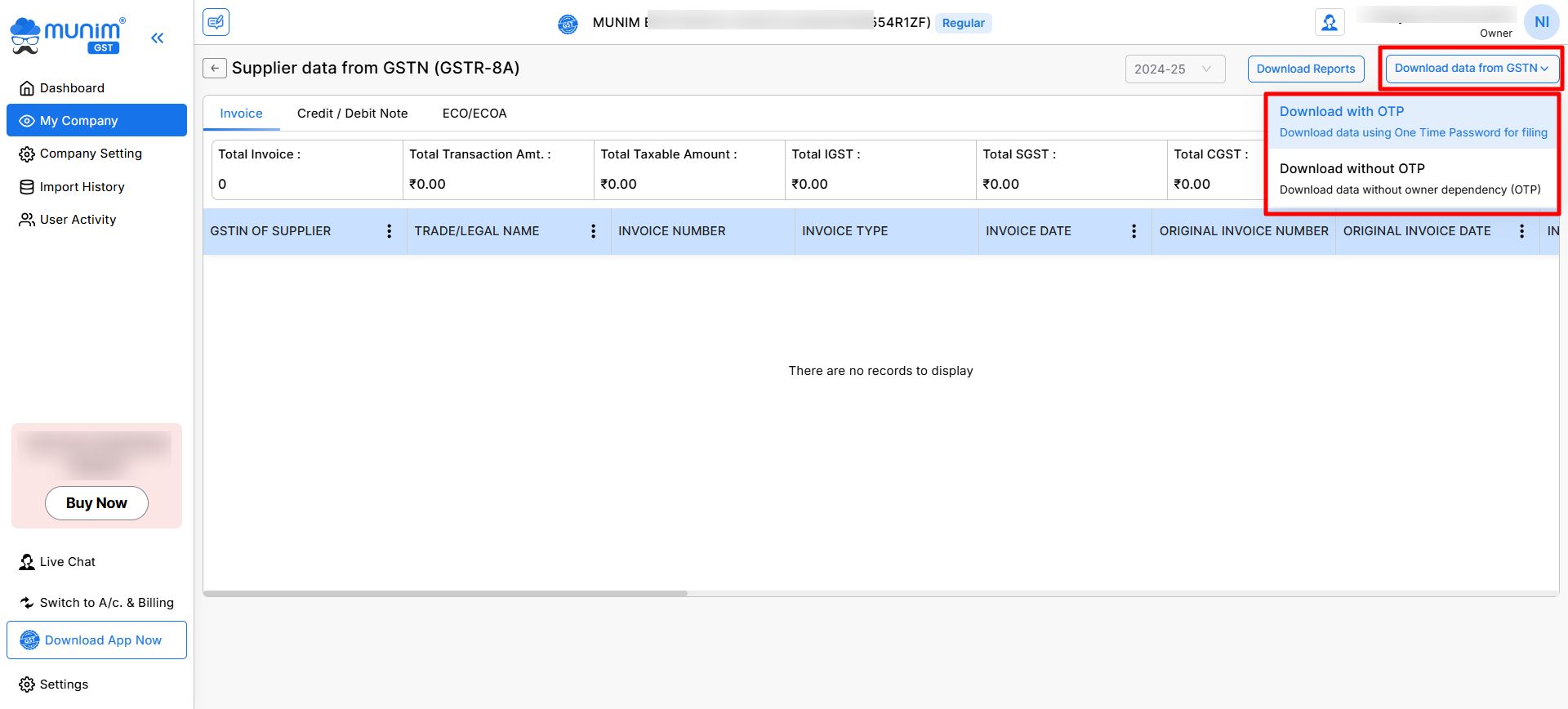

Download Supplier Data from GSTN

Munim provides two options to download GSTR-8A data from the GST Portal:

- Download with OTP

- Uses One Time Password sent to the registered mobile/email

- Recommended when GST Portal requires authentication

- Download without OTP

- Downloads data without owner dependency

- Faster option when OTP is not mandatory

Use the Download data from GSTN button to choose the required option.

