333 views

333 views Migrating from ClearTax GST Filing Software to Munim GST Filing Software is quick and easy.

This guide will help you export your client list (with GST numbers and related details) from ClearTax and import it into Munim using an Excel file.

Export Client Data from ClearTax

Follow these steps to export your client list from ClearTax:

- Log in to ClearTax GST Software

Open your ClearTax account and go to the Settings section from the left main menu. - Open Gstin Credentials

In the submenu, locate and click on Gstin Credentials. This section contains your client company list and GSTIN details. - Copy Data

- Select all the GSTIN data and copy it.

- Now you are ready to paste the copied data into the Munim sample file

- This data will include client Business names, GSTINs, and GSTIN Usernames.

(Note: ClearTax does not export GST portal passwords for security reasons.)

- Verify Data

- Before copying the data to Munim, please verify it thoroughly.

- Check that all client names and GSTINs are listed correctly.

- If you maintain login credentials separately, ensure they’re ready for manual entry later in Munim.

Import Client Data into Munim

Once your client list is ready, follow these steps in Munim:

- Log in to Munim GST Software

- Open your Munim dashboard and go to the My Company section.

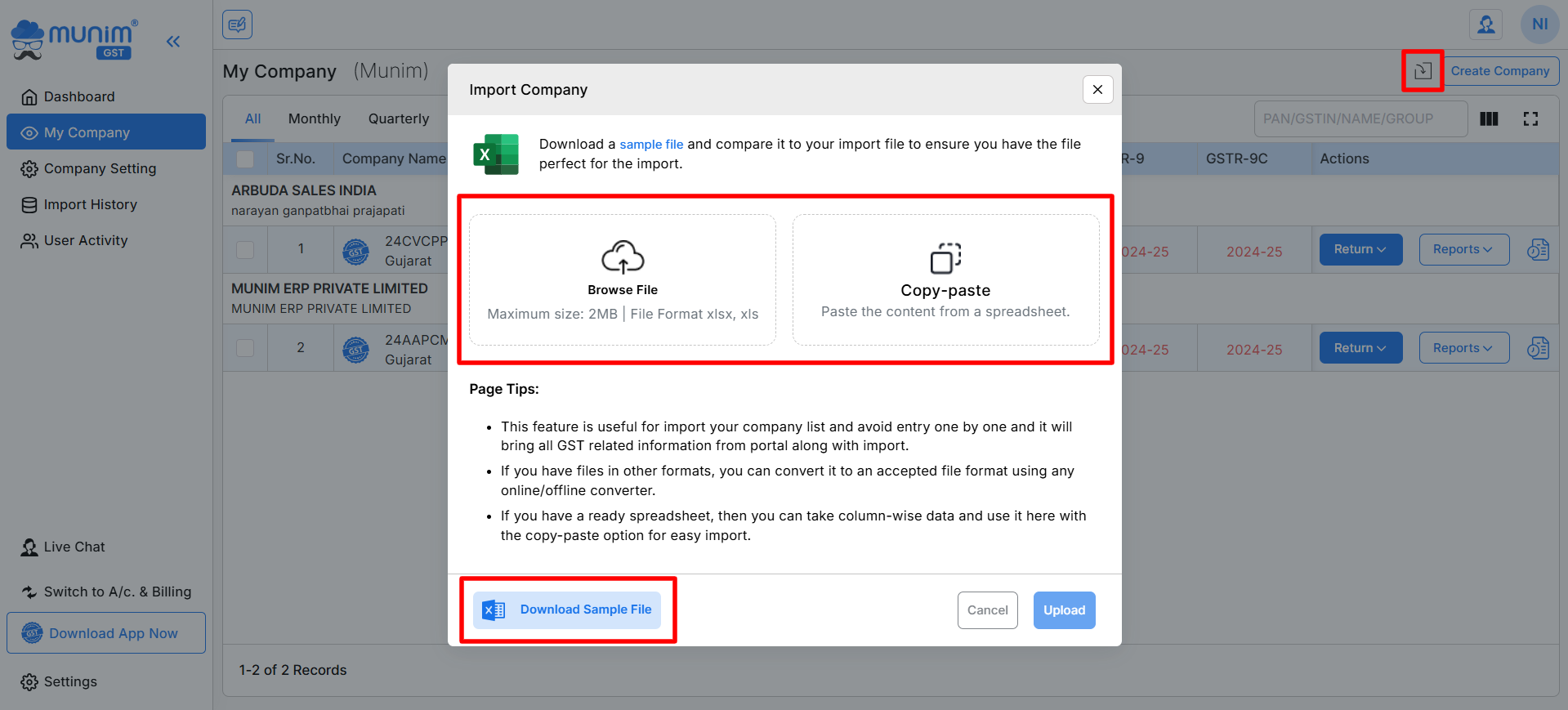

Import Company options:

- We have provided two options to import your data to Munim.

- Import through Sample Excel Template File

- Copy-Paste data into Munim

Download Sample Excel File Template

- Click on the Import option next to the Create Company button.

- In the pop-up, click Download Sample File to get the Munim import Excel format.

- Open this template in Excel. Copy your client data from the ClearTax into the Munim template.

- Upload the Excel File

- Go back to Munim’s import popup.

