145 views

145 views The E-Commerce Excel Template allows you to import sales data directly from marketplaces like Flipkart, Amazon, Meesho, etc., using their seller-provided Excel reports.

This helps you avoid manual entry, Auto-validate e-commerce sales, prepare GSTR-1 faster, and consolidate data when multiple GSTINs exist

As of now, our e-commerce template functionality specifically works with Flipkart, Amazon and Meesho only, and we will provide support for integration with other e-commerce platforms later on.

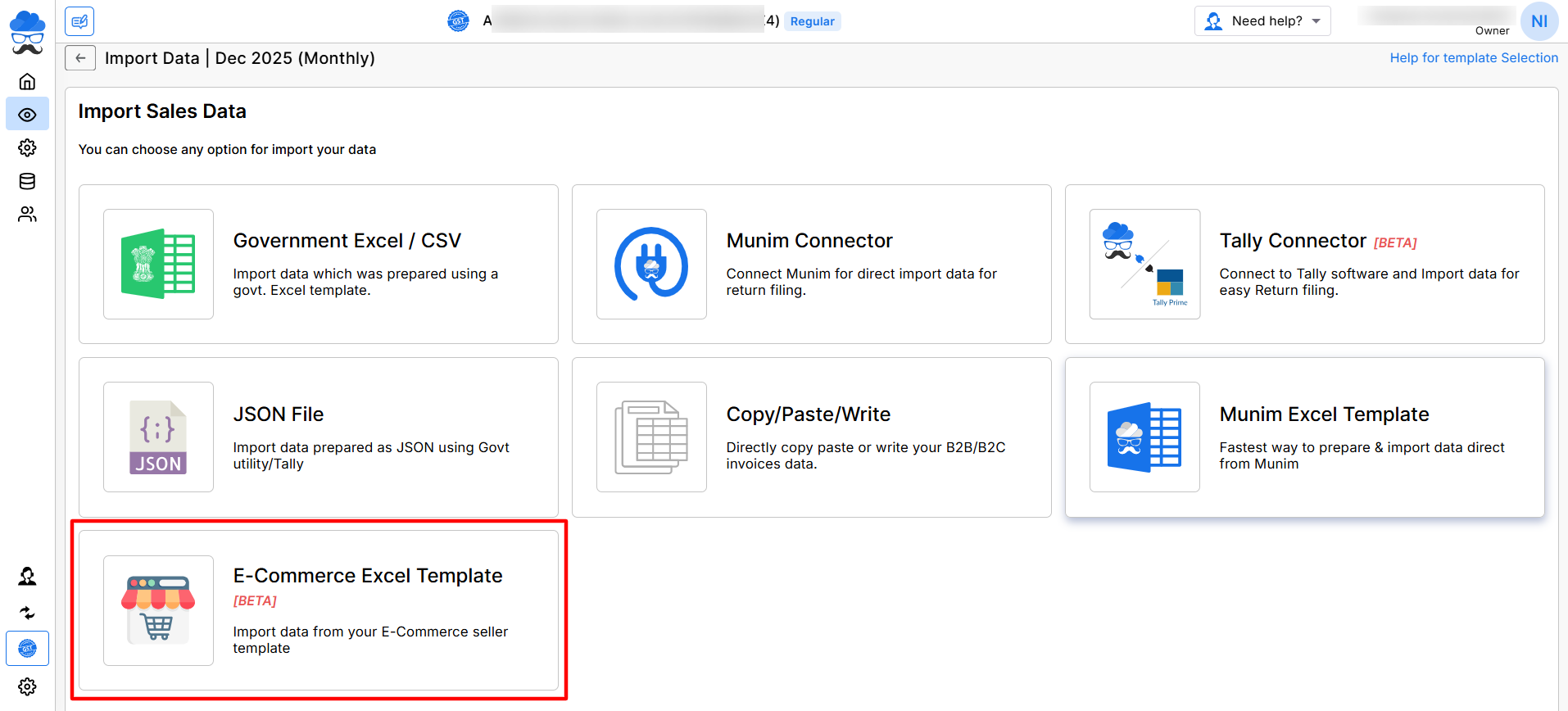

Where You See This Option

- Navigate to the company Return section, specifically within GSTR-1, and select Import Your Data located in the top right corner.