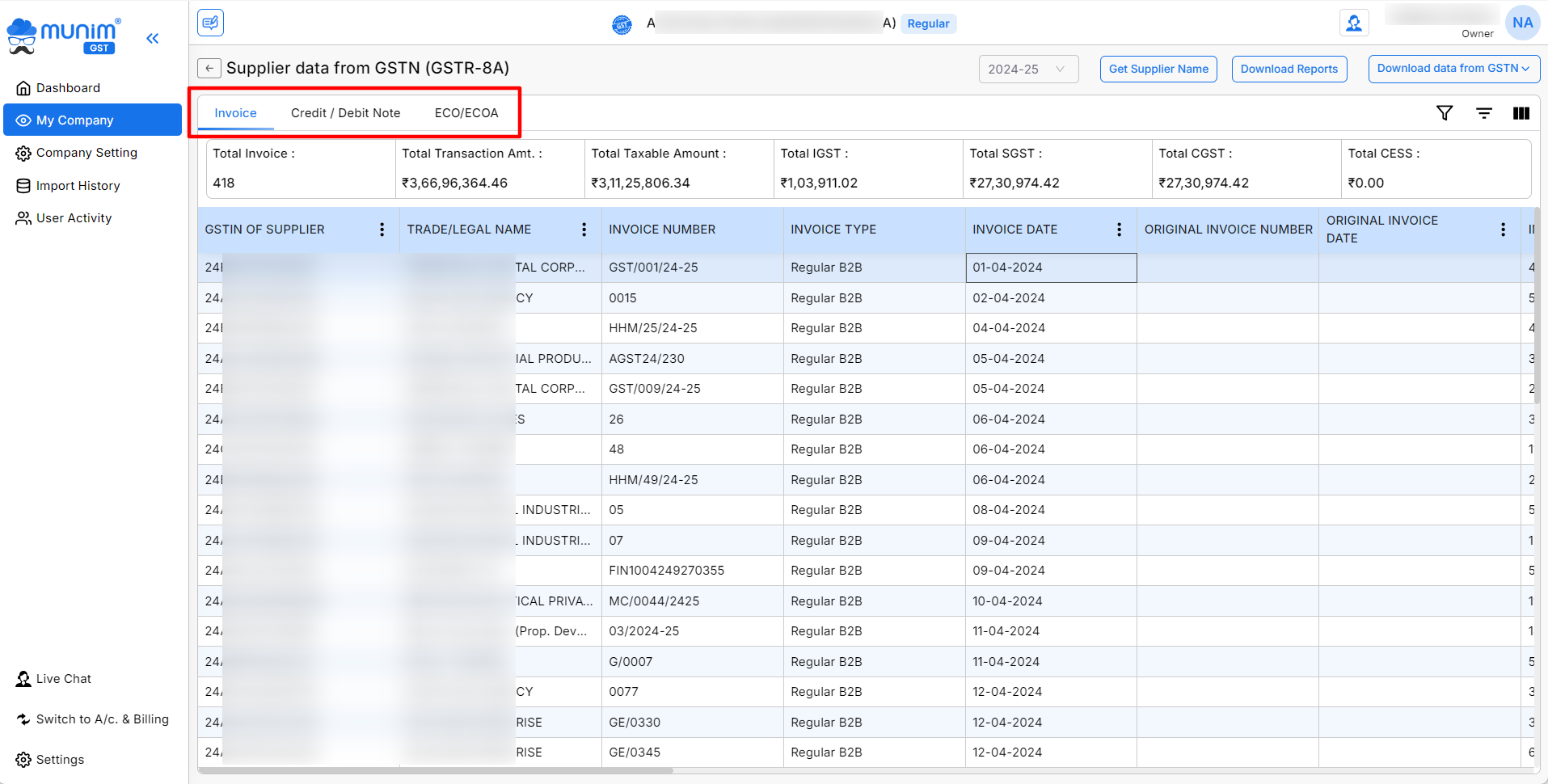

Tabs Available in GSTR-8A

- Invoice

- Displays regular B2B purchase invoices uploaded by suppliers

- Credit / Debit Note

- Shows credit and debit notes issued by suppliers

- ECO / ECOA

- Displays data related to e-commerce operator transactions, if applicable

Summary Information Displayed

At the top of the report, Munim shows consolidated figures such as:

- Total Invoice Count, Total Transaction Amount, Total Taxable Amount, Total IGST, Total CGST, Total SGST etc.

This helps in the quick verification of overall purchase values.

Invoice-Level Details Available

Each record in the GSTR-8A report includes the following fields:

- GSTIN of Supplier, Trade / Legal Name, Invoice Number, Invoice Type (e.g., Regular B2B), Invoice Date, Original Invoice Number (if applicable), Original Invoice Date (if applicable), etc. and many more required columns.