- Click Choose File, select your prepared Excel, and then Upload.

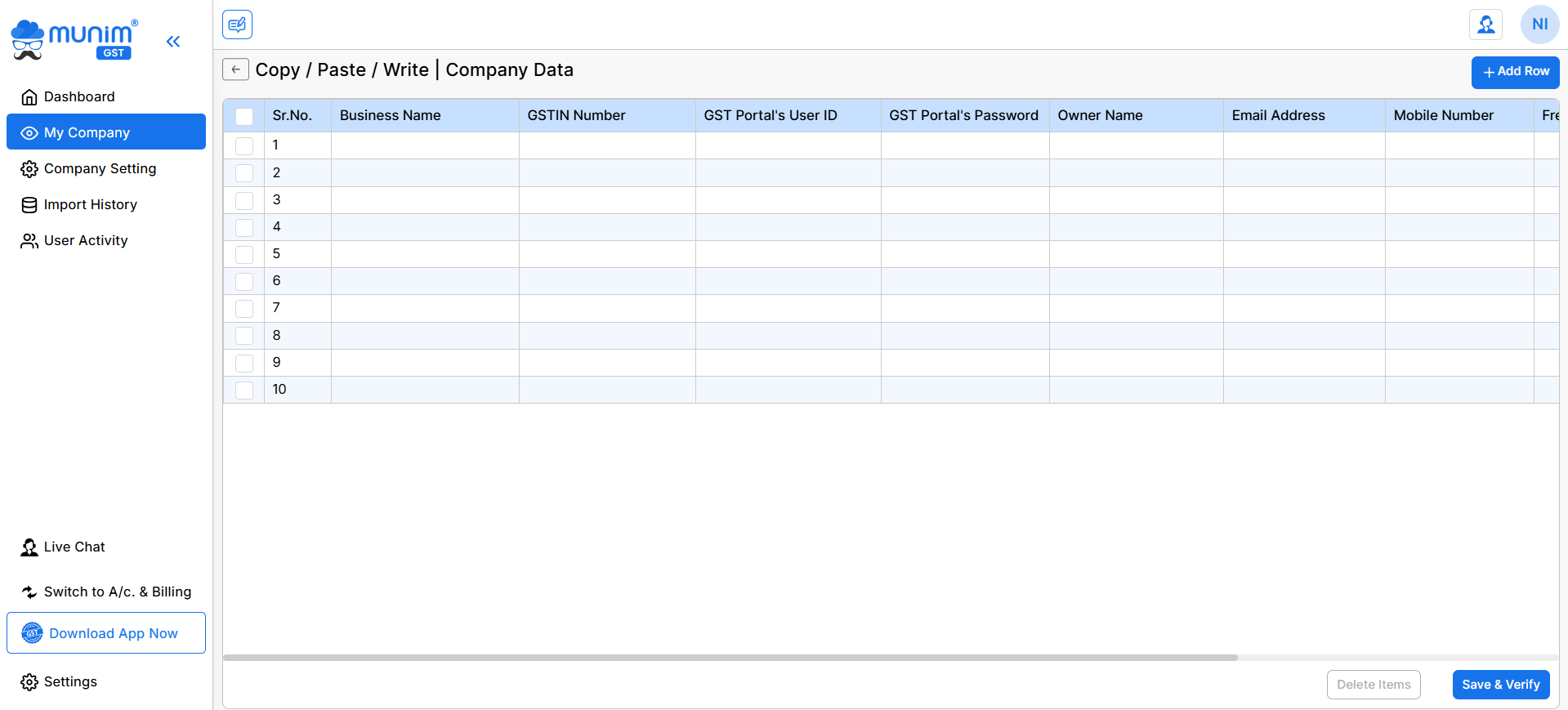

Copy/Paste Company Data:

- In the Import Company pop-up, click Copy-Paste to get to the Copy/Paste/Write page.

- Same as Excel Template, here you can paste your already copied data from ClearTax.

- Input GSTIN credentials and other required data into the appropriate fields.

- After a careful review of the input, click the Save & Verify button to move forward with adding the companies.

Munim will process the file and show an import progress bar on the page

Verify Imported Clients

- After import completion, go to My Company and check that all clients appear correctly.

- If any errors occur, Munim will generate an Error File for download at the top.

- Open the file, fix the issues (like invalid GSTINs), and re-upload.

- For more details, check out the helpdesk page: How to add company

Add GST Portal Credentials Securely

- Other than importing the GST portal Credentials of the client from Excel files, you can also add credentials later, once your client list is imported:

- Go to the Company Settings module, and go to each client’s name and click Edit.

- Enter their GST Portal Username and Password, then click Save.

Important Security & Compatibility Tips

- Do not share Excel files containing sensitive data over email.

- Always use Munim’s sample template for import to ensure correct formatting.

- Keep client login credentials only within Munim’s secure storage—not in Excel.

- If import errors occur, download the Error File, correct highlighted rows, and re-upload.

- Check all GSTINs for accuracy before finalising.

Need Help?

If you face any issues during migration:

Call us at +91-9898665536

Email us at support@themunim.com

Or visit our Helpdesk at Munim GST Filing Helpdesk

Our support team will guide you through any step of the migration process.