- Clicking on it will present multiple import options, including the E-Commerce Excel Template (BETA).

- Click this option to begin uploading E-Commerce data.

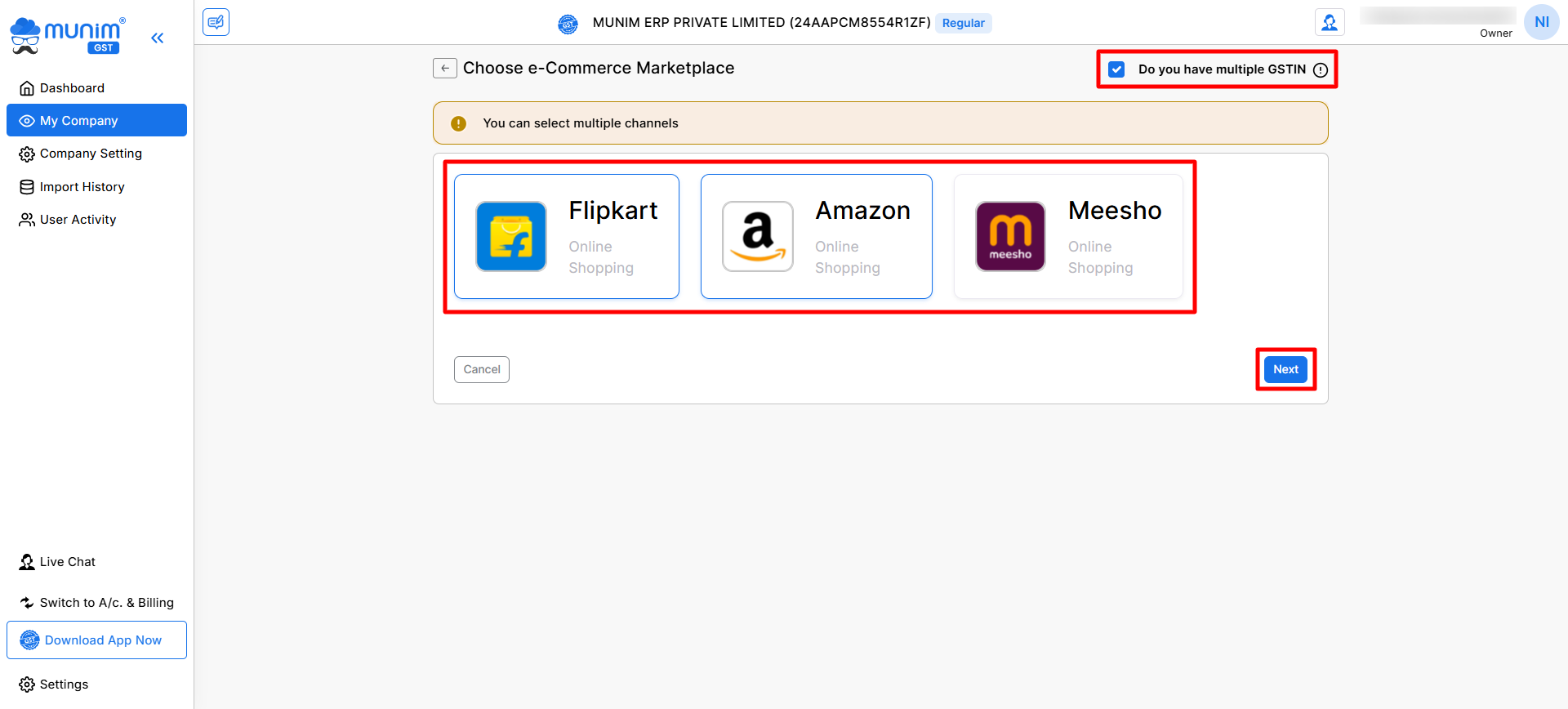

Selecting GSTIN & Return Period

- Once you open the template, Munim displays the currently selected GSTIN and the filing period

- The interface will display the supported e-commerce operator marketplace options for data upload.

- If your business operates with more than one GSTIN under the same company, enable the option: Do you have multiple GSTIN?

- This lets you upload combined data from all GSTINs in a single Excel file, provided by the marketplace.

- You may select multiple marketplaces and proceed by clicking the “Next” button.

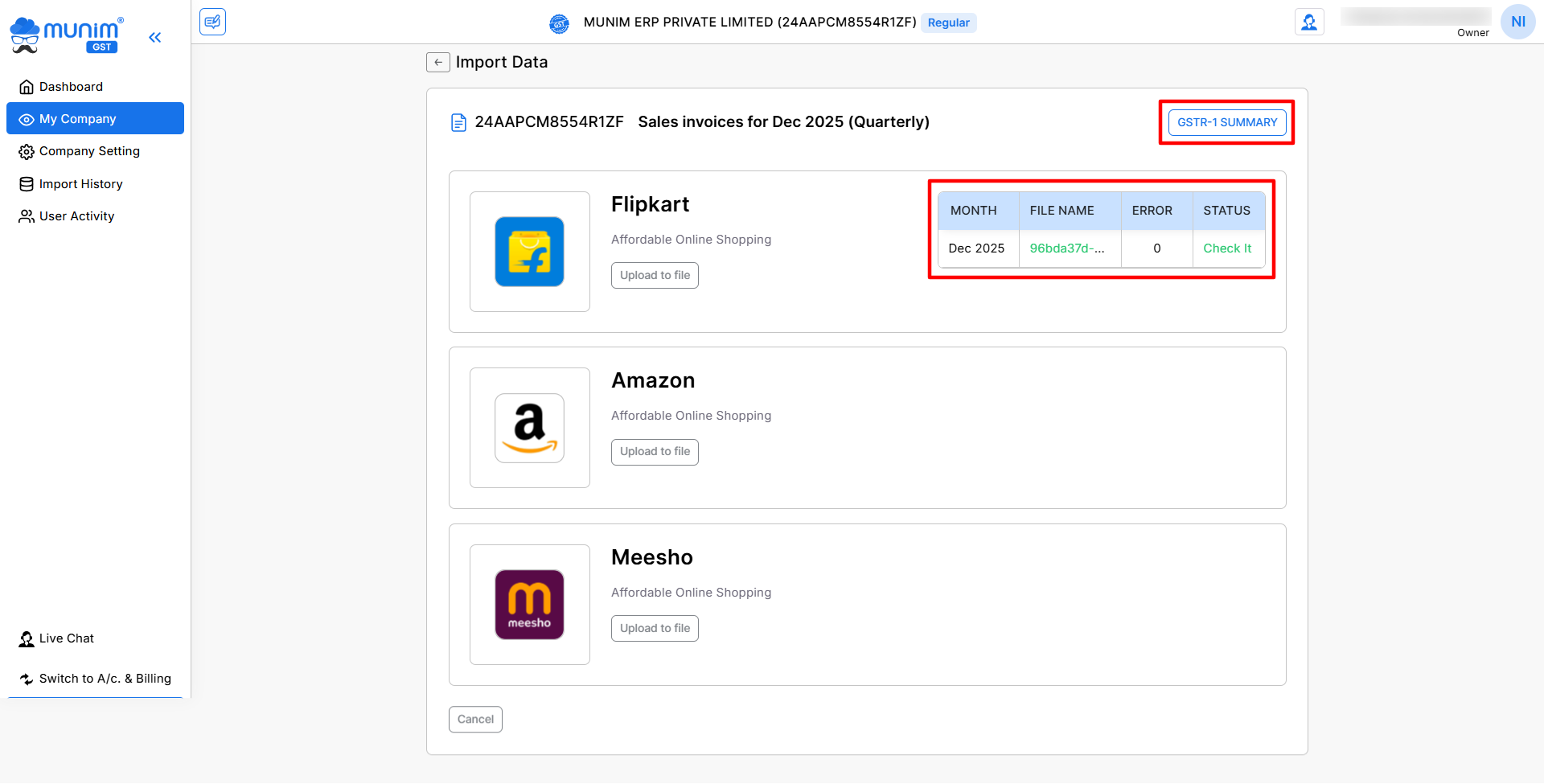

- On this page, you can view the import data options for various marketplaces you have selected and prepare them one by one.

- On this page, you can upload files and utilise the validation process to identify any errors in files.

- You will also find a summary box for each marketplace, displaying the uploaded data with its status.

- You can click on the GSTR-1 Summary button on the top right after successfully uploading and verifying the data.

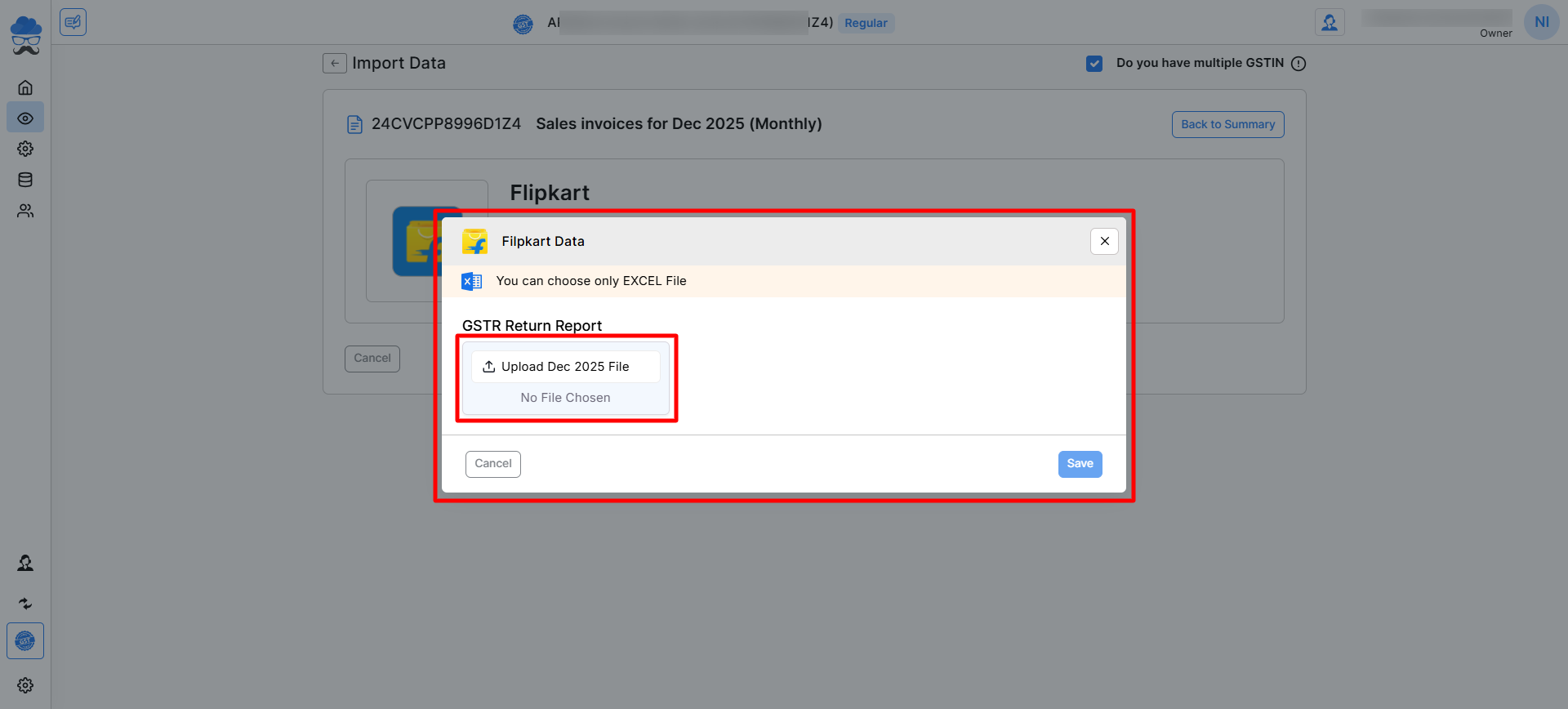

Uploading Marketplace Excel Files

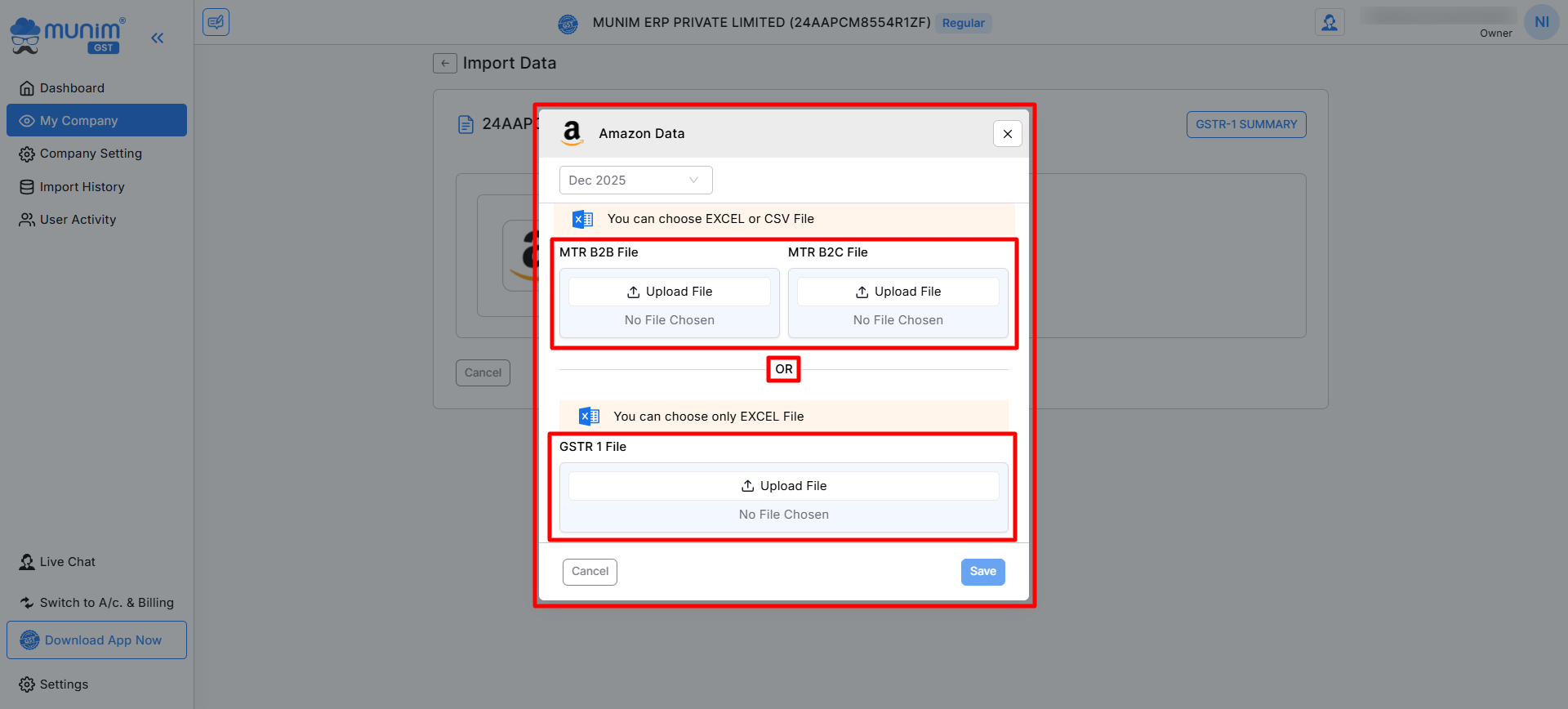

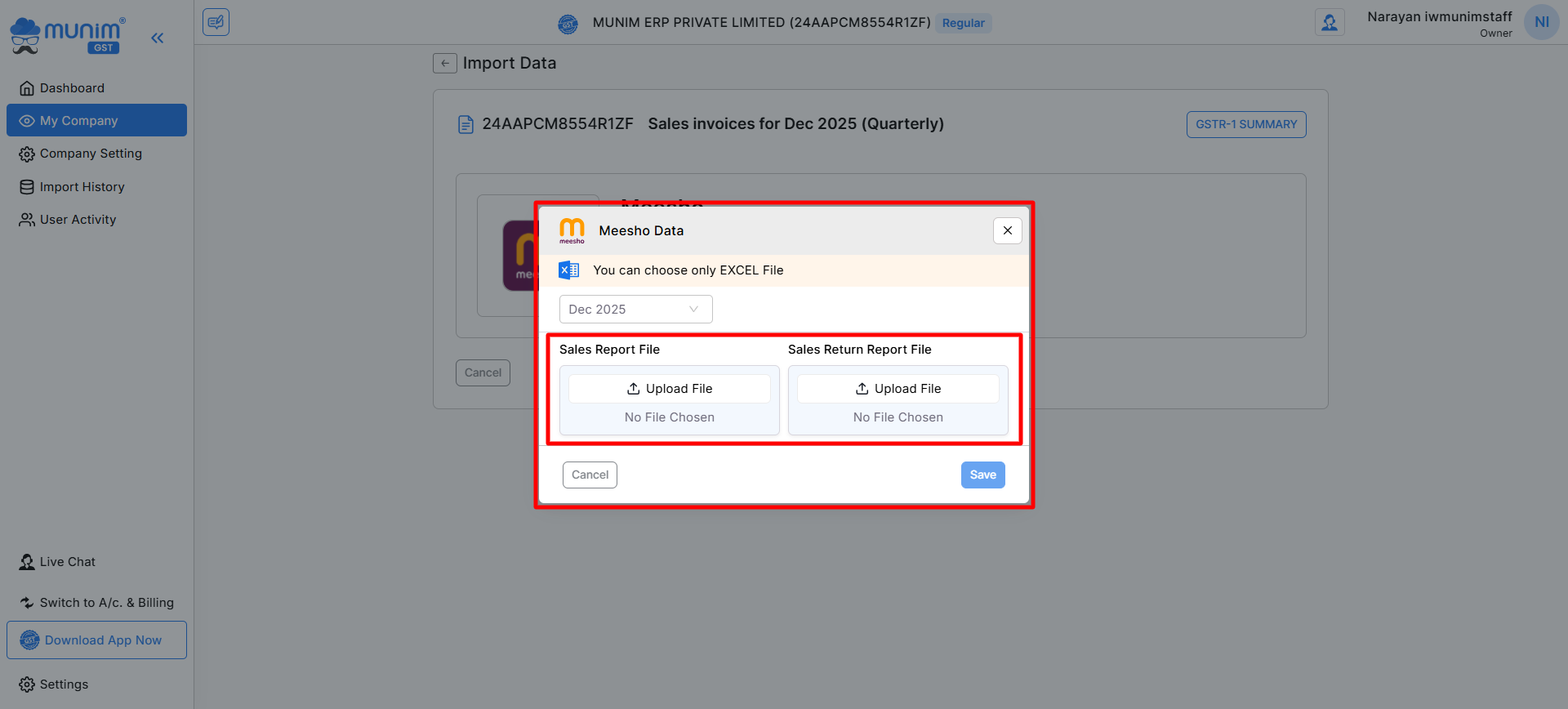

- On the Import data page, under each marketplace, click the Upload file button.

- A pop-up will appear, which shows the upload boxes for the required Excel files.

- There will be one month box for regular filing; for quarterly filing, you will see upload options for each month in qaurter month.

- Only Excel (.xlsx) file formate are accepted. File types vary according to the Marketplace. As shown below Screenshots:

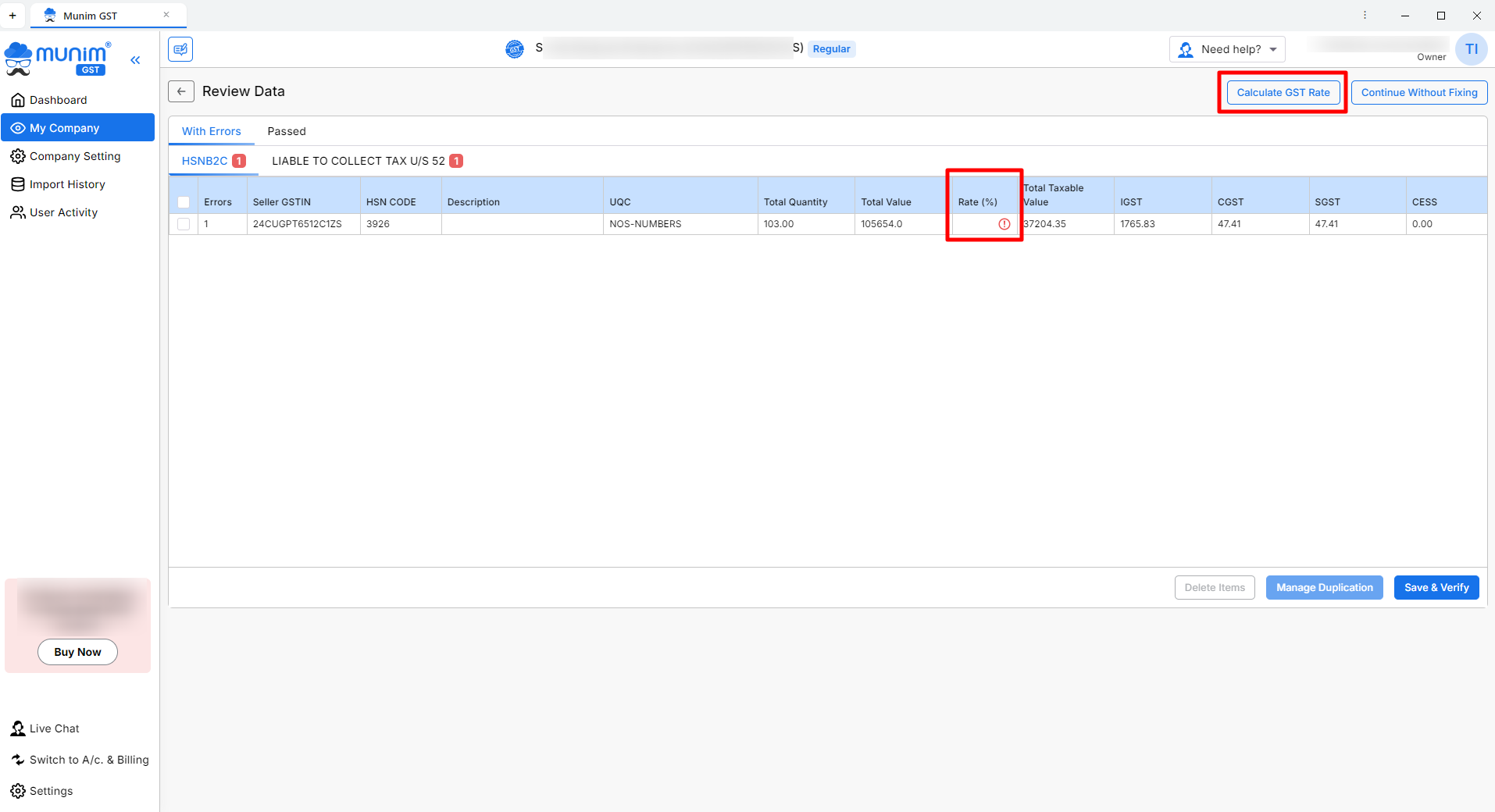

Validation & Import Process

- Once files are uploaded, Munim GST will automatically:

- Reads and validates data, Detects missing GST rate or wrong invoices, Identifies duplicate entries, Checks incorrect formats, Add Ecommerce Operator GST no.

- If any issues are found, an error summary will appear. Here you can correct the data and proceed.

- We have provided a Calculate GST Rate button to fetch the GST rate according to the HSN number.

- If everything is correct, the data will be successfully imported.

Which Files Should You Upload?

- You must upload the GSTR Return Report downloaded from the e-commerce operator’s seller dashboard.

- Supported file types and locations to download:

- Flipkart GST Return Report- Flipkart Seller Hub → Reports → Report Centre → Tax Reports → GSTR Return Report → Generate & Download.

- Amazon GST Settlement / GST Summary Excel- Amazon Seller Central → Reports → Tax Document Library → GST Settlement / Monthly Tax Report (MTR) → Download

- Meesho GST Report- Meesho Supplier Panel → Orders → Reports → Sales / Sales Return → Download

- Any other e-commerce operator Excel that contains GST-wise sales breakdown (Coming Soon)

Make sure you download the file directly from the operator without modifying it.

How This Helps in GSTR-1 Filing

After import, all e-commerce invoices directly appear in your GSTR-1 module, accurately sorted into:

- B2B sales

- B2C sales

- TCS collected by the operator

This reduces manual entry and ensures accurate filing.

Important Notes

- Only Excel files are supported.

- PDF or CSV files are not accepted.

- Do not modify the downloaded Excel manually.

- File names should be simple, without special characters.

- For quarterly returns, monthly files must be uploaded separately.