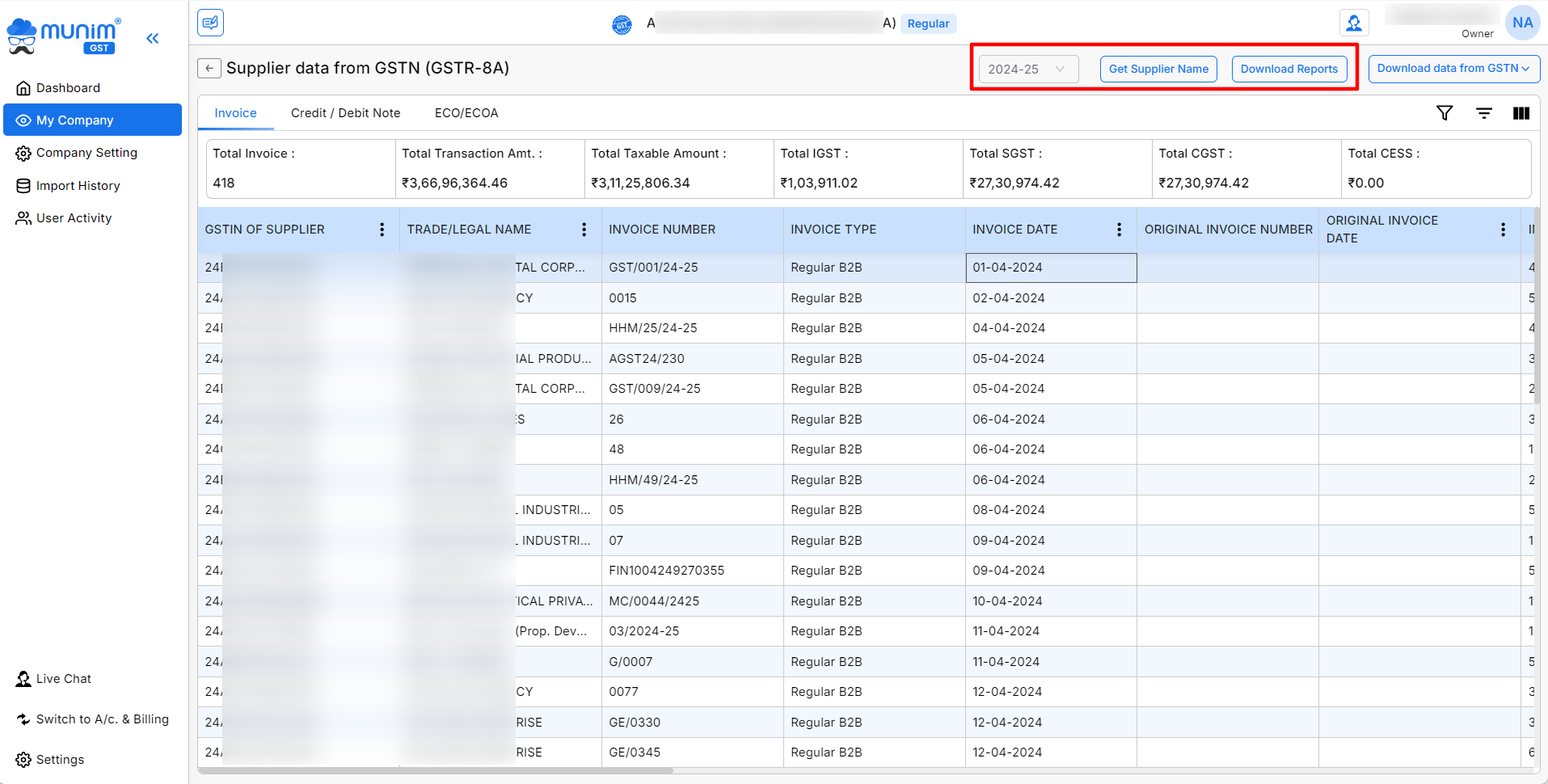

Financial Year Selection and Supplier Name fetch

- Select the applicable Financial Year from the dropdown from the top right side. Data will be fetched and displayed based on the selected year

- We have provided an option to retrieve supplier names using the Get Supplier Name button, which can be used to refresh the names if they are not displayed.

Download Reports

- Use the Download Reports button at the top right to export data for offline review in Excel format.

- Reports can be used for reconciliation, audit, and compliance purposes

Important Notes

- GSTR-8A data is fetched directly from GSTN and depends on supplier filings

- Any mismatch should be followed up with the respective supplier

- Downloaded data can be used for purchase reconciliation and annual return preparation

For any inquiries or assistance, please contact